How Much Is 100k Per Month After Taxes After Tax Income In the U S the concept of personal income or salary usually references the before tax amount called gross pay For instance a person who lives paycheck to paycheck can calculate how much they will have available to pay next month s rent and expenses by using their take home paycheck amount 4 050 per person

If you make 100 000 a year living in the region of California USA you will be taxed 29 959 That means that your net pay will be 70 041 per year or 5 837 per month Your average tax rate is 30 0 and your marginal tax rate is 42 6 This marginal tax rate means that your immediate additional income will be taxed at this rate On average in the United States someone earning 100k Salary per year will take home 71944 yearly 5995 monthly 2767 bi weekly 1384 weekly and 34 59 hourly after Federal and State taxes Keep in mind this is simply a baseline to a ball park figure how much you will take home

How Much Is 100k Per Month After Taxes

How Much Is 100k Per Month After Taxes

https://www.dontworkanotherday.com/wp-content/uploads/2022/06/How-Much-is-100k-a-Month-1024x585.jpg

How Much Youtube Pay Me For 100k Subscribers YouTube

https://i.ytimg.com/vi/FsvsV2vFCn0/maxresdefault.jpg

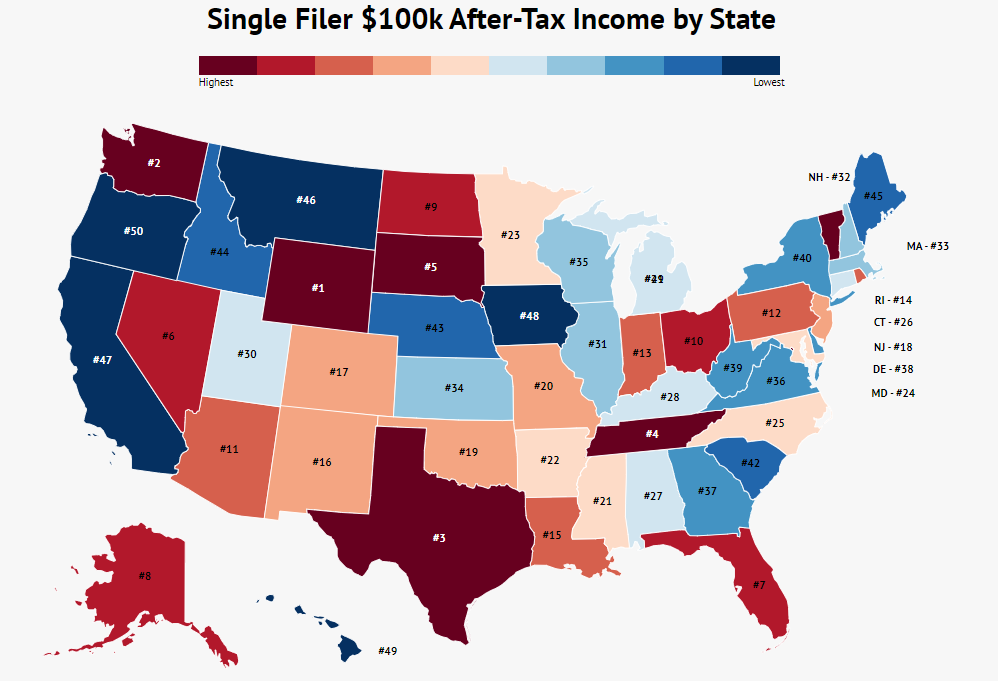

100k After Tax Income By State 2023 Zippia

https://www.zippia.com/wp-content/uploads/2023/03/single-filer-after-tax-income.png

A 100 000 paycheck is much smaller after taxes Hero Images Getty Updated 2020 03 05T19 53 00Z Share Facebook Email X LinkedIn Copy link Save Saved Read in app The IRS Tax Year 2025 2026 If you live in California and earn a gross annual salary of 72 280 or 6 023 per month your monthly take home pay will be 4 715 This results in an effective tax rate of 22 as estimated by our US salary calculator

The 100k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Arizona is used for calculating state taxes due Answer is 51 63 assuming you work roughly 40 hours per week or you may want to know how much 100k a year is per month after taxes Answer is 6 282 85 in this How much is 100 000 a Year After Tax in the United States In the year 2025 in the United States 100 000 a year gross salary after tax is 77 582 annual 5 828 monthly 1 340 weekly 268 06 daily and 33 51 hourly gross based on the information provided in the calculator above

More picture related to How Much Is 100k Per Month After Taxes

How Much YouTube Paid Me For 100k Views YouTube

https://i.ytimg.com/vi/yzUoLUfNtx0/maxresdefault.jpg

How Much I Made On Tiktok with Over 100k Followers YouTube

https://i.ytimg.com/vi/1BdYfzqhAfA/maxresdefault.jpg

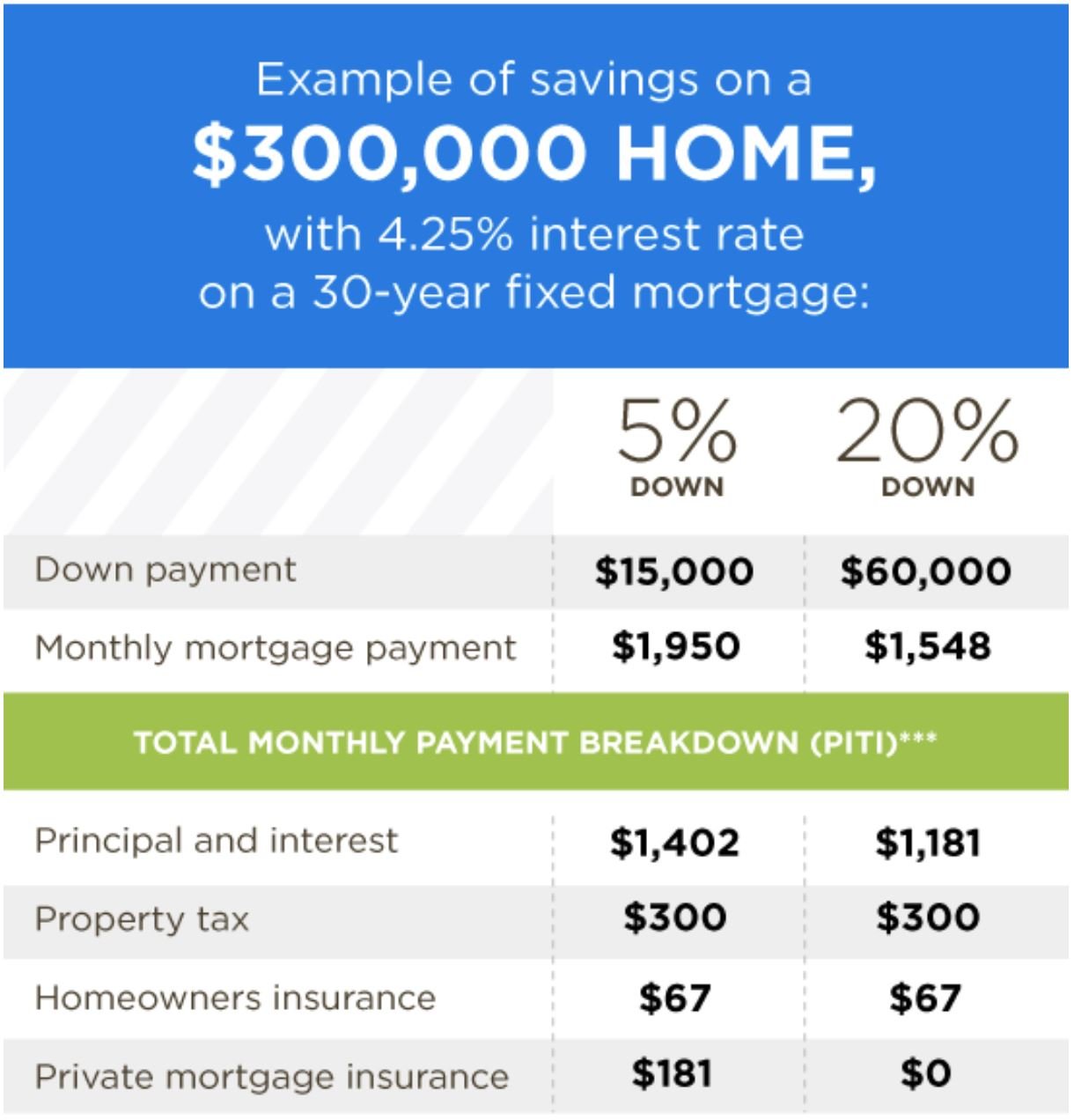

How Much Is A 100k Mortgage Per Month MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/how-much-is-100k-mortgage.jpeg

The Top 10 Most Expensive After Tax Income States The state with the most expensive after tax income in the US is Oregon In this state a single filer making 100k can expect to take home just under 70k In general some states are better or worse for single or married filers but here is our list of the top ten most tax unfriendly states In Nebraska 72 938 80 452 of a 100K salary is left after federal and state taxes The state s income tax gobbles up 5 15 of that income The state has a 5 50 sales tax and local income taxes add as much as 2 more

[desc-10] [desc-11]

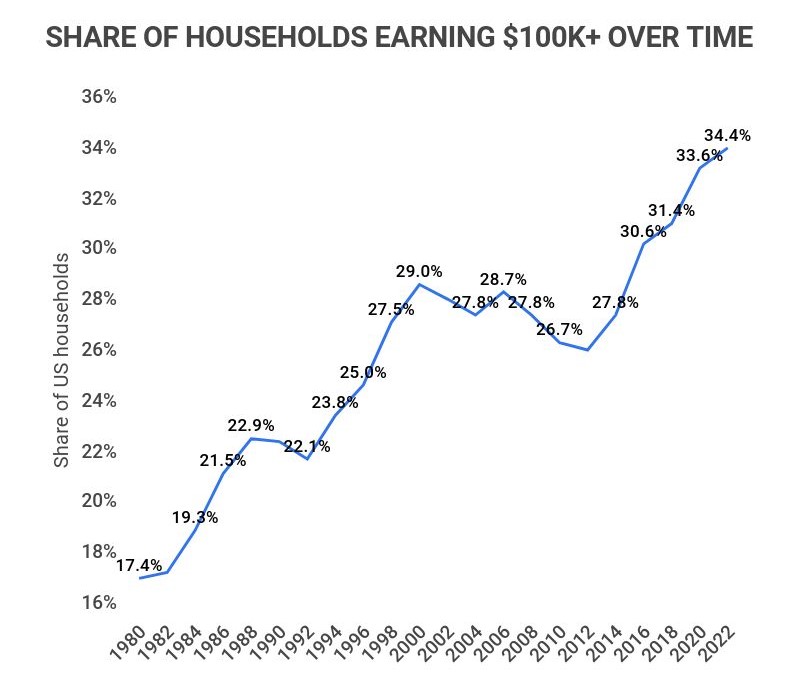

How Many People Make Over 100k Per Year Zippia

https://www.zippia.com/wp-content/uploads/2023/03/share-of-households-earning-100k-or-more-over-time.jpg

How Much Money YouTube Gives For 100k Views YouTube Earnings Per 100K Views With Live Proof

https://i.ytimg.com/vi/Sc0fhKeOfOQ/maxresdefault.jpg

How Much Is 100k Per Month After Taxes - Tax Year 2025 2026 If you live in California and earn a gross annual salary of 72 280 or 6 023 per month your monthly take home pay will be 4 715 This results in an effective tax rate of 22 as estimated by our US salary calculator