How To Calculate Monthly Car Payment In Excel Step 01 Computing Total Payable Interest to Calculate Car Payment in Excel First we need to calculate the Total Interest that needs to be paid in the span of 5 years Here we are also going to compute the Monthly Payment by using the PMT function Let s follow the steps mentioned below

Use NerdWallet s auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price interest rate down payment sales tax fees and more Follow these steps to calculate your monthly car payment in Excel 1 Open a new Excel worksheet 2 Enter the variables for your specific loan Balance the price of the car minus any down payment or trade in value of your current vehicle

How To Calculate Monthly Car Payment In Excel

How To Calculate Monthly Car Payment In Excel

https://i.ytimg.com/vi/qtr_gmqEf2o/maxresdefault.jpg

How To Calculate Monthly Loan Payments In Excel InvestingAnswers

https://investinganswers.com/sites/www/files/Excel-monthly-payment-6.gif

How To Calculate Monthly Car Payments By Hand Manually Explained

https://i.ytimg.com/vi/kPVSpcZ5ZeQ/maxresdefault.jpg

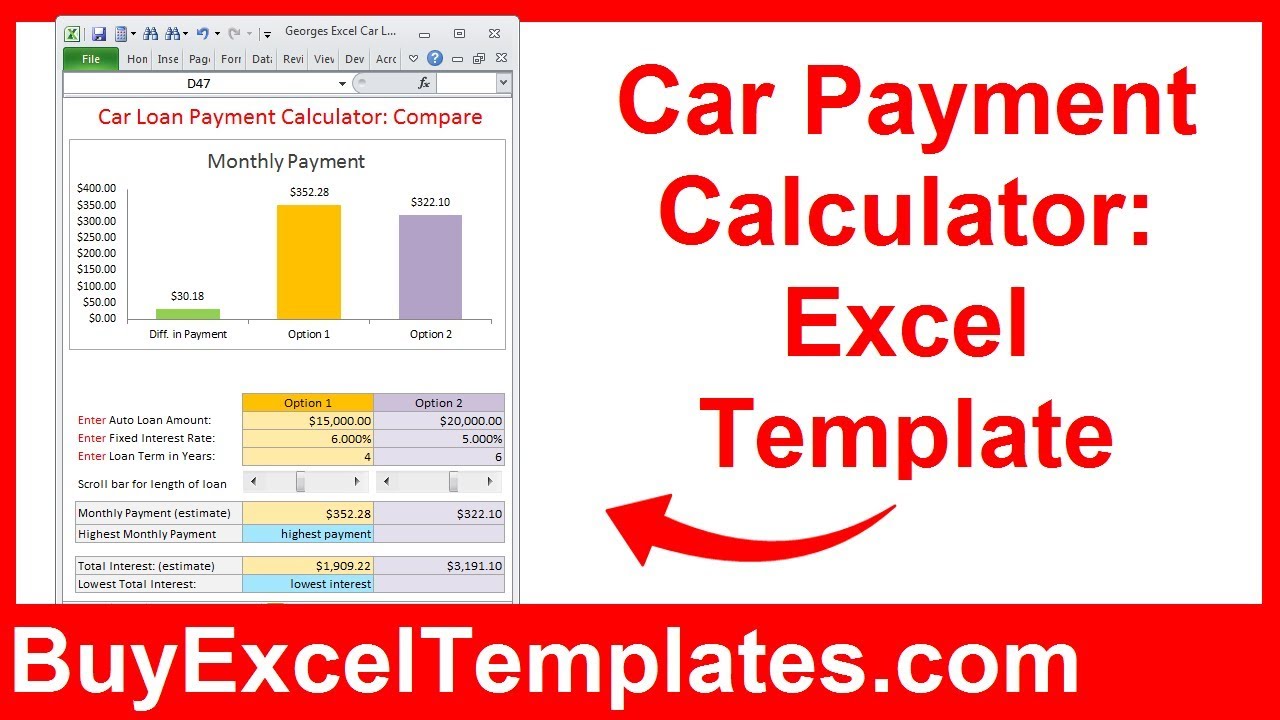

1 Use the Auto Loan Calculator worksheet to calculate the amount you will need to finance based on the sales price of the car destination charge fees sales tax down payment cash rebate and trade in value of an older auto 2 Launch Microsoft Excel 2 Open a new worksheet and save the file with a descriptive name such as Car Loan 1 3 Create labels for the cells in A1 down through A6 as follows Car sale price Trade in value Down payment Rebates Additional charges and Amount financed 2 4

The only required arguments are the first three for interest rate number of payments and loan amount To get the monthly payment amount for a loan with four percent interest 48 payments and an amount of 20 000 you would use this formula PMT B2 12 B3 B4 Loan Use our auto loan calculator to estimate your monthly car loan payments Enter a car price and adjust other factors as needed to see how changes affect your estimated payment

More picture related to How To Calculate Monthly Car Payment In Excel

How To Calculate Monthly Loan Payment In Excel YouTube

https://i.ytimg.com/vi/4_w7T5FLeN0/maxresdefault.jpg

How To Calculate Monthly Mortgage Payment In Excel Using Function

https://i.pinimg.com/originals/58/e1/2c/58e12ceccd0ce9e911b29480df411223.jpg

How To Calculate A Monthly Payment In Excel 12 Steps

http://www.wikihow.com/images/2/28/Calculate-a-Monthly-Payment-in-Excel-Step-12-Version-2.jpg

An auto loan amortization schedule allows you to see that shift from month to month For example if you borrowed 20 000 for 60 months and your APR was 5 your payment would be 377 42 If you 1 Settle on the price of the vehicle that you re buying with the dealership or seller You might be able to pay a lower price than the sticker or asking price by negotiating with the seller Once you settle on a price however that s your starting point For example suppose you negotiate a deal to purchase a new car for 19 055

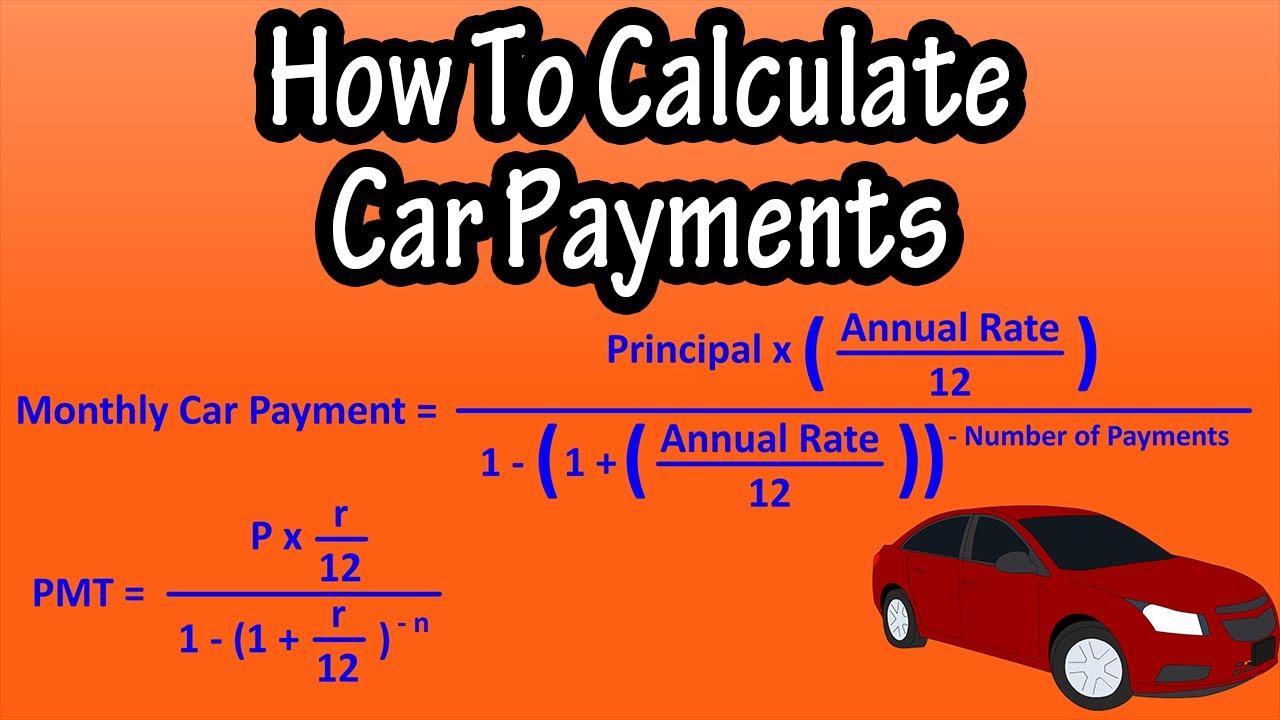

To calculate your monthly car loan payment by hand divide the total loan and interest amount by the loan term the number of months you have to repay the loan For example the total interest on The basic formula for calculating a monthly car payment in Excel is PMT rate nper pv fv type Where rate The interest rate for the loan nper The number of periods over which the loan will be repaid pv The present value or total amount of the loan

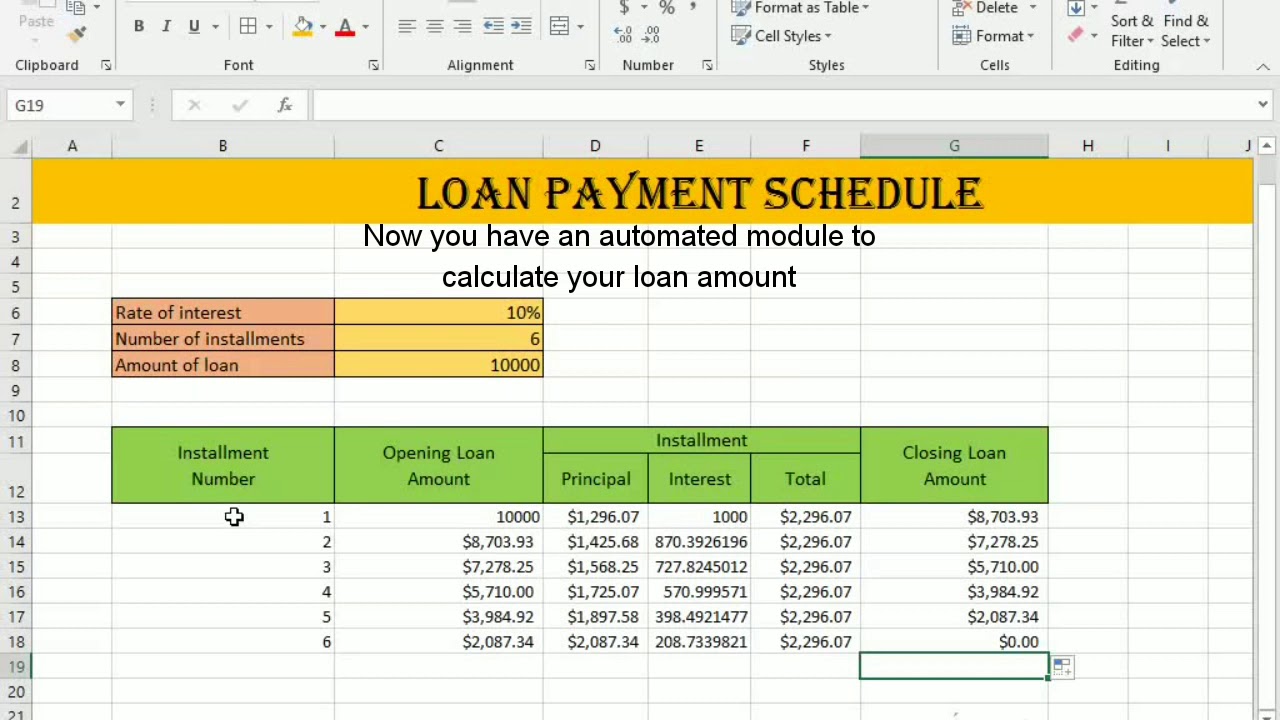

Loan Payment Schedule PMT Formula Excel Automation YouTube

https://i.ytimg.com/vi/DLzaJdo5S1k/maxresdefault.jpg

Estimate Mortgage Payment Excel Formula Exceljet

https://exceljet.net/sites/default/files/styles/og_image/public/images/formulas/estimate mortgage payment.png

How To Calculate Monthly Car Payment In Excel - After entering the formula press Enter to calculate the monthly car payment based on the provided data Following these steps will allow you to use the PMT function in Excel to easily calculate car payments By leveraging the power of Excel functions you can make informed decisions about your car purchase and financial planning