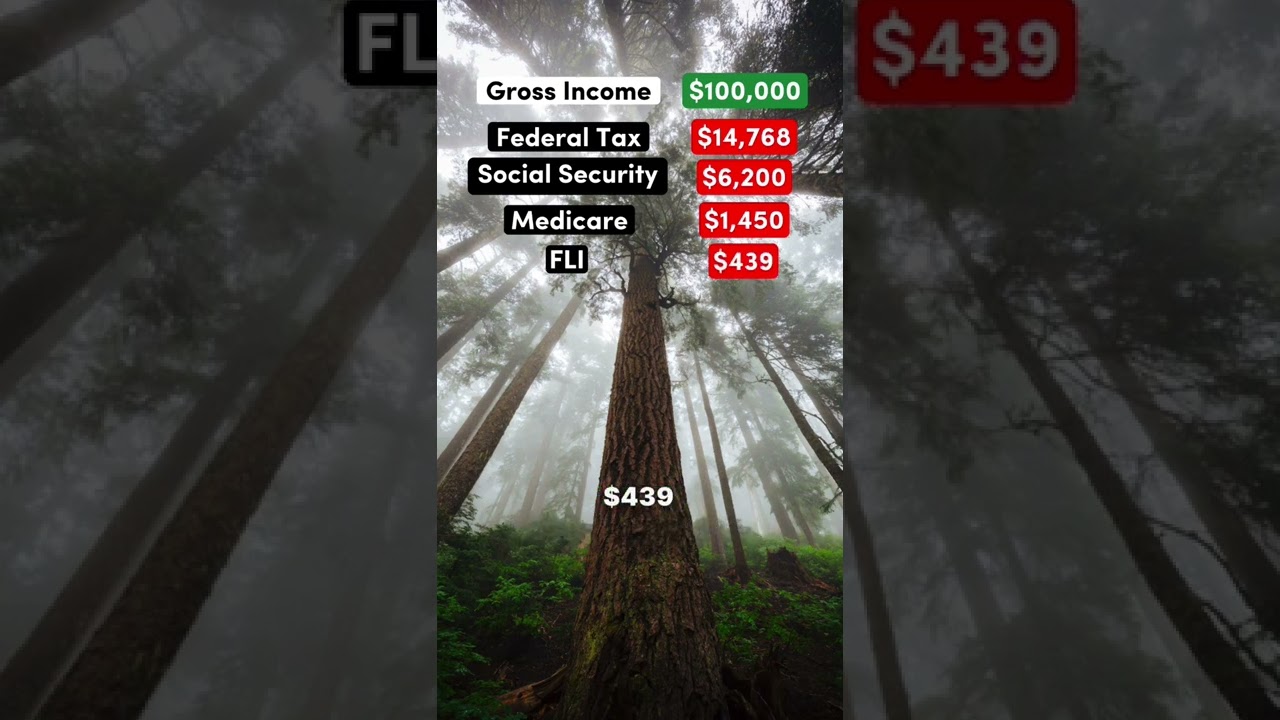

How Much Is 100k After Taxes In Florida Summary If you make 100 000 a year living in the region of Florida USA you will be taxed 22 418 That means that your net pay will be 77 582 per year or 6 465 per month Your average tax rate is 22 4 and your marginal tax rate is 31 3 This marginal tax rate means that your immediate additional income will be taxed at this rate

Federal income tax 10 to 37 Social Security 6 2 Medicare 1 45 to 2 35 Other non tax deductions also reduce your take home pay The combined tax percentage usually ranges from 15 to 30 Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in Florida After entering it into the calculator it will perform the following calculations Federal Tax Filing 100 000 00 of earnings will result in 13 841 00 of that amount being taxed as federal tax FICA Social Security and Medicare Filing 100 000 00 of earnings will result in 7 650 00 being taxed for FICA purposes Florida State Tax

How Much Is 100k After Taxes In Florida

How Much Is 100k After Taxes In Florida

https://i.ytimg.com/vi/i7eab6adNoM/maxresdefault.jpg

How Much Youtube Pay Me For 100k Subscribers YouTube

https://i.ytimg.com/vi/FsvsV2vFCn0/maxresdefault.jpg

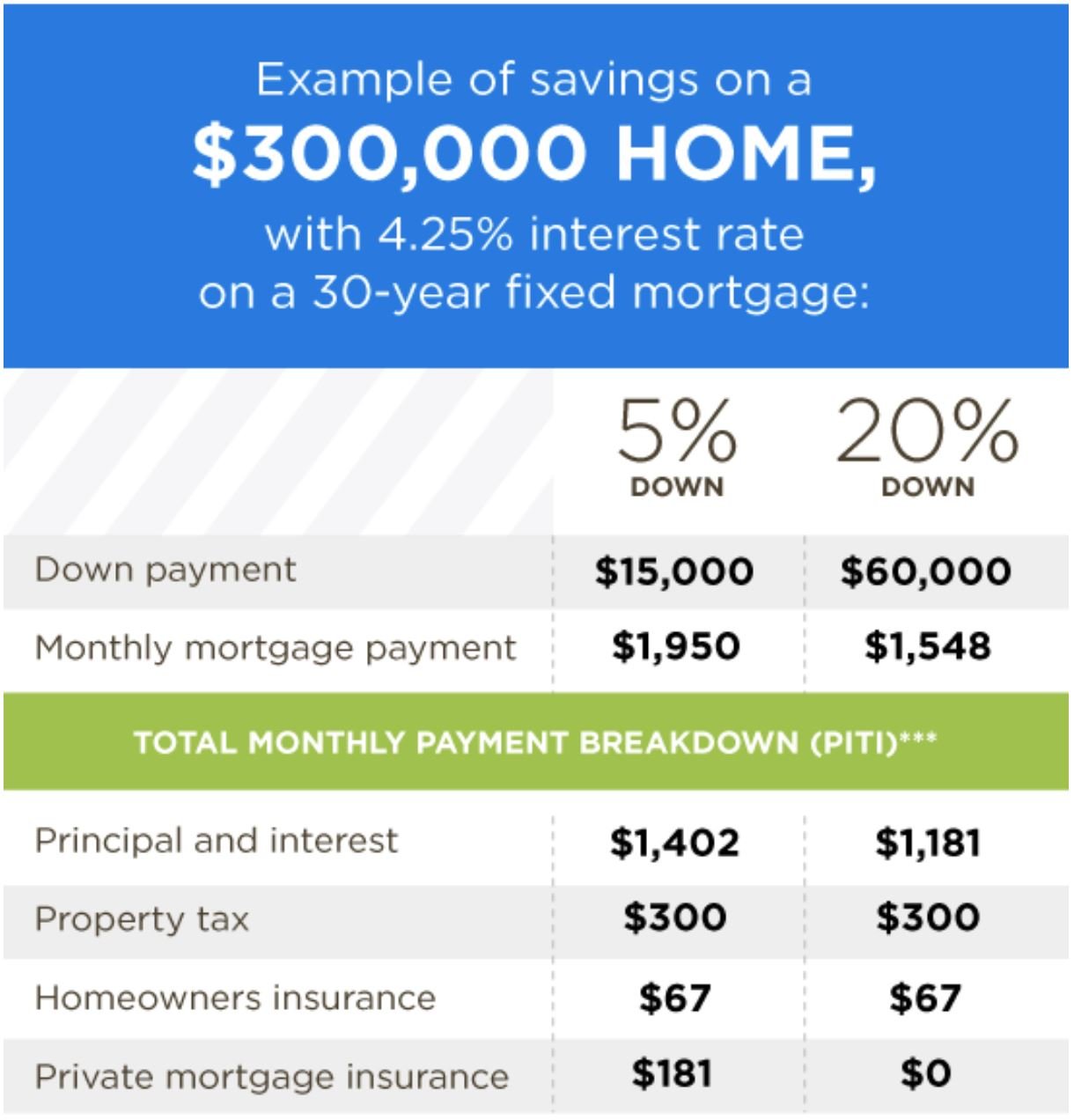

What Is Monthly Mortgage Payment On 100k MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/how-much-is-100k-mortgage.jpeg

The tax calculation below shows exactly how much Florida State Tax Federal Tax and Medicare you will pay when earning 100 000 00 per annum when living and paying your taxes in Florida The 100 000 00 Florida tax example uses standard assumptions for the tax calculation This tax example is therefore a flat example of your tax bill in Florida Launch ADP s Florida Paycheck Calculator to estimate your or your employees net pay Free and simple Fast easy accurate payroll and tax so you can save time and money Payroll Overview Overview Small Business Payroll 1 49 Employees Midsized to Enterprise Payroll 50 1 000 Employees Compare Packages

Take home salary for single filers 69 808 Take home salary for married filers 76 301 Oregon residents pay the highest taxes in the nation with single filers earning 100 000 a year paying 30 96 of their income and joint filers paying 24 22 The effective tax rate for single filers is a steep 8 28 100k Salary After Tax in Florida 2024 This Florida salary after tax example is based on a 100 000 00 annual salary for the 2024 tax year in Florida using the State and Federal income tax rates published in the Florida tax tables The 100k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour

More picture related to How Much Is 100k After Taxes In Florida

Living On 100k After Taxes In Washington washington blowthisup

https://i.ytimg.com/vi/aO02VGhoXdg/maxresdefault.jpg

Living On 100k After Taxes In Germany germany liberal taxes salary

https://i.ytimg.com/vi/1X2Pu2oPVx0/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYRCBZKHIwDw==&rs=AOn4CLDJxoxJh3AYwizjphdgonDLHU8qzw

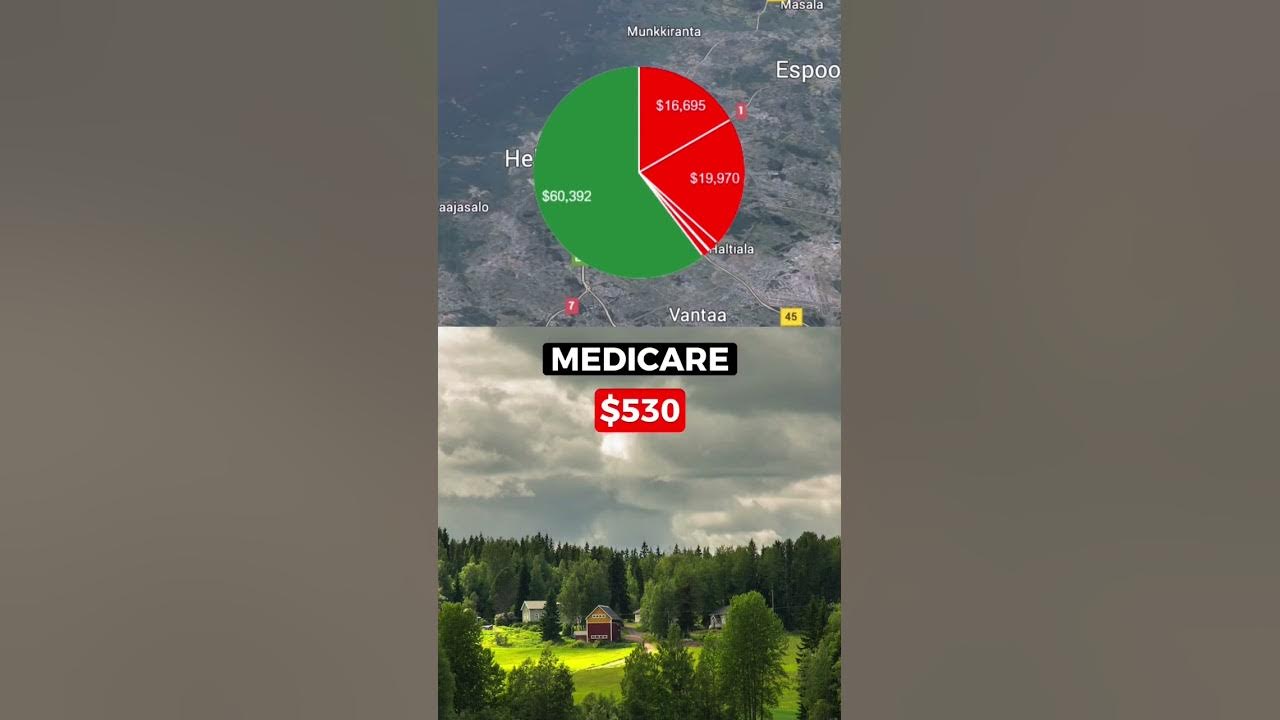

100k After Taxes In The Happiest Country In The World finland

https://i.ytimg.com/vi/YyhxA8-P8UI/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBdKFMwDw==&rs=AOn4CLBlDDpZOkLnQry2INxKXWj0CkEbTQ

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Taxes in Florida Florida State Tax Quick Facts Income tax None Sales tax 6 7 50 Property tax 0 86 average effective rate Gas tax 36 525 cents per gallon of regular gasoline and 20 20 cents per gallon of diesel Florida s official nickname is The Sunshine State but it may as well be The Low Tax State To determine just how much a 100k salary really looks like in every state GOBankingRates pulled data from federal and state tax brackets from the Tax Foundation s 2023 data Florida Take

7 Realistic Ways To Make 100k A Month Ultimate 2023 Guide

https://www.dontworkanotherday.com/wp-content/uploads/2022/06/How-Much-is-100k-a-Month.jpg

Living On 100k After Taxes In Minnesota salary minnesota democrat

https://i.ytimg.com/vi/VXNDrGSK3i8/maxresdefault.jpg

How Much Is 100k After Taxes In Florida - The tax calculation below shows exactly how much Florida State Tax Federal Tax and Medicare you will pay when earning 100 000 00 per annum when living and paying your taxes in Florida The 100 000 00 Florida tax example uses standard assumptions for the tax calculation This tax example is therefore a flat example of your tax bill in Florida