How Do I Work Out My Hourly Rate As A Contractor Step 1 Determine your desired annual income Step 2 Tally your annual business expenses Step 3 Include your health insurance costs Step 4 Account for retirement savings Step 5 Add the extra self employment tax you re paying Step 6 Set your weekly work hours

The first involves determining the rate to pay contractors by the hour Here s the formula to use to calculate a contractor hourly rate Annual salary of a full time employee with similar job duties 40 hours per week x 52 weeks contractor hourly rate You may choose to pay your contractors per project To calculate your salary from your hourly pay Choose for which period you want to calculate your salary yearly monthly weekly etc Find the number of hours you worked If you work 8 hours a day 5 days a week you work 8 5 40 hours weekly 40 52 2 080 hours yearly and 2 080 12 173 34 hours monthly

How Do I Work Out My Hourly Rate As A Contractor

How Do I Work Out My Hourly Rate As A Contractor

https://i.ytimg.com/vi/oVGYkoemDZs/maxresdefault.jpg

Can I Work Out My Arms Every Day What You Need To Know

https://www.gym-pact.com/wp-content/uploads/2021/10/can-i-work-out-my-arms-every-day.jpg

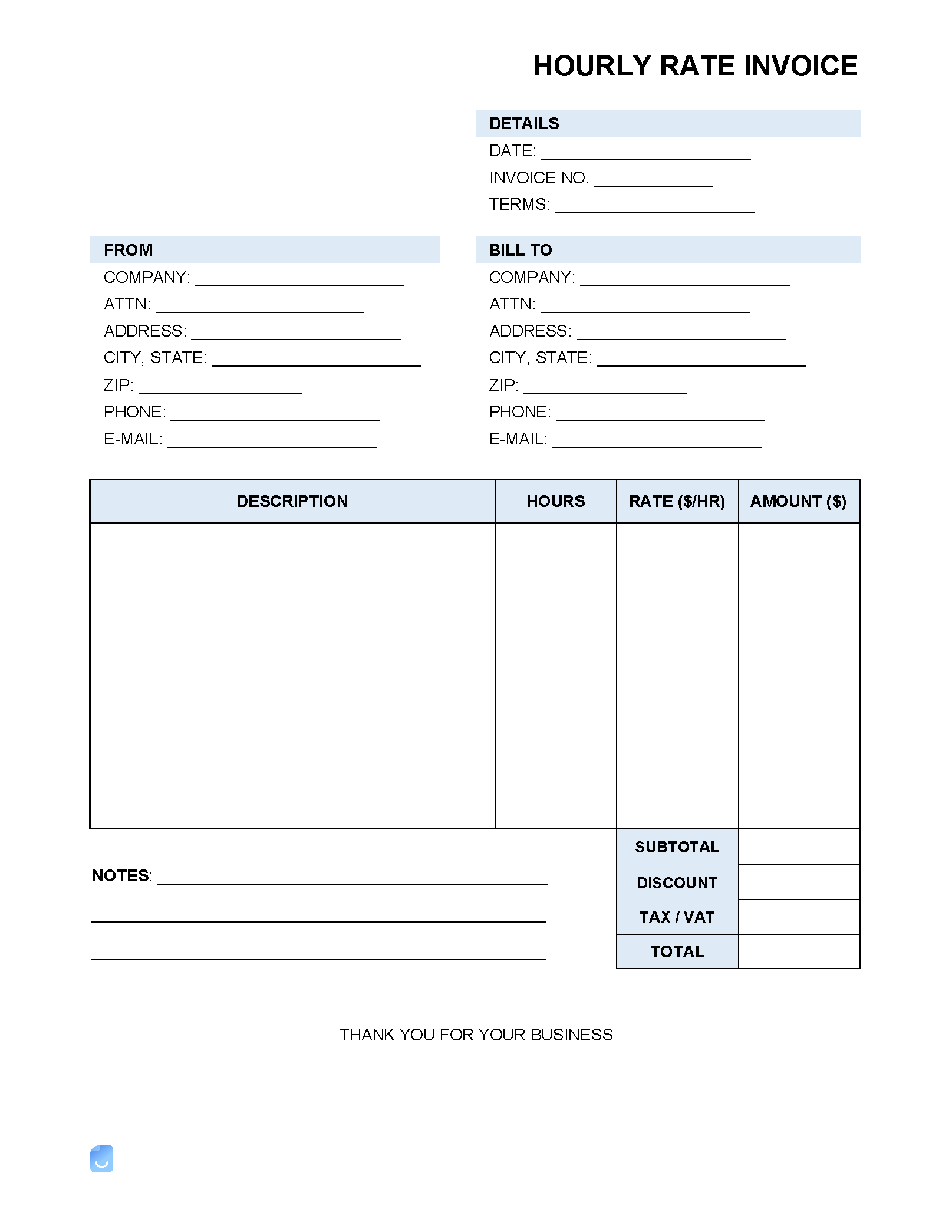

Hourly Rate hr Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Hourly-Rate-Invoice-Template.png

Divide the rate by the hours 100 10 hours 10 hour GROSS Next subtract your payroll and income taxes 30 is the standard but use your actual if you know it 10 X 30 3 ps make sure you actually move this amount to a separate account and DO NOT TOUCH IT until tax time This leaves you will an after tax hourly rate of 7 10 If you re looking for a quick over the thumb rule you can figure that your equivalent consulting rate should be about twice what you would be paid hourly as an employee Assuming you work 2 000 hours a year if you would receive a 100 000 salary your hourly rate should be 100 Of course this is only a very rough guideline Ultimately your

How do I calculate hourly rate First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 If you subtract 544 hours 68 days x 8 hours per day from that you get 1536 hours This makes 1536 hours a simple basis for calculating an hourly contract rate Lets take a look at a few examples using base salaries ie excluding superannuation 35000pa is about 17 hr for a permanent employee 35000 2080

More picture related to How Do I Work Out My Hourly Rate As A Contractor

How Businesses Charge Clients And Calculate Hourly Rate

https://static2.clutch.co/s3fs-public/inline-images/hourly rate calcluation.png

Independent Contractor Hourly Invoice Template In 2022 Invoice

https://i.pinimg.com/originals/60/c1/4d/60c14da18e900b48917b3324da22d829.jpg

How Do I Work Out What Tyres Will Fit On These Rims 70 X 100mm Rccars

https://i.redd.it/l54rqwelii261.jpg

Divide the adjusted salary amount by the number of hours you plan to work That number is the hourly rate you need to charge for your desired annual salary Say your adjusted salary is 65 000 per year and you plan to work full time with 2 000 hours going toward actual client work Divide 65 000 by 2 000 to get 32 50 1 Hourly versus salary If you re paid hourly as a contractor you may need to convert that hourly pay into a salary so you can compare to a full time salary Here s how I do that Take your hourly rate and multiply it by 2 080 which is the number of hours in a year if you work 40 hours a week for 52 weeks Or if you need to convert a

Using these numbers our formula would be 10 417 147 1 25 1 610 147 or when simplified down 94 49 10 95 After rounding we arrive at an hourly rate of 106 per hour Use our free hourly rate calculator to determine how much to charge per hour as a general contractor subcontractor or handyman Companies can back a salary into an hourly wage For instance if a grocery store hires cashiers for an hourly rate of 15 00 per hour on a full time schedule of 40 hours a week you can calculate the annual pre tax salary by multiplying the hourly rate by 40 Then multiply the product by the number of weeks in a year 52

Help This Just Arrived How Do I Work Out Date Let Me Know If You

https://i.redd.it/upj2awqfhjez.jpg

Painter Shirt

https://res.cloudinary.com/teepublic/image/private/s--2RruNMNM--/t_Resized Artwork/c_crop,x_10,y_10/c_fit,h_626/c_crop,g_north_west,h_626,w_470,x_-16,y_0/g_north_west,u_upload:v1462829024:production:blanks:a59x1cgomgu5lprfjlmi,x_-411,y_-325/b_rgb:eeeeee/c_limit,f_auto,h_630,q_90,w_630/v1590554581/production/designs/10642464_0.jpg

How Do I Work Out My Hourly Rate As A Contractor - And these self employment taxes really add up The current self employment tax rate is 12 4 for Social Security and 2 9 for Medicare a total of 15 3 just in self employment tax The good