How Much Does Doordash Charge For Taxes For tax calculation purposes like trying to determine how much to save for taxes for Doordash and others here s how we do it with our tax calculator Add all income from all gig economy sources Doordash and other platforms including tips

To ensure that our partners receive the best possible service DoorDash charges a commission or fee for orders processed using our products and services Keep reading to learn about DoorDash pricing what pickup and delivery commission and fees on DoorDash cover and how they help bring value to your business and your broader community How Much Does DoorDash Cost Using DoorDash involves several costs the meal price delivery fees typically 1 99 to 5 99 service fees about 10 of the subtotal and local taxes Orders under 15 may have an additional small order fee of around 2 50 Tipping the driver is optional but common

How Much Does Doordash Charge For Taxes

How Much Does Doordash Charge For Taxes

https://media.smallbiztrends.com/2021/12/how-much-money-can-you-make-with-doordash.png

DoorDash Tax Guide What Deductions Can Drivers Take Picnic

https://www.picnictax.com/wp-content/uploads/2021/08/doordash-taxes.jpeg

Doordash Business Address For Taxes

https://www.hrblock.com/tax-center/wp-content/uploads/2021/01/doordash-feature-1280x720.jpg

How much does DoorDash cost for food and service First let s look at what is Doordash DoorDash is a meal delivery service that allows you to get meals delivered to your front door from local eateries and large franchises DoorDash is currently the most popular food delivery service with a market share of more than 35 compared to competitors like Uber Eats Grubhub and Postmates How Much Does DoorDash Cost While individual fees vary based on distance time of day demand surges and other variables most DoorDash orders tally up between 10 to 25 total including tips taxes and all charges

Retail deliveries on DoorDash use the same pricing system You pay for the cost of the items taxes a delivery fee and the service fee Does DoorDash add markup to restaurant item prices Merchants on DoorDash set their own prices DoorDash does not add markup to restaurant prices If prices are higher in the DoorDash app the restaurant or store chose to list higher prices DoorDash does How are Taxes Calculated Taxes apply to orders based on local regulations The amount of tax charged depends on many factors including the following The type of item purchased The time and date of the purchase The location of the store and your delivery address The date and method of fulfillment These factors can change between the time you place an order and when your order is complete We

More picture related to How Much Does Doordash Charge For Taxes

How Does DoorDash Work Guide For 2023 Cozymeal

https://res.cloudinary.com/hz3gmuqw6/image/upload/c_fill,q_auto,w_750/f_auto/how-does-doordash-work-phpY0eHAt

How To Get DoorDash Tax 1099 Forms YouTube

https://i.ytimg.com/vi/fDR4xehHEjk/maxresdefault.jpg

Doordash Is Considered Self Employment Here s How To Do Taxes Stride

https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/bea1cd88-6aec-4981-a2c0-962d82b5638a/screencapture-irs-gov-pub-irs-pdf-f1099nec-pdf-2022-01-10-13_48_46.jpg

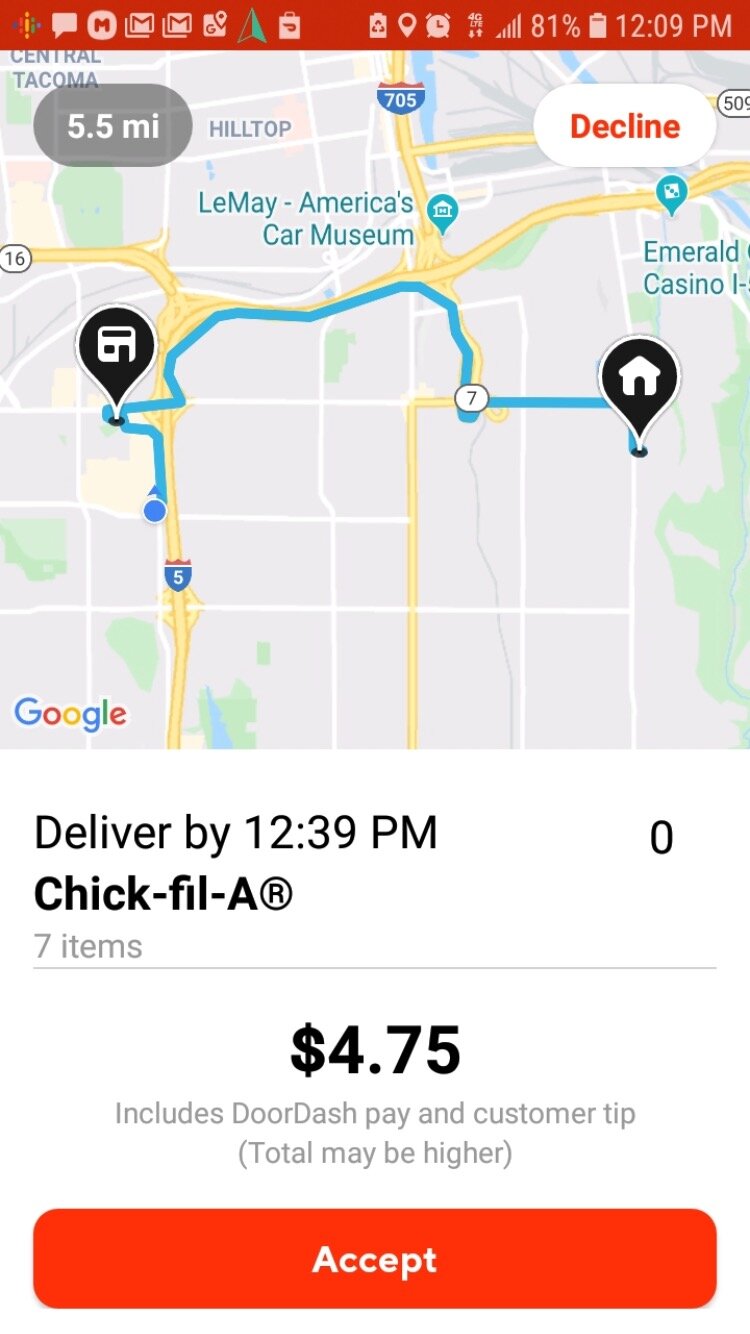

A common question is How much does DoorDash charge for delivery But what some don t think of are the multiple layers to the one price they pay Customers often see a delivery charge but what comes with it are small order fees peak hour surge fees service fees Dasher tips and taxes What do restaurants pay for Learn about the various charges and fees associated with DoorDash deliveries Calculate your DoorDash charges and compare them to competitors Discover tips to save on DoorDash charges

[desc-10] [desc-11]

How Does DoorDash Work And How Much Does It Cost

https://www.shopfood.com/wp-content/uploads/2021/09/doordash-delivery-1200x800-main.jpg

How To Pay Driver Assessment Fee Tideyoutube

https://images.squarespace-cdn.com/content/v1/5c6ea7674d87113fa997ce97/1579147433357-8SFJXR8T21F5COF5TK74/IMG_2440.jpg

How Much Does Doordash Charge For Taxes - [desc-12]