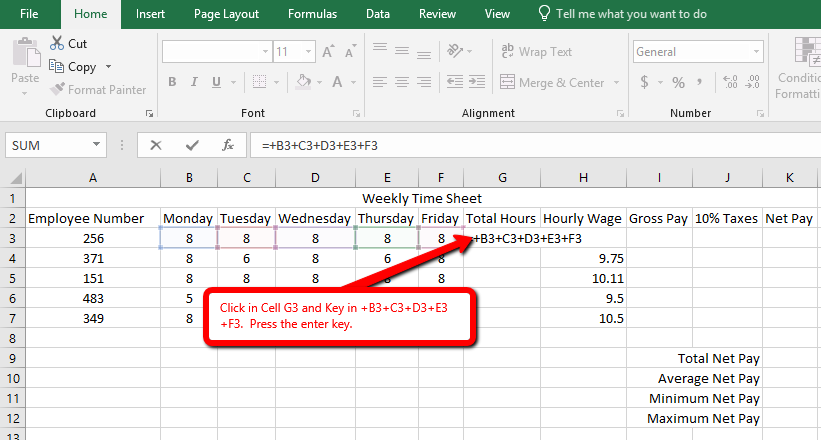

How To Calculate Net Pay In Excel Step 1 Employee Database Basic Salary Structure Here the below figure is showing the basic salary structure of a company And we want to calculate the net salary by adding allowances and subtracting deductions subsequently Step 2 Create Allowance and Deduction Structure

To calculate gross pay in Excel you can use a simple formula that multiplies the hours worked by the hourly rate or the salary amount For example if an employee worked 40 hours at 15 per hour the formula would be hours worked hourly rate To calculate gross pay in Excel you can use the following formula hourly rate hours worked overtime pay bonuses commissions Alternatively if the employee is salaried you can use the formula annual salary number of pay periods in a year Examples of different scenarios for calculating gross pay

How To Calculate Net Pay In Excel

How To Calculate Net Pay In Excel

https://i.pinimg.com/736x/1b/d2/18/1bd218faa238513b091aafee112f6f15.jpg

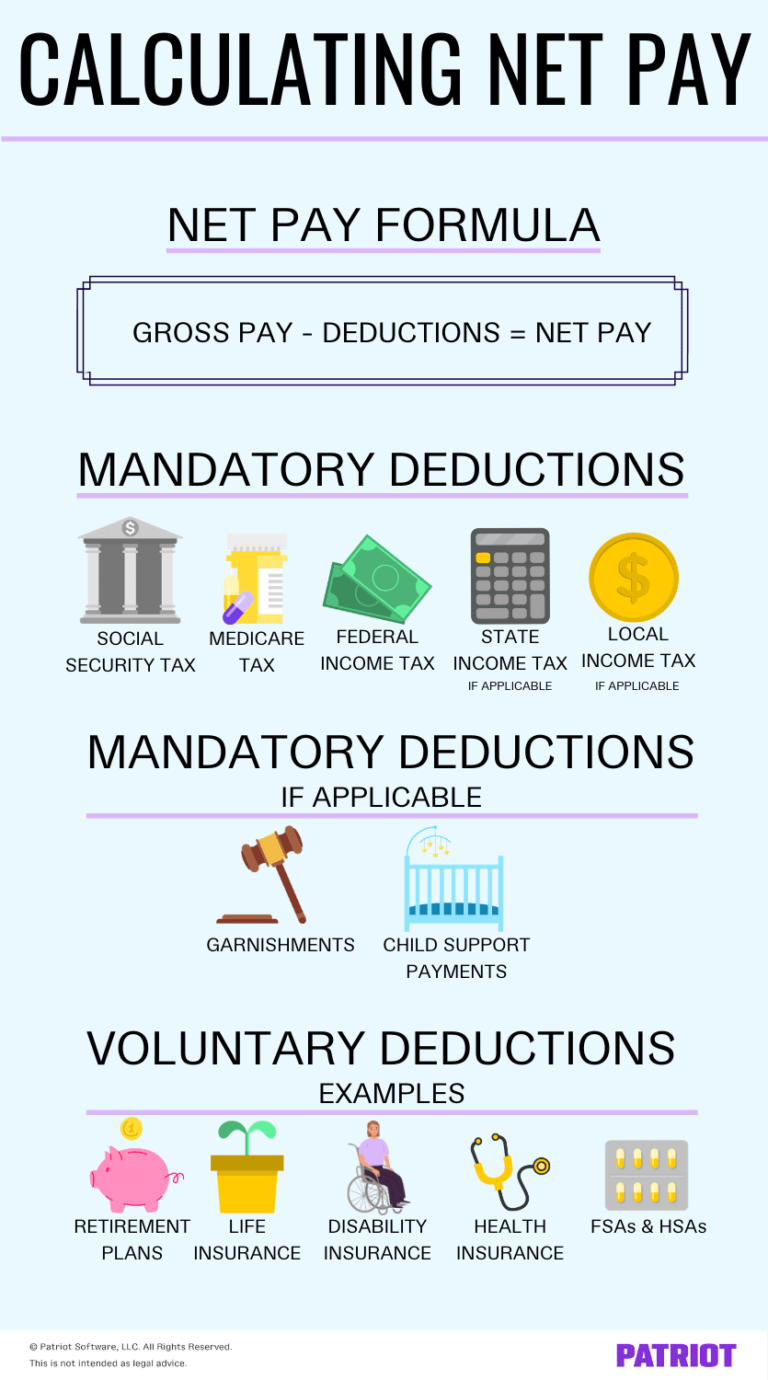

How To Calculate Net Pay Step by step Example

https://www.patriotsoftware.com/wp-content/uploads/2018/05/calc-net-pay-gross-pay-1.jpg

:max_bytes(150000):strip_icc()/009-calculate-net-salary-using-microsoft-excel-d888cfadd5d844ae85b51ed88c4edd37.jpg)

Calculate Net Salary Using Microsoft Excel

https://www.lifewire.com/thmb/kzD-R12K29YWlI6P6kOVfCCm-4U=/1920x0/filters:no_upscale():max_bytes(150000):strip_icc()/009-calculate-net-salary-using-microsoft-excel-d888cfadd5d844ae85b51ed88c4edd37.jpg

Step 1 Gathering the necessary information Step 2 Calculating taxable income Step 3 Determining tax deductions Step 4 Subtracting taxes from gross pay to find net pay Key Takeaways Calculating net pay after taxes is crucial for effective budgeting and financial planning Paycheck Calculator is a simple and automated way of calculating the salaries and the taxable withholdings In case of an employer it is his sole responsibility to calculate tax and deduct that amount from the gross value Apart from this even the individual has to declare his her other means of income other than the salary being received

Steps to create Net Pay using Ms Excel Steps to create Net Pay using Ms Excel 2 Subtract deductions to find net pay To calculate net pay deduct FICA tax federal state and local income taxes and health insurance from the employee s gross pay Using the formula to calculate net pay determine the employee s net pay Net Pay Gross Pay Deductions Here s a rundown of the withholding amounts we calculated

More picture related to How To Calculate Net Pay In Excel

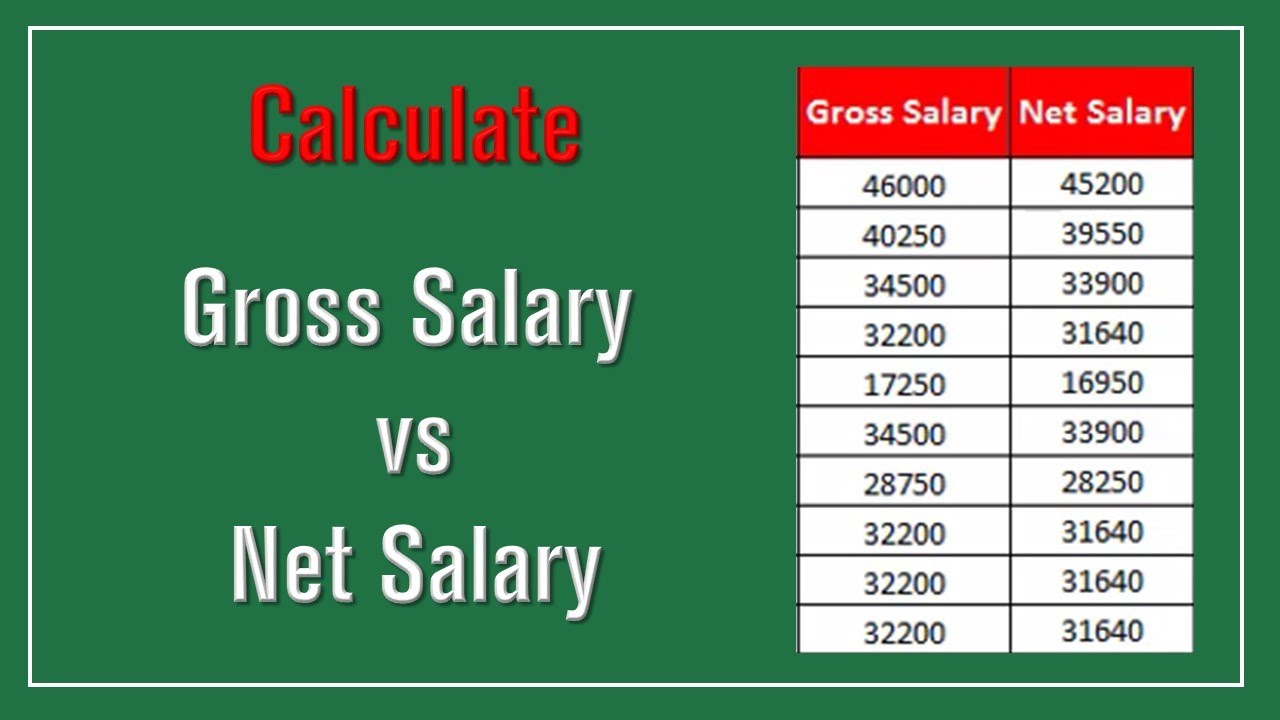

How To Calculate Net Salary Gross Salary In Excel YouTube

https://i.ytimg.com/vi/eowCuwKkybY/maxresdefault.jpg

How To Calculate Net Salary In Excel 2016 YouTube

https://i.ytimg.com/vi/RPQoUvHYwcM/maxresdefault.jpg

How To Calculate Net Pay Step by step Example

https://www.patriotsoftware.com/wp-content/uploads/2018/05/how-to-calculate-net-pay-1-768x1380.png

Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions withholdings federal tax and allowances on your net take home pay Unlike most online paycheck calculators using our spreadsheet will allow you to save your results see how the calculations are done and even customize it How To Calculate Net Pay in 3 Steps Plus Definition Indeed Editorial Team Updated March 10 2023 As a wage earning employee it s important to understand the figures included on your paycheck One category is net pay Not only is it important to understand net pay but knowing how to calculate it can help you with your finances

This is an educational channel where I keep on uploading educational videos along with tips tricks solutions of most commonly faced problems Subscribe th What Is a Salary Sheet A salary sheet is a report where the net payable amount as salary to an employee is recorded The basic wage of an employee extra allowances and deductions are recorded here Upon these calculations gross salary and net payable salary are calculated and recorded Common Salary Sheet Components

Excel Advanced Cell Formatting NCTTA

https://ncpreventiontta.zendesk.com/hc/article_attachments/360021374452/Excel45.png

17 Net Salary Calculator Template Template Invitations Template

https://www.excel-templates.net/wp-content/uploads/2020/08/Employee-Salary-Calculator.jpg

How To Calculate Net Pay In Excel - Insert monthly gross pay select pay period select filing status and applicable information The template will automatically calculate the rest take home paycheck amount for you This template is helpful for HR professionals admin staff as well as employers to calculate the withholding tax on the paycheck