How Much Does A Mortgage Broker Make In Alberta How much money do brokers make Because a broker s job is commission based they are paid by the transaction So for example a broker who charges a 2 rate to close a loan valued at 250 000

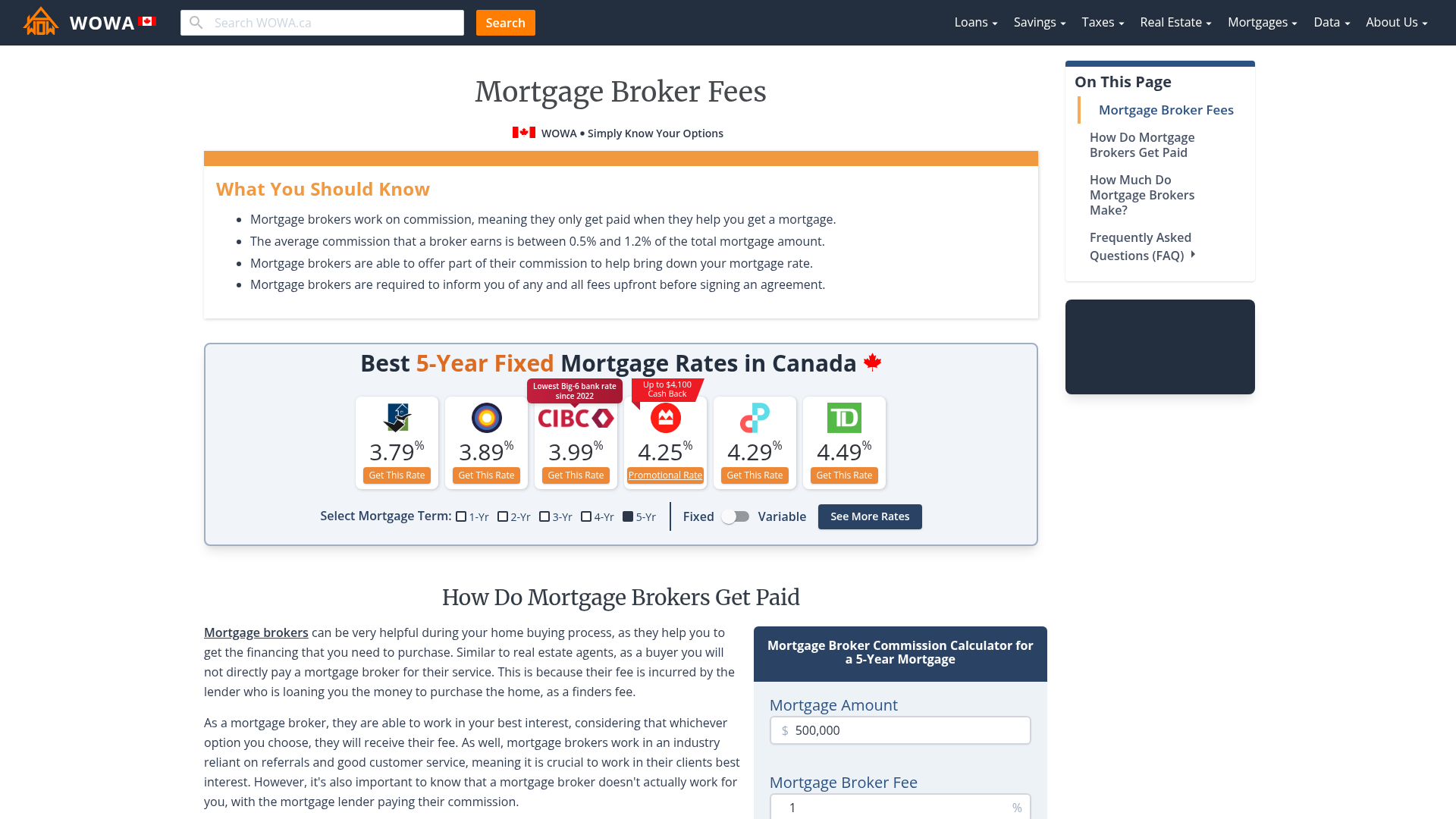

Mortgage broker commissions vary between banks and individual brokers However a typical range might be 0 5 to 1 2 of your full mortgage amount The exact percentage will also depend on the term and type of the mortgage For example if your mortgage was 500 000 and your broker was paid a 1 commission they would receive 5 000 PayScale puts the average salary of mortgage brokers at 64 630 based on 57 reports and notes commissions ranging from 12 000 to 178 000 Brokers with less than one year of experience earned

How Much Does A Mortgage Broker Make In Alberta

How Much Does A Mortgage Broker Make In Alberta

https://wowa.ca/static/img/opengraph/how-mortgage-brokers-paid.png

How Much Does A Mortgage Broker Make YouTube

https://i.ytimg.com/vi/nyW4kvWpRa0/maxresdefault.jpg

Why Use A Mortgage Broker In Alberta What You Need To Know

https://www.danheon.com/wp-content/uploads/2017/04/Why-Use-a-Mortgage-Broker-in-Alberta.jpg

Average mortgage broker salaries A review of data from ZipRecruiter in 2023 says average mortgage broker salaries range from a low of about 65 000 a year to a high of almost 100 000 a year How much does a Mortgage Broker make in Alberta Average base salary Data source tooltip for average base salary 64 975 same as national average The average salary for a mortgage broker is 64 975 per year in Alberta 70 salaries reported updated at April 26 2024 Highest paying cities for Mortgage Brokers near Alberta

STEP 1 MINIMUM ELIGIBILITY REQUIREMENTS A person should be At least 18 years of age A Canadian Citizen or have a valid Permanent Resident PR Card or Open Work Permit Have a Canadian High School Diploma or an Equivalent post college diploma or university Degree Be Proficient in English Brokers still have the ability to make a very good living even with limited volume A broker who closes just 2 million a month could earn over 500 000 annually Very few other occupations pay anywhere close to that much The 360 Mortgage Group believes brokers will be able to adapt to the compensation changes

More picture related to How Much Does A Mortgage Broker Make In Alberta

How Much Do Mortgage Brokers Actually Make In Canada YouTube

https://i.ytimg.com/vi/-_R57xsB6q8/maxresdefault.jpg

Benefits Of Using A Mortgage Broker Grow Advisory Group

https://growadvisorygroup.com.au/wp-content/uploads/2022/04/Benefits-of-using-a-mortgage-broker-1050x750.jpg

Does It Make Sense To Use A Mortgage Broker When Buying A Home Don t

https://dontcallmepenny.com.au/wp-content/uploads/2020/05/iStock-874445016-1024x684.jpg

They charge a fee for their service which is paid by either you the borrower or the lender The fee is a small percentage of the loan amount generally between 1 and 2 If you pay this fee Payscale Payscale shows total pay for mortgage brokers typically ranging from 30 000 to 137 000 per year The site also breaks down earnings by type of pay It finds that mortgage brokers can earn between 36 000 and 124 000 in base salary 2 000 to 36 000 in bonuses and up to 1 000 from profit sharing

Mortgage brokers typically make money through broker or loan origination fees that range from 0 5 to 2 75 of the total mortgage amount While it is common for the lender to cover the fee the borrower sometimes assumes the cost Consider someone who is buying a 500 000 home and wants to get a mortgage for 400 000 They might find a broker who agrees to find a loan for a 1 borrower fee The mortgage broker matches the

-2.png)

Why Use A Mortgage Broker Instead Of A Bank

https://www.olympiabenefits.com/hubfs/Untitled design (3)-2.png

What Does A Mortgage Broker Do

https://www.realestate.com.au/blog/wp-content/uploads/2017/10/06115243/what-does-a-mortgage-broker-do_800x600.jpg

How Much Does A Mortgage Broker Make In Alberta - STEP 1 MINIMUM ELIGIBILITY REQUIREMENTS A person should be At least 18 years of age A Canadian Citizen or have a valid Permanent Resident PR Card or Open Work Permit Have a Canadian High School Diploma or an Equivalent post college diploma or university Degree Be Proficient in English