Gusto Utah Paycheck Calculator Hourly Paycheck and Payroll Calculator Need help calculating paychecks Use Gusto s hourly paycheck calculator to determine withholdings and calculate take home pay for your hourly employees Simply enter their federal and state W 4 information as well as their pay rate deductions and benefits and we ll crunch the numbers for you

Use ADP s Utah Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Important note on the salary paycheck calculator The calculator on this page is provided through the ADP A withholding of 6 2 of your income goes toward Social Security taxes with an additional 6 2 coming from your employer Medicare taxes account for a smaller percentage at 1 45 with employers again matching that amount If you earn wages in excess of 200 000 single filers 250 000 joint filers or 125 000 married people filing

Gusto Utah Paycheck Calculator

Gusto Utah Paycheck Calculator

https://prod.gusto-assets.com/wp-content/uploads/Payroll-1201x1156-8370816.png

Free Paycheck and Payroll Calculators Online | Gusto

https://embed-ssl.wistia.com/deliveries/2e1a900547e04794d979034c90c58347.webp?image_crop_resized=1280x720

Business Resources for Payroll, Benefits and HR | Gusto Resource Center

https://embed-ssl.wistia.com/deliveries/18306a2a1bea45988748060290d4cdc234f1b637.webp?image_crop_resized=1280x720

For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount If this employee s pay frequency is weekly the calculation is 52 000 52 payrolls 1 000 gross pay If this employee s pay frequency is semi monthly the calculation is 52 000 24 payrolls 2 166 67 gross pay How much will you take home from your paycheck in Utah Use Forbes Advisor s Paycheck Calculator to find out your net pay taxes and deductions for salary and hourly payment in 2023

The Utah Paycheck Calculator is a powerful tool designed to help employees and employers in Utah accurately calculate the net take home pay after deductions such as federal and state taxes Social Security Medicare and other withholdings This guide provides an in depth understanding of the calculator s utility its audience and the benefits Utah Paycheck Calculator Calculate your take home pay after federal Utah taxes Updated for 2024 tax year on Feb 14 2024 regardless of income This simplified tax system makes calculating your state tax obligation a breeze Utah does not impose a state payroll tax making things even easier for its residents

More picture related to Gusto Utah Paycheck Calculator

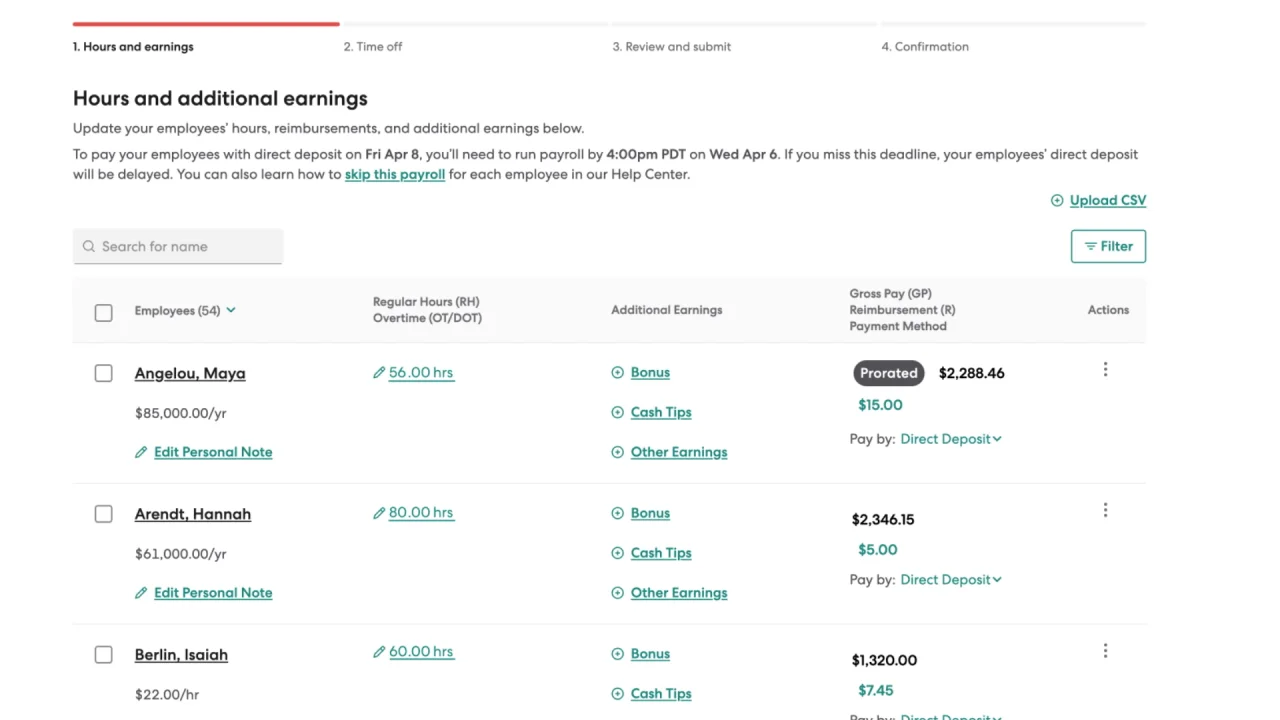

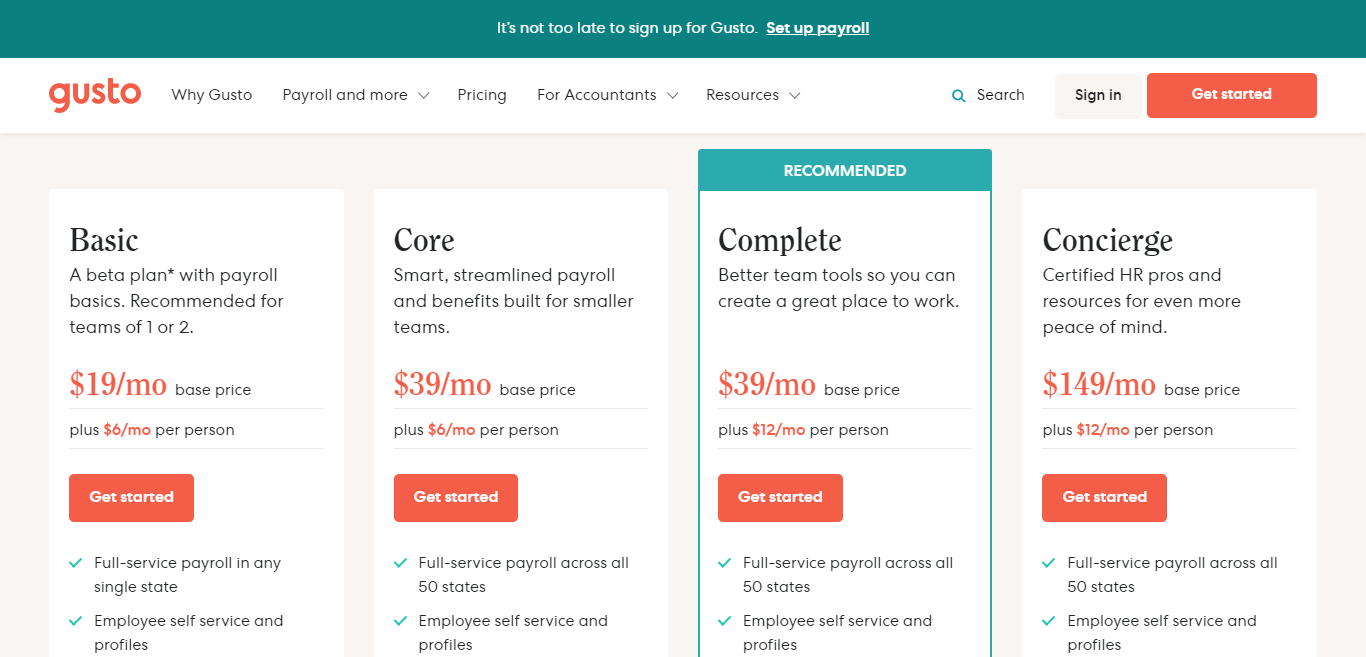

Gusto Review: Is This The Best Payroll Service Right Now?

https://thedigitalmerchant.com/wp-content/uploads/2021/01/gusto-5.png

Get Gusto Solutions | Gusto Payroll, Benefits and Human Resources

https://www.govdocfiling.com/wp-content/uploads/Gustologo_f45d485.png

Gusto Review: Is This The Best Payroll Service Right Now?

https://thedigitalmerchant.com/wp-content/uploads/2021/01/gusto-4.png

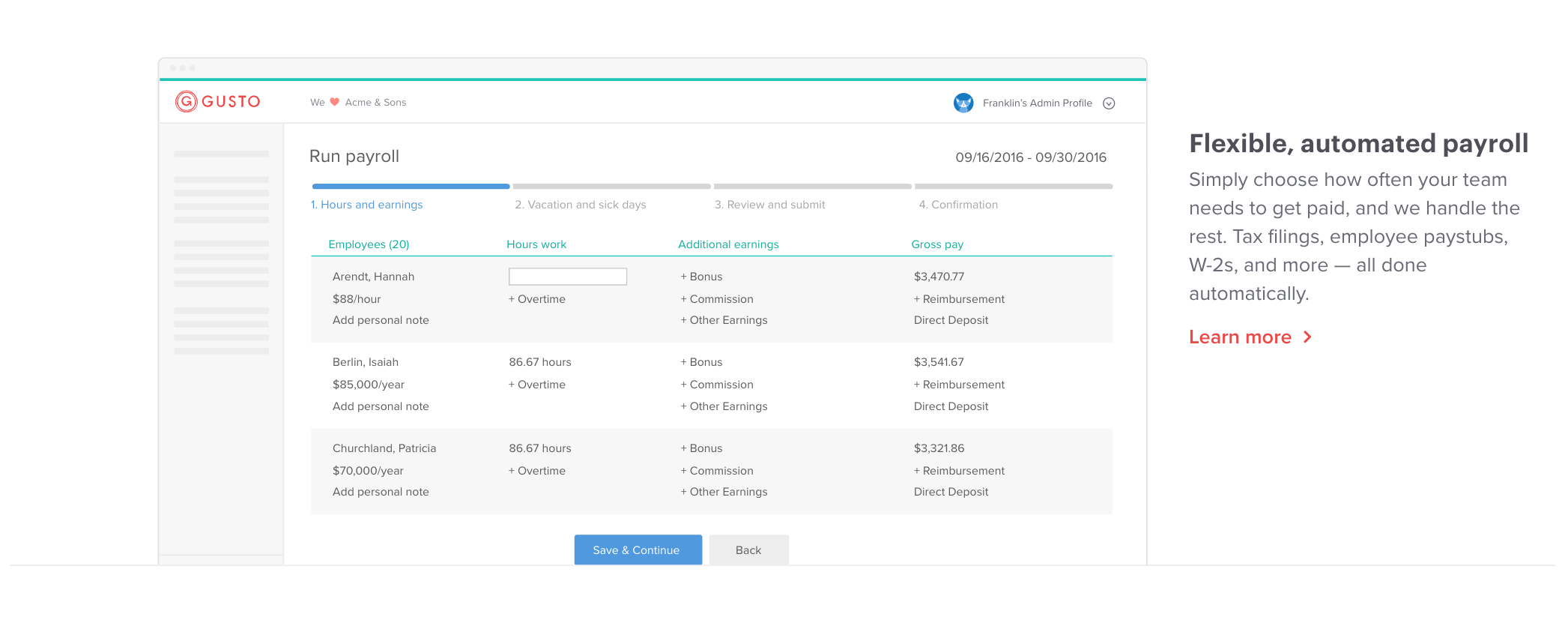

The gross pay will be 40 20 800 After deductions the net pay becomes 800 50 750 Applications of the Gusto Hourly Paycheck Calculator The Calculator finds wide applications including 1 Payroll Management It aids businesses in accurately calculating employee salaries reducing the possibility of errors 2 Utah Hourly Paycheck and Payroll Calculator Use Gusto s hourly paycheck calculator to determine withholdings and calculate take home pay for your hourly employees in Utah Simply enter their federal and state W 4 information as well as their pay rate deductions and benefits and we ll crunch the numbers for you

The state income tax rate in Utah is under 5 while federal income tax rates range from 10 to 37 depending on your income This paycheck calculator can help estimate your take home pay and your average income tax rate How many income tax brackets are there in Utah The state income tax system in Utah only has a single tax bracket Step 1 Register your company as an employer To get a new Federal Employer Identification Number FEIN new businesses may need to use the federal Electronic Federal Tax Payment System EFTPS FEIN To pay federal taxes you ll need your FEIN Step 2 Register your company with the Utah Department of Commerce

How to Manage Payroll Yourself for Your Small Business | Gusto

https://gusto.com/wp-content/uploads/2020/07/IRS-Wage-Bracket-Table-1024x870.jpg

Gusto Review 2022 Pricing, Features, Shortcomings

https://www.betterbuys.com/wp-content/uploads/2015/11/Gusto-1a.png

Gusto Utah Paycheck Calculator - Utah Paycheck Calculator Calculate your take home pay after federal Utah taxes Updated for 2024 tax year on Feb 14 2024 regardless of income This simplified tax system makes calculating your state tax obligation a breeze Utah does not impose a state payroll tax making things even easier for its residents