How Much Is My Biweekly Paycheck After Taxes Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents

Paycheck Calculator Advertiser Disclosure Paycheck Calculator For Salary And Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

How Much Is My Biweekly Paycheck After Taxes

How Much Is My Biweekly Paycheck After Taxes

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-in-mn.jpeg

2023 Biweekly Payroll Calendar Template Customize And Print

https://i.pinimg.com/originals/73/e5/19/73e519320e03e1a2db0330e552482dd1.jpg

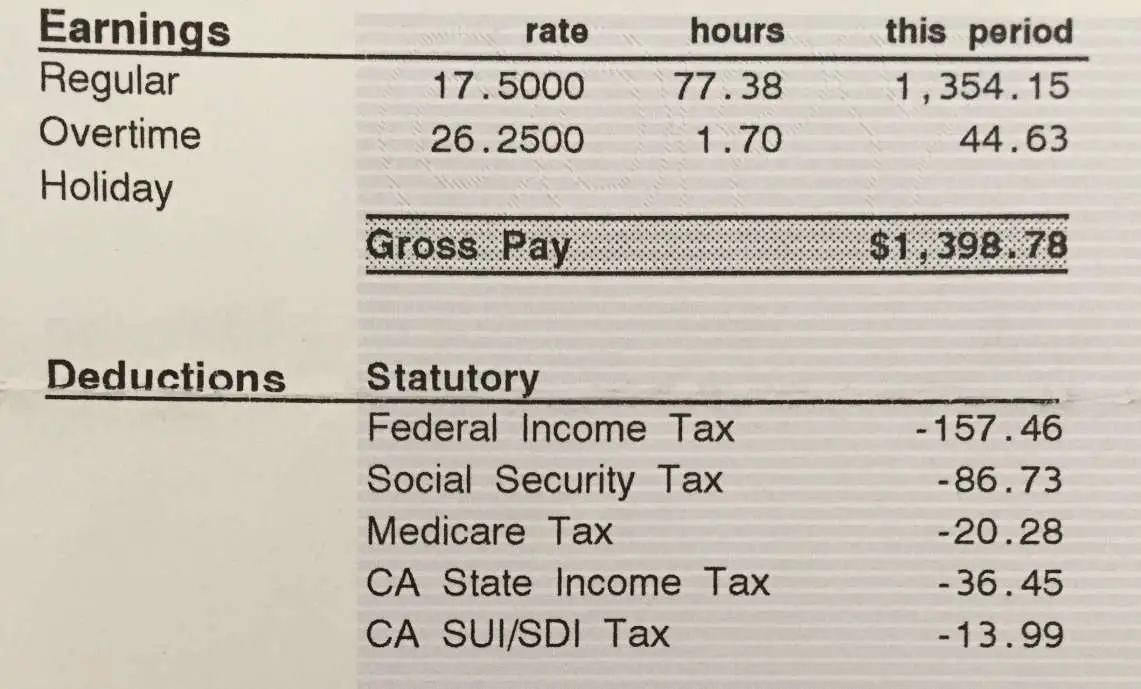

Here s My Paycheck Before And After Taxes Can Anyone Explain To Me Why

https://external-preview.redd.it/5iIg3rApN1rXsQV-AV-zd1T-Rpj_St0uB4AaQAKTqMo.png?auto=webp&s=14e29bb202b6859aa2afc2bb487994dfc4e7864e

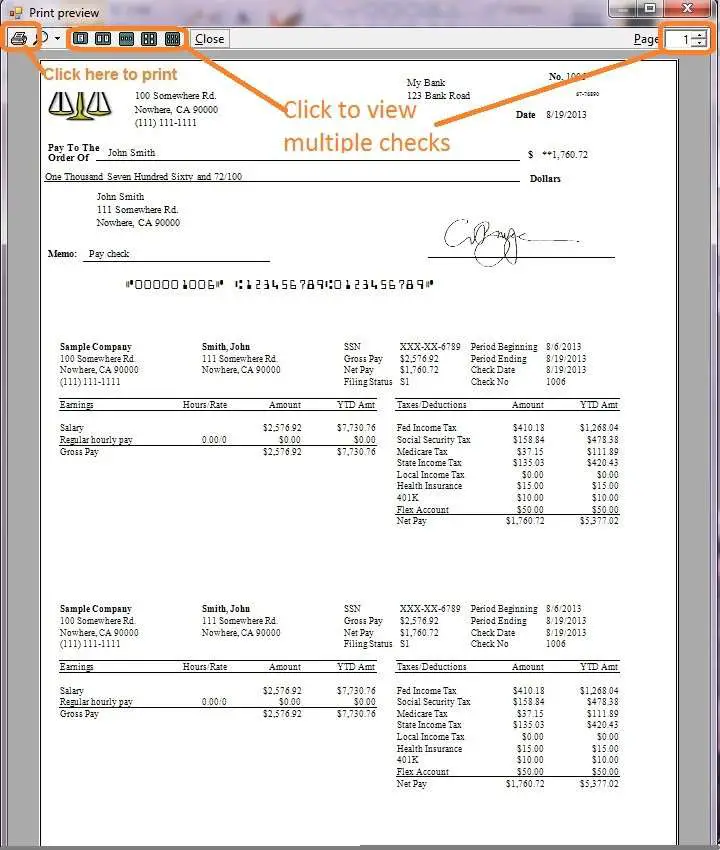

Biweekly pay is a salary or wage paid every two weeks usually on Fridays If one payment date falls on a holiday the standard practice is making the payment on the previous day i e Thursday As a year contains 52 weeks there are 26 biweekly payments annually 52 2 26 To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year This number is the gross pay per pay period Subtract any deductions and payroll taxes from the gross pay to get net pay Don t want to calculate this by hand The PaycheckCity salary calculator will do the calculating for you

A bi weekly every other week pay period results in 26 paychecks in a year A semi monthly twice a month pay period results in 24 paychecks in a year Similar to the federal taxes withheld each state also withhelds some of your paycheck s taxes State income taxes vary greatly among different states No of Allowances Allowances on the Suppose an employee has a gross income of 2 500 bi weekly After accounting for 400 in taxes and 100 in deductions the Bi Weekly Paycheck Calculator would determine the net pay as follows text Net Pay 2 500 400 100 2 000 FAQs Q Can the Bi Weekly Paycheck Calculator account for overtime or bonuses

More picture related to How Much Is My Biweekly Paycheck After Taxes

How To Calculate Payroll Taxes In California TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-in-california-tax.jpeg

Paycheck Before Taxes 1698 58 Paycheck After Taxes 97 14 The

https://i.pinimg.com/originals/19/42/c9/1942c95fd0df35b1354e03865f960512.png

How To Calculate Paycheck After Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-texas.jpeg

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Self employed individuals earning up to 200 000 are subject to a combined Social Security and Medicare tax rate of 15 3 In comparison those earning over 200 000 are subject to a combined rate of 16 2 Updated on Dec 05 2023 Free tool to calculate your hourly and salary income after taxes deductions and exemptions

Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages First enter your current payroll information and deductions Then enter the hours you expect Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details More from CNN

Taxes On Lottery Winnings Calculator TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/how-to-calculate-paycheck-after-taxes-nc.png

How To Manage A Biweekly Paycheck ICR Staffing Services Inc

https://secureservercdn.net/192.169.221.188/p3l.28c.myftpupload.com/wp-content/uploads/2021/02/Managing-Your-Biweekly-Paycheck-1280x720.jpg

How Much Is My Biweekly Paycheck After Taxes - Enter the percentage of your income that is withheld for 401k contributions each pay period without the percent sign enter 5 2 as 5 2 Typically this amount cannot exceed 22 500 annually employees 50 and older can contribute an extra 7 500 Qualified tax deferral plan such as 401K