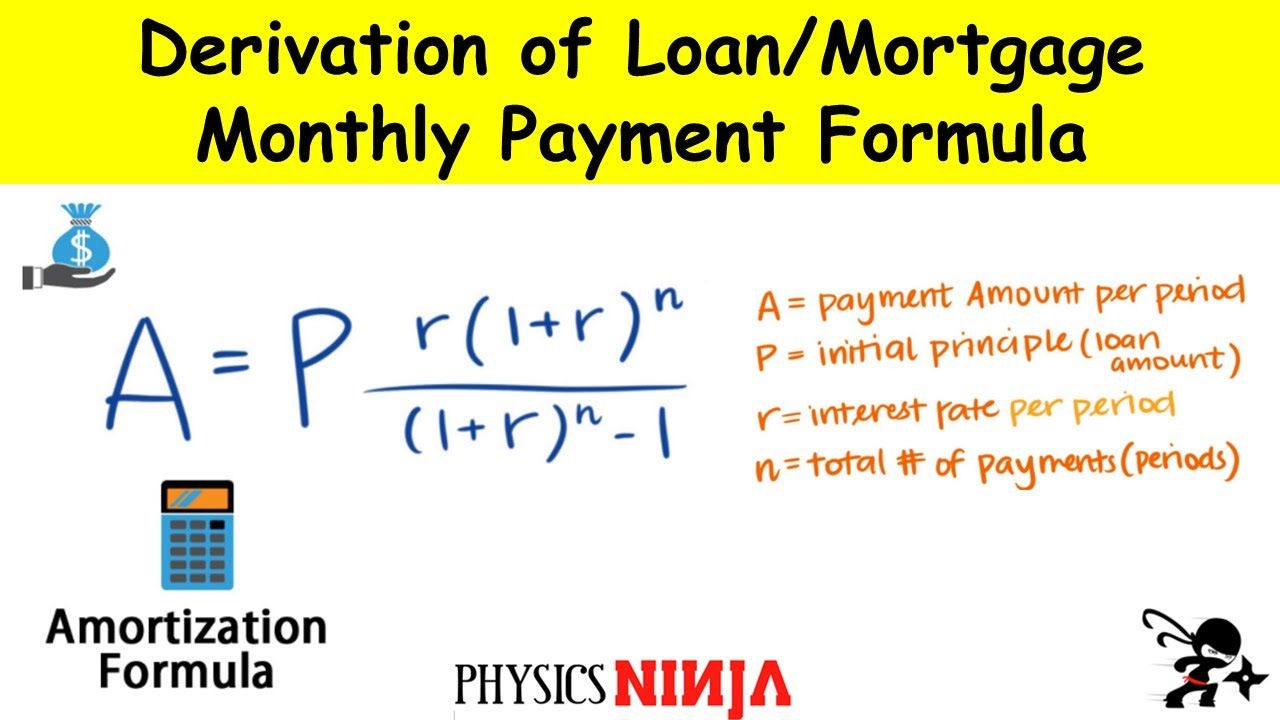

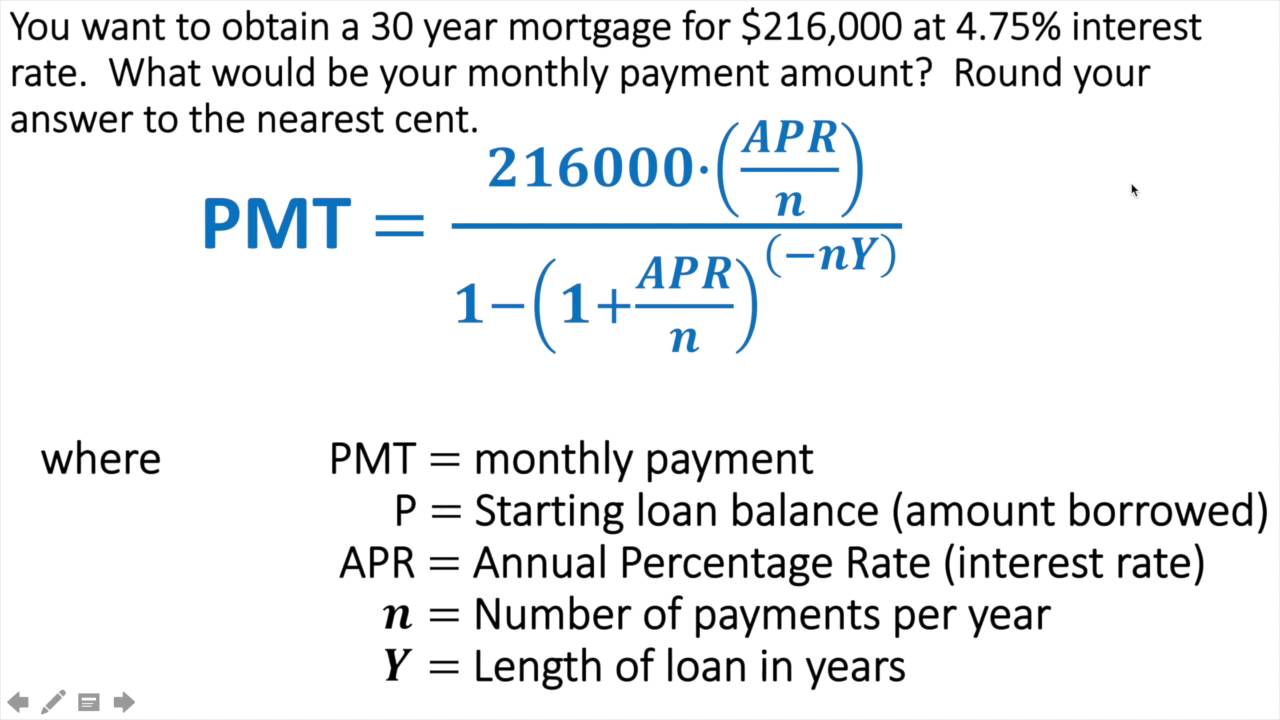

How Do You Calculate Monthly Loan Repayments The monthly payment formula calculates how much a loan payment will be and includes the loan s principal and interest When you receive a loan from a lender you receive an amount called the principal and the lender tacks on interest You pay back the loan over a set number of months or years and the interest makes the total amount of money you owe larger

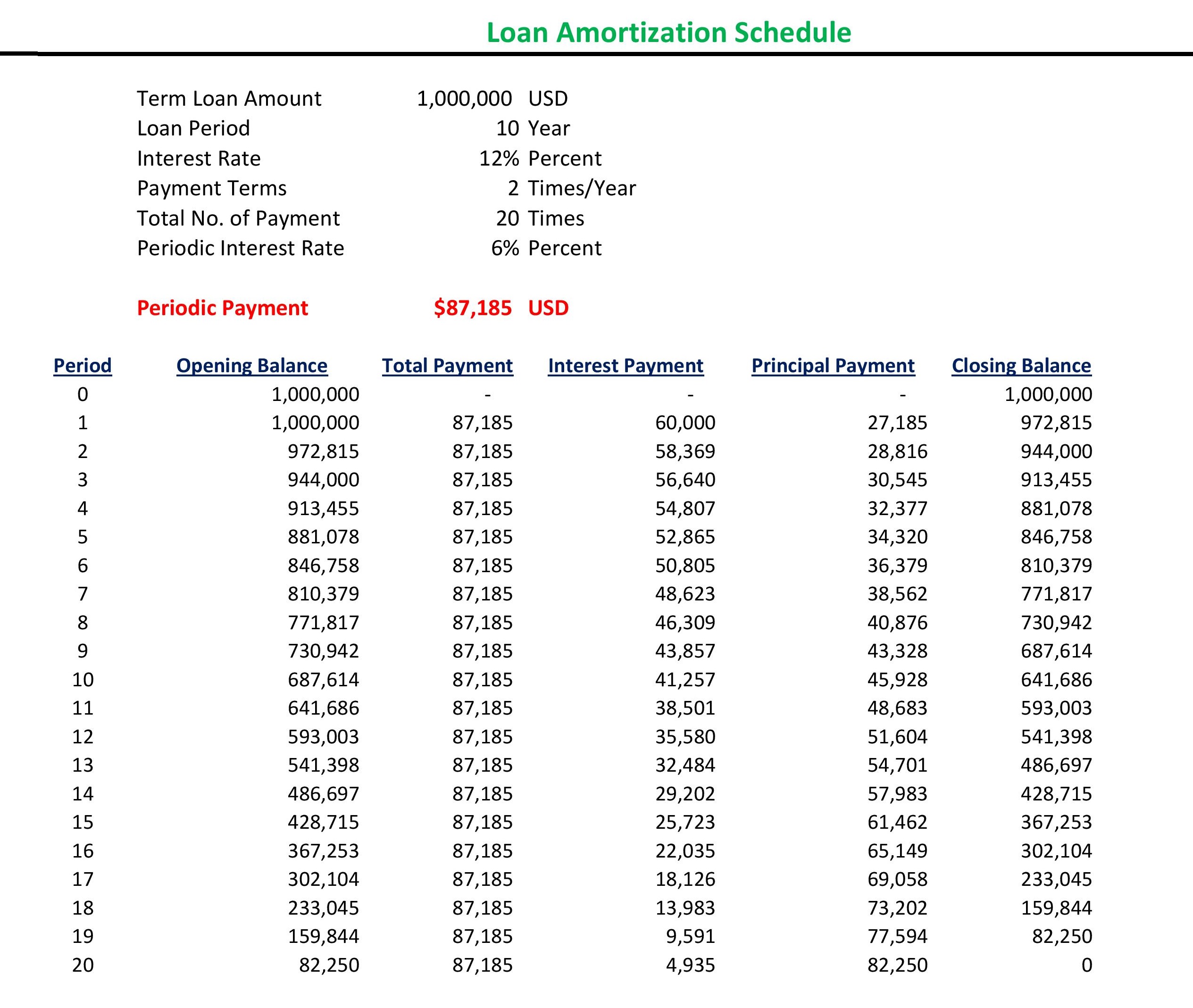

The original amount on a new loan or principal outstanding if you are calculating a current loan Interest Rate the annual interest rate stated rate on the loan Remaining Term Months number of months which coincides with the number of payments to repay the loan How much time is left on this loan Current Monthly Loan Payment As you can see the lowest interest payment occurs with the even principal repayment structure which is the result of paying back more of the principal in the early monthly payments Logically the best way to reduce the borrowing cost of the loan and shorten the loan repayment time is to increase the monthly installments

How Do You Calculate Monthly Loan Repayments

How Do You Calculate Monthly Loan Repayments

https://i.ytimg.com/vi/iilFXMHKkZQ/maxresdefault.jpg

How To Calculate The Monthly Interest And Principal On A Mortgage Loan

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

Calculating Loan Payments For A Mortgage YouTube

https://i.ytimg.com/vi/Ryfn1L1mjXw/maxresdefault.jpg

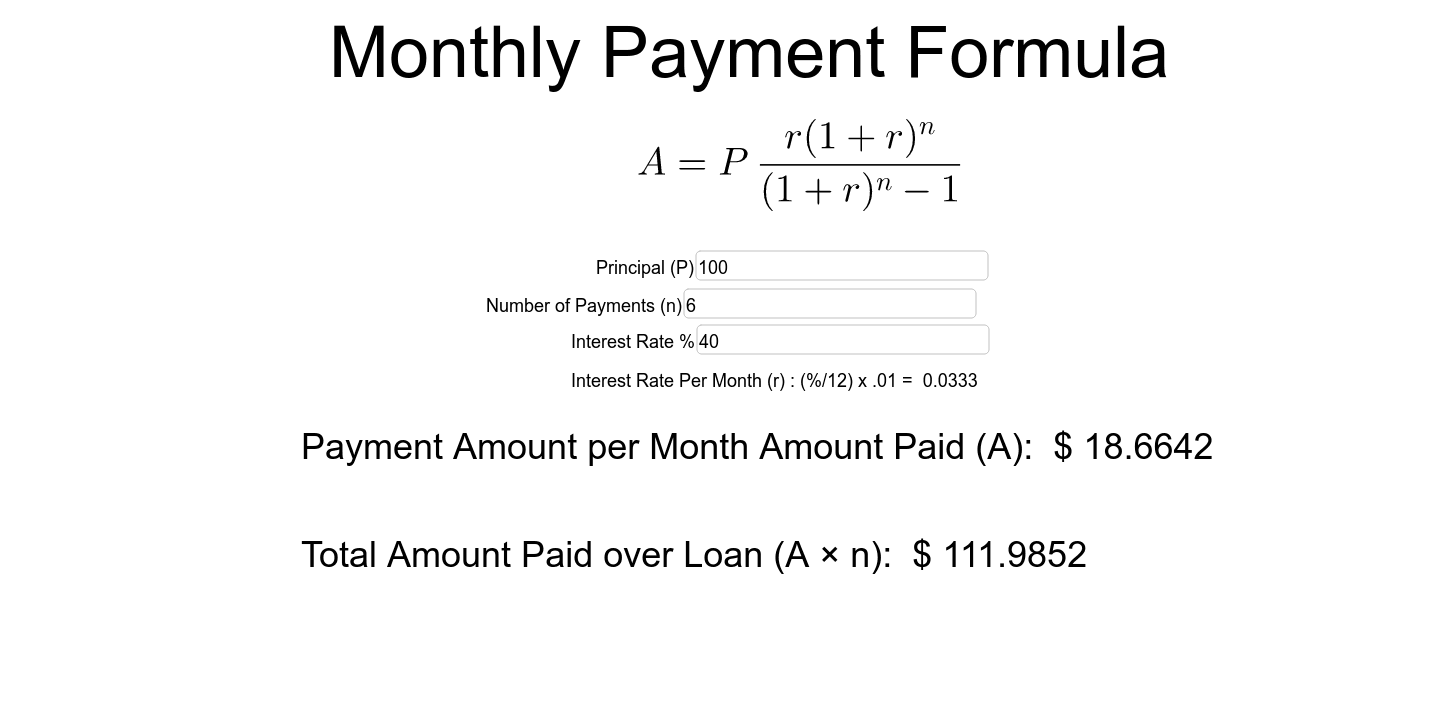

A loan calculator uses basic information to estimate your installment payments and give you an idea of how much interest you d pay over the life of the loan Let s say you want to borrow Loans are usually taken over a number of years with monthly repayments Therefore a loan taken over 5 years will have 60 repayments since there are 12 months per year A 10 year loan would have 120 monthly repayments When the loan amount is repaid is over more months each payment is smaller However the longer term loan will incur more interest

Student loans usually have high interest rates ranging from 6 and up and using a personal loan to pay off student loans will translate to lower interest rates and faster debt repayments However keep in mind that this will come with certain pitfalls How Does the Monthly Loan Repayment Calculator Work The Monthly Loan Repayment Calculator works by using a simple formula based on three main loan factors Loan Amount The total amount of money you are borrowing Interest Rate The annual interest rate charged by the lender Loan Term The period over which you will repay the loan typically measured in months e g 24 months 60 months

More picture related to How Do You Calculate Monthly Loan Repayments

How To Calculate Monthly Loan Repayments YouTube

https://i.ytimg.com/vi/Coxza9ugW4E/maxresdefault.jpg

Monthly Payment Formula GeoGebra

https://www.geogebra.org/resource/hayse2uN/bN4hQ7YGCjlwYfMX/material-hayse2uN.png

Dollartimes Interest Calculator

https://ordnur.com/wp-content/uploads/2019/12/Loan-Amortization-Schedule-in-Excel.jpg

How To Calculate The Monthly Payment On A Personal Loan When you use an installment loan you ll repay the amount you ve borrowed the principal over a set amount of time the repayment term You ll also have to pay interest and fees both of which make up the loan s annual percentage rate APR The principal loan term and APR are the three main components of your monthly payment The loan payment formula is used to calculate the payments on a loan The formula used to calculate loan payments is exactly the same as the formula used to calculate payments on an ordinary annuity A loan by definition is an annuity in that it consists of a series of future periodic payments The PV or present value portion of the loan

[desc-10] [desc-11]

Worksheet calculate

http://www.wikihow.com/images/2/28/Calculate-a-Monthly-Payment-in-Excel-Step-12-Version-2.jpg

Interest Rates Estimates 2025 Joshua M Matter

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/12/12004614/Loan-Amortization-Schedule-Calculator-960x753.jpg

How Do You Calculate Monthly Loan Repayments - Student loans usually have high interest rates ranging from 6 and up and using a personal loan to pay off student loans will translate to lower interest rates and faster debt repayments However keep in mind that this will come with certain pitfalls