How Much Do You Need To Make To Have 100k After Taxes Take Home Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major change since 1987

Tax Year 2024 2025 If you live in California and earn a gross annual salary of 69 368 or 5 781 per month your monthly take home pay will be 4 537 This results in an effective tax rate of 22 as estimated by our US salary calculator We used a paycheck calculator to find out take home pay for a 100 000 salary in the largest US cities based on 2020 tax rates

How Much Do You Need To Make To Have 100k After Taxes

How Much Do You Need To Make To Have 100k After Taxes

https://www.retirementnewsdailypress.com/wp-content/uploads/2021/12/How-much-money-do-you-need-to-live-comfortably-UK.jpeg

How Much Tax Is Taken Out Of Paycheck In Texas TaxesTalk

https://www.taxestalk.net/wp-content/uploads/see-what-a-100k-salary-looks-like-after-taxes-in-your-state.jpeg

How Much Money Do You Need To Make To Be Middle Class In Arkansas

https://townsquare.media/site/170/files/2021/12/attachment-Welcome-to-arkansas-Wes-Spicher-Townsquare-Media.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

Use this tax calculator to help you estimate your 2023 2024 federal income tax based on earnings age deductions and credits The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

If you make 100 000 a year living in the region of California USA you will be taxed 29 959 That means that your net pay will be 70 041 per year or 5 837 per month Your average tax rate is 30 0 and your marginal tax rate is 42 6 This marginal tax rate means that your immediate additional income will be taxed at this rate Calculate your take home pay per paycheck for both salary and hourly employees using Forbes Advisor s paycheck calculator

More picture related to How Much Do You Need To Make To Have 100k After Taxes

How Much Of My Net Income Should Go To Mortgage MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/heres-how-to-figure-out-how-much-home-you-can-afford.jpeg

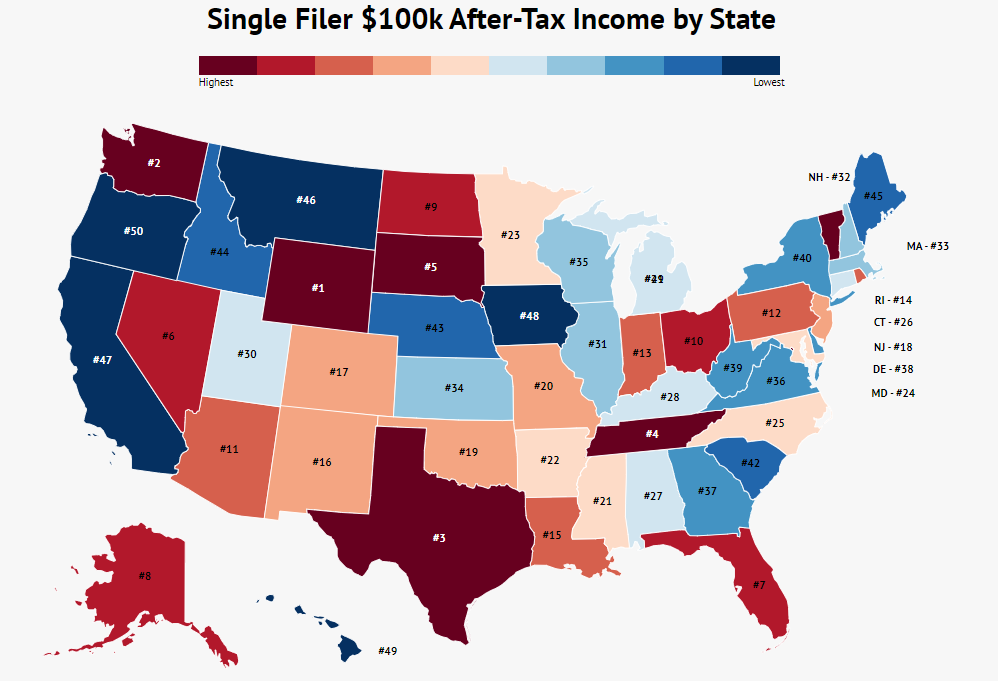

100k After Tax Income By State 2023 Zippia

https://www.zippia.com/wp-content/uploads/2023/03/single-filer-after-tax-income.png

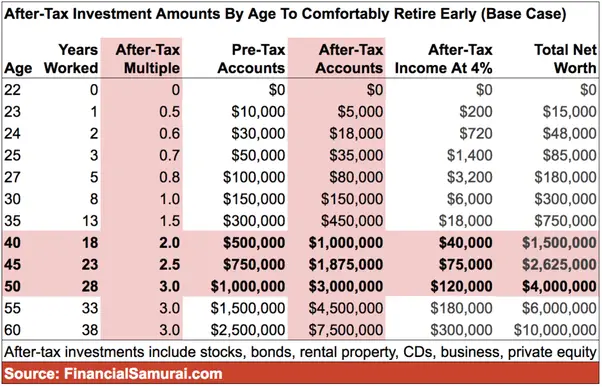

How Much Do You Need In 401k To Retire 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/if-i-max-out-my-401k-from-age-30-to-60-will-i-have-enough.png

Tax Withholding Estimator Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck This is tax withholding SmartAsset s Georgia paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

SmartAsset s Florida paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay 37 609 351 or more 731 201 or more 365 601 or more 690 351 or more Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are all taken into account and are kept up to date with 2024 25 rates

How Much Do You Need To Make To Buy A Home In Your State Nassau

https://bt-wpstatic.freetls.fastly.net/wp-content/blogs.dir/239/files/2018/04/chart-1.jpg

A Look At The Changes Manchester City May Need To Make To Have Success

https://image.assets.pressassociation.io/v2/image/production/c92f63c88a29bd0a5ec463e8b2ea00b3Y29udGVudHNlYXJjaCwxNTk3NzY4MDA5/2.54875121.jpg?w=1280

How Much Do You Need To Make To Have 100k After Taxes - The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator