Can I Do My Own Payroll Taxes Payroll is a crucial task for any business but it can be complicated and time consuming If you want to learn how to do payroll on your own you need to understand the legal and tax requirements

Step 1 Collect your tax information Before running payroll for the first time you ll need to set up an Employer Identification Number EIN with the Internal Revenue Service IRS Your EIN is a unique number that identifies your business The application is free and you can access it online by mail or by phone To use a paycheck calculator you simply enter the information on your employee s W 4 You then list the employee s gross wages and select which state you re filing from to calculate state income tax if your state has one which some don t The calculator automatically calculates the amount to deduct 6

Can I Do My Own Payroll Taxes

Can I Do My Own Payroll Taxes

https://free-template.co/wp-content/uploads/2022/01/8955583aa7d0c677/payroll-statement-template.jpeg

How To Run Payroll In QuickBooks Online Standard Payroll

https://digitalasset.intuit.com/IMAGE/A4Kg2rw2C/pay-date-employee-toggle-prepare-payroll-standard-payroll.gif

Can I Do My Own Taxes MoneyLion

https://moneylion.nyc3.cdn.digitaloceanspaces.com/wp-content/uploads/2022/03/31183959/Can-I-do-my-own-taxes.jpg

We ll go into the details below as well as a step by step process for how to calculate them but here is the gist Social Security tax formula Employee Income 6 2 Social Security Tax Medicare tax formula Employee Income 1 45 Medicare Tax According to the wage bracket table the tentative withholding amount is 256 Step 3 Next you ll account for additional tax credits like your employee s dependents Look at your employee s W 4 and line 3 of Step 3 This is where your employee claims their dependents

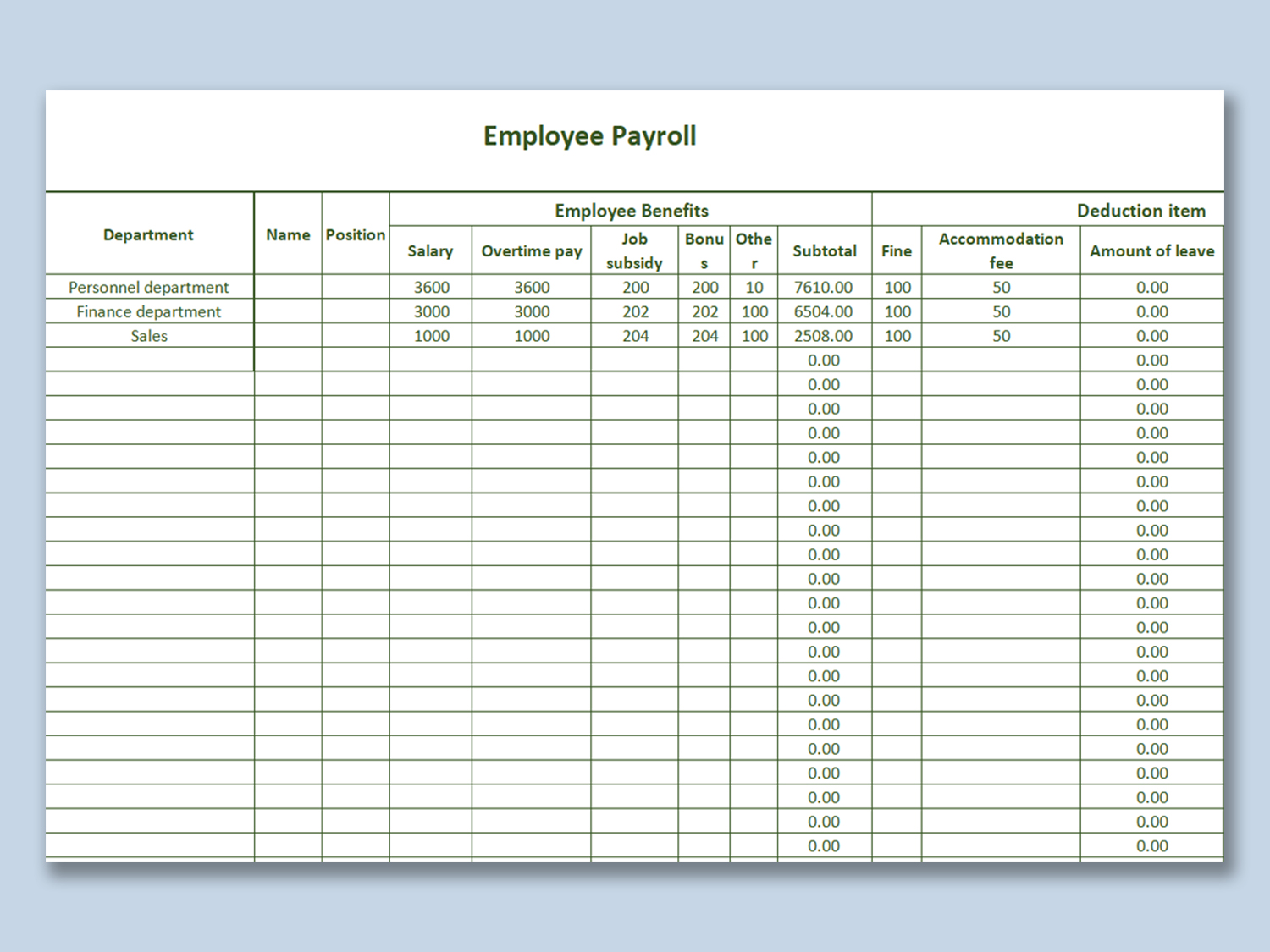

Preparation Prepare for payroll calculation and processing and decide who will do all the payroll tasks before you begin to hire employees Paying employees Set up a system to calculate employees pay to write paychecks and to distribute them Post payment Set aside money for taxes make tax payments and send payroll reports to the Internal Revenue Service IRS the Social Security There are two main ways to pay yourself as a business owner Salary You pay yourself a regular salary just as you would an employee of the company withholding taxes from your paycheck This is

More picture related to Can I Do My Own Payroll Taxes

Should I Do My Own Taxes AvvoStories

https://marketing-assets.avvo.com/uploads/sites/3/2018/03/DIYTaxes.jpg

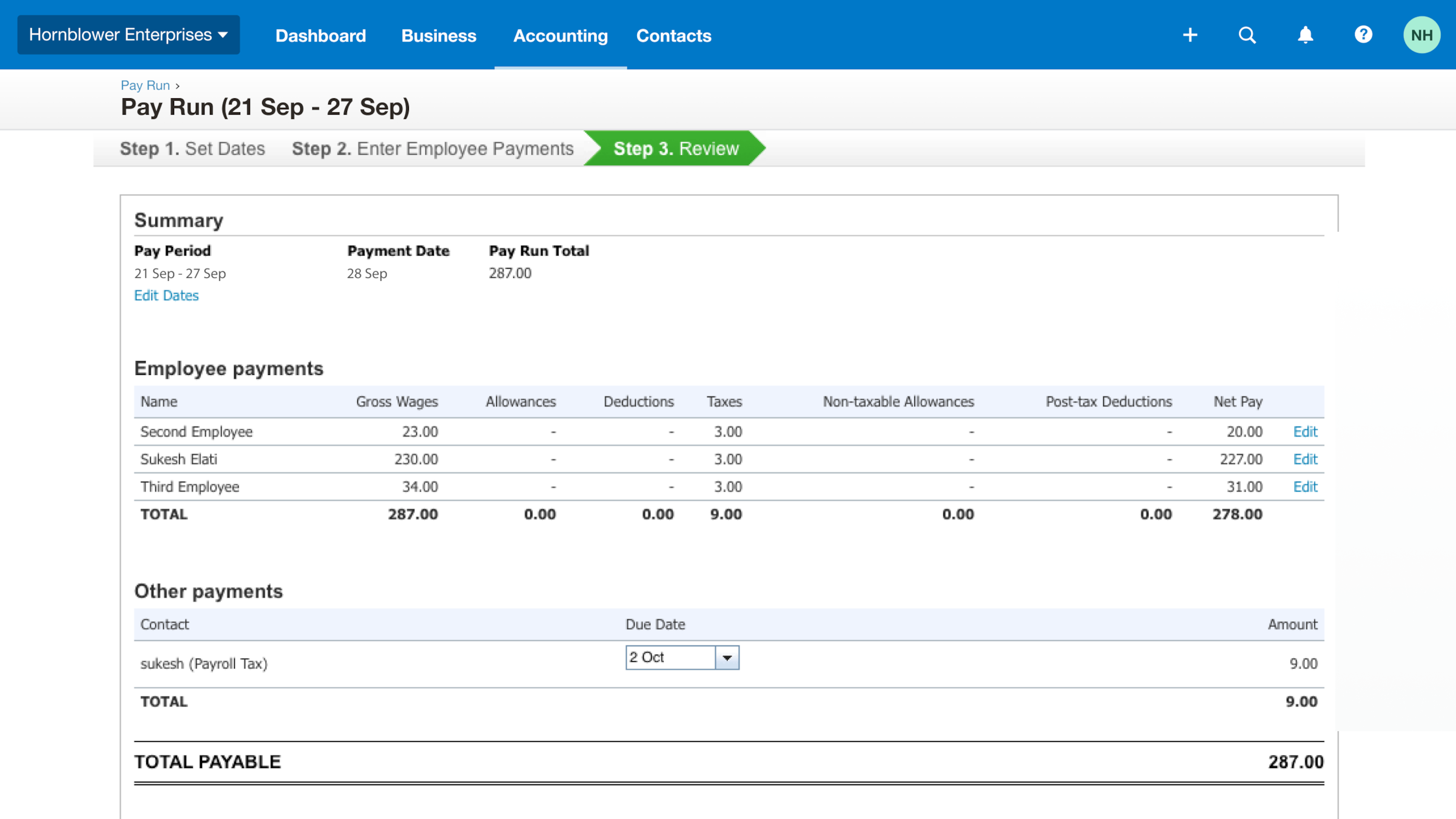

Online Pay Runs Basic Online Payroll Software Xero CA

https://www.xero.com/content/dam/xero/pilot-images/features/payroll/Pay runs - video placeholder.1646877480769.png

What Are Payroll Taxes An Employer s Guide Wrapbook

https://assets-global.website-files.com/5fa0baa5ea5c262586cf8fd0/60e5e5091a241b6c4ce8b6a7_What are Payroll Taxes - Goverment Tax Revenue Sources - Wrapbook.jpg

Published Date April 30 2024 Key takeaways To complete payroll manually start by gathering information about each employee s pay benefits deductions and tax witholding Tread carefully You ll also need a thorough understanding of federal state and local labor laws and tax codes You can use a payroll record book spreadsheet or Employers submitting the forms themselves will need to purchase IRS approved software There may be a fee to file electronically Also the software will require a signature by one of two ways The software instructs the user to apply for an online signature PIN Taxpayers should allow at least 45 days to receive their PIN

Distribute take home pay to employees using your designated method e g direct deposit File and deposit taxes File and remit employment taxes according to your deposit schedule and form due dates 2 Purchase payroll software Payroll software is a great middle ground option for doing your own payroll FICA taxes for 2022 amount to 7 65 of an employee s paycheck The precise amount may change so it s best to keep up with yearly trends Once the business withholds the payroll tax it must deposit it according to the IRS schedule Businesses that file payroll taxes up to 50 000 must deposit monthly

Indiana Paycheck Taxes

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Understanding California Payroll Tax Finansdirekt24 se

https://www.patriotsoftware.com/wp-content/uploads/2022/08/Copy-of-Payroll-Taxes-in-California-835-×-986-px-1.png

Can I Do My Own Payroll Taxes - We ll go into the details below as well as a step by step process for how to calculate them but here is the gist Social Security tax formula Employee Income 6 2 Social Security Tax Medicare tax formula Employee Income 1 45 Medicare Tax