How Much Would A 80000 Home Equity Loan Cost Per Month Learn what to expect during the home equity loan application process with Discover Home Loans Start your application online or give us a call Call us at 1 855 361 3435 Weekdays 8am Midnight ET Weekends 10am 6pm ET Get Started DISCOVER LOGO PO Box 29029 Phoenix AZ 85038 9029 X Facebook You Tube

NerdWallet rating Min credit score 680 Max loan amount 350 000 Check Rate on Rocket Mortgage Use this home equity loan calculator to see whether a lender might give you a home equity loan 10 year home equity loan A 10 year 80 000 home equity loan at 8 74 interest would come with a monthly payment of 1 002 18 And you would pay 40 262 04 in interest by the time you paid the

How Much Would A 80000 Home Equity Loan Cost Per Month

How Much Would A 80000 Home Equity Loan Cost Per Month

https://www.cobaltcu.com/sites/default/files/2022-01/Home-Equity-Loan-VS-Line-of-Credit.png

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog

https://www.bestfinance-blog.com/wp-content/uploads/2021/04/AdobeStock_165000956-scaled.jpeg

What Is A Home Equity Loan Home Equity Solutions

https://jfh-assets.s3.amazonaws.com/BJxcPJs1e.jpg

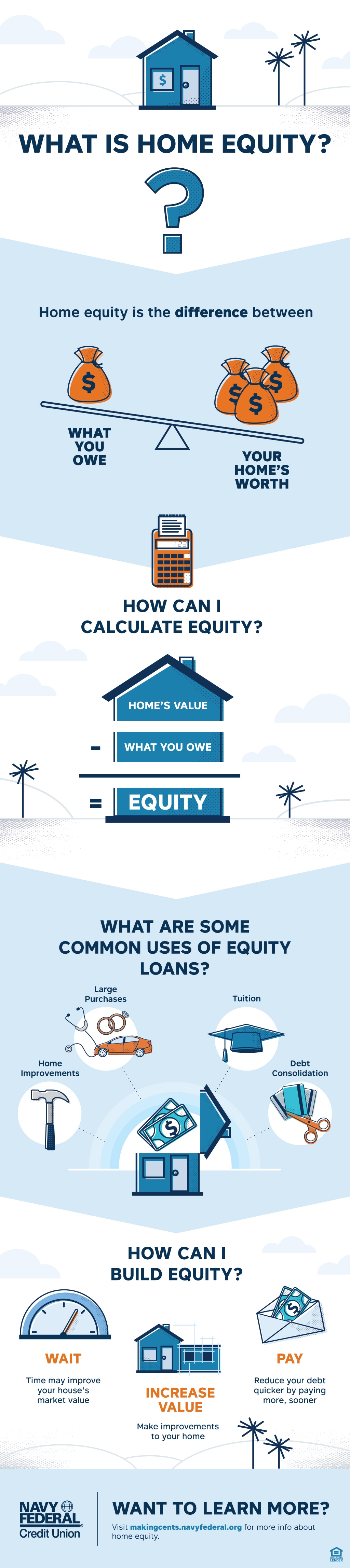

Closing Home equity loans typically have a closing cost ranging between 2 and 5 of the amount borrowed This would mean that if you borrowed 50 000 you might expect to pay 1 000 to 2 500 in closing costs Total closing costs on a home equity loan are typically significantly lower than closing costs on either a home purchase or a mortgage A home equity loan is a fixed rate lump sum loan whose amount is determined by how much equity the borrower has in their home The homeowner can borrow up to 85 of their home equity to be paid

CoreLogic estimated that in the second quarter of 2018 U S homeowners saw an average increase of equity of 16 200 for the past 12 months while key states like California increased by as much as 48 000 Through the middle of 2018 homeowners saw an average equity increase of 12 3 for a total increase of 980 9 billion Subtract the 220 000 outstanding balance from the 410 000 value Your calculation would look like this 410 000 220 000 190 000 In this case your home equity would be 190 000 a

More picture related to How Much Would A 80000 Home Equity Loan Cost Per Month

Home Equity Loan Jeff Bank

https://www.jeff.bank/wp-content/uploads/2017/05/Home-Equity-Loan.jpg

How Much Would A 20 000 Home Equity Loan Cost Per Month

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1ijaSE.img

Infographic What Is Home Equity MakingCents Navy Federal Credit Union

https://www.navyfederal.org/content/dam/on-track/mortgage/articles/home_equity_infographic_final_.jpg

Enter your loan s interest rate This is the annual interest rate you ll pay on the loan Home equity loan rates are between 3 5 and 9 25 on average Select Calculate Payment The calculator returns your estimated monthly payment including principal and interest Actual payments may vary The APR will vary with Prime Rate the index as published in the Wall Street Journal As of November 6 2023 the variable rate for Home Equity Lines of Credit ranged from 8 95 APR to 13 10 APR Rates may vary due to a change in the Prime Rate a credit limit below 50 000 a loan to value LTV above 60 and or a credit score less than 730

CHB Current HELOC Balance RP Repayment Period years RATE monthly interest rate Decimal Rate 12 or RATE Annual Interest Rate 100 12 Currently 4 52 5 This HELOC calculator is designed to help you quickly and easily calculate your monthly HELOC payment per your loan term current interest rate and remaining balance The home equity loan calculator generates an amortization schedule that shows you all the payment details The home equity loan payment breakdown shows you how much interest and principal you are paying each month for your home equity loan 10000 Home Equity Loan Payment 15000 Home Equity Loan Payment 80000 Home Equity Loan Payment

How Home Equity Loans Affect Taxes Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2022/10/2022-optima-tax-home-equity-loans-scaled.jpg

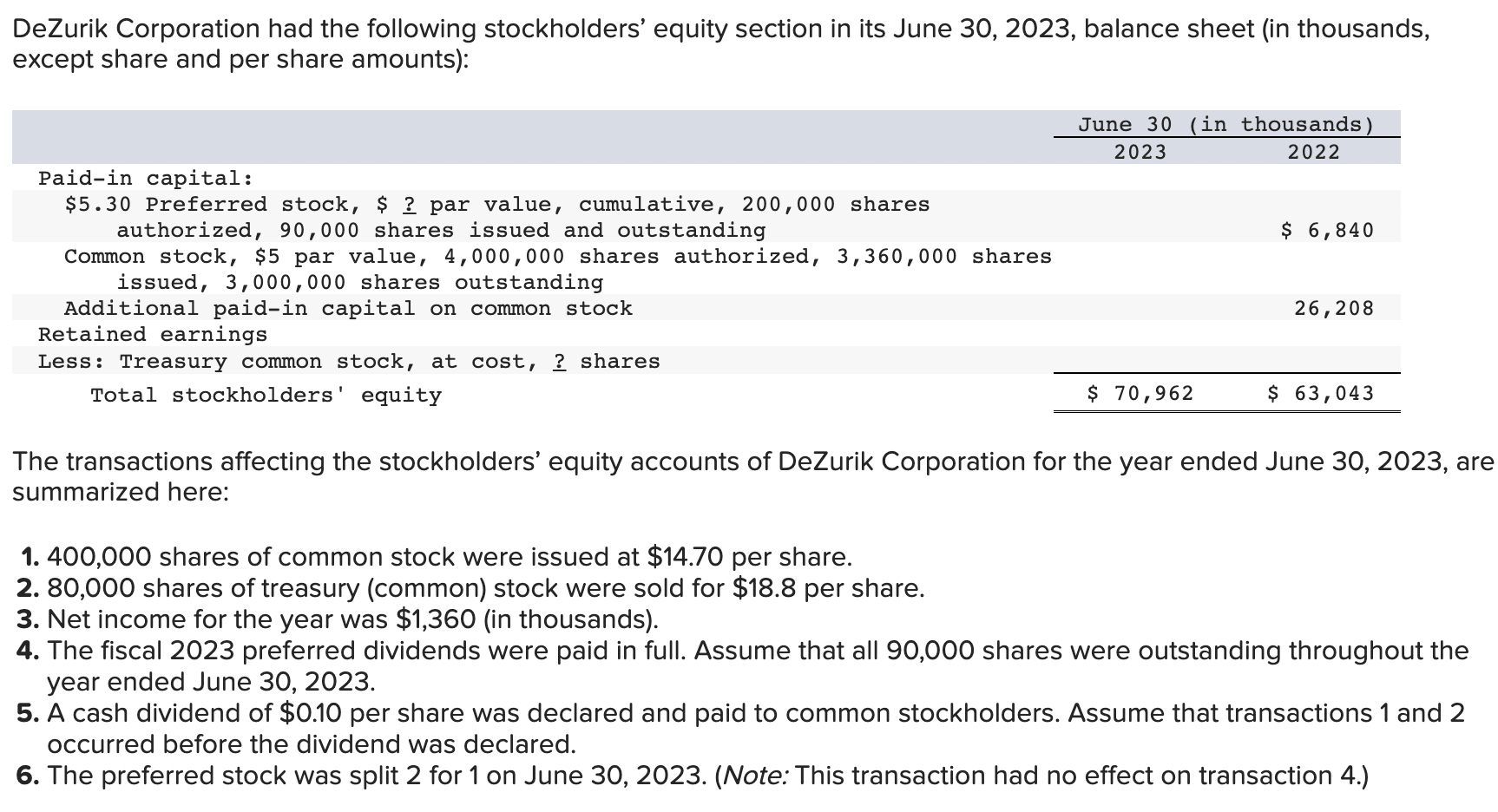

Solved DeZurik Corporation Had The Following Stockholders Chegg

https://media.cheggcdn.com/media/113/11344108-0316-4a94-9f21-e7112b307a77/phpF9Iuh4

How Much Would A 80000 Home Equity Loan Cost Per Month - Subtract the 220 000 outstanding balance from the 410 000 value Your calculation would look like this 410 000 220 000 190 000 In this case your home equity would be 190 000 a