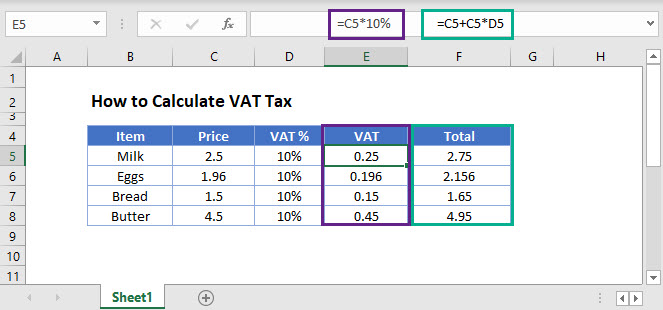

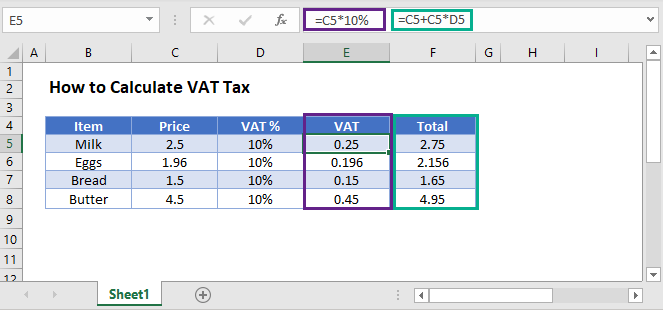

Formula To Calculate Vat In Excel Calculate VAT in Excel VAT can be calculated in Excel using a simple formula C5 10 This formula will calculate the VAT amount based on a VAT rate of 10 When you enter the formula you can either type 10 or you can type 0 1 both methods will return the same result

To calculate VAT in Excel you need to know the exact tax percentage then multiply it by the gross amount to get the vat tax amount After that add that tax amount to the actual invoice amount In this tutorial we write a formula to calculate the VAT Let s check this out Calculate VAT Separately You can use the below steps In Excel you can use the following formula to calculate the VAT amount original price cell 15 B Provide an example to illustrate the formula in action Let s take an example to illustrate how the formula works Suppose the original price of a product is 100

Formula To Calculate Vat In Excel

Formula To Calculate Vat In Excel

https://www.exceltip.com/wp-content/uploads/2014/08/img1.gif

How To Calculate VAT In Excel 2 Handy Ways ExcelDemy

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-VAT-in-excel-from-initial-price-1-767x637.png

How To Calculate VAT In Excel 2 Handy Ways ExcelDemy

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-VAT-in-excel-from-price-with-VAT-1.png

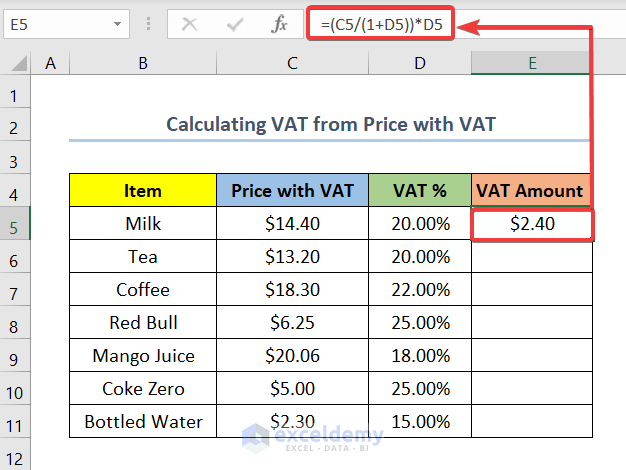

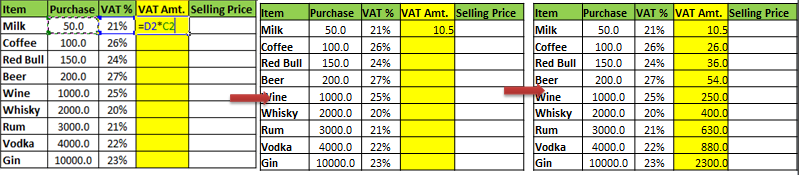

B4 C1 Price including VAT Price Tax To calculate the price including VAT you just have to add the product price AND the VAT amount B4 C4 Formula to add the price and the tax You can also calculate the value of your product with tax in a single formula 75 75 16 87 Explanation of the calculation Step 1 Prepare a Table We prepared below the table in Excel Spreadsheet Step 2 Calculate the VAT amount In Cell E2 write this formula and hit enter D2 C2 You will have your VAT amount calculated in E4 for milk Drag Down the formula to E10 Note in Vat column symbol is necessary

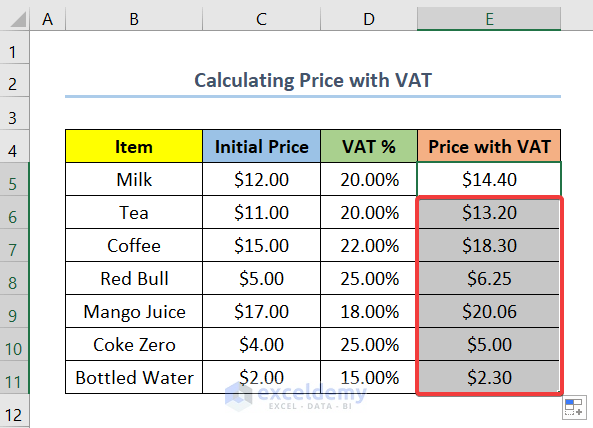

Adding VAT to a value in Excel Excel 365 Excel 2021 Excel 2019 Excel 2016 February 12 2022 6 Comments Sales taxes are levied in many parts of the world In the UK this is known as VAT or Value added Tax but it s also known as sales tax consumption tax and GST Goods and Services Tax To calculate VAT you will need to multiply the quantity by the tax percentage converted to a decimal for example 21 tax is 0 21 4 is 0 04 VAT price without tax 0 21 This will give us the amount of tax that will need to be added to the initial price to find out the final cost For example if a purchase is 500 with 21 VAT

More picture related to Formula To Calculate Vat In Excel

How To Calculate VAT Tax Excel Google Sheets Automate Excel

https://www.automateexcel.com/excel/wp-content/uploads/2020/12/calculate-vat-tax-Main-Function.jpg

How To Calculate VAT From Gross Amount In Excel 2 Examples

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-vat-from-gross-in-excel-2.png

How To Calculate VAT In Excel VAT Formula Calculating Tax In Excel

https://www.exceltip.com/wp-content/uploads/2014/08/VAT3.png

Method 1 The Formula that is Generic for VAT calculation in Excel is VAT Purchase Price VAT And for the selling price the Generic Formula for Calculating is Selling Price Purchase Taxes Let s have an example of various Drinks Assuming that Different VAT is to various drink products And we know the VAT Calculation of VAT price for each item We will put on cell F13 the result of price Taxes 1st solution enter the formula SUM D13 E13 2nd solution use the tool AutoSum and select the cell to add Calculation of Total VAT invoice we will put on cell F18 in our example the result of Total Taxes Enter the formula SUM F13 F17

The easiest way to calculate VAT with Excel is with one of its formulas which can be activated in a cell by typing the equals symbol Let s look at an example to make things easier if the VAT to be applied is 21 and you want to know the final price of a product or service that without VAT would be 50 then you need to calculate 21 of 50 A2 1 B2 In the above formula Cell A2 would be the Net amount Cell B2 would be the VAT rate and resulting Gross amount formula that you can see above would be entered into cell C2 So how does the VAT formula work So if you ve read this far you ll be wanting to know how the VAT formula works

How To Calculate VAT In Excel 2 Handy Ways ExcelDemy

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-price-with-VAT-in-excel-2.png

How To Calculate VAT Tax Excel Google Sheets Automate Excel

https://www.automateexcel.com/excel/wp-content/uploads/2020/12/calculate-vat-tax.png

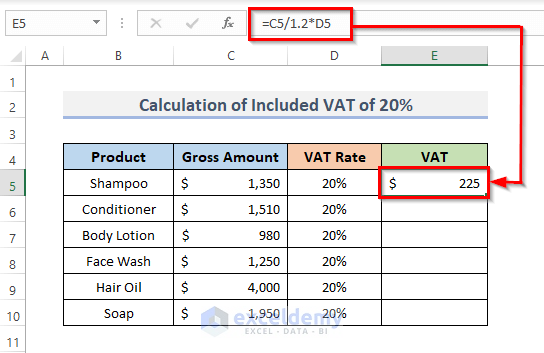

Formula To Calculate Vat In Excel - The formula for calculating the VAT from gross is VAT Gross Price 1 VAT Rate VAT Rate Let s see the examples to generate the VAT amount from gross with an Excel spreadsheet 1 Calculate the Included VAT of 20 from the Gross Amount In the first example we have a VAT of 20