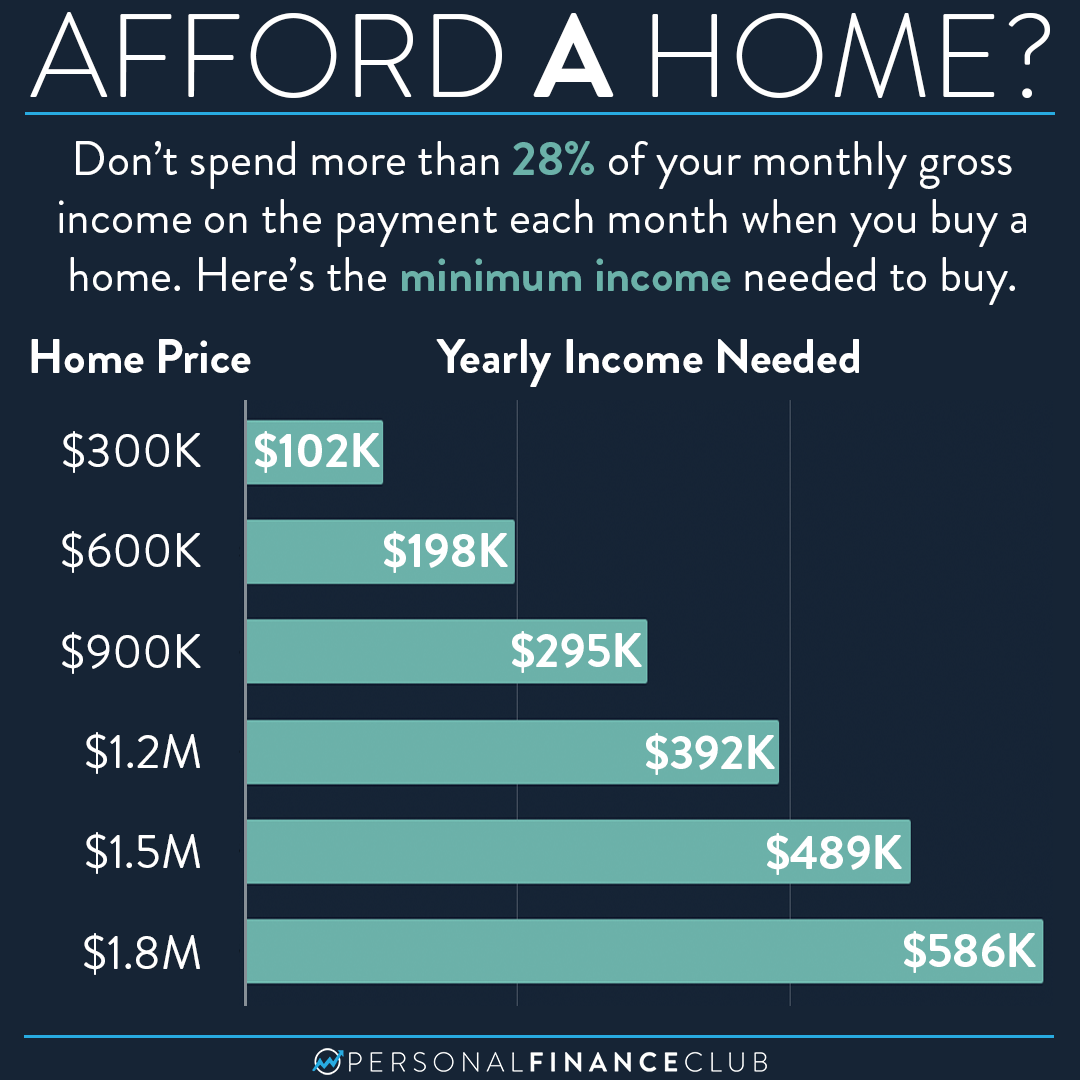

How Much Home Can I Afford With 60000 Salary In general home buyers should use lower percentages for more conservative estimates and higher percentages for more risky estimates A 20 DTI is easier to pay off during stressful financial periods compared to say a 45 DTI Home buyers who are unsure of which option to use can try the Conventional Loan option which uses the 28 36 Rule

For instance if your annual income is 60 000 about 5 000 monthly your mortgage payment should be less than 1 400 To calculate an affordable mortgage amount consider a standard 30 year mortgage at an estimated rate The 28 36 percent rule is a tried and true home affordability rule of thumb that establishes a baseline for what you can afford to pay every month For example let s say you earn 4 000 each month

How Much Home Can I Afford With 60000 Salary

How Much Home Can I Afford With 60000 Salary

https://www.personalfinanceclub.com/wp-content/uploads/2023/11/2023-11-7-Afford-a-home-1.png

Here s How To Figure Out How Much Home You Can Afford

https://image.cnbcfm.com/api/v1/image/104226075-chart_1_noheadlineaa_1024.jpg?v=1484764159&w=1920&h=1080

HOW MUCH HOUSE CAN I AFFORD Home Affordability Spreadsheet YouTube

https://i.ytimg.com/vi/HfrqjUKj1uA/maxresdefault.jpg

Let s ask and answer How much home can I afford with a 100 000 salary If you make 100 000 per year before taxes you have 62 500 saved for a down payment and closing costs and your monthly This home price might be difficult to afford A DTI ratio above 43 can signal to lenders that you may find it challenging to pay debt

Find out how much house you can afford with our home affordability calculator See how much your monthly payment could be and find homes that fit your budget In order to determine how much mortgage you can afford to pay each month start by looking at how much you earn each year before taxes 60 000 300 000 1 179 39 15 45 000 This is the amount you pay upfront toward your home purchase Typically the recommended amount is 20 of your purchase price Under certain loan programs a down payment amount may be as low as 3 5

More picture related to How Much Home Can I Afford With 60000 Salary

How Much House Can I Afford On 150k Salary YouTube

https://i.ytimg.com/vi/tyebTUhoTOI/maxresdefault.jpg

How Much Mortgage Can I Afford With 100k Salary How Much House Can I

https://i.ytimg.com/vi/heUn4Vqsx58/maxresdefault.jpg

How Much House Can I Afford With 150k Salary How Much House Can I

https://i.ytimg.com/vi/l6hbD_qsgsI/maxresdefault.jpg

Home Affordability Calculator Estimate the maximum home price you can afford by factoring in your income debts and mortgage details Simplify Your Workflow Search miniwebtool How many years you plan to pay off the mortgage common terms are 15 or 30 Embed Home Affordability Calculator Widget Home Affordability Calculator Home Value 185 731 33 Mortgage Amount 165 731 33 Monthly Principal Interest 1 016 67 Monthly Property Tax 166 67

[desc-10] [desc-11]

Detailed Explanation How Much House Can You Afford With 80K Salary

https://i.ytimg.com/vi/Sm1ie8sqtwM/maxresdefault.jpg

House Loan Vs Salary Home Sweet Home Modern Livingroom

https://i0.wp.com/www.MLSMortgage.com/wp-content/uploads/How-much-house-can-I-afford-excel-worksheet.png?resize=720%2C651&ssl=1

How Much Home Can I Afford With 60000 Salary - Find out how much house you can afford with our home affordability calculator See how much your monthly payment could be and find homes that fit your budget In order to determine how much mortgage you can afford to pay each month start by looking at how much you earn each year before taxes 60 000 300 000 1 179 39 15 45 000