How To Calculate Monthly Payment On A Loan The number of payments required to repay the loan Monthly Payment The amount to be paid toward the loan at each monthly payment due date Compounding This calculator assumes interest compounding occurs monthly as with payments For additional compounding options use our Advanced Loan Calculator Loan Calculations When you take out a loan you

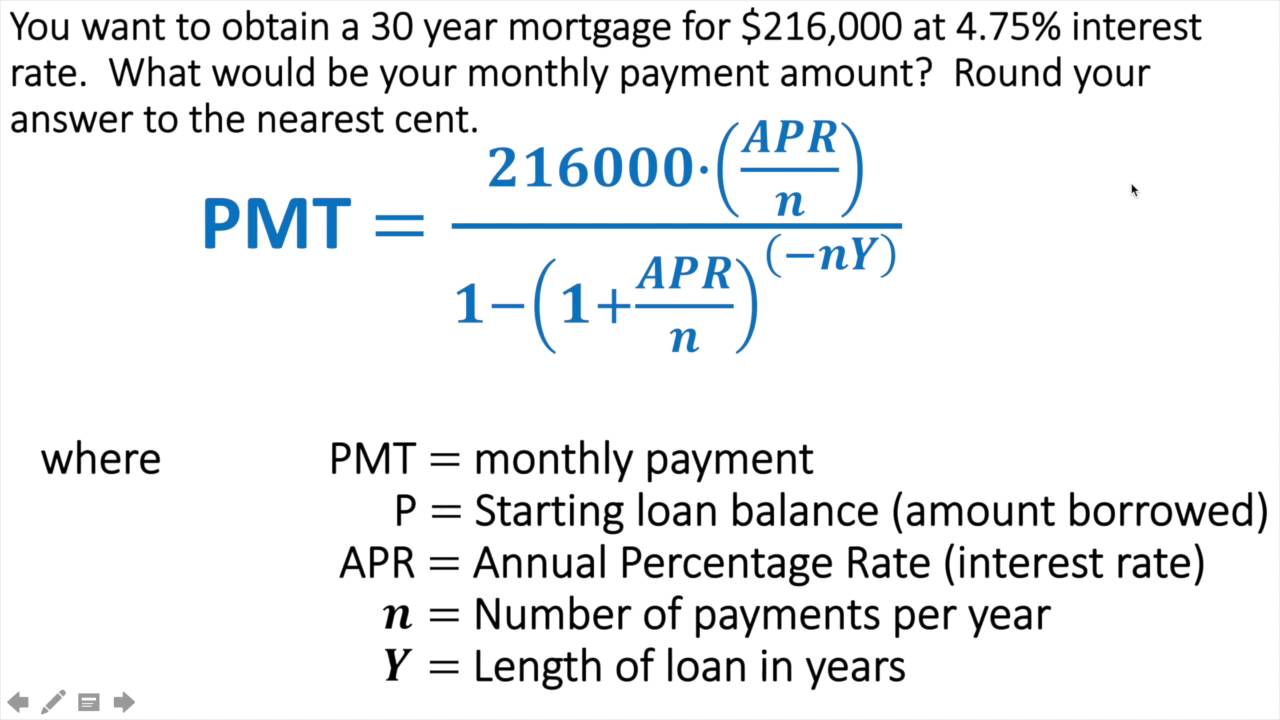

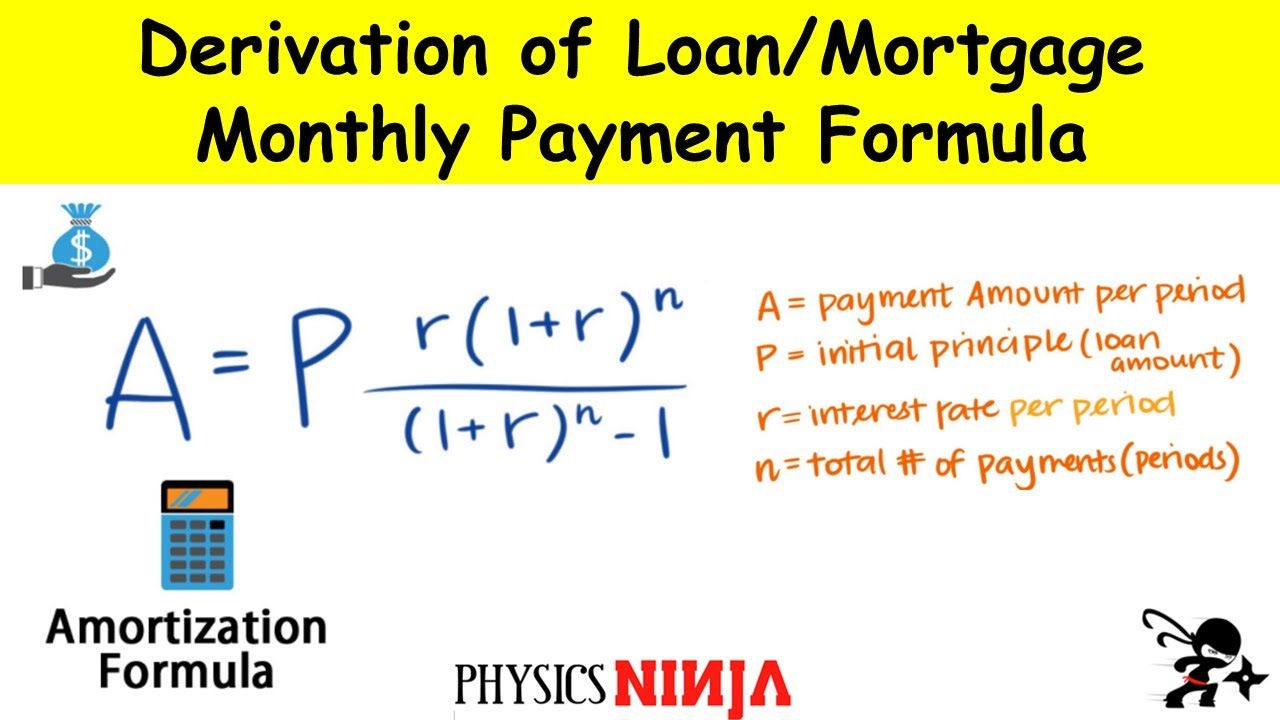

The monthly payment formula calculates how much a loan payment will be and includes the loan s principal and interest When you receive a loan from a lender you receive an amount called the principal and the lender tacks on interest You pay back the loan over a set number of months or years and the interest makes the total amount of money you owe larger The calculation uses a loan payment formula to find your monthly payment amount including principal and compounded interest Input loan amount interest rate as a percentage and length of loan in years or months and we can find what is the monthly payment on your loan This loan calculator also lets you create and print a loan amortization

How To Calculate Monthly Payment On A Loan

How To Calculate Monthly Payment On A Loan

https://i.ytimg.com/vi/Ryfn1L1mjXw/maxresdefault.jpg

How To Calculate Interest Rate Given Monthly Payment Haiper

https://i.ytimg.com/vi/nmsHngY4-BA/maxresdefault.jpg

How To Determine The Monthly Payment On A Loan Payment Poin

https://image.slidesharecdn.com/calc-month-loan-payments-111229001438-phpapp02/95/calculate-monthly-loan-payments-3-728.jpg?cb=1325118368

For example let s say someone is considering getting an auto loan with the following terms 25 000 loan at 4 interest for 5 years First we need to adjust the numbers so they will work with the loan payment formula The formula requires a periodic or monthly interest rate so we need to divide the 4 interest rate by 12 months to arrive at a periodic interest rate of 0 3333 Biweekly Payments For loans that require monthly repayments submitting half of the monthly payment every two weeks instead of one monthly payment can speed up the repayment of loans in two ways Firstly less total interest will accrue because payments will lower the principal balance more often

Your payment plummets to 188 71 which is a monthly savings of 65 22 as well as annual savings of 782 64 Over the life of the loan you will repay only 11 322 60 or approximately 11 percent more than the first amount borrowed A monthly payment calculator allows you to compare different scenarios and how they might affect your budget Referring to the previous example maybe 300 per month is too costly for you

More picture related to How To Calculate Monthly Payment On A Loan

Monrhly Payment Car Loan Calc Elegantxoler

https://investinganswers.com/sites/www/files/Excel-monthly-payment-6.gif

How To Calculate Monthly Loan Payment In Excel YouTube

https://i.ytimg.com/vi/4_w7T5FLeN0/maxresdefault.jpg

Average Mortgage Calculate Average Mortgage Payment

http://www.wikihow.com/images/3/38/Calculate-a-Loan-Payment-Step-3.jpg

You want to calculate how much a mortgage payment would be on a 200 000 mortgage at 6 interest for 360 months 30 years you would enter 200000 or 200 000 Loan Amount 360 Months 6 Interest Rate Compounded Monthly Press the Payment button and you ll see that your monthly payment would be 1 199 10 How the Monthly Payment Calculator Works The Monthly Payment Calculator is pretty straightforward You enter some essential details and it spits out your monthly payment Here s a quick look at how it operates Inputs Principal Amount The total loan amount or cost of the purchase Annual Interest Rate The yearly interest rate charged on

[desc-10] [desc-11]

How To Calculate Monthly Mortgage Payment In Excel Using Function

https://i.pinimg.com/originals/58/e1/2c/58e12ceccd0ce9e911b29480df411223.jpg

Derivation Of Loan Mortgage Monthly Payment Formula YouTube

https://i.ytimg.com/vi/iilFXMHKkZQ/maxresdefault.jpg

How To Calculate Monthly Payment On A Loan - A monthly payment calculator allows you to compare different scenarios and how they might affect your budget Referring to the previous example maybe 300 per month is too costly for you