How Much Can I Earn A Week Before Paying Tax And National Insurance Most U S citizens or permanent residents who work in the U S have to file a tax return Generally you need to file if Your gross income is over the filing requirement You have over 400 in net earnings from self employment side jobs or other independent work You had other situations that require you to file

1 Class 1 National Insurance thresholds Employers and employees pay Class 1 National Insurance depending on how much the employee earns You can view these earnings thresholds by For example if you earn 1 000 a week you pay nothing on the first 242 10 72 50 on the next 725 2 66p on the next 33 This is calculated each time you get paid so you could pay different amounts if your pay changes each time Your National Insurance contributions will stop completely when you reach State Pension age

How Much Can I Earn A Week Before Paying Tax And National Insurance

How Much Can I Earn A Week Before Paying Tax And National Insurance

https://quasa.io/storage/images/news/e7Yizg3OCkCd9vZu63D5S5YzP7On4OGOOn4MqcMo.jpg

How Much Can You Earn Before Paying Tax In Canada Finance

https://b2962890.smushcdn.com/2962890/wp-content/uploads/How-Much-Can-You-Earn-Before-Paying-Tax-Canada-768x512.jpg?lossy=1&strip=1&webp=1

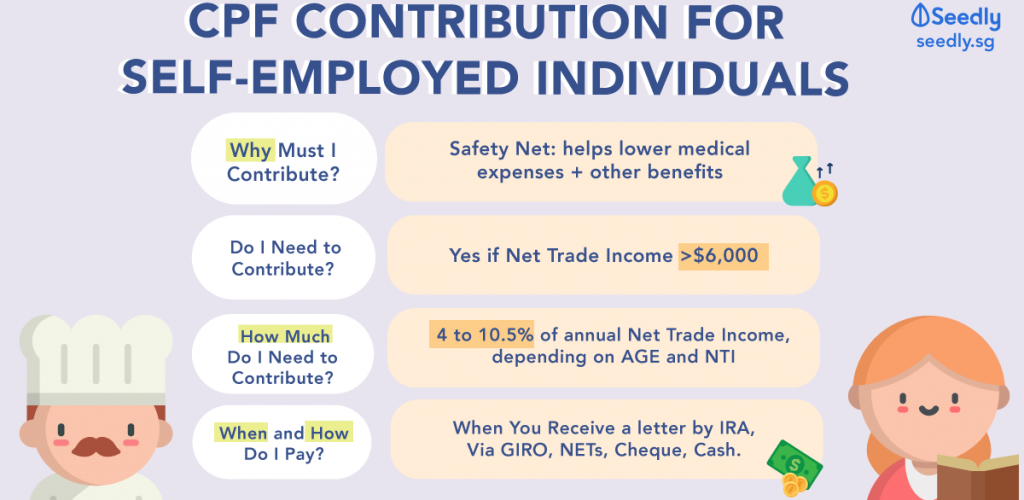

How Much Can I Earn Before Registering As Self employed

https://bridefeed.com/wp-content/uploads/2021/08/How-much-can-I-earn-before-registering-as-self-employed-1024x500.png

For 2023 24 this threshold is aligned with the personal allowance for income tax and is therefore 242 a week or 1 048 a month The actual amount of Class 1 NIC you pay depends on what you earn up to the upper earnings limit which is 967 per week or 4 189 per month for 2023 24 From 6 January 2024 the Class 1 rate that 27 million workers pay will fall from 12 to 10 which will lower your bill in 2023 24 Our calculator can show you how much you will pay Then from 6 April 2024 the Class 2 flat rate currently 3 45 a week that self employed people pay will be scrapped and the Class 4 rate will drop from 9 to 8

Who pays National Insurance National Insurance has to be paid by both employed and self employed workers from 16 until they reach state pension age currently 66 In some situations you will be exempt from paying National Insurance contributions For example if you earn below 12 570 are unemployed or receiving benefits You pay mandatory National Insurance if you re 16 or over and are either an employee earning more than 242 per week from one job self employed and making a profit of more than 12 570 a

More picture related to How Much Can I Earn A Week Before Paying Tax And National Insurance

Paying Tax And National Insurance Due Under Your PSA Wellway

https://www.wellwayconnect.co.uk/wp-content/uploads/2021/11/Paying_tax_and_National_Insurance_due_under_your_PSA-1080x675.jpg

How Much Can I Earn In UK Before Paying Tax Accounting Firms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/12/earn-before-paying-tax-1.png

How Much Can You Earn Before Paying Income Tax Evening Standard

https://static.standard.co.uk/2023/03/27/00/f01b91ef08d35c211f0a6de634c15922Y29udGVudHNlYXJjaGFwaSwxNjc5NzYwNTI3-2.34653039.jpg?width=968&auto=webp&quality=50&crop=968:645%2Csmart

National Insurance contributions NICs are the UK s second biggest tax expected to raise almost 150 billion in 2021 22 about 20 of all tax revenue They are paid by employees and the self employed on their earnings and by employers on the earnings of those they employ Up to a certain threshold earnings are free of NICs This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 2023 24 Enter your Salary and click Calculate to see how much Tax you ll need to Pay Income Tax NI Calculator Income Age Married Weekly Hours Weekly Days Class 2 Class 4

For 2023 24 employers are liable to pay NIC on any employee s pay over 175 per week 758 per month You can see the key rates of employer NIC on GOV UK However because most small employers can get up to 5 000 a year off their National Insurance bill there may not actually be any employer s NIC to pay TaxAid Tip If your earnings are between 0 and 190 you are treated as if you had made National Insurance contributions but you don t actually have to pay National Insurance This threshold increases to 242 per week from 5 July 2022 At higher levels of earnings above 190 242 but less than 967 you pay National insurance at a

Let The IRS Take Your Money If You Don t Work To Keep It The IRS Gets It

http://radcliffcpa.com/wp-content/uploads/2018/10/tax-money-to-Uncle-Sam.jpg

How Much Are Virtual Tax Office Earnings Should You Invest

https://annettapowell.com/wp-content/uploads/2022/09/tax-ofic-1080x675.png

How Much Can I Earn A Week Before Paying Tax And National Insurance - It s best to register as soon as you can but the deadline is 5 October the following tax year a tax year runs 6 April to 5 April For example if you started being self employed in June 2024 you d need to register by 5 October 2025 You might have to pay a penalty if you register late