How To Calculate Gross Annual Income From Ctc CTC Gross Pay Statutory additions PF ESI Bonus In the above formula the statutory additions are the employer s contributions and not the employee which we will look into as this article progresses However The confusion between gross salary and basic pay is often caused

Gross salary is the aggregate amount of compensation paid by an employer or company towards the employment of an employee Gross salary is the total amount of money your employer pays you before any deductions are made It s essentially the raw number before taxes provident fund contributions and other social security payments are taken out Updated 12 November 2022 Cost to company CTC is the total amount that a company spends on its employees in a year There are certain formulas that can help you calculate CTC easily Understanding different terms and the formula to calculate the CTC can help you learn the base of your salary structure

How To Calculate Gross Annual Income From Ctc

How To Calculate Gross Annual Income From Ctc

https://www.taxesprotalk.com/wp-content/uploads/gross-annual-income-compute-imor-salary.png

What Is Pre Tax Commuter Benefit

http://www.remotefinancialplanner.com/wp-content/uploads/2017/02/word-image-3.png

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week Income Tax Calculator FD Calculator HRA Calculator Gratuity Calculator EPF Calculator Rent Reciept Generator Additional Information Save Tax up to 78 000 What is Salary Calculator Your salary slip has two main sections One section is income or earnings And the second part is deductions

How to Calculate CTC There s a simple formula that organisations follow to calculate annual CTC Here s what it is CTC Gross Salary Direct Benefits Indirect Benefits Savings Contributions or Deductions In the formula Gross Salary Basic salary allowances like DA and HRA among others Direct Benefits Monetary benefits such as If you know your annual income and want to determine what your hourly wage is simply input your annual income and the number of working hours and weeks and the calculator will provide the hourly wage Similarly if you have your net salary and know your tax rate you can work backward to find out your gross annual income

More picture related to How To Calculate Gross Annual Income From Ctc

LouizeGeorgie

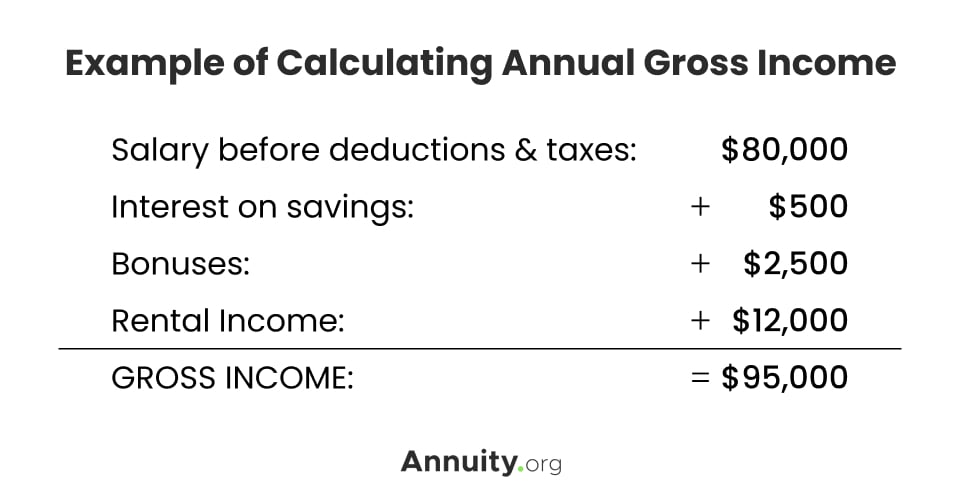

https://www.annuity.org/wp-content/uploads/example-of-calculating-annual-gross-income.jpg

K n lat Zaj tterem Calculate Your Income Tax India Perseus AIDS Gyep

https://m.foolcdn.com/media/dubs/images/gross-monthly-income-infographic_cOZTYId.width-880.png

Dec t Detaliat Venituri How To Calculate Gross Annual Income nvins Director Nod

https://i.ytimg.com/vi/PaD6N4iwQtU/maxresdefault.jpg

So to put it another way Annual income hourly wage x weekly hours x weeks worked in a year Say you earn 30 per hour and work 40 hours per week Your annual gross income will be 62 400 if A gross salary is a gratuity and EPF employee provident fund subtracted from the cost to the company The components of Gross salary consists of the following Basic Salary House rent allowance Special Allowance Conveyance Allowance Educational Allowance Medical allowance Leave travel allowance etc

Gratuity 29 629 Now Disha s CTC is the total of all the direct benefits listed which amounts to INR 7 00 000 Reduce that amount by the gratuity and PF contribution to arrive at the gross salary So as per the gross salary formula Gross Salary 7 00 000 84 000 29 629 INR 5 86 371 Now subtract from this value the total Cost To Company abbreviated as CTC is the all inclusive annual package that sums up every expense made by employers for their employees in a year How To Calculate Gross Salary From CTC Gross Salary is the sum of all the earnings profits interest payments reimbursements and other forms of payment without any deductions

Car MSRP Vs Invoice Everything You Need To Know The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/08/making-its-first-appearance-in-chicago-is-the-all-new-news-photo-1584893537-660x400.jpg

How To Calculate Gross Annual Value In House Property GAV Under New Tax

https://i.ytimg.com/vi/fkmwu9M49Io/maxresdefault.jpg

How To Calculate Gross Annual Income From Ctc - Income Tax Calculator FD Calculator HRA Calculator Gratuity Calculator EPF Calculator Rent Reciept Generator Additional Information Save Tax up to 78 000 What is Salary Calculator Your salary slip has two main sections One section is income or earnings And the second part is deductions