How Much Is 12 An Hour Monthly After Taxes The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions for example if you did 10 extra hours each month at time and a half you would enter 10 1 5 5 hours double time would be 5 2 Filing

The 12 month period for income taxes begins on January 1st and ends on December 31st of the same calendar year The federal income tax rates differ from state income tax rates Federal taxes are progressive higher rates on higher income levels At the same time states have an advanced tax system or a flat tax rate on all income Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

How Much Is 12 An Hour Monthly After Taxes

How Much Is 12 An Hour Monthly After Taxes

https://moneytamer.com/wp-content/uploads/2022/02/woman-sad-holding-empty-wallet-pink-background-1024x683.jpg

40k A Year Is How Much An Hour Monthly Budget Examples

https://www.moneyforthemamas.com/wp-content/uploads/2022/05/50-30-20-budget-for-40k-salary.jpg

I Tried Typing Subtitles For 12 An Hour YouTube

https://i.ytimg.com/vi/STN2mLXr6lQ/maxresdefault.jpg

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Bi weekly is once every other week with 26 payrolls per year or 27 during a leap year like 2024 Semi monthly is twice per month with 24 payrolls per year rates are 0 10 12 22 24 32 35 or 37 2024 Tax Rate of the gross pay or a percentage of the net pay For hourly calculators you can also select a fixed amount per

Multiply 188 by a stated wage of 20 and you get 3 760 Paid a flat rate If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with the equivalent monthly wages If you are paid 60 000 a year then divide that by 12 to get 5 000 per month If you know you work 40 hours a week for 50 Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Monthly payments per year 12 Biweekly payments per 52 Working days per week 5 Working hours per week 40 0 Show Taxes Monthly Gross Income 5 781 69 368 2 668 1 334 266 80 33 35 Tax

More picture related to How Much Is 12 An Hour Monthly After Taxes

90 000 A Year Is How Much An Hour Monthly Budget Breakout

https://www.moneyforthemamas.com/wp-content/uploads/2022/07/90k-a-year-is-how-much-an-hour-683x1024.jpg

How Much Is 12 Quarts Of Apples Adelyn has Mahoney

https://www.myfrugalhome.com/wp-content/uploads/2021/09/bowlofapples1200whitebackground.jpg

Quarterly Tax Calculator Calculate Estimated Taxes

https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/63499df76fe7a914e18ab62c_quarterly-tax-calculator.png

In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay

Your monthly income is 3 120 provided that you work 40 hours per week Otherwise you need to use the formula monthly income hourly wage hours worked per week 52 12 or resort to an online monthly income calculator Adjust number of hours and days Select the checkbox to adjust the numbers of hours and days you work Monthly pay Yearly pay 12 32 500 12 2 708 Our second quest is 15 an hour is how much a year adjusted for holidays and vacation In this case your hourly pay is 15 dollars You also worked 25h per week 5 days per week We had 10 days of vacation and 10 days of holiday Use the formula for the salary after taxes Net

55000 A Year Is How Much An Hour Good Salary Or No Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/55000-a-year-1-683x1024.jpg

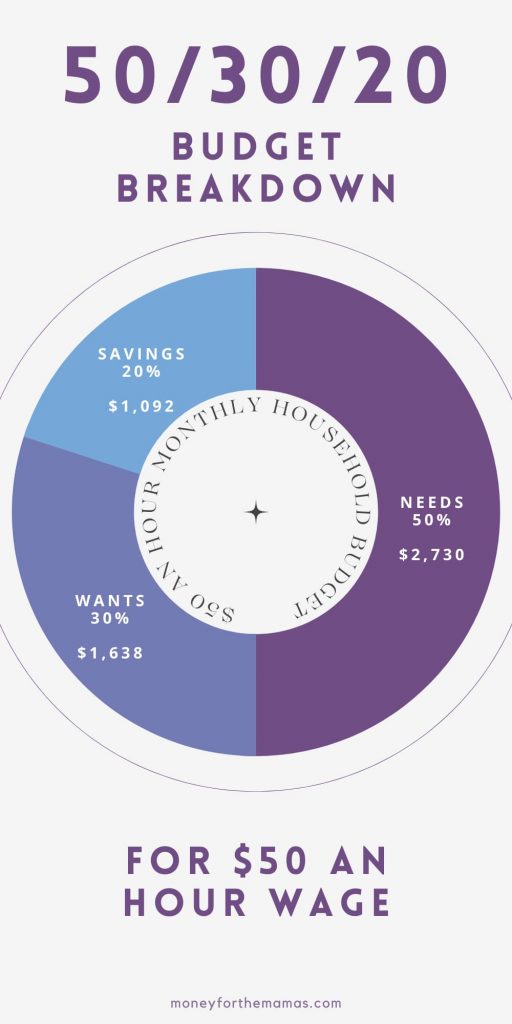

50 An Hour Is How Much A Year Am I Rich What You Need To Know

https://www.moneyforthemamas.com/wp-content/uploads/2022/06/50-an-hour-monthly-budget-50-30-20-512x1024.jpg

How Much Is 12 An Hour Monthly After Taxes - Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Monthly payments per year 12 Biweekly payments per 52 Working days per week 5 Working hours per week 40 0 Show Taxes Monthly Gross Income 5 781 69 368 2 668 1 334 266 80 33 35 Tax