How Much Is 70 000 A Year Per Hour After Taxes 2024 US Tax Calculation for 2025 Tax Return 70k Salary Example If you were looking for the 70k Salary After Tax Example for your 2024 Tax Return it s here Brace yourselves for a surprise

To answer 70 000 a year is how much an hour divide the annual amount by 2 080 52 weeks 40 hours resulting in an hourly income of 24 49 Is 70 000 a Year a Good Salary To answer if 70 000 a year is a good salary We need to compare it to the national median If you make 70 000 a year you would take home 25 24 an hour after taxes Your pre tax hourly wage was 33 65 But after paying 25 in taxes your after tax hourly wage would be 25 24 a year The amount you pay in taxes depends on many different factors But assuming a 25 to 30 tax rate is reasonable

How Much Is 70 000 A Year Per Hour After Taxes

How Much Is 70 000 A Year Per Hour After Taxes

https://www.moneyforthemamas.com/wp-content/uploads/2022/05/60k-a-year-is-how-much-an-hour-683x1024.jpg

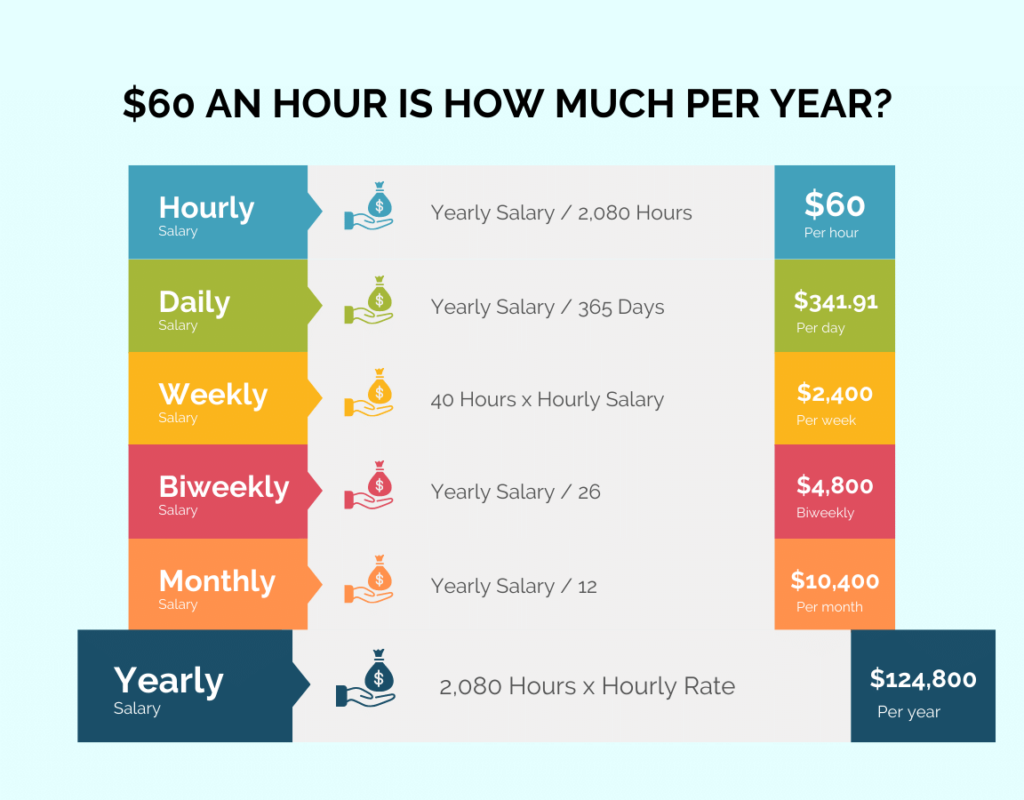

60 An Hour Is How Much A Year How To FIRE Online Library GoSpring

https://www.howtofire.com/wp-content/uploads/60-dollars-an-hour-1024x800.png

60000 A Year Is How Much An Hour Good Salary Or Not Money Bliss

https://moneybliss.org/wp-content/uploads/2021/05/60000-a-year.jpg

When earning 70 000 per year as a single filer for example you pay 10 on the first 11 000 12 on the next 33 725 and 22 on the rest which is 25 275 Make Your Money Work Better for You Because the U S uses marginal rates figuring out how much is taken out in each check is more complicated than finding your income on the rate chart 70 000 52 weeks a year 1 346 a week 50 hrs 26 92 an hour How much is 70k a year in monthly pay 70 000 12 months 5 833 gross pay How much is 70 000 dollars a year in bi weekly pay 70 000 26 pay periods 2 692 gross pay 70k is how much a week 70 000 52 weeks 1 346 gross pay 70 000 is how much a day

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Your employer withholds between 15 846 and 13 015 in tax on a 70000 United States salary in 2023 if you work in the US and your tax filing status is single These withholdings contain US income tax and FICA taxes Social Security and Medicare Optionally your employer withholds state income tax and other state mandated insurance

More picture related to How Much Is 70 000 A Year Per Hour After Taxes

40000 A Year Is How Much An Hour And Is It A Good Salary Savvy

https://www.savvyfrugalmom.com/wp-content/uploads/2020/12/40000-a-year-per-hour-2048x1365.jpg

60 000 A Year Is How Much An Hour Savvy Budget Boss

https://savvybudgetboss.com/wp-content/uploads/2021/12/how-much-is-60000-a-year-per-hour-1.jpg

60k A Year Is How Much An Hour Full Financial Breakdown

https://www.moneyforthemamas.com/wp-content/uploads/2022/05/how-much-is-60000-a-year-per-hour-1-683x1024.jpg

70 000 income tax calculator 2024 California salary after tax Want to send us feedback 70 000 yearly is how much per hour 33 65 hourly is how much per year What is the average salary in the U S a year living in the region of you will be taxed That means that your net pay will be per month It depends on how many hours you work but assuming a 40 hour work week and working 50 weeks a year then a 70 000 yearly salary is about 35 00 per hour Is 70k a year good pay It s above average We estimate a person earning 70 000 a year makes more than 73 of workers in the United States Median Yearly Salary by Profession United States

If your filing status is single head of household of qualifying widow er your earnings in excess of 200 000 are subject to the 0 9 Medicare surtax not matched by your employer This threshold is 250 000 if you re married and file jointly and 125 000 if you re married and file separately Assuming an annual salary of 70 000 a federal tax rate of 22 and a state tax rate of 4 the estimated monthly take home pay after taxes would be approximately 4 372 67 per month Annual Salary 70 000 00 Gross Monthly Pay 5 833 33 Federal Tax Withholding 1 283 33 State Tax Withholding 233 33

50 000 A Year Is How Much An Hour Savvy Budget Boss

https://savvybudgetboss.com/wp-content/uploads/2021/12/50000-a-year-is-how-much-an-hour-1.jpg

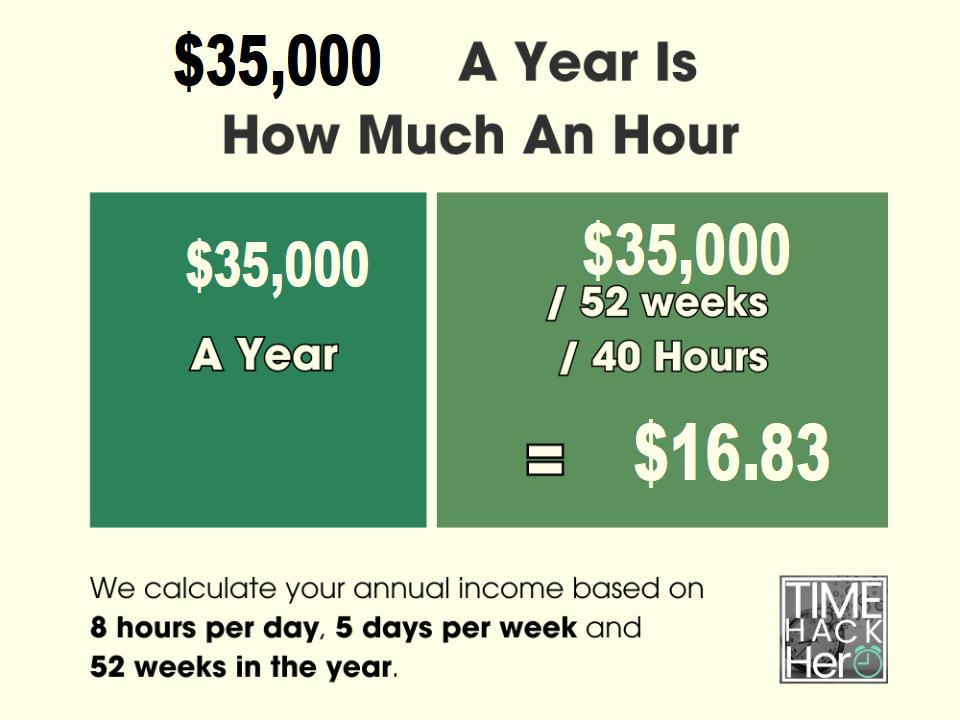

35000 A Year Is How Much An Hour Before And After Taxes

https://timehackhero.com/wp-content/uploads/2023/10/35000-a-Year-is-How-Much-an-Hour.jpg

How Much Is 70 000 A Year Per Hour After Taxes - When earning 70 000 per year as a single filer for example you pay 10 on the first 11 000 12 on the next 33 725 and 22 on the rest which is 25 275 Make Your Money Work Better for You Because the U S uses marginal rates figuring out how much is taken out in each check is more complicated than finding your income on the rate chart