How Much Is 75k A Year After Taxes In Georgia 2013 46 992 If you file in Georgia as a single person you will get taxed 1 of your taxable income under 750 If you earn more than that then you ll be taxed 2 on income between 750 and 2 250 The marginal rate rises to 3 on income between 2 250 and 3 750 4 on income between 3 750 and 5 250 5 on income between 5 250 and

After entering it into the calculator it will perform the following calculations Federal Tax Filing 75 000 00 of earnings will result in of that amount being taxed as federal tax FICA Social Security and Medicare Filing 75 000 00 of earnings will result in being taxed for FICA purposes Georgia State Tax FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

How Much Is 75k A Year After Taxes In Georgia

How Much Is 75k A Year After Taxes In Georgia

https://expathub.ge/wp-content/uploads/2020/12/Taxes-in-Georgia-cover.jpg

Is 75k A Good Salary Clever Money Journey

https://www.clevermoneyjourney.com/wp-content/uploads/2021/01/Is-75k-A-Good-Salary.jpg

How Much Youtube PAID Me For 75k Views First Week Of Monetisation

https://i.ytimg.com/vi/-7S5AdqpS1k/maxresdefault.jpg

75k Salary After Tax in Georgia 2024 This Georgia salary after tax example is based on a 75 000 00 annual salary for the 2024 tax year in Georgia using the State and Federal income tax rates published in the Georgia tax tables The 75k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour 75 000 00 Salary Income Tax Calculation for Georgia This tax calculation produced using the GAS Tax Calculator is for a single filer earning 75 000 00 per year The Georgia income tax example and payroll calculations are provided to illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year when filing a tax return in Georgia for 75 000 00 with no

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total

More picture related to How Much Is 75k A Year After Taxes In Georgia

Georgia Taxes Economy Finance Georgia Business Tax Rates Tax Updates

https://www.worldwide-tax.com/georgia/images/0001.jpg

75 000 A Year Is How Much An Hour And Best Jobs To Give You 75K

https://radicalfire.com/wp-content/uploads/2022/09/75000-A-Year-Is-How-Much-An-Hour-and-Best-Jobs-To-Give-You-75K.jpg

Jobs That Pay 75K A Year Or More With No Experience Required

https://gigsdoneright.com/wp-content/uploads/2023/01/jobs-that-pay-75k-a-year.jpg

75k Salary After Tax in Georgia 2023 This Georgia salary after tax example is based on a 75 000 00 annual salary for the 2023 tax year in Georgia using the income tax rates published in the Georgia tax tables The 75k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour The additional amount is 3 900 00 if the individual is both 65 or over and blind Retirement Plan Contributions 401 k 403 b SARSEP and 457 plans Calculated using the individual contributions limits for 2024 22 500 00 standard with additional 7 500 00 catch up for those 50 or older at the end of 2024

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax What is a 75k after tax 75000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2024 tax return and tax refund calculations 57 240 04 net salary is 75 000 00 gross salary

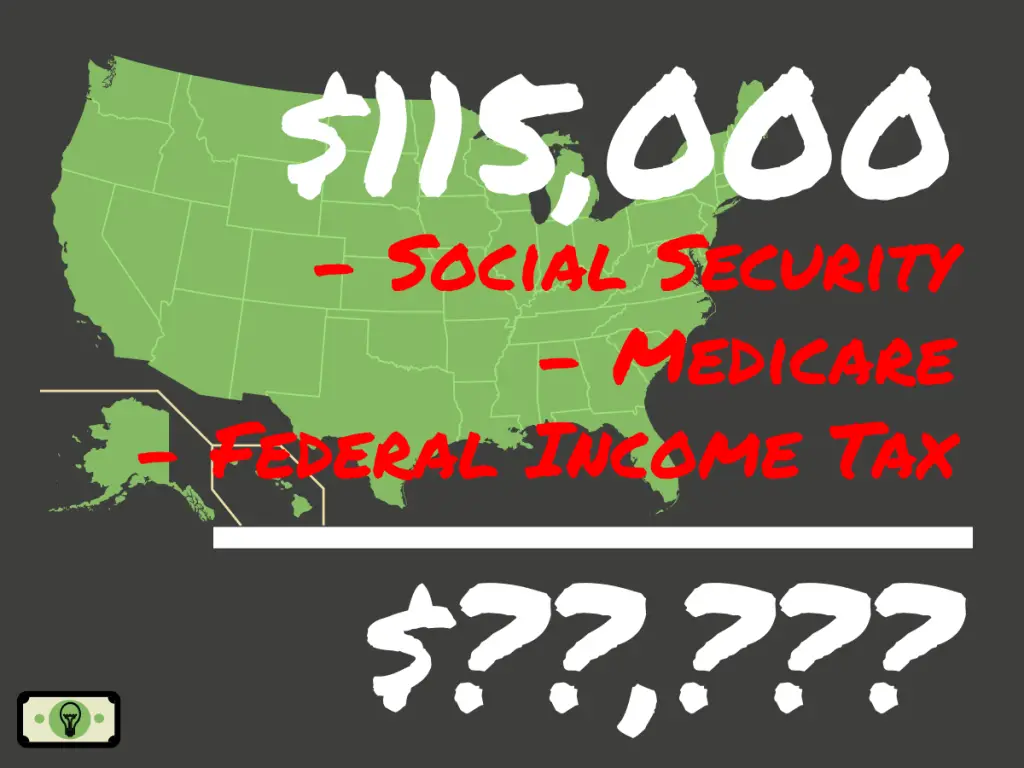

How Much Is 115 000 A Year After Taxes filing Single Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-115000-dollars-sm-2-1024x768.png

Hecht Group Who Pays Property Taxes When A House Is Sold Mid Year

https://img.hechtgroup.com/1662954474877.jpg

How Much Is 75k A Year After Taxes In Georgia - 75 000 00 Salary Income Tax Calculation for Georgia This tax calculation produced using the GAS Tax Calculator is for a single filer earning 75 000 00 per year The Georgia income tax example and payroll calculations are provided to illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year when filing a tax return in Georgia for 75 000 00 with no