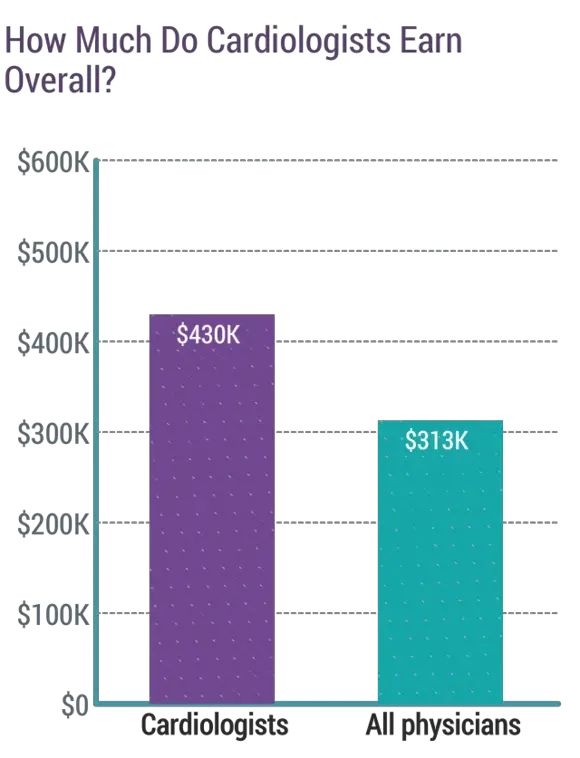

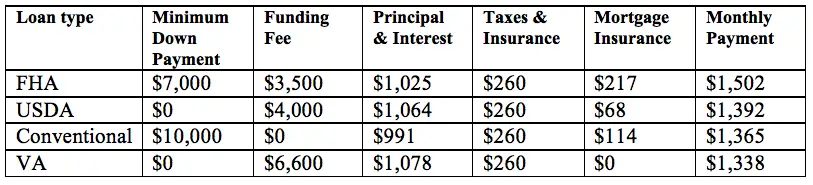

How Much Mortgage Can I Afford With 200k Salary If you re earning 200 000 annually your monthly gross income is likely to be about 16 666 Applying the 28 36 rule your monthly mortgage payment should be no more than 4 666 which is 28

How much can I afford on my salary Let s say you earn 100 000 each year which is 8 333 per month By using the 28 percent rule your mortgage payments should add up to no more than 28 That will affect how large of a mortgage payment you can afford In the example above a home buyer with 1 500 in monthly debt payments 43 DTI needs an 84 000 salary to qualify for a 200 000

How Much Mortgage Can I Afford With 200k Salary

How Much Mortgage Can I Afford With 200k Salary

https://www.mortgageinfoguide.com/wp-content/uploads/how-much-mortgage-can-i-afford-with-200k-salary-swohm.png

How Much Mortgage Can I Afford with A 1 200 Payment

https://www.myrealestatespot.com/hs-fs/hubfs/Planning Images/Planning Strategy.jpg?width=1184&name=Planning Strategy.jpg

How Much Mortgage Can I Afford On 200k Salary MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/how-much-house-can-i-afford-200k-income-whmuc.png

Affordability Guidelines Your mortgage payment should be 28 or less Your debt to income ratio DTI should be 36 or less Your housing expenses should be 29 or less This is for things like insurance taxes maintenance and repairs You should have three months of housing payments and expenses saved up How much house can I afford Using a percentage of your income can help determine how much house you can afford For example the 28 36 rule may help you decide how much to spend on a home The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt

This is what you can afford in 417 249 Your monthly payment 2 500 Affordable Stretch Aggressive Your debt to income ratio DTI would be 36 meaning 36 of your pretax income would go For example if you re thinking of a total monthly housing payment of 1 500 and your income before taxes and other deductions is 6 000 then 1 500 6 000 0 25 We can convert that to a percentage 0 25 x 100 25 Since the result is less than 28 the house in this example may be affordable In addition to deciding how much of your

More picture related to How Much Mortgage Can I Afford With 200k Salary

How Much House Can I Afford On 200k Salary SalaryInfoGuide

https://www.salaryinfoguide.com/wp-content/uploads/how-much-house-can-i-afford-200k-salary-mchwo.jpeg

How Much Mortgage Can I Afford Nerdwallet MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/how-much-house-can-i-afford-with-a-va-home-loan-muchw.jpeg

How Much Mortgage Can I Afford With 100k Salary MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/100k-annual-salary-how-much-house-can-i-afford-mchwo.png

Front end DTI This only includes your housing payment Lenders usually don t want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance Following Kaplan s 25 percent rule a more reasonable housing budget would be 1 400 per month So taking into account homeowners insurance and property taxes you d be better off sticking to a

Mortgage insurance The mandatory insurance to protect your lender s investment of 80 or more of the home s value Escrow The monthly cost of property taxes HOA dues and homeowner s insurance Payments Multiply the years of your loan by 12 months to calculate the total number of payments A 30 year term is 360 payments 30 years x 12 months Monthly debt gross monthly income DTI Generally DTI is displayed as a range of 20 to 50 and reflects an estimate of the top and bottom of your affordability This range will help you

How Much Mortgage Can I Afford How To Calculate YouTube

https://i.ytimg.com/vi/6Y8M-Abxs3U/maxresdefault.jpg

How Much Mortgage Can I Afford With 150k Salary MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/how-much-house-can-i-afford-on-150k-salary-swohm.jpeg

How Much Mortgage Can I Afford With 200k Salary - For example if you re thinking of a total monthly housing payment of 1 500 and your income before taxes and other deductions is 6 000 then 1 500 6 000 0 25 We can convert that to a percentage 0 25 x 100 25 Since the result is less than 28 the house in this example may be affordable In addition to deciding how much of your