How To Calculate Gross Pay From Net Amount This calculator helps you determine the gross paycheck needed to provide a required net amount First enter the net paycheck you require Then enter your current payroll information and

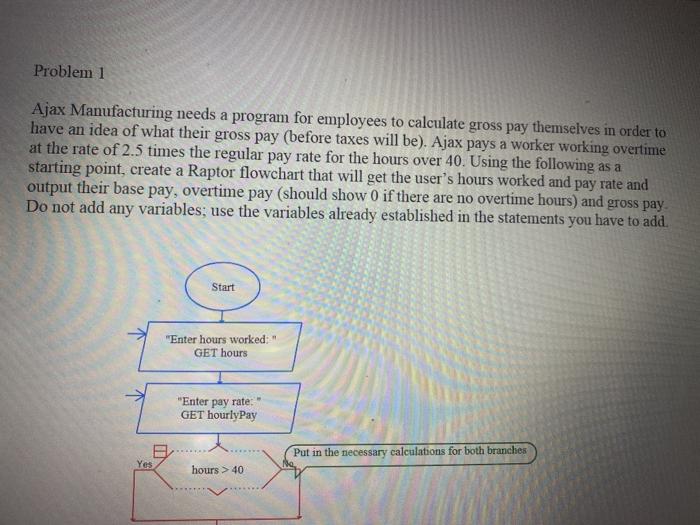

The following steps show how to calculate gross pay for hourly wages Determine the actual number of hours worked Multiply the number of hours worked by the hourly wage If there is overtime multiply the number of overtime hours worked by the overtime pay rate Add regular pay and overtime pay together to find the gross pay for that pay period Use this gross pay to net pay calculator to gross up wages based on net pay For example if an employee receives 500 in take home pay it will calculate the gross amount that must be used when calculating payroll taxes It determines the amount of gross wages before taxes and deductions that are withheld given a specific take home pay amount

How To Calculate Gross Pay From Net Amount

How To Calculate Gross Pay From Net Amount

https://media.cheggcdn.com/study/f1d/f1df08d8-36b8-4df3-821c-6b1369062206/image

How To Calculate Unemployment Tax UnemploymentInfo

https://www.unempoymentinfo.com/wp-content/uploads/how-to-calculate-federal-unemployment-taxes-payable-yemplon.png

What Is Gross Pay Difference Between Gross Pay Net Pay Low Earnings

https://lowearnings.com/wp-content/uploads/2022/03/gross-pay-vs-net-pay.jpg

1 minus 2965 0 7035 Then we ll divide the net pay 700 by the rate 0 7035 700 divided by 0 7035 is 995 00 this number totals the gross payment 995 x 2965 is 295 00 this number equals the total tax withheld 995 295 700 this is the net bonus the employee should receive So the gross up or extra pay the employer The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

2 Divide your employee s annual salary by the number of pay periods If you have a salaried employee making 60 000 per year here s how gross pay would look divided by each type of pay period Weekly 60 000 52 1 153 85 per pay period Every two weeks 60 000 26 2 307 69 per pay period 2 Subtract deductions to find net pay To calculate net pay deduct FICA tax federal state and local income taxes and health insurance from the employee s gross pay Using the formula to calculate net pay determine the employee s net pay Net Pay Gross Pay Deductions Here s a rundown of the withholding amounts we calculated

More picture related to How To Calculate Gross Pay From Net Amount

.png)

How To Calculate Gross Profit Formula And Examples Hourly Inc 2022

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/63646b209859532b69040e08_Net Profit Calculation (1).png

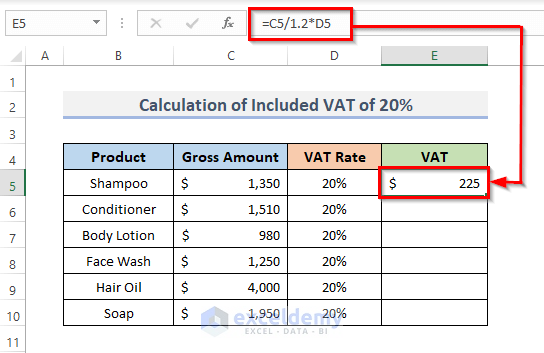

How To Calculate VAT From Gross Amount In Excel 2 Examples

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-vat-from-gross-in-excel-2.png

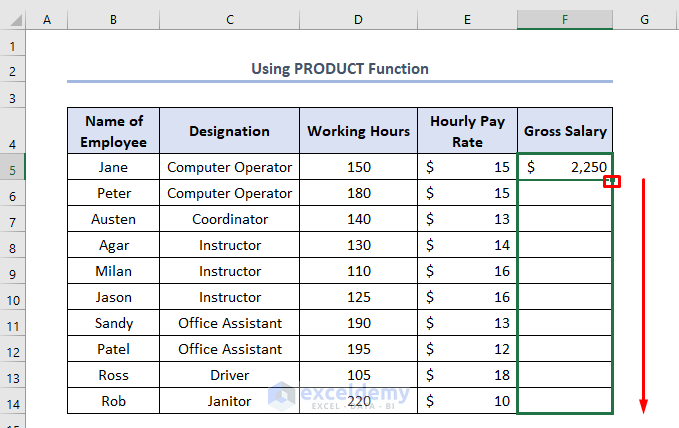

How To Calculate Gross Salary In Excel 3 Useful Methods ExcelDemy

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-gross-salary-4.png

Net pay is the amount of money employees earn after payroll deductions are taken away from gross pay These includes taxes benefits wage garnishments and other deductions In simple terms net In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

There is no income limit on Medicare taxes 1 45 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1 45 If you make more than a certain amount you ll be on the hook for an extra 0 9 in Medicare taxes Here s a breakdown of these amounts for the current tax year Last updated December 1 2023 Calculate the gross amount of pay based on hours worked and rate of pay including overtime Summary report for total hours and total pay Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more

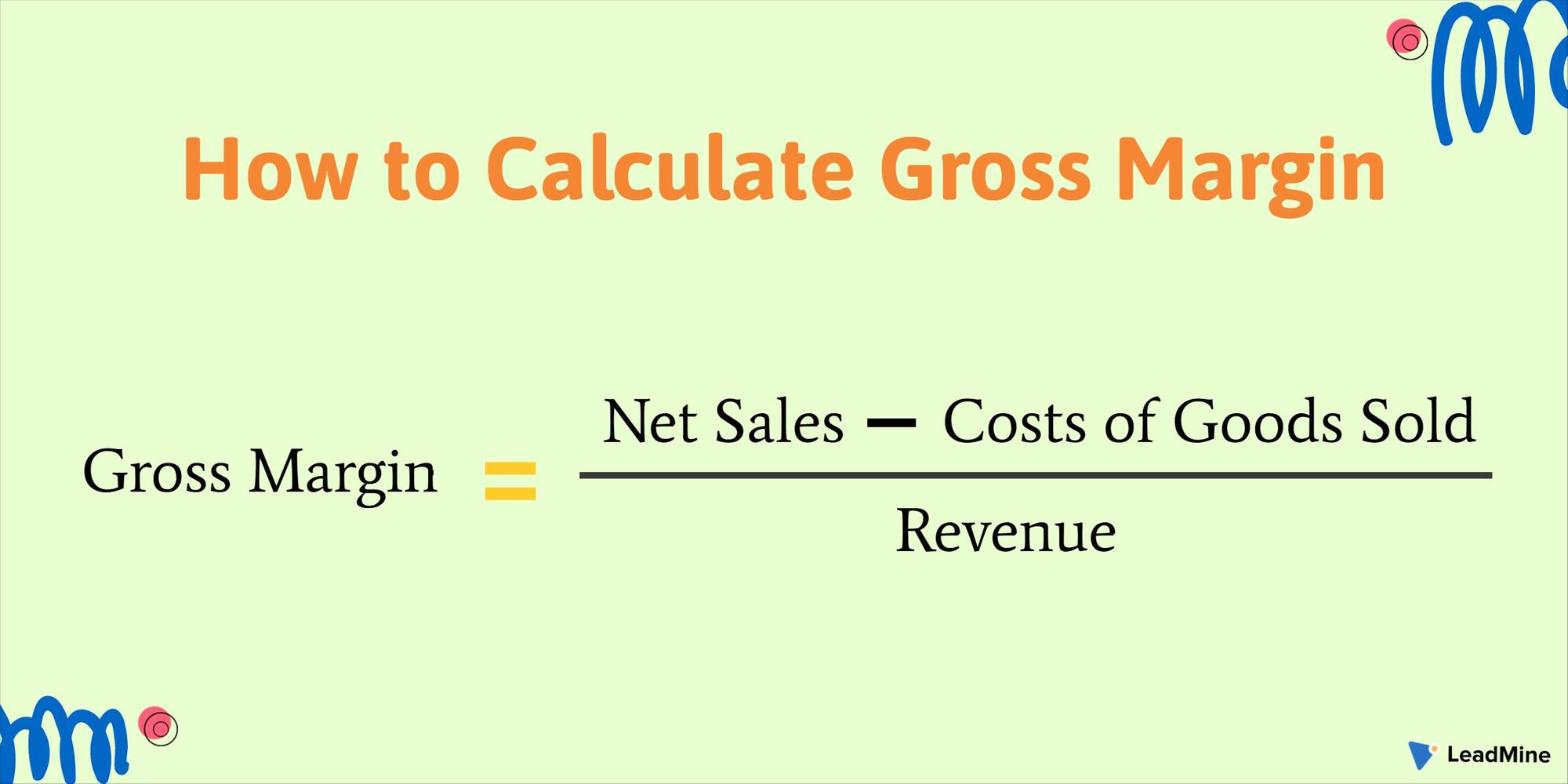

Gross Margin Definition Formula Profit Margin Vs Gross Margin

https://www.leadmine.net/glossary/content/images/2021/04/Calculate-Gross-Margin.jpeg

Gross Annual Income Calculator Hourly JeremyAarya

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/11073323/Annual-Income-Calculator.jpg

How To Calculate Gross Pay From Net Amount - The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck