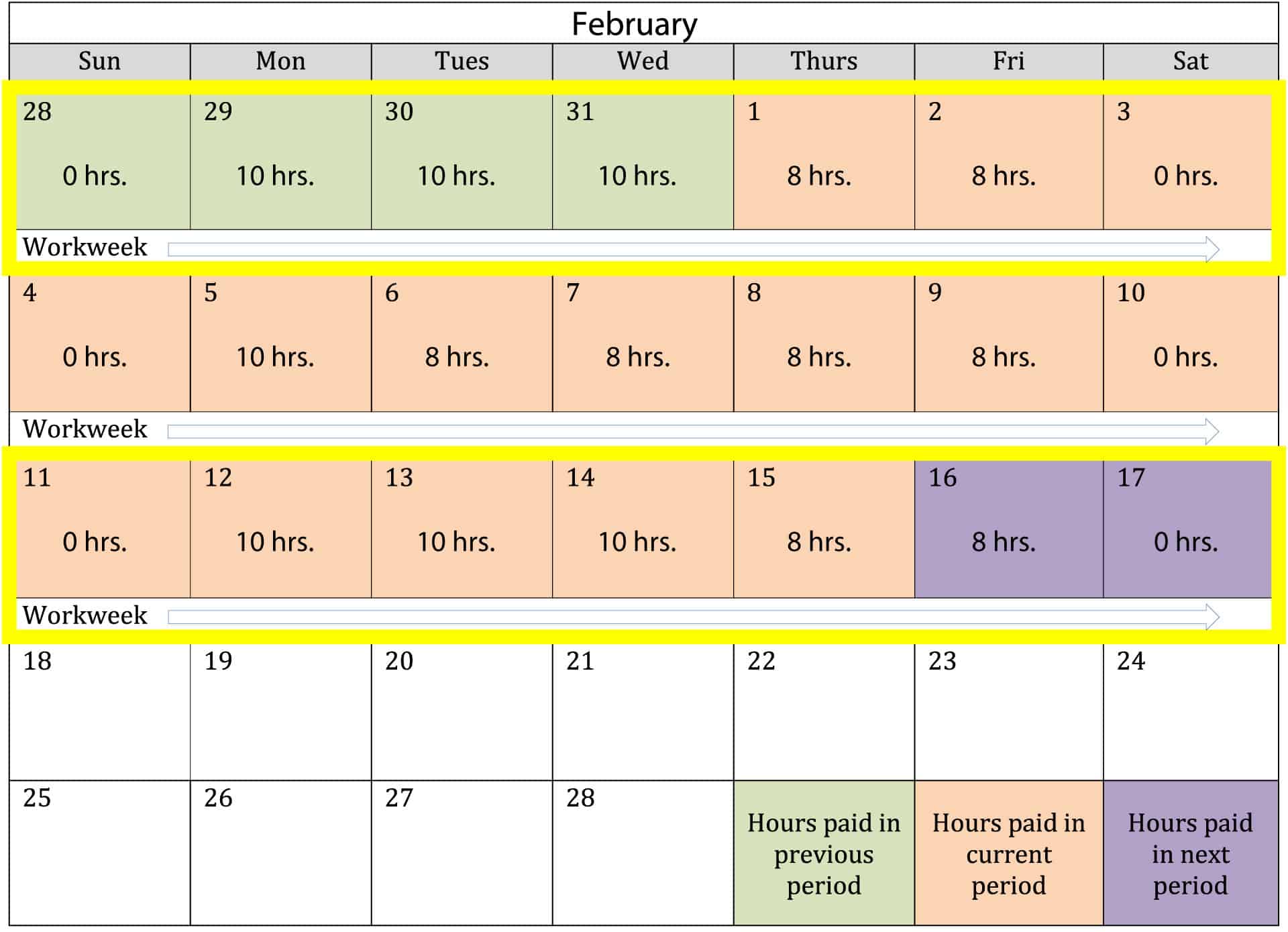

How Are Semi Monthly Pay Periods Calculated Overtime is calculated based on a workweek which is a 7 day period established by your employer However semi monthly pay periods can be confusing when determining overtime pay due to the way the pay period cuts across workweeks Since most months have more than just 4 weeks or 28 days a semi monthly pay period will often include days

Calculating semi monthly pay isn t as straightforward as other payroll schedules This is especially true when dealing with non exempt employees A common mistake with semi monthly pay is assuming a fixed number of hours like 86 67 hours for each pay period Before deciding if a semi monthly pay period is right for a business employers Overtime pay for that week will be 10 x 4 OT hrs 40 The last workweek is split and does not end in the current pay period Payroll will calculate and pay overtime for this workweek in the

How Are Semi Monthly Pay Periods Calculated

How Are Semi Monthly Pay Periods Calculated

https://img.periodprohelp.com/wp-content/uploads/semi-monthly-pay-vs-bi-weekly-understanding-the-difference.jpeg

Gsa Pay Periods 2022 Printable Calendar Template 2022

https://simplecalendaryo.net/wp-content/uploads/2022/01/paycheck-calendar-2021-february-2021.jpg

Semi Monthly Pay Key Differences In Semimonthly And Biweekly Algrim co

https://www.algrim.co/images/semi-monthly-2.jpg

Calculating semi monthly pay involves converting an annual salary into the amount paid per each of the two monthly pay periods Here s how to do it Semi monthly pay Gross annual salary 24 Gross annual salary This is your total gross salary over a year 24 Represents the total number of pay periods in a year when you are paid twice a A semi monthly payroll occurs twice each month and 24 times each year Also as you should know there are 2 080 workdays in a calendar year 52 weeks multiplied by 40 hours As a result of this salaried employees are paid for 86 67 hours each semi monthly pay period You can calculate this by dividing the 2 080workdayss by the 24 semi

Take a look at the following overtime semimonthly payroll steps Count the total hours worked for the entire first workweek associated with the pay period even if the workweek is split between different pay periods Add up the total number of hours for every workweek in the pay period If any workweek exceeds 40 hours worked you owe overtime Our semi monthly salary calculator takes your twice a month pay and calculates the equivalent hourly daily weekly bi weekly monthly quarterly and annual income Calculating various pay periods can help you plan out your budget Annual salary divided into hourly daily weekly and monthly pay

More picture related to How Are Semi Monthly Pay Periods Calculated

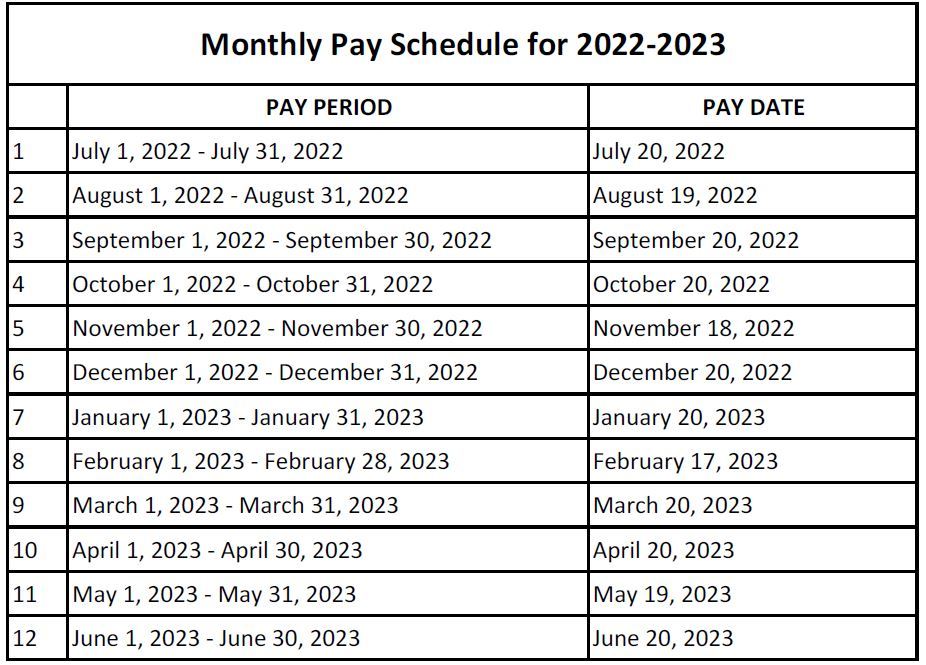

Monthly Pay Schedule

https://www.bgsu.edu/content/dam/BGSU/payroll/Images/STRS-2022-2023-monthly-pay-calendar.jpg

2022 Federal Pay Period Calendar Printable Calendar Template 2022

https://simplecalendaryo.net/wp-content/uploads/2022/01/federal-pay-period-calendar-2021-printable-printable.png

What Is Biweekly Pay AIHR HR Glossary

https://www.aihr.com/wp-content/uploads/Biweekly-Pay-vs-Semi-Monthly-Pay.png

This calculator will help you to quickly convert a wage stated in one periodic term hourly weekly etc into its equivalent stated in all other common periodic terms so each year has 24 semi monthly periods in it The following table shows the equivalent semi monthly pay for various annual salaries presuming each payment is the same Different Pay Frequencies The calculator contains options to select from a number of periods normally used to express salary amounts but actual pay frequencies as mandated by varying countries states industries and companies can differ The most common pay period frequencies tend to be monthly semi monthly twice a month bi weekly

When giving a semimonthly paycheck to a salaried employee you divide their annual gross salary by 24 the total number of pay periods For example say you pay a salaried employee 72 000 annually using a semimonthly payroll calendar You ll divide 72 000 by 24 to get 3 000 In other words you ll pay them a gross salary of 3 000 Semi Monthly Pay Period Having a semi monthly pay period will create two pay days per month and there are several different options when creating a semi monthly pay period For the sake of simplicity we have chosen the pay periods of the 1st15th and the 16th last day of the month for our examples below The pay periods are identified in

Pay Periods Definitions Types And Factors To Consider

https://www.cutehr.io/wp-content/uploads/2022/03/Pay_Periods.png

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

https://staffscapes.com/wp-content/uploads/2019/03/calculating-overtime.jpg

How Are Semi Monthly Pay Periods Calculated - The payroll calculator converts payroll amounts for one type of period to quantities for a longer or shorter period The most frequent frequency for pay periods is daily weekly bi weekly every two weeks semi monthly twice a month and monthly Mainly monthly and semi monthly are the most prevalent pay period frequencies Payment