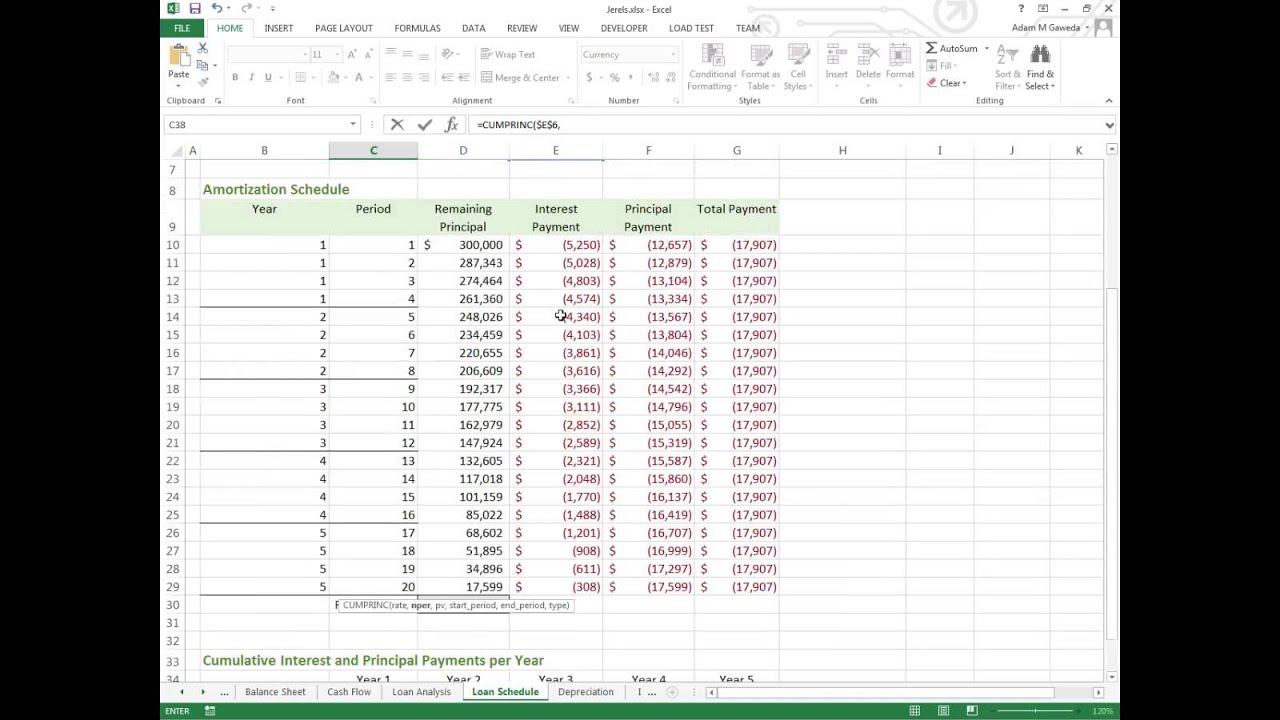

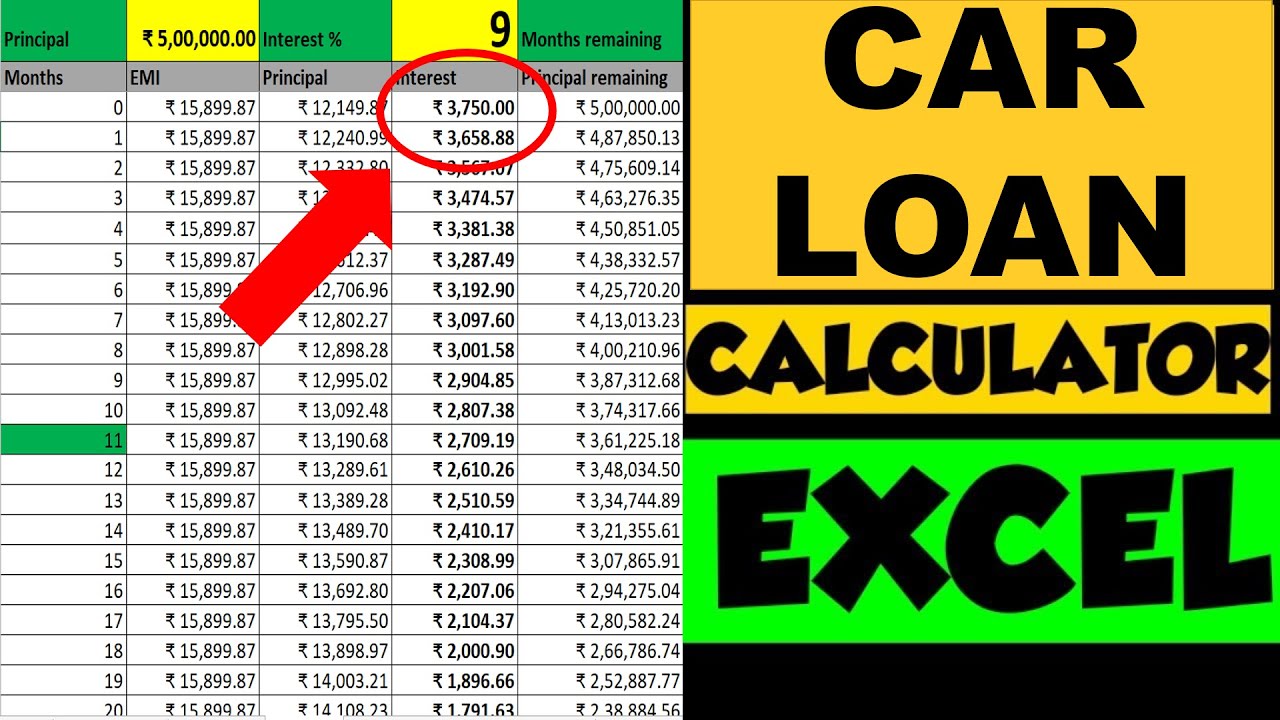

How To Calculate Monthly Interest And Principal Payments In Excel Loan Amount 5 000 000 00 The loan amount It must be entered as a negative value Yearly Rate 10 10 interest rate should be paid annually Period per Year 12 There are 12 months in a year Period 1 To get the result for the first month the input is 1 This value is variable Total Period year 25 The number of years allowed to pay off the total loan amount

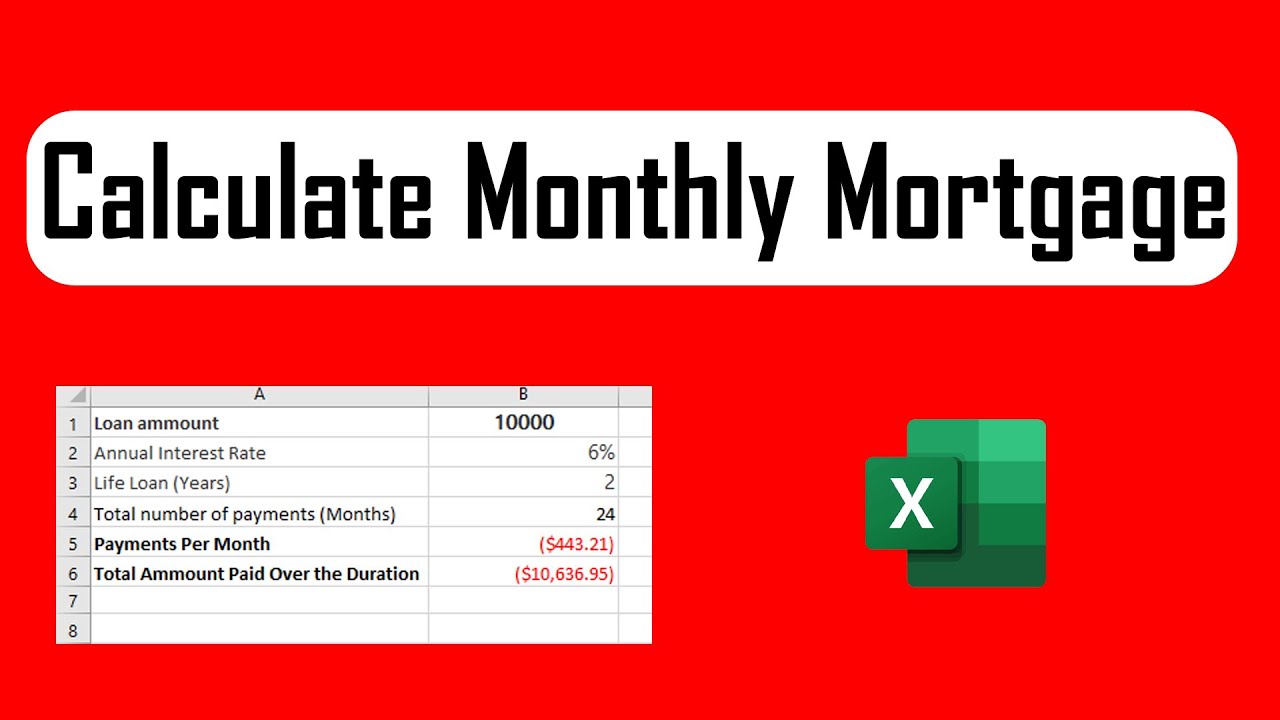

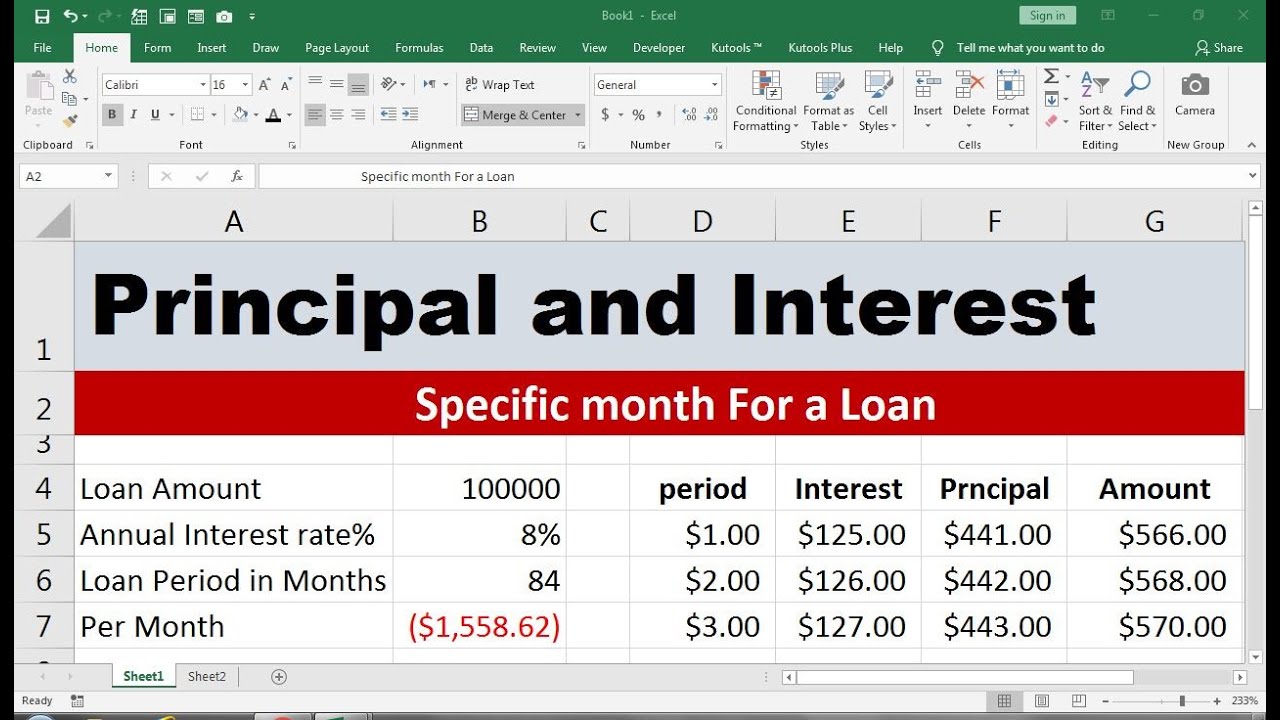

This article will show 3 methods to calculate monthly interest rate in excel learn the methods download the workbook and practice The amount of interest charged monthly by a lender to a borrower on a principal is called the Monthly Interest Rate The interest rate is also applicable when receiving interest as opposed to paying it such D1 Monthly Payment Step 4 Calculate Monthly Interest Rate In a new cell calculate the monthly interest rate by dividing the annual interest rate by 12 If your annual interest rate is in cell B1 you would enter B1 12 in a new cell Step 5 Use the PMT Function To calculate the monthly payment use the PMT function The syntax is PMT

How To Calculate Monthly Interest And Principal Payments In Excel

How To Calculate Monthly Interest And Principal Payments In Excel

https://i.ytimg.com/vi/mHI17_KiOZw/maxresdefault.jpg

How To Calculate Monthly Mortgage Payment In Excel Using Function YouTube

https://i.ytimg.com/vi/0XDu2sKZXYQ/maxresdefault.jpg

How To Calculate Principal And Interest On A Loan In Excel YouTube

https://i.ytimg.com/vi/NyZE0vNllc0/maxresdefault.jpg

Figure out monthly mortgage payments Imagine a 180 000 home at 5 interest with a 30 year mortgage Using the function PMT rate NPER PV PMT 5 12 30 12 180000 the result is a monthly payment not including insurance and taxes of 966 28 The rate argument is 5 divided by the 12 months in a year The NPER argument is 30 12 for a 30 year 2 Total interest expense for one year The total interest for one year can be calculated using the following formula 3 Monthly interest and total interest with compound interest If you do need to use compound interest the monthly interest will increase gradually because the interest will be added to the principal each month Therefore

To calculate the impact of extra payments on the schedule you can use the PMT function in Excel to determine the new monthly payment amount You can then input this new payment amount into the amortization schedule to see how the extra payments affect the remaining balance and the overall timeline for paying off the loan For example for a 800 000 loan at 8 13 over 12 months the monthly payment is approximately 69 638 84 Payment s breakdown Interest and principal interest In the formula IF months 0 0 IPMT rate IF months 0 1 months periods loan 0 0 the IPMT function calculates the interest portion of the payment for a given month The

More picture related to How To Calculate Monthly Interest And Principal Payments In Excel

How To Calculate The Monthly Interest And Principal On A Mortgage Loan

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

Car Loan EMI Calculator Excel With Principal Interest Examples Car

https://i.ytimg.com/vi/7yvUY3SGtXE/maxresdefault.jpg

How To Calculate Monthly Interest And Principal Payments In Excel

https://i.ytimg.com/vi/lSSR2CXAG7I/maxresdefault.jpg

First you need to know the type of loan before you can calculate the payments Interest Only Loan Payment An interest only loan is the one in which the borrower pays only the interest for a certain period of time These types of loan s monthly payments can be calculated by multiplying the interest rate of the loan with the loan amount and Fill separate boxes with the amount of the loan the length you have to pay and the interest and Excel can calculate your monthly payments for you For the remainder of the section you can use the following example loan You take out a 100 000 home loan You have 30 years to pay it off at 4 5 annual interest rate

[desc-10] [desc-11]

How To Calculate Your Monthly Mortgage Payment Given The Principal

https://i.ytimg.com/vi/6bLg_Ex0A-4/maxresdefault.jpg

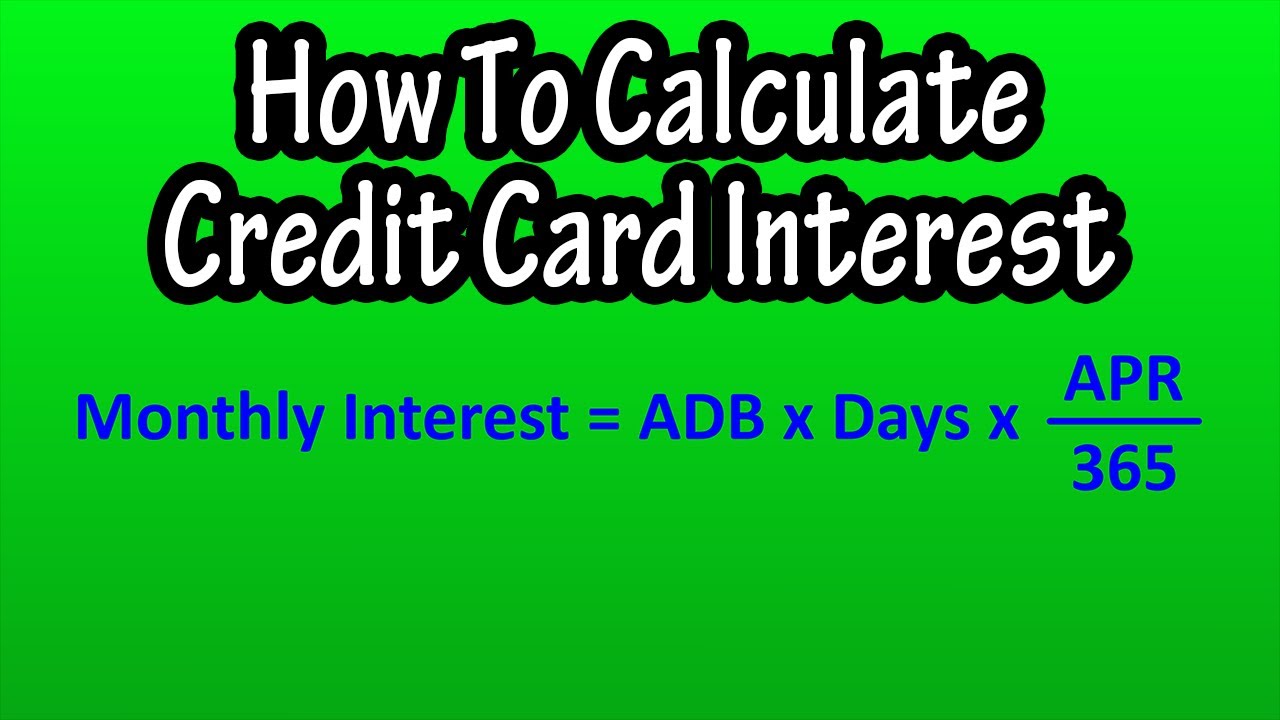

How To Calculate Monthly Credit Card Interest Explained How To

https://i.ytimg.com/vi/Q4sD4oTyVyA/maxresdefault.jpg

How To Calculate Monthly Interest And Principal Payments In Excel - [desc-12]