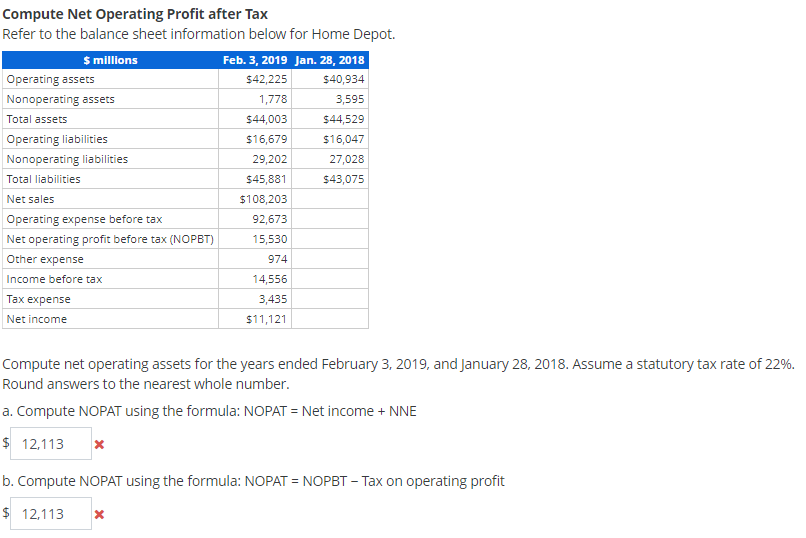

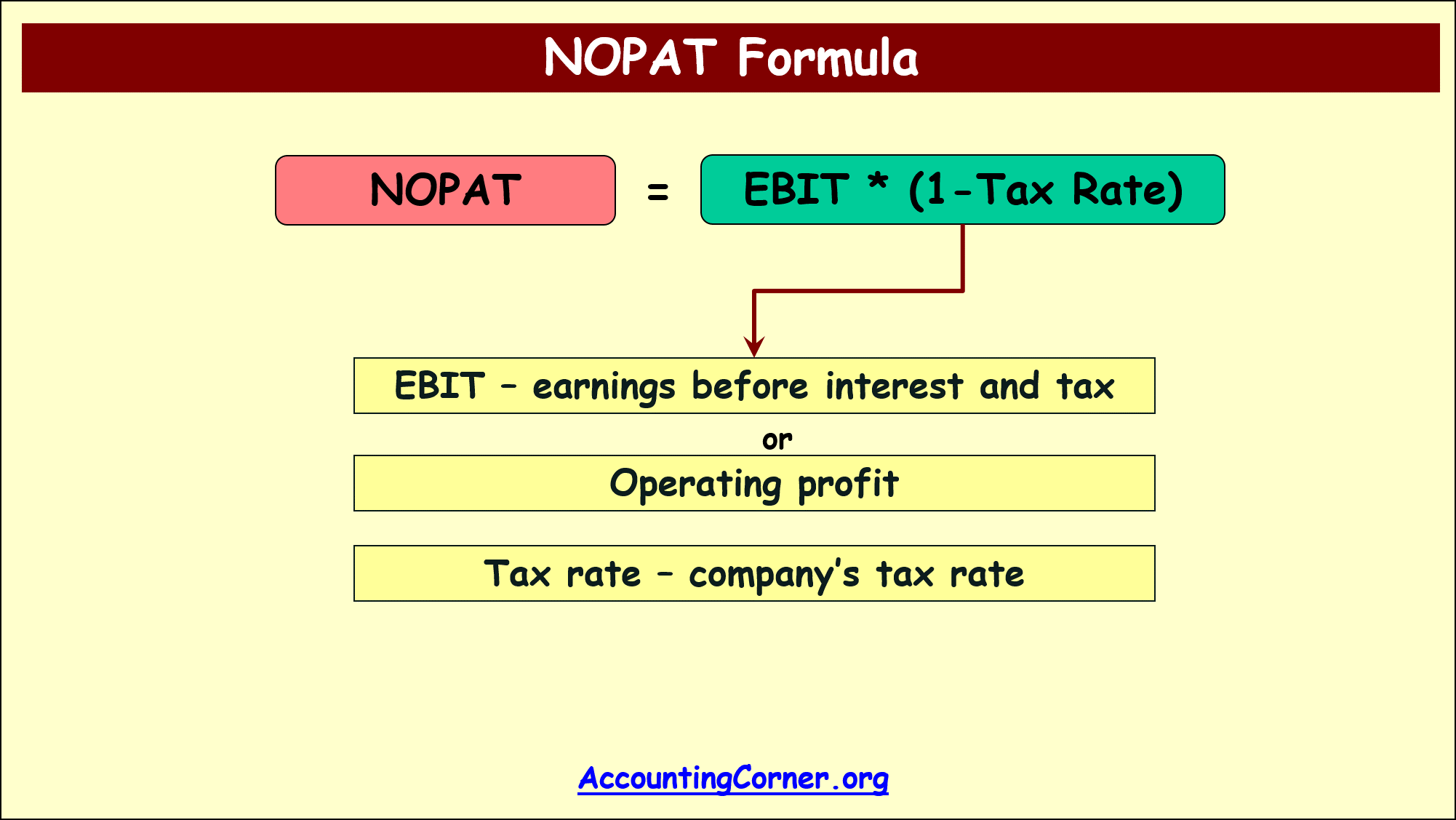

Compute Net Operating Profit After Tax Nopat For 2018 Net Operating Profit After Tax NOPAT EBIT 1 Tax Rate EBIT equals the gross profit of a company minus the total operating expenses incurred in the given period The operating expenses OpEx section of the income statement frequently includes items such as depreciation employee salaries overhead and rent

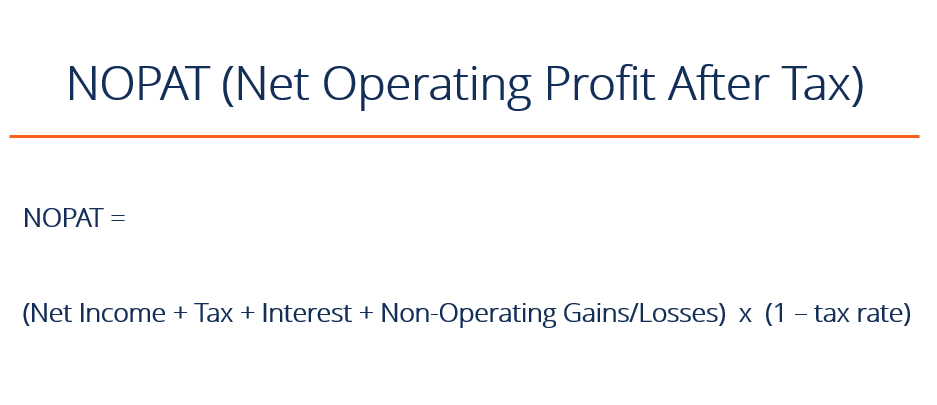

The NOPAT formula is as follows Simple form Income from Operations x 1 tax rate or Long form Net Income Tax Interest Expense any Non Operating Gains Losses x 1 tax rate NOPAT Calculation Example Here is an example of how to calculate Net Operating Profit After Tax The Net Operating Profit After Tax NOPAT is a financial measure of profitability that provides an unbiased look at the income from a company s operations if it had no debt or leverage Imagine you are trying to compare two companies financial performance HattyBags and Baggies using their income statement

Compute Net Operating Profit After Tax Nopat For 2018

Compute Net Operating Profit After Tax Nopat For 2018

https://media.cheggcdn.com/media/669/669a72c6-3760-48a4-aa49-a8c3b0b6da0a/php01kFMU.png

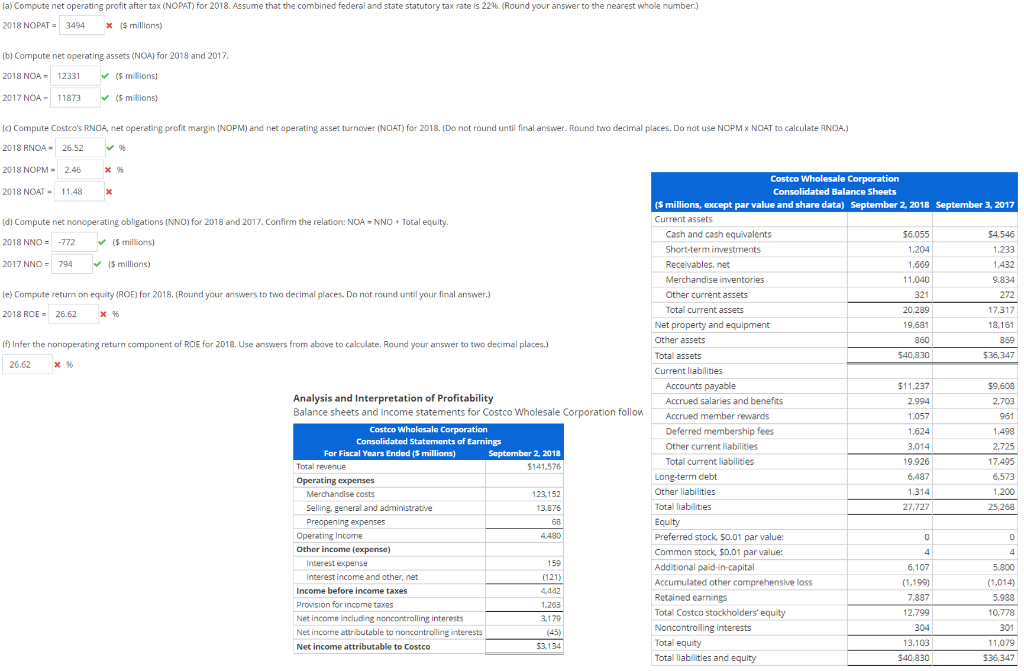

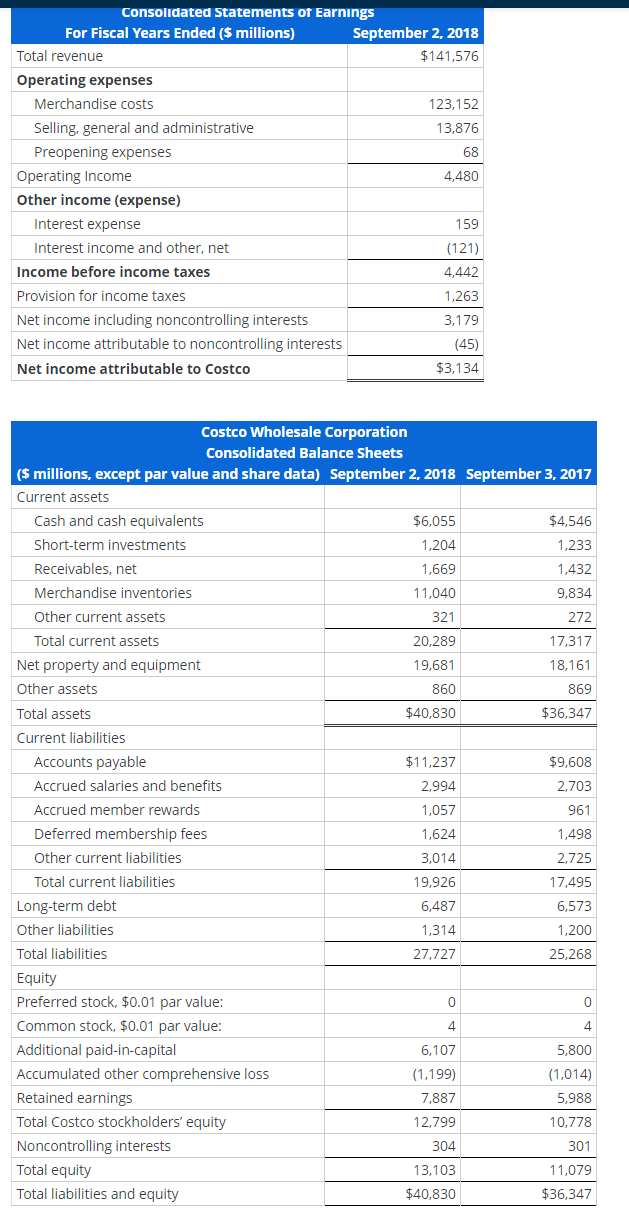

Analysis And Interpretation Of Profitability Balance Sheets And Income

https://img.homeworklib.com/questions/a7d92340-0ea0-11eb-a227-172a8cb68c8d.png?x-oss-process=image/resize,w_560

Solved Analysis And Interpretation Of Profitability Balance Chegg

https://media.cheggcdn.com/media/5c7/5c7cc628-02d6-43d6-8b43-ef96a46b8963/phpnCLgLH

What Is Net Operating Profit After Tax Net operating profit after tax NOPAT is a financial measure that shows how well a company performed through its core operations net of taxes How to Calculate NOPAT Margin The NOPAT margin is the ratio between a company s net operating profit after tax NOPAT and revenue NOPAT NOPAT stands for Net Operating Profit After Tax and represents the hypothetical operating income of a company if its capital structure was all equity i e contains no debt financing Revenue Net revenue or net sales is the

Net operating profit after taxes In corporate finance net operating profit after tax NOPAT is a company s after tax operating profit for all investors including shareholders and debt holders 1 NOPAT is used by analysts and investors as a precise and accurate measurement of profitability to compare a company s financial results across 1 Gather information Begin by gathering the information you ll need to calculate the net profit after tax This includes the organization s tax rate and the gross profits and operating expenses for the time period Most information should be available in your organization s records Related Gross Profit vs Net Profit What Is the Difference 2

More picture related to Compute Net Operating Profit After Tax Nopat For 2018

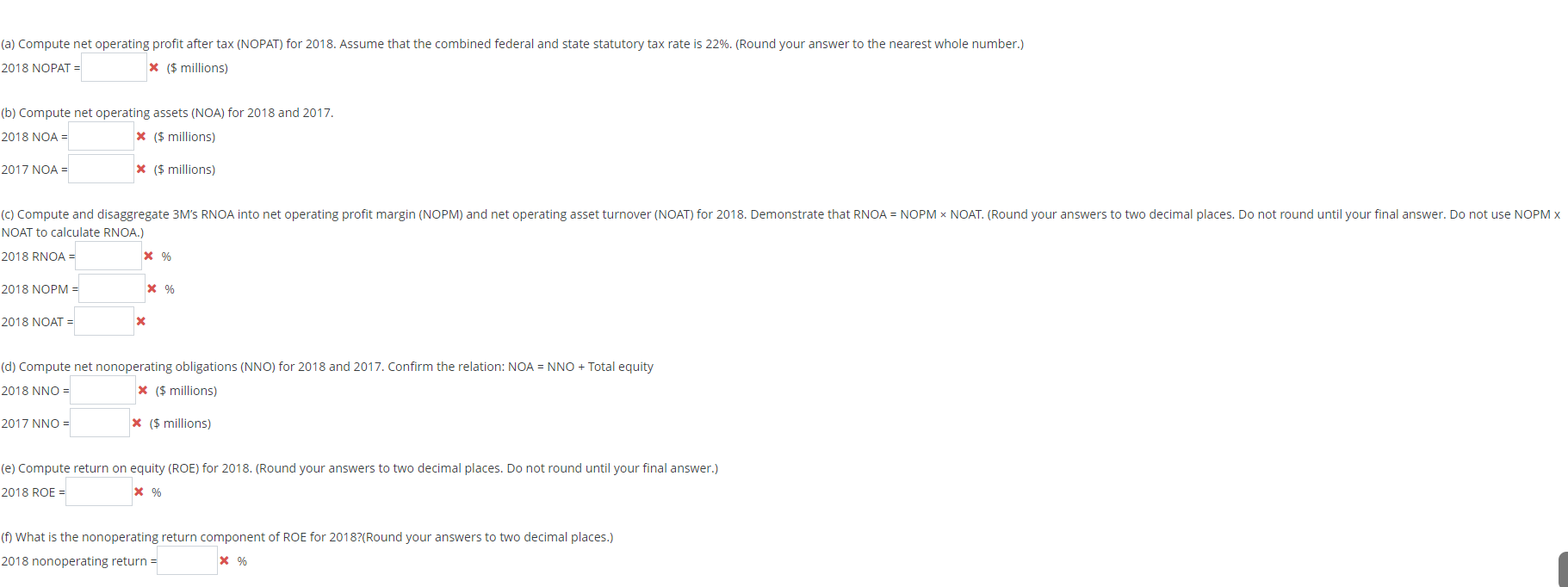

Solved Compute Net Operating Profit After Tax Refer To The Chegg

https://media.cheggcdn.com/media/771/771754dd-2a6e-4362-8e2e-fb87aab13552/php7j7osc.png

NOPAT Net Operating Profit After Tax Accounting Corner

https://accountingcorner.org/wp-content/uploads/2022/07/Picture7.png

Solved a Compute Net Operating Profit After Tax NOPAT Chegg

https://media.cheggcdn.com/media/81a/81ab6120-d584-4cd3-ac8f-9a31b414167a/phpO76Nec

NOPAT 120 000 1 0 2 So your company s Net Profit After Tax is 96 000 If you have categories of raw data you can calculate your NOPAT using Excel or Google Spreadsheet Dividing your net operating profit after tax by the total revenue generated gives you the NOPAT margin There is the option of calculating the net operating profit after tax equation using the net income by backing out the payments of interest like this NOPAT Net Income Net Interest x 1 Tax Rate You can find the interest expense operating profit and net income on the income statement The tax rate can sometimes be found in front

Net Income Revenue COGS Labour G A Expenses Net Income 300 000 100 000 80 000 20 000 Net Income 100 000 Further We need to Calculate Tax Expenses which are calculated on the Profit Before Tax Profit Before Tax is calculated using the formula given below ADVERTISEMENT This problem has been solved You ll get a detailed solution from a subject matter expert that helps you learn core concepts See Answer Question a Compute net operating profit after tax NOPAT for 2016 Assume that the combined federal and state statutory tax rate is 37

NOPAT Net Operating Profit After Tax What You Need To Know

https://cdn.corporatefinanceinstitute.com/assets/nopat.png

Solved What Is The Net Operating Profit After Tax NOPAT For 2021 B

https://www.coursehero.com/qa/attachment/29662411/

Compute Net Operating Profit After Tax Nopat For 2018 - The formula for calculating operating profit is as follows Operating Profit Gross Profit Operating Expenses Tax Rate It is the rate of tax applicable to the company for which you are calculating net operating profit after tax Last Updated on June 16 2022 Sanjay Bulaki Borad