How Much Is A Paycheck On 70000 Salary How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000

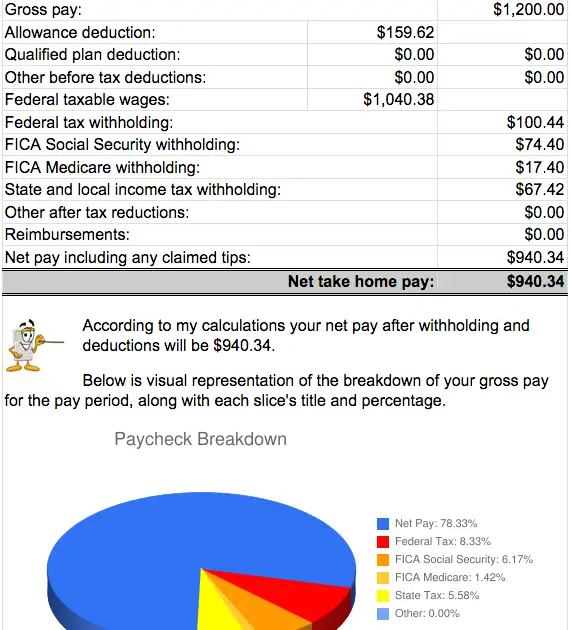

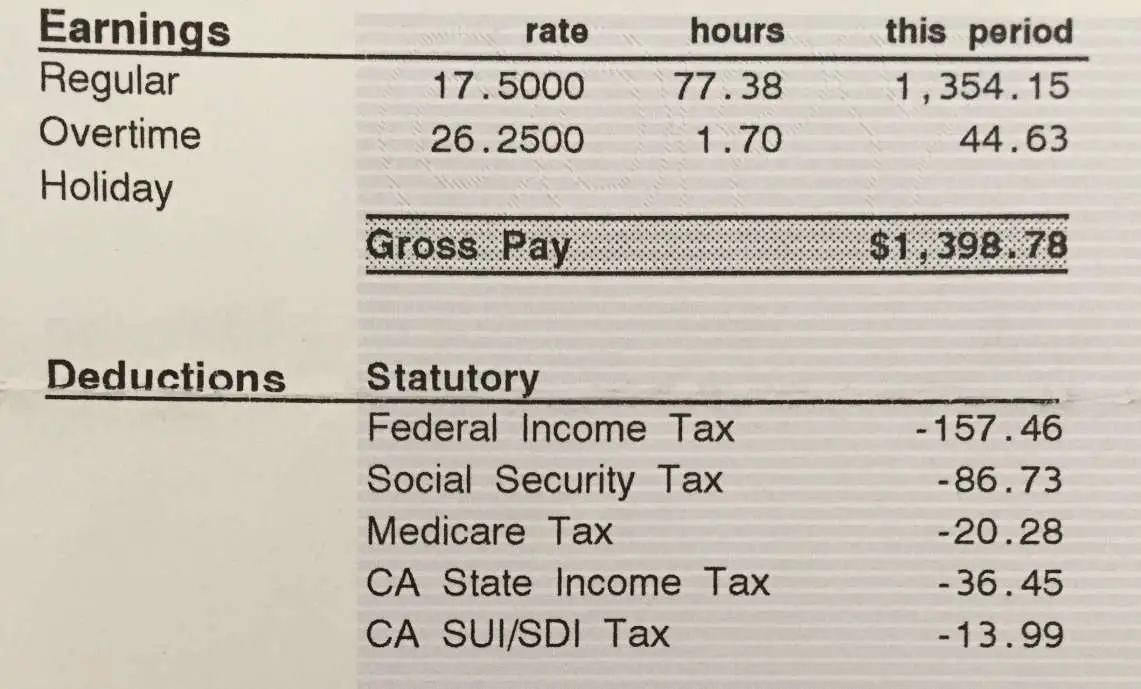

For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount If this employee s pay frequency is weekly the calculation is 52 000 52 payrolls 1 000 gross pay If this employee s pay frequency is semi monthly the calculation is 52 000 24 payrolls 2 166 67 gross pay An individual who receives 54 530 05 net salary after taxes is paid 70 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 70 000 00 salary

How Much Is A Paycheck On 70000 Salary

How Much Is A Paycheck On 70000 Salary

https://www.moneyforthemamas.com/wp-content/uploads/2022/06/what-can-i-afford-on-70000-salary.jpg

How Much Taxes Get Taken Out Of Paycheck TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-much-are-taxes-taken-out-of-paycheck-tax-walls.png

How Much Is 70 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-70000-dollars-sm-2-1024x768.png

Paycheck Calculator For Salary And Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator If you re an Factors that Influence Salary and Wage in the U S Most Statistics are from the U S Bureau of Labor in 2022 In the third quarter of 2022 the average salary of a full time employee in the U S is 1 070 per week which comes out to 55 640 per year While this is an average keep in mind that it will vary according to many different factors

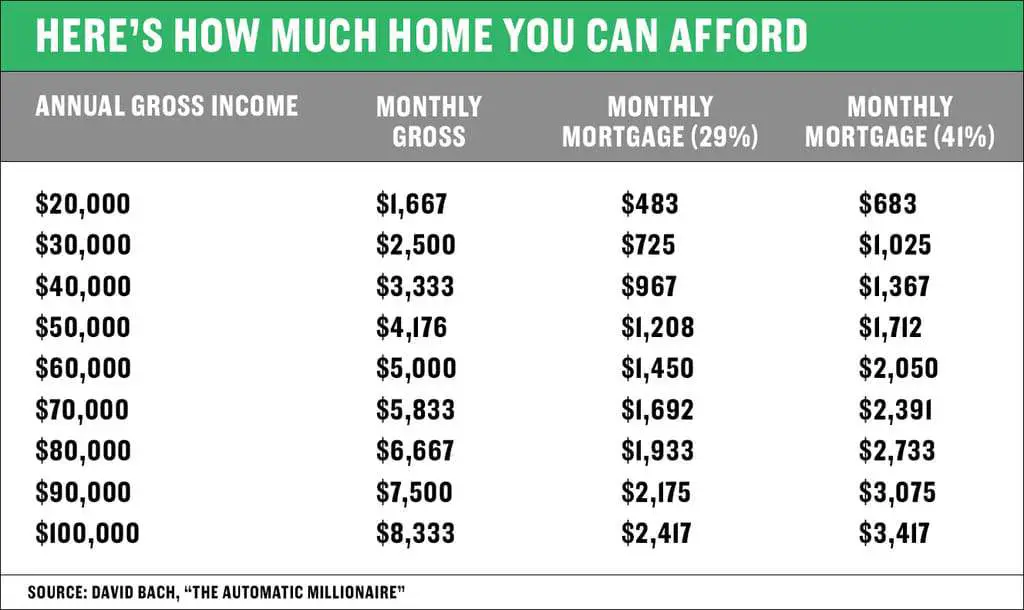

1 Pretax deductions withheld These are the deductions to be withheld from the employee s salary by their employer before the salary can be paid out including 401k the employee s share of the health insurance premium health savings account HSA deductions child support payments union and uniform dues etc 2 Deductions not withheld To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week Salary to hourly calculator 70 000 dollars a year is how much every two weeks 70 000 dollars is about 2 692 dollars every two weeks biweekly 34 dollars an hour is how much a year

More picture related to How Much Is A Paycheck On 70000 Salary

How Much Taxes Deducted From Paycheck Ma TaxesTalk

https://www.taxestalk.net/wp-content/uploads/what-are-the-deductions-on-a-paycheck-quora.png

How Much Loan Can I Afford Based On Monthly Payment UnderstandLoans

https://www.understandloans.net/wp-content/uploads/heres-how-to-figure-out-how-much-home-you-can-afford.jpeg

Turns Out A 70 000 Salary Doesn t Always Buy Happiness

https://images.fastcompany.net/image/upload/w_1280,f_auto,q_auto,fl_lossy/fc/3049820-poster-p-1-turns-out-a-70000-salary-doesnt-always-buy-happiness.jpg

For example a salary for a marketing manager might be 75 000 per year If that salary is paid monthly on the 1st of each month you can calculate the monthly salary by dividing the total salary by the number of payments made in a year to determine the rate of pay on each paycheck For example 75 000 12 pay periods 6 250 per pay period It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck recalculate monthly wage to hourly rate weekly rate to a yearly wage etc This salary converter does it all very quickly and easily saving you time and effort

US Income Tax Calculator 70 000 After Tax US On this page you ll find a detailed analysis of a 70 000 after tax annual salary for 2023 with calculations for monthly weekly daily and hourly rates as of December 6th 2023 at 11 00 PM Your employer withholds between 15 846 and 13 015 in tax on a 70000 United States salary in 2023 if you work in the US and your tax filing status is single These withholdings contain US income tax and FICA taxes Social Security and Medicare Optionally your employer withholds state income tax and other state mandated insurance

How To Calculate Payroll Taxes In California TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-in-california-tax.jpeg

A Week In New York City On A 70 000 Salary Oye Times

https://www.oyetimes.com/wp-content/uploads/2018/05/image-548.jpg

How Much Is A Paycheck On 70000 Salary - Factors that Influence Salary and Wage in the U S Most Statistics are from the U S Bureau of Labor in 2022 In the third quarter of 2022 the average salary of a full time employee in the U S is 1 070 per week which comes out to 55 640 per year While this is an average keep in mind that it will vary according to many different factors