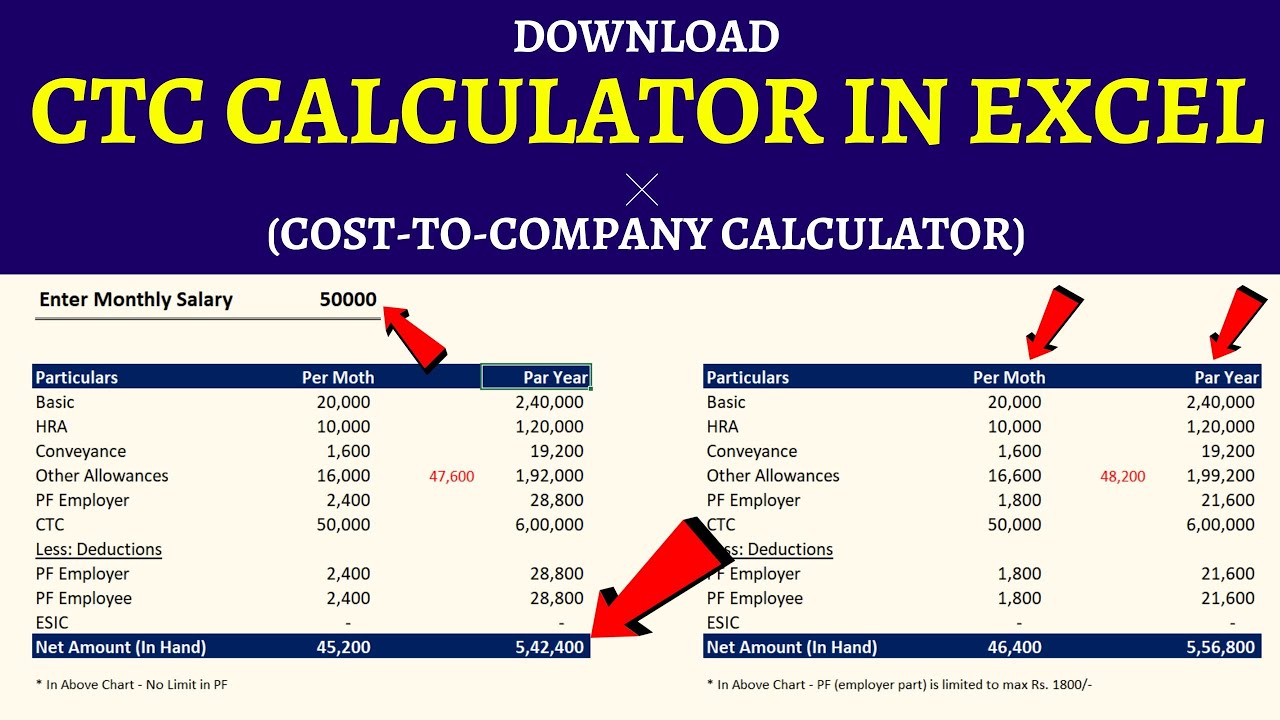

How To Calculate Basic Salary From Ctc In Excel CTC Calculator in Excel Download Cost to company Calculator The article discusses a tool called the CTC Salary Calculator which is an Excel based calculator designed to help businesses and HR professionals calculate the cost to company CTC of an employee s salary

In this video I ll guide you through three methods to calculate a basic salary You ll learn about using gross salary using CTC and deducting PF to calcul Firstly select the B15 cell and write down the following formula VLOOKUP B7 Structure B 5 D 8 3 0 D7 E7 Then hit Enter Consequently we will have the net basic salary of the employee for that month Move the cursor down to autofill the rest of the cells Formula Breakdown

How To Calculate Basic Salary From Ctc In Excel

How To Calculate Basic Salary From Ctc In Excel

https://i.ytimg.com/vi/LEDuXuR0HC8/maxresdefault.jpg

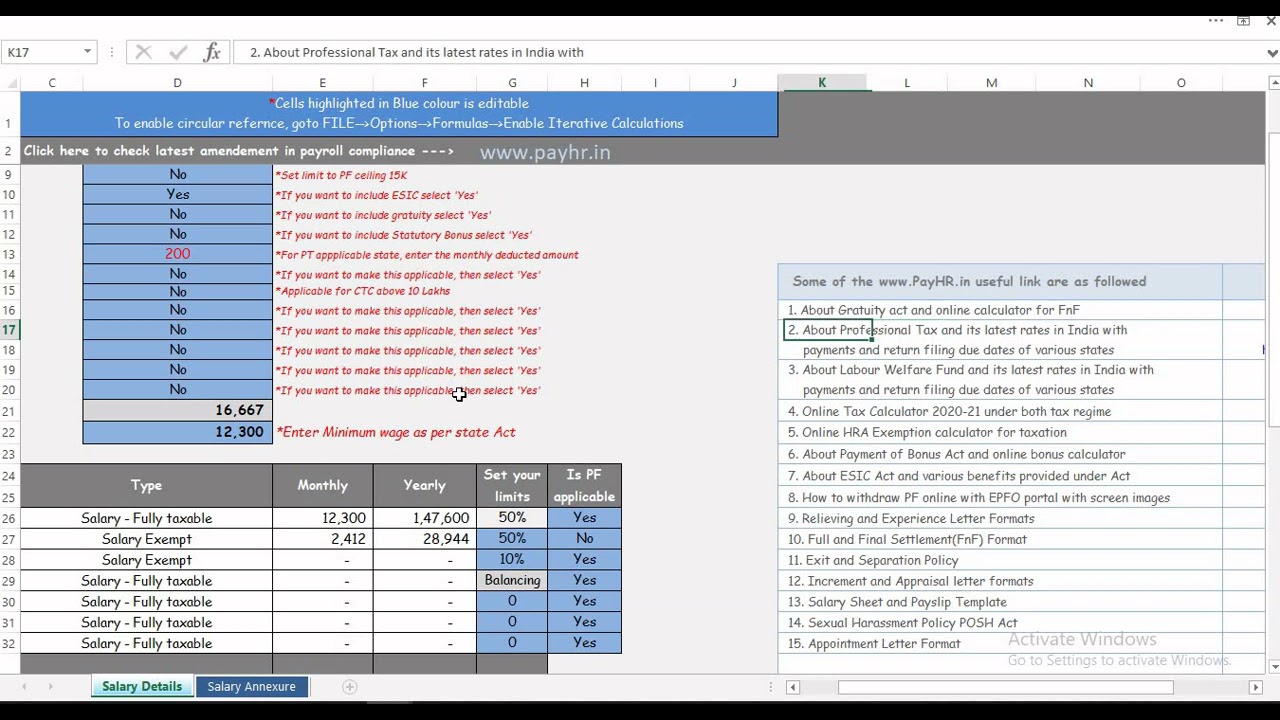

Download CTC Calculator In Excel Cost To Company Calculator YouTube

https://i.ytimg.com/vi/Ig5izabu_bU/maxresdefault.jpg

Basic Salary Percentage Of CTC Calculation Simply Explained By

https://i.ytimg.com/vi/Ntuv6zlWlRI/maxresdefault.jpg

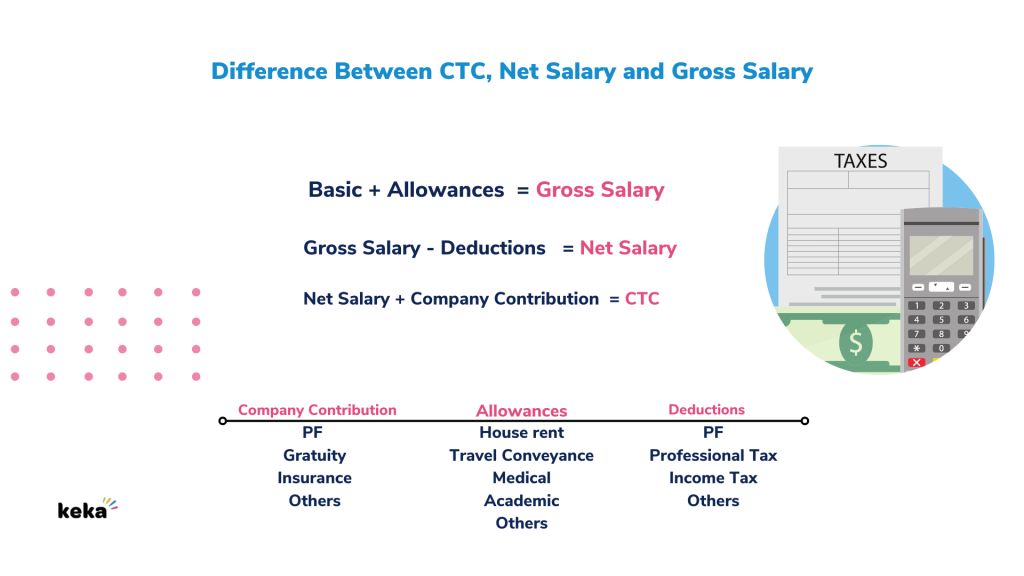

Salary Basic HRA Transport Allowance FBP Allowance Bonus Provident Fund Income Tax Insurance The salary structure can vary significantly between countries due to cultural norms economic factors industry practices job market conditions cost of living and local labor laws Consider these examples on how to calculate basic pay Assume that Raj s Gross Pay is Rs 45 000 From the above formulas basic salary is generally 40 of Gross Pay or Rs 18 000 If Rashi s CTC is 60 000 and if we use the CTC percentage then her basic salary amounts to 50 of the CTC or Rs 30 000 Thus her basic salary is Rs 30 000

CTC Gross Pay Statutory additions PF ESI Bonus In the above formula the statutory additions are the employer s contributions and not the employee which we will look into as this article progresses However The confusion between gross salary and basic pay is often caused 1 Enter the Annual Income CTC Amount Start by entering the annual salary amounts in the designated fields This includes basic salary HRA LTA special allowance and other allowances 2 Select Compliance Settings Next select the compliance settings as per your establishment s applicability

More picture related to How To Calculate Basic Salary From Ctc In Excel

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

CTC Calculator In Excel Download Cost to company Calculator

https://techguruplus.com/wp-content/uploads/2023/04/CTC-Calculator-in-Excel-Download-Cost-to-company-Calculator.gif

How To Calculate MAPE With Zero Values simply Explained

https://stephenallwright.com/content/images/size/w1384/2022/07/How-to-calculate-MAPE-with-0-values.png

Basic Salary Calculation Formula in Excel Most of the companies will fix the basic salary between 40 60 of gross salary But remember after calculating the amount the basic pay should be more than minimum wages fixed by your state govt if you get less amount then increase the percentage Calculate In Hand Salary Create formulas to deduct taxes and contributions from the CTC to calculate the in hand salary Review Results Test the calculator by inputting different values and reviewing the calculated in hand salary Using an Excel calculator allows you to customize and tailor the calculations based on your specific situation

Step 1 First you are required to enter the CTC Step 2 Enter the variable part of the CTC like the bonus Step 3 Enter the basic salary from your CTC Step 4 ET Money s Salary Calculator will show the approximate net take home salary Step 5 Lastly You also have the option to calculate actual in hand salary 1 Basic Salary This is the fixed component of the salary excluding any benefits and privileges It can vary depending on the job location industry and designation It accounts for around 40 60 of the CTC and is fully taxable

How To Calculate Your Salary In India A Comprehensive Guide

https://imgmidel.modeladvisor.com/1666240018708.jpg

What Is Cost To Company CTC Meaning Definition Keka HR

https://d2w2i7rp1a0wob.cloudfront.net/media/2021/04/Basic-Allowances-Gross-Salary-1-1024x576.png

How To Calculate Basic Salary From Ctc In Excel - 1 Enter the Annual Income CTC Amount Start by entering the annual salary amounts in the designated fields This includes basic salary HRA LTA special allowance and other allowances 2 Select Compliance Settings Next select the compliance settings as per your establishment s applicability