How Much Interest Will I Pay Over The Life Of My Mortgage A mortgage is a loan secured by property usually real estate property Lenders define it as the money borrowed to pay for real estate In essence the lender helps the buyer pay the seller of a house and the buyer agrees to repay the money borrowed over a period of time usually 15 or 30 years in the U S

Let s say you have a 15 year fixed rate mortgage with a loan amount of 200 000 and an interest rate of 3 If you feed our mortgage calculator with these parameters you will see that your monthly principal and interest payment would be 1 381 16 In the first month in line with the loan amortization method your payment will cover mostly interest 500 mortgage interest calculated by Check out the web s best free mortgage calculator to save money on your home loan today Estimate your monthly payments with PMI taxes homeowner s insurance HOA fees current loan rates more Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules Our calculator includes amoritization tables bi weekly savings estimates refinance info

How Much Interest Will I Pay Over The Life Of My Mortgage

How Much Interest Will I Pay Over The Life Of My Mortgage

https://i.ytimg.com/vi/6sLvqJK_iSI/maxresdefault.jpg

How To Calculate Your Car Loan Payment YouTube

https://i.ytimg.com/vi/p8f8XP2tmvE/maxresdefault.jpg

TehreemKarmela

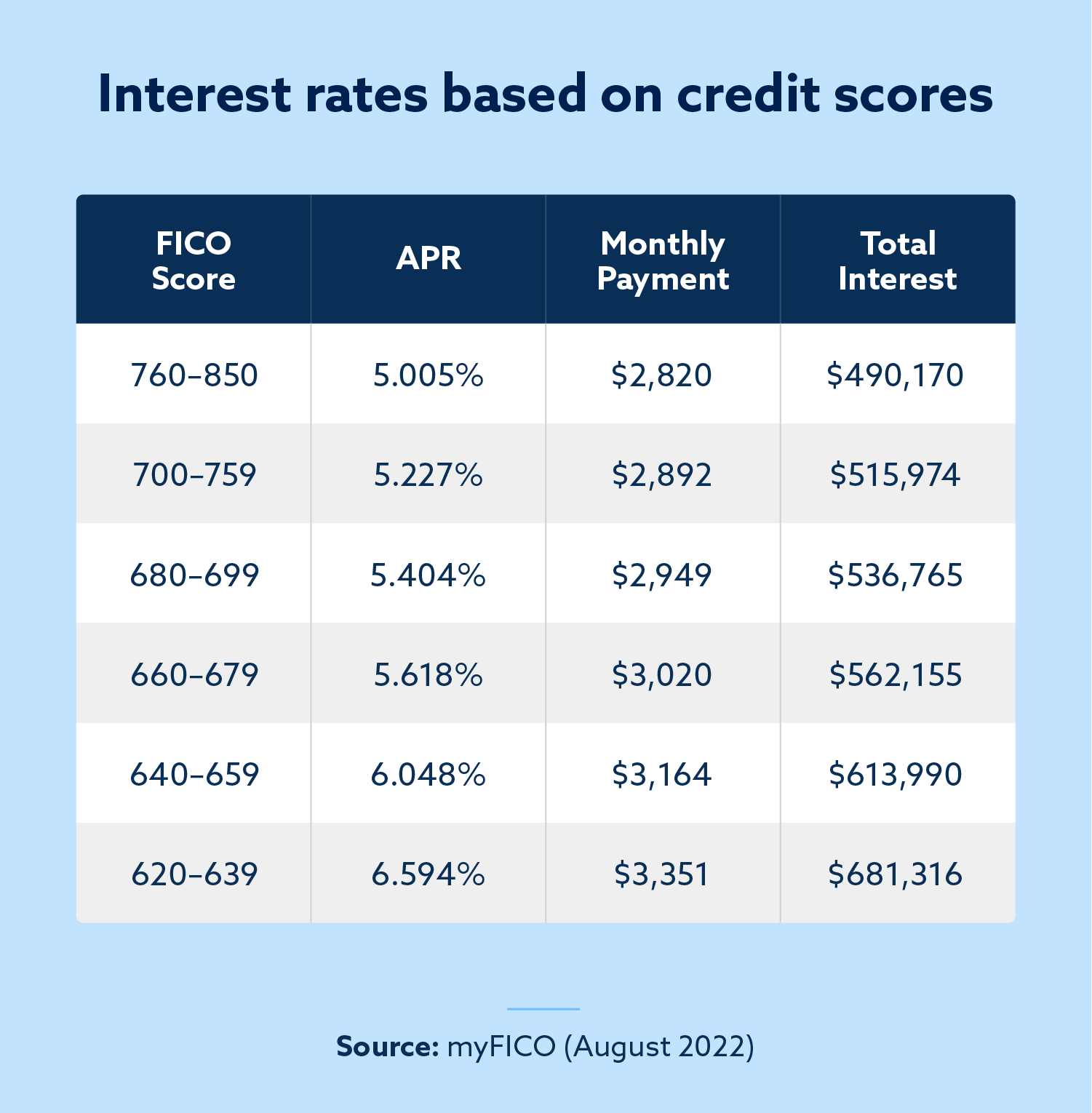

https://www.lexingtonlaw.com/blog/wp-content/uploads/2022/09/Asset-1.png

The Bankrate loan interest calculator only applies to loans with fixed or simple interest When used correctly it can help you determine the total interest over the life of your loan as well as How much will my monthly payment be and how much interest will I pay over the life of the loan Use this calculator to generate an estimated amortization schedule for your current mortgage Quickly see how much interest you could pay and your estimated principal balances You can even determine the impact of any principal prepayments

Once you determine how much you can truly afford to borrow getting the lowest interest rate possible is crucial Even half a percentage point from 3 to 3 5 will cost you 100 extra every month and over the lifetime of your loan you ll pay nearly 40 000 more just in interest Getting the best interest rate that you can will significantly decrease the amount you pay each month as well as the total amount of interest you pay over the life of the loan Loan Term A 30 year fixed rate mortgage is the most common type of mortgage However some loans are issues for shorter terms such as 10 15 20 or 25 years

More picture related to How Much Interest Will I Pay Over The Life Of My Mortgage

How To Calculate The Monthly Interest And Principal On A Mortgage Loan

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

How To Calculate How Much Of A Car Loan You Can Afford To Borrow

https://i.ytimg.com/vi/MiPvFbKCx8U/maxresdefault.jpg

How To Calculate Monthly Credit Card Interest Explained How To

https://i.ytimg.com/vi/Q4sD4oTyVyA/maxresdefault.jpg

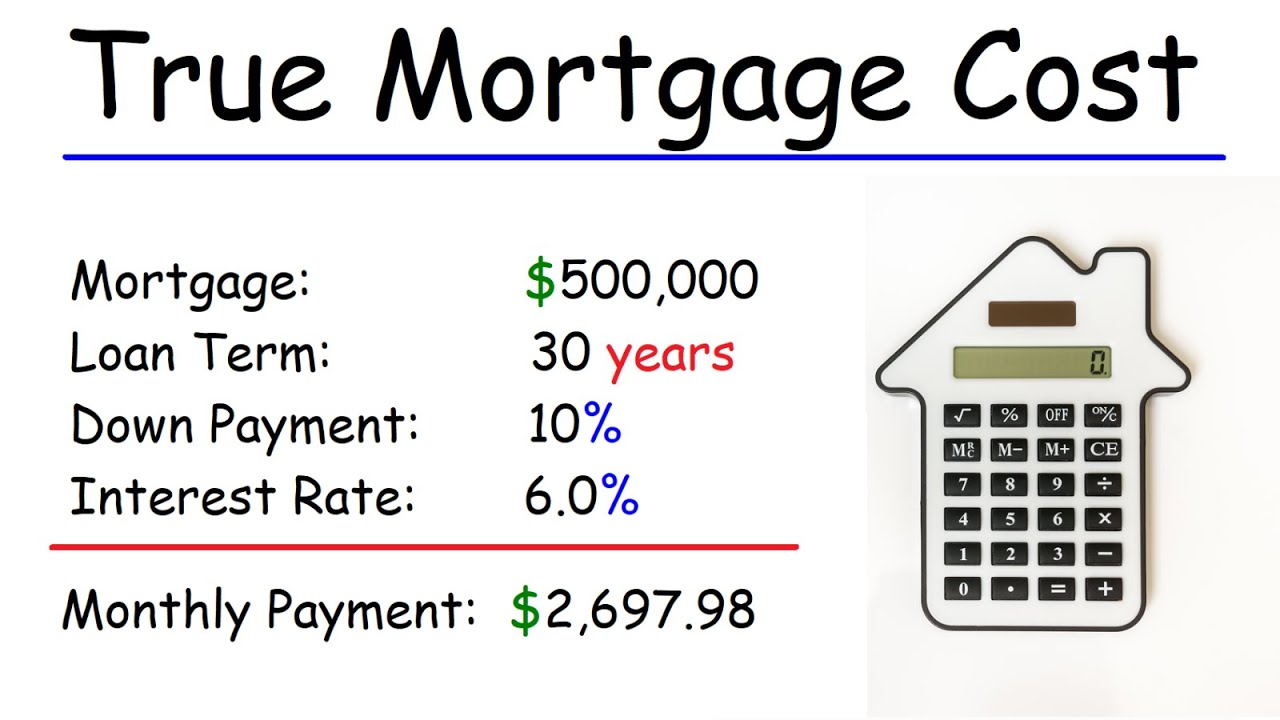

The amortization chart shows the trend between interest paid and principal paid in comparison to the remaining loan balance Based on the details provided in the amortization calculator over 30 years you ll pay 351 086 in principal and interest Example Your bank offers a loan at an annual interest rate of 6 and you are willing to pay 250 per month for 4 years 48 months How much of a loan can to take Solve using CalculatorSoup Loan Calculator Calculation Find the Loan Amount Interest Rate 6 Number of Months 48

[desc-10] [desc-11]

Fixed Deposit Interest Calculation FD Interest FD Maturity Amount

https://i.ytimg.com/vi/BzDGXgPJ1ic/maxresdefault.jpg

How To Calculate The True Cost Of A Mortgage Loan YouTube

https://i.ytimg.com/vi/ihnxr2ycLUo/maxresdefault.jpg

How Much Interest Will I Pay Over The Life Of My Mortgage - [desc-14]