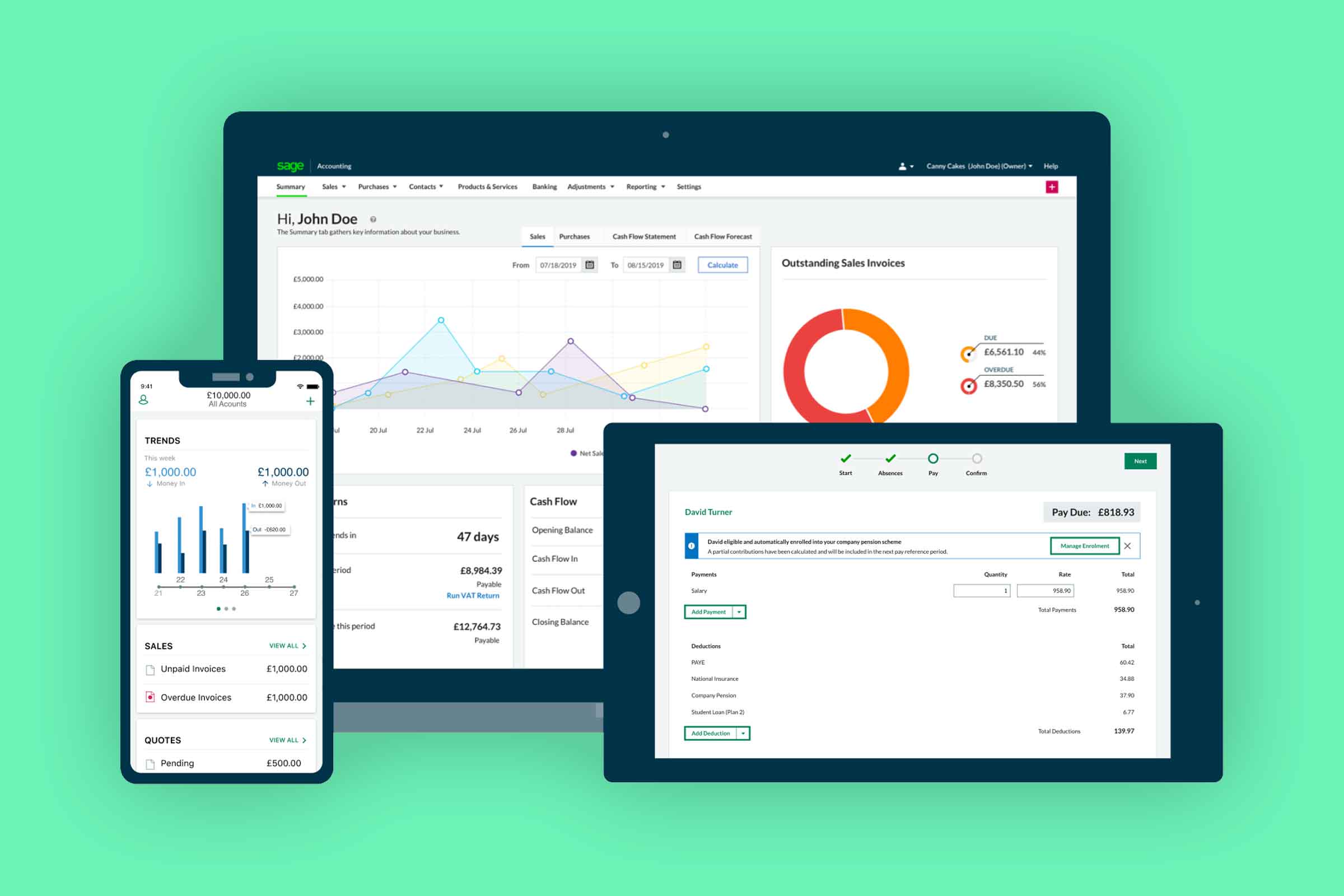

Does Sage Do Payroll Flexible payroll processing Flawless payroll management is critical to your business Give your financial team a powerful tool for complete on time payroll processing And because it s so flexible you can customize it to handle your payroll your way Set up unlimited earnings and deduction codes with a wide variety of calculation methods

Sage 50 offers payroll options to meet your needs If you choose to do payroll yourself without subscribing to a payroll solution you will have to keep up with tax laws and calculations yourself and manually calculate your payroll taxes and deductions You ll also have to manually enter your payroll tax forms such as W 2s and 941s Optimize your human resources department Transform HR from tactical to strategic with actionable information and tools for small and medium businesses With tools and information that save your HR teams time and optimize their efforts Payroll HCM helps you drive the capital in human capital management Recruiting and candidate management

Does Sage Do Payroll

Does Sage Do Payroll

https://www.creative.onl/payrollindex/wp-content/uploads/2022/03/sage-payroll-review.jpg

What Is Sage Payroll System Features Price Demo Actiwise

https://www.actiwise.com.my/wp/wp-content/uploads/2019/05/sage-payroll-system-malaysia.jpg

Payroll Accountings Sage Payroll Payslips

https://www.payslips-direct.co.uk/wp-content/uploads/images/products/p-3718-slpay1g_pay_advice_pantone_green-794x1123.jpg

Sage offers an integrated do it yourself payroll module Run payroll set up vacation sick time and create W2s tax forms and more Pricing is tiered based on number of employees Call 1 866 257 0454 Discover the Sage 50 pricing plans and find the right accounting software for your business needs Effectively manage and grow your business Payroll integrates seamlessly with Sage Accounting software to give you total visibility of your business After every pay run payment data syncs with Sage Accounting in just a click Minimize manual work and mistakes and focus on running your business Easily reconcile the payments made to your employees in your accounting software

Work smarter with Sage Payroll Get 2 months free Filing pensions P60s and payslips is made simple for your small business using Sage Payroll now with in built HR features Manage leave timesheets and expenses to ensure your payslips are accurate and on time Get 2 months free then from 10 month excl VAT Get 2 months free Sage payroll plans include timely and comprehensive in house payroll processing within your Sage 50 solution to help you save time and reduce the risk of payroll tax penalties at year end Process payroll at any time 2 Easily prepare payroll cheques or issue Direct Deposit 3 payments in batches Pay employees salary or hourly pay rates

More picture related to Does Sage Do Payroll

Pro Tip Don t Monkey With An Employee s regular Hourly Rate To Avoid

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhKotQdg8xgK1MYuqdupMgN6jY2BFd1hgQg7VnXWgUiblMhvSZuSJCDYaGy0K6YmmhUfPATVE8UuwqFrKkHA0FPItYZSVseQwpfZWMxeMysSWXno81tjAAzgr_JkZEuQWol_xIeCQ-lRDMHmNFFHqdTey8dvoSJs2-dmxnJVqr48mFV9JXb4PBAoj3z/s1200/Payroll.jpg

Payroll Software Companies In Australia Glitchdata

https://i1.wp.com/glitchdata.com/wp-content/uploads/2014/08/payroll1-1200x800.jpg

Payroll Services Free Of Charge Creative Commons Post It Note Image

https://www.picpedia.org/post-it-note/images/payroll-services.jpg

While you can administer payroll manually within Sage 50 Accounting there are a number of advantages to subscribing to a service plan that includes payroll including automatic calculation of employee earnings deductions and taxes Gets you the latest federal and provincial payroll tax updates as soon as they are released Eliminates the need to manually prepare payroll cheques and T4 and Sage 300cloud Payroll provides these robust Sage payroll functionalities out of the box Calculations of earnings deductions benefits accruals and Federal Provincial taxes and levies Retain years of payroll history analysis Government reporting generation and filing of T4 T4A s and ROE Pay employees using EFT direct deposit

That said Sage Payroll does offer you everything you need to manage employee data enrol employees in pension schemes manage their time off and overtime and pay them the correct amount of time Another thing worth noting is that Sage offers a dozen other platforms such as Sage Accounting Payments CRM HR and Enterprise Management apps When payroll is complete you are ready to synchronize direct deposit requests to your company financial institution You do this in the Direct Deposit Confirmation window of the WebSync wizard Get instructions for syncing direct deposit payroll transactions Following sync the transactions are transmitted through the ACH network to Sage 50

Sage Payroll Professional

https://img06.en25.com/EloquaImages/clients/SageGlobalInstance/87ecac6f-9e27-43a3-8f98-95e33bd7b13e_main-bg.jpg

Bimonthly Payroll Calendar Templates For 2021 Article

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/2021-payroll-calendar-biweekly-us.png

Does Sage Do Payroll - Sage 50 offers payroll options to meet your needs If you choose to do payroll yourself without subscribing to one of the payroll solutions you will have to keep up with tax laws and calculations yourself and manually calculate your payroll taxes and deductions You ll also have to manually enter your payroll tax forms such as W 2 s and 941 s