How Much Will I Bring Home After Taxes In Illinois To effectively use the Illinois Paycheck Calculator follow these steps Enter your gross pay for the pay period Choose your pay frequency e g weekly bi weekly monthly Input your filing status and the number of allowances you claim Add any additional withholdings or deductions such as retirement contributions or health insurance premiums

Median household income in Illinois 78 433 U S Census Bureau Number of cities that have local income taxes How Your Illinois Paycheck Works For each pay period your employer will withhold 6 2 of your earnings for Social Security taxes and 1 45 of your earnings for Medicare taxes The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

How Much Will I Bring Home After Taxes In Illinois

How Much Will I Bring Home After Taxes In Illinois

https://i.ytimg.com/vi/kGEQUrSqD5Y/maxresdefault.jpg

How Much Tax Is Taken Out Of Paycheck In Texas TaxesTalk

https://www.taxestalk.net/wp-content/uploads/see-what-a-100k-salary-looks-like-after-taxes-in-your-state.jpeg

How Much Will I Bring Home After Taxes Texas Designbyburke

https://lh3.googleusercontent.com/proxy/TX_htbVc8SUld93Vo8uO3TUBfjXeNUiXGl_rcbf4FMYIDSHe4BaPB-qDGzymFnzB5EBIX3x4FMI5OK1K_86AIa4747N0fUnD9yk1nZ9rK491ytaYVkg_NTgMXtKBuhBCmEGuaj-7thtQWDLfdIlD2l1i1bfxAW62lA=s0-d

If you re an employee generally your employer must withhold certain taxes such as federal tax withholdings social security and Medicare taxes from your paycheck In addition you may opt to Income tax calculator Illinois Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 State Income Tax 2 723 Social Security 3 410 Medicare 798 Total tax 11 798 Net pay 43 202 Marginal tax rate 34 6

You have to fill out this form and submit it to your employer whenever you start a new job but you may also need to re submit it after a major life change like a marriage If you do make any changes your employer has to update your paychecks to reflect those changes Use ADP s Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest

More picture related to How Much Will I Bring Home After Taxes In Illinois

Ways To Get Your Finances Under Control Finances

https://drmarciewolisky.com/wp-content/uploads/2021/11/ways-to-get-your-finances-under-control-800x445.png

High Property Taxes In Illinois Real Estate Lawyer

https://stelklaw.com/wp-content/uploads/2021/04/property-taxes-e1621345175143.jpg

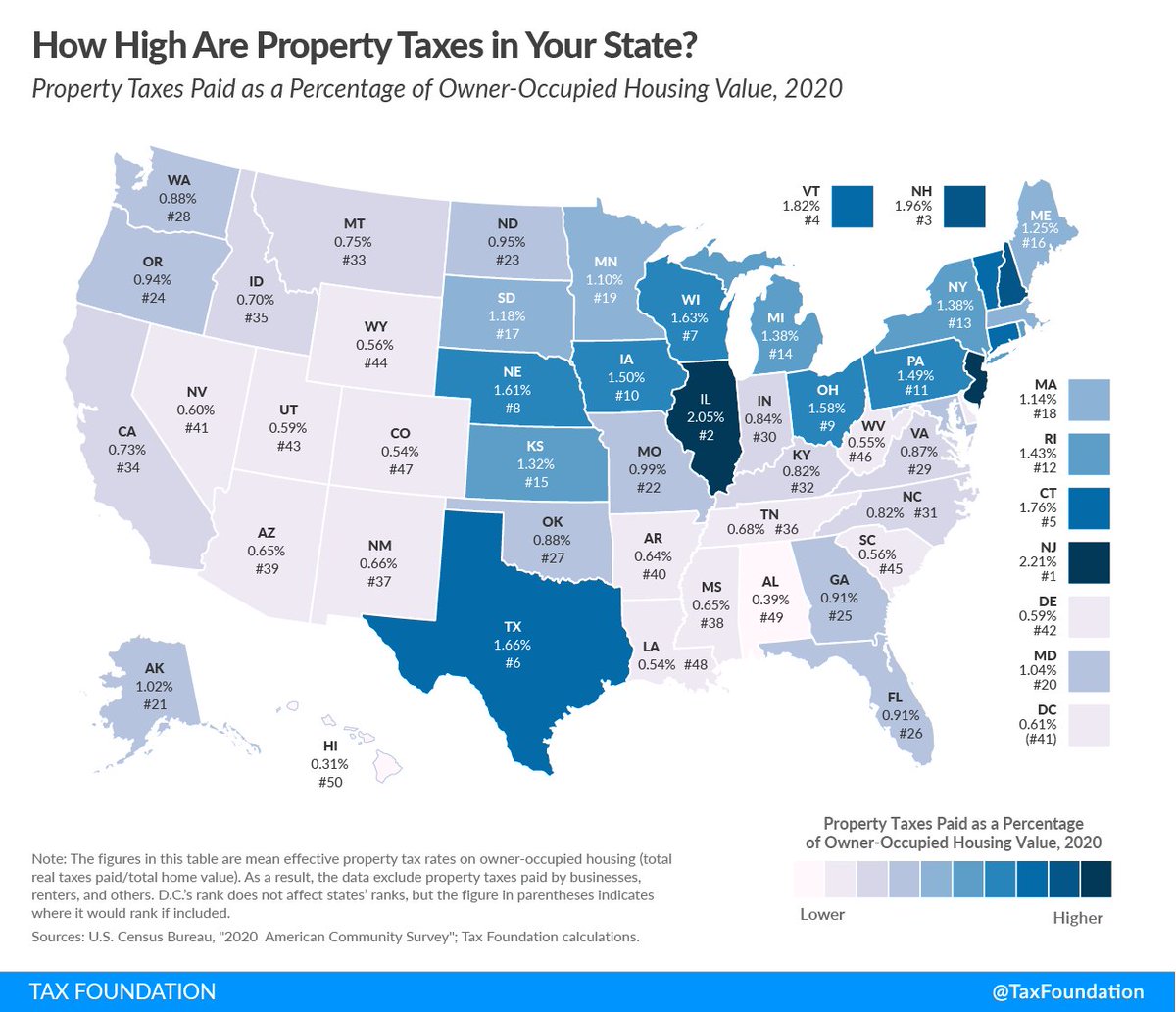

M Nolan Gray On Twitter Probably Not An Accident That New Jersey

https://pbs.twimg.com/media/FfYHvR1XkAMtoxY.jpg

A married couple who earns 126 000 per year will take home 98 114 07 after tax How much taxes will get deducted from a 63 000 paycheck in Illinois The total taxes deducted for a single filer are 1161 54 monthly or 536 1 bi weekly Here s how much you would bring home after taxes in Illinois Factoring in Illinois 4 95 tax the final average payment would be 20 35 million This article tagged under

Maximizing Your Take Home Pay Now that you understand how much you ll bring home after taxes and the factors that affect your net income let s explore some strategies for maximizing your take home pay Review Your Withholding Periodically review your Form W 4 and adjust your withholding allowances as needed There is also a citywide referendum question on the ballot to amend the real estate tax in Chicago RELATED Illinois election board decides Donald Trump will stay on primary ballot Early voting

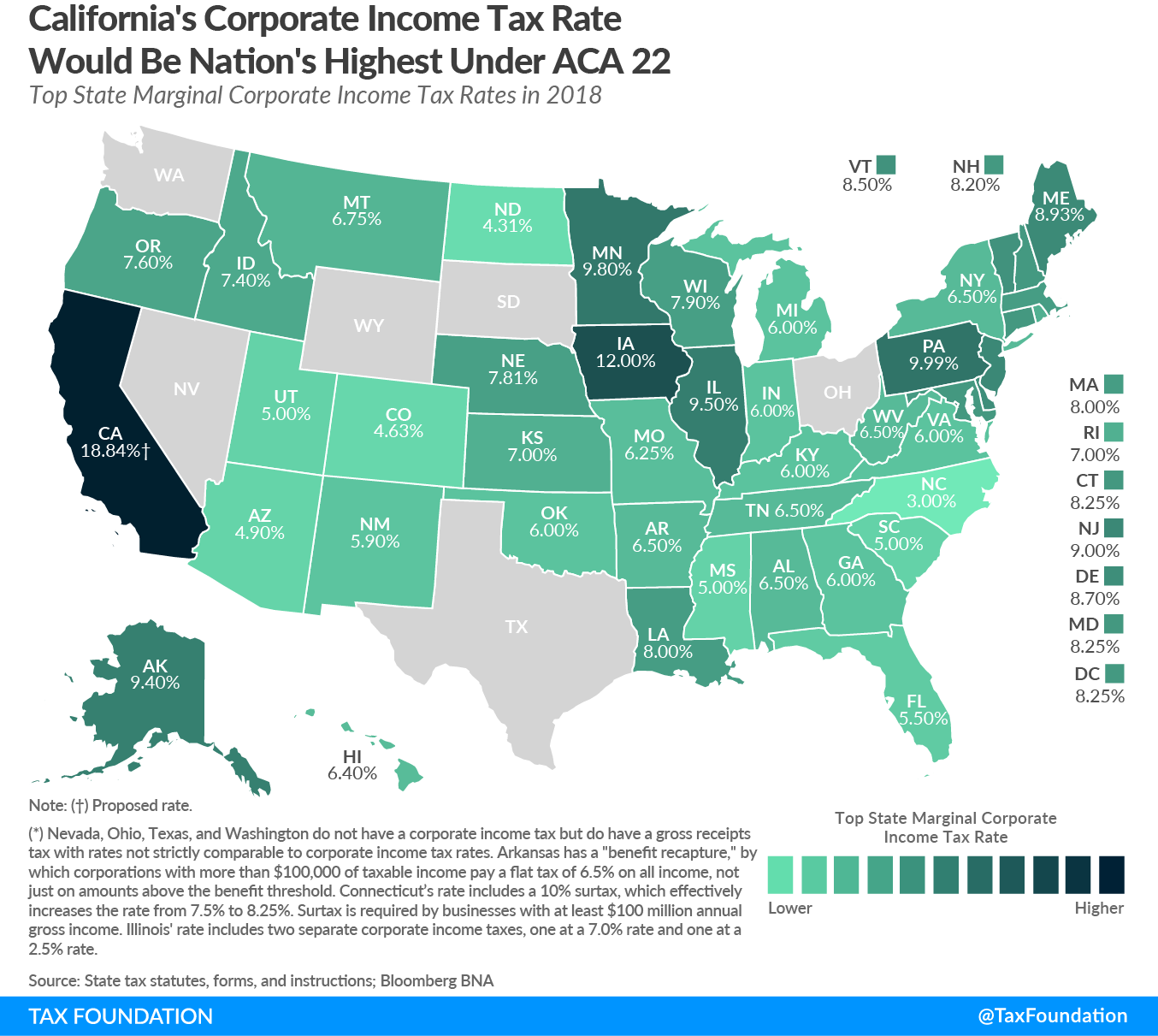

What Is California State Tax Rate TaxesTalk

https://www.taxestalk.net/wp-content/uploads/californias-corporate-income-tax-rate-could-rival-the.png

How To Calculate Fuel Tax TaxesTalk

https://www.taxestalk.net/wp-content/uploads/calculating-fuel-tax-credit-manually-ps-support.png

How Much Will I Bring Home After Taxes In Illinois - Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total