How Do I Work Out My Take Home Pay Uk Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2024 to 5 April 2025 This tells you your take home pay if you do not have

Calculate your take home pay per paycheck for salary and hourly jobs after federal state local taxes Updated for 2024 tax year on Jul 06 2024 There are six main steps to work out your final paycheck Step 1 Gross income First we need to determine your gross income If you are salaried your annual salary will be your gross income FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

How Do I Work Out My Take Home Pay Uk

How Do I Work Out My Take Home Pay Uk

https://www.wolseymortgage.co.uk/wp-content/uploads/2022/03/b2ap3_large_calculator-1516869_1920-1-1.jpeg

Specified Adult Childcare Credits Boost Your State Pension

https://www.danbro.co.uk/wp-content/uploads/2019/01/Pensions-and-retirement-planning.png

Teachers Take Home Pay Calculator UK 2022

https://www.getmakedigital.com/assets/teachers_uk/teachers_salary_calculator_uk.jpg

Personal Allowance is an amount of money you re allowed to earn each year without having to pay income tax on it You can used this allowance for your salary savings interests dividends and other income For the 2024 25 tax year the Personal Allowance is set at 12 570 If you earn less than this amount you typically won t owe any Income Tax Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

To calculate employer taxes use PaycheckCity Payroll Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and Calculate the take home pay for your salary This easy to use calculator will work out your deductions and show you a full take home pay breakdown for 2024 2025 UK Take Home Pay Calculator Use this calculator to find exactly what you take home from any salary you provide We have redesigned this tool to be as easy to use as possible

More picture related to How Do I Work Out My Take Home Pay Uk

DO I WORK OUT My Work Out Journey How I Lost 100 Pounds In A Year

https://i.ytimg.com/vi/oVGYkoemDZs/maxresdefault.jpg

My Epic Halloween Display Went Viral Here s How To Create An Epic

https://i0.wp.com/spy.com/wp-content/uploads/2022/09/Swamp-juice-fog.jpg?w=1024

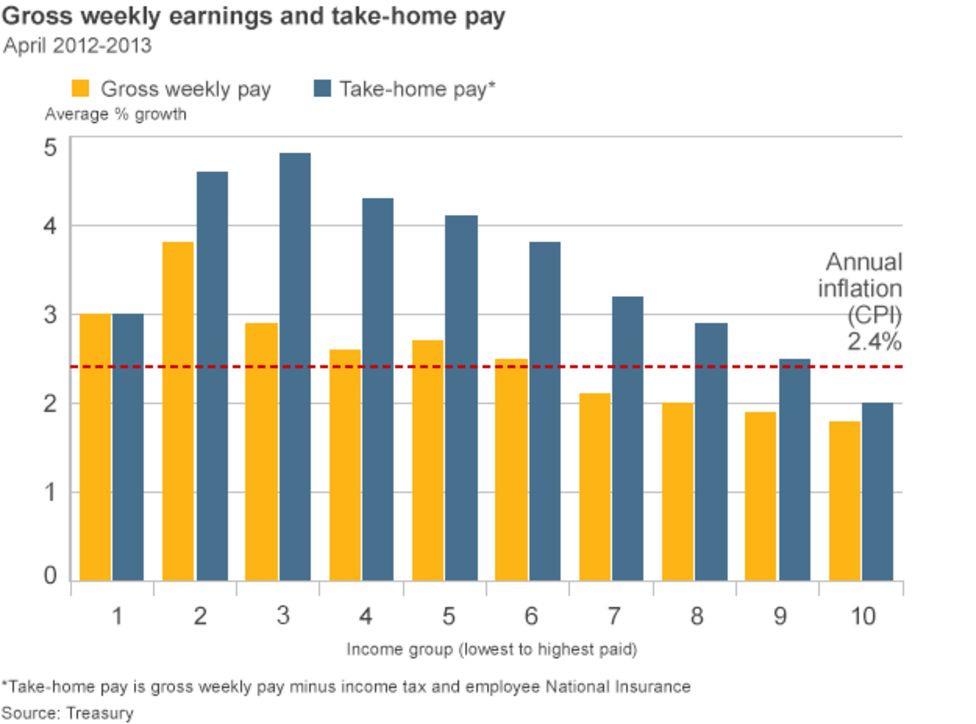

UK Pay Rising In Real Terms Says Coalition BBC News

https://ichef.bbci.co.uk/news/976/mcs/media/images/72504000/gif/_72504434_gov_earnings_640_v2.gif

1 Check your tax code you may be owed 1 000s free tax code calculator 2 Transfer unused allowance to your spouse marriage tax allowance 3 Reduce tax if you wear wore a uniform uniform tax rebate 4 Up to 2 000 yr free per child to help with childcare costs tax free childcare 5 The Salary Calculator has been updated with the latest tax rates which take effect from April 2024 Try out the take home calculator choose the 2024 25 tax year and see how it affects your take home pay If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by

Paycheck Calculator Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions withholdings federal tax and allowances on your net take home pay Unlike most online paycheck calculators using our spreadsheet will allow you to save your results see how the calculations are done and even customize it Calculate your Take Home Pay considering income tax rate salary personal allowance national insurance and tax code Update 2024 August Your contribution is determined by your actual annual rate of pay If you work part time your contribution rate may be lower as it is calculated based on your annual earnings England Northern Ireland

Take Home Pay Calc Online Sale Save 51 Jlcatj gob mx

https://d3f7q2msm2165u.cloudfront.net/aaa-content/user/files/Screen Shot 2020-02-17 at 10.15.15 AM.png?1581963446089

UK Finance How To Work Out Your Take home Pay Unifrog Blog

https://cdn.unifrog.org/image/20/16646/4.jpg

How Do I Work Out My Take Home Pay Uk - To calculate employer taxes use PaycheckCity Payroll Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and