How Much After Tax 100k Federal Paycheck Quick Facts Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023 How Your Paycheck Works Income Tax Withholding

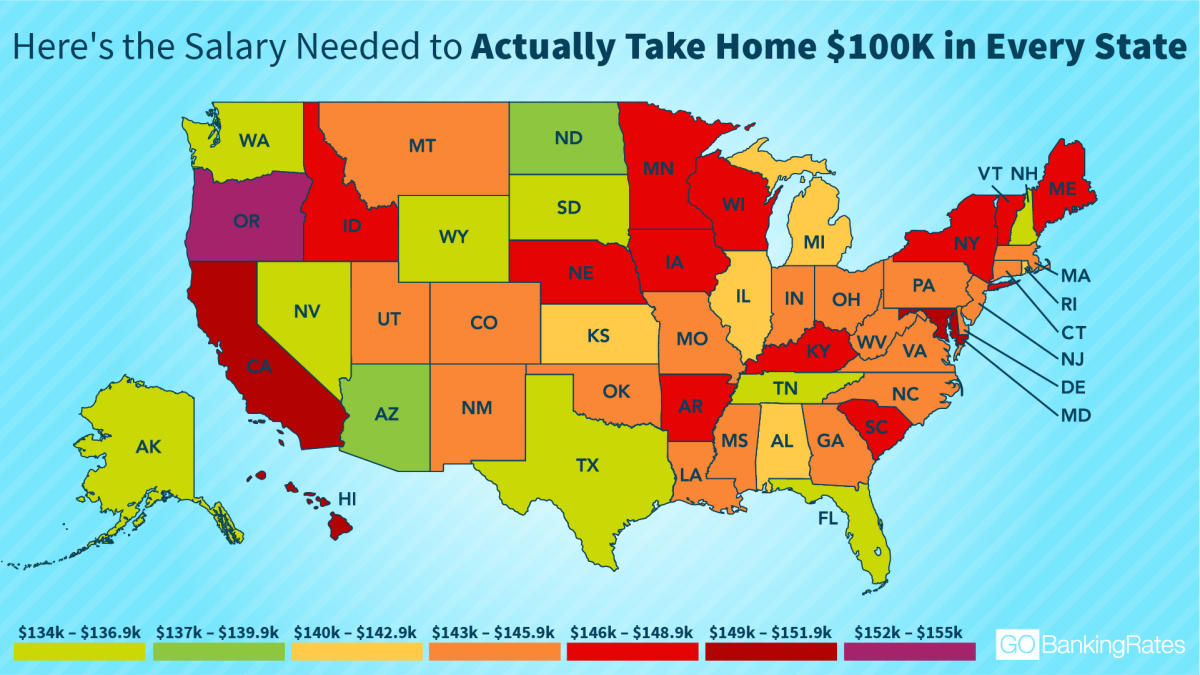

The tax burden is highest for single filers in Oregon coming in at 30 39 for single filers earning 100 000 One good way to use this data during the current financial crisis is to divide your 2024 US Tax Calculation for 2025 Tax Return 100k Salary Example If you were looking for the 100k Salary After Tax Example for your 2024 Tax Return it s here Brace yourselves for a surprise

How Much After Tax 100k

How Much After Tax 100k

https://i.ytimg.com/vi/JYZ6gni7wtA/maxresdefault.jpg

100k After Tax Calculator How Much Is Salary After Tax 100000 In UK

https://www.londonbusinessblog.co.uk/wp-content/uploads/2023/03/after-tax-for-100k.png

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

In this situation gross income of 100 000 would be reduced by the standard deduction of 12 400 That leaves taxable income of 87 600 The tax on that income is 15 103 50 The state s effective average tax rate of 5 17 apply to any tax return whether filed by a single person or a married couple with 8 000 or more in earnings But Arkansas residents can save on taxes by taking advantage of its tax free weekend on clothing and school supplies which runs in August California

How much federal tax should I pay if I make 100K You will owe roughly 25 of your income in federal taxes if you make 100k More specifically you d likely pay between 18 24 of your income More typically you might expect to pay between 17 836 and 18 916 in tax Alaska Take home salary for single filers 78 089 Take home salary for married filers 84 114 Alaska is one of the most tax friendly states in the U S because it s one of the nine states

More picture related to How Much After Tax 100k

Here s The Salary Needed To Actually Take Home 100K In Every State

https://cdn.gobankingrates.com/wp-content/uploads/2018/03/money-currency-100-dollar-bill-iStock-665477004.jpg?quality=90

70k A Year Is How Much An Hour Before After Tax Breakdown

https://www.moneyforthemamas.com/wp-content/uploads/2022/06/dave-ramsey-recommended-budget-percentages-for-70000-salary-512x1024.jpg

Ca Tax Brackets Chart Jokeragri

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min-1309x1536.jpg

This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major change since 1987 Income Tax Calculator Budget Calculator Before Tax vs After Tax Income Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week

Calculate your potential tax liability or refund with our free tax calculator The calculator will estimate your 2023 2024 federal income taxes based on your income deductions and credits The IRS released new tax brackets which tell employers how much to take out of your paycheck for income taxes If you make 100 000 here s what to expect Search Jobs Apply4Me Resume Career

This Is The Ideal Salary You Need To Take Home 100K In Your State

https://s.yimg.com/ny/api/res/1.2/U7NjUVhG7xWBJwUW_nBP3A--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en-US/gobankingrates_644/b1c67f0ee5e533346e14defceab29095

Earning 100k And On The Wrong Tax Code TaxScouts

https://taxscouts.com/wp-content/uploads/Delivery_100K_Cover_Update-1536x806.png

How Much After Tax 100k - The state s effective average tax rate of 5 17 apply to any tax return whether filed by a single person or a married couple with 8 000 or more in earnings But Arkansas residents can save on taxes by taking advantage of its tax free weekend on clothing and school supplies which runs in August California