Can I Do My Own Payroll For S Corp An S corp offers business owners three basic options for paying themselves by salary distributions or both The right choice depends largely on how you contribute to the company and the company

5 Missing Payroll Tax Payments Another misstep you may make when running payroll for your single owner S Corp is failing to make regular payroll tax payments Once you ve set yourself a salary you need to process payroll to pay yourself You can do this by following a simple four step process Complete a W 4 If you own an S Corporation you likely know that you need to pay yourself reasonable compensation for the job you perform for your company This goes back to the whole idea of the IRS not wanting to lose out on your tax money In fact you can pay yourself 0 in wages as long as you pay yourself 0 in distributions as well Let s

Can I Do My Own Payroll For S Corp

Can I Do My Own Payroll For S Corp

https://free-template.co/wp-content/uploads/2022/01/8955583aa7d0c677/payroll-statement-template.jpeg

4 Advantages Of Outsourcing Payroll

https://www.youroffice.com/wp-content/uploads/2017/02/payroll.jpg

How To Run Payroll In QuickBooks Online Standard Payroll

https://digitalasset.intuit.com/IMAGE/A4Kg2rw2C/pay-date-employee-toggle-prepare-payroll-standard-payroll.gif

S corporations S corporations are corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes Shareholders of S corporations report the flow through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates Active business owners in an S corporation S corp or C corporation C corp structure must pay themselves a W 2 salary Types of business where you can take an owner s draw Multi member LLCs have more flexibility By default they re classified as a partnership so they must use an owner s draw

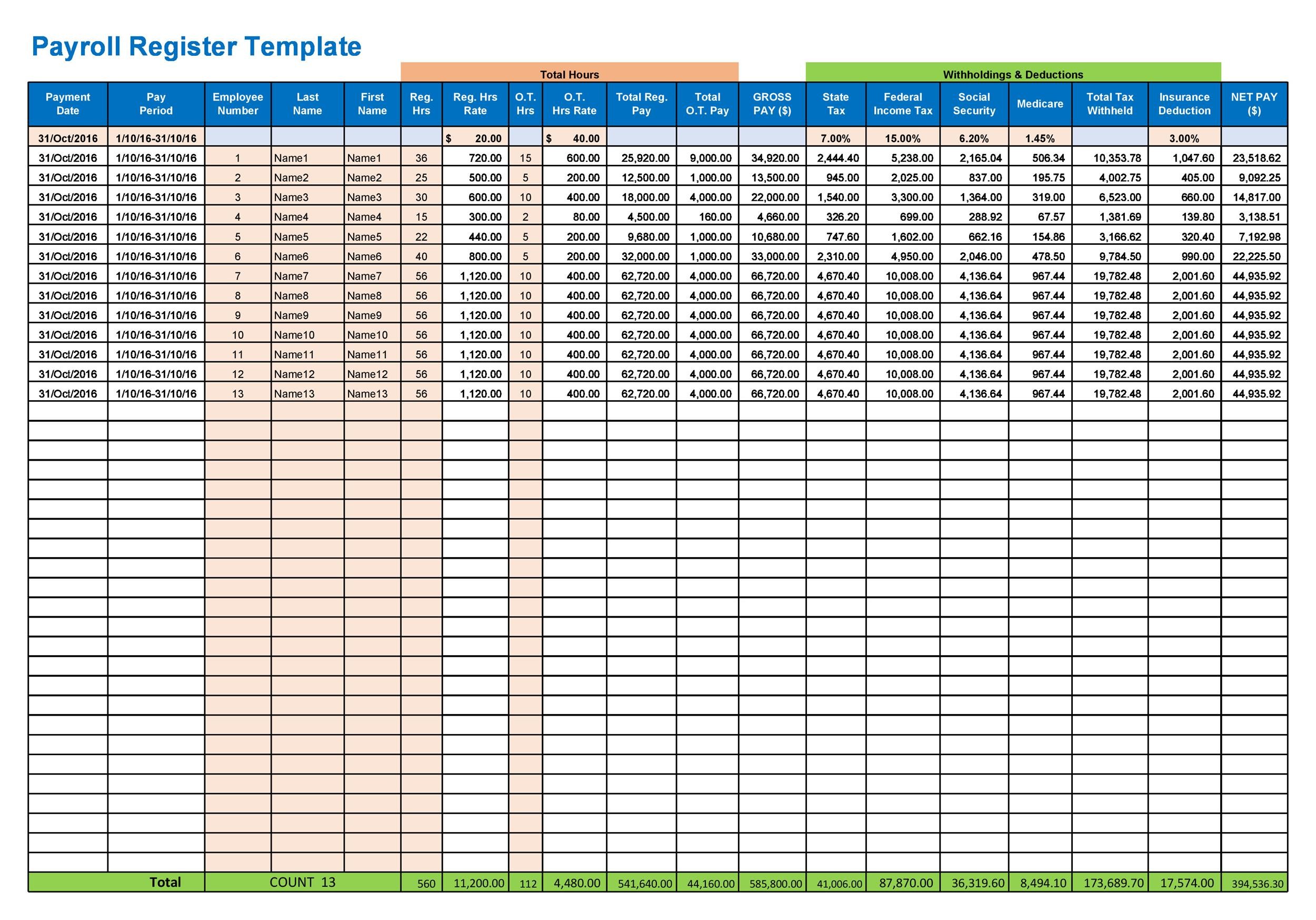

As a reminder Social Security is 6 2 of an employee s gross taxable wages paid by both the employer and employee Medicare is 1 45 of gross taxable wages paid by both the employer and employee Use Publication 15 T to determine the amount of federal income tax to withhold Consider using payroll software to calculate S Corp payroll taxes Here s how paying an S corporation salary is done 1 Set a reasonable salary S corporation shareholder employees must earn a salary that s comparable to what similar businesses pay their employees for the same type of work 2 Calculate payroll and taxes

More picture related to Can I Do My Own Payroll For S Corp

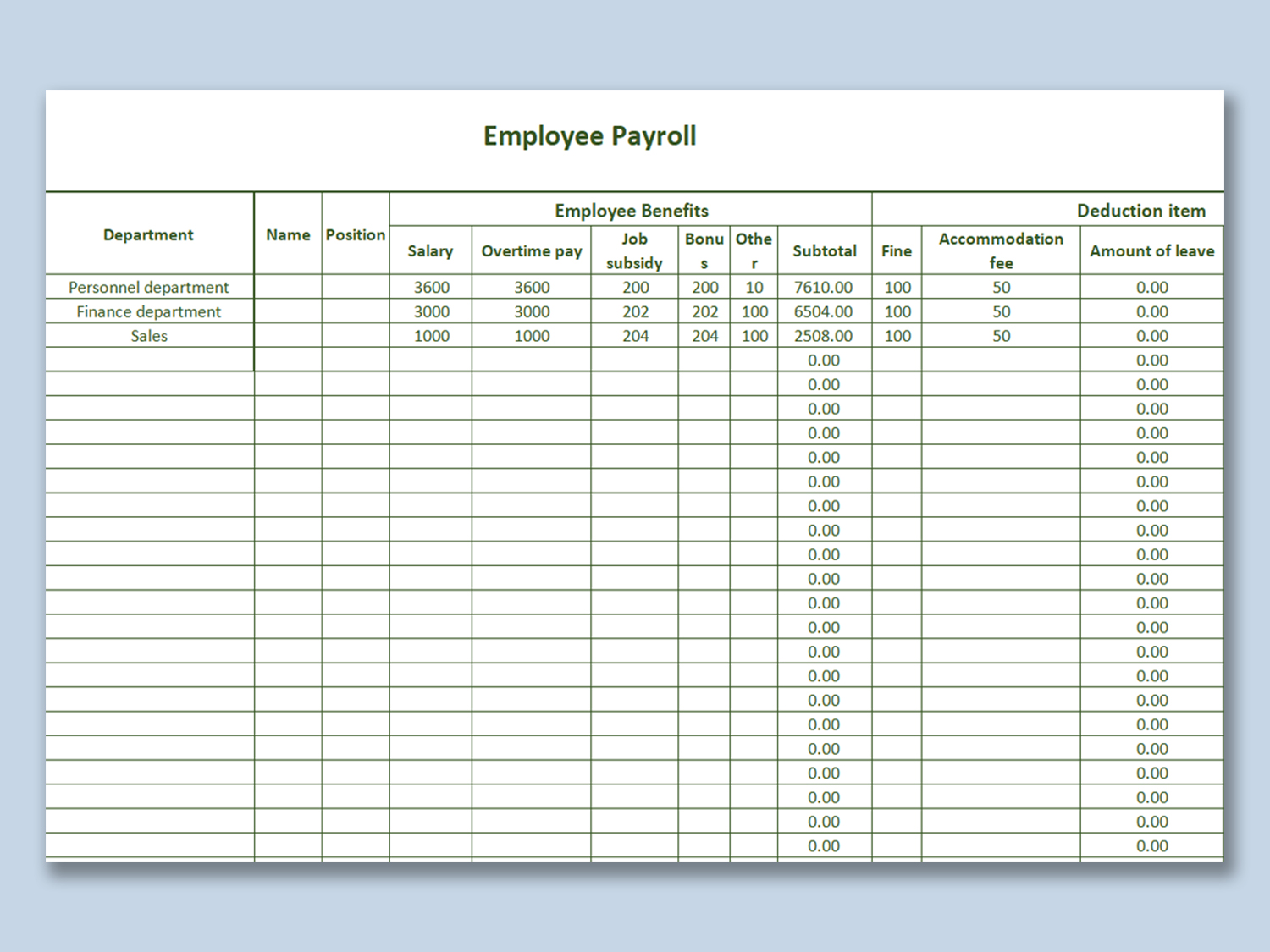

Make An Efficient Payroll Statement Template Using These Tips And

https://free-template.co/wp-content/uploads/2022/01/1cf53f8084dd3be6/payroll-statement.jpeg

Can I Do My Own Payroll Milestone

https://www.milestone.inc/wp-content/uploads/2022/09/Can_I_do_my_own_payroll_-1024x569.jpg

Can I Do My Own Payroll For My Daycare Business

https://www.childcarebiz.com/assets/components/phpthumbof/cache/can-i-do-my-own-payroll-for-my-daycare-business.76fffd892ab62e070f26dc5b4a962c2e.jpg

Regular 18 49 24 49 Variable 1 No double taxation C corporations known as traditional corporations pay income tax at the entity and shareholder levels One of the hallmarks of S ConnectPay can provide you with local tax experts and connections that can help you run your S Corp payroll processes like a well oiled machine 4 Record Payroll Transactions Our fourth tip for how to run payroll for an S Corp is to maintain accurate and detailed records for all payroll transactions

For these reasons it s vital that S corp owners pay themselves at a reasonable rate because this ultimately determines their tax liability Ways to pay yourself as an S corp So we ve covered how important paying yourself is as an S corp owner How you pay yourself depends on your position and responsibilities within the company You can Here s how you can run payroll for an S Corp to automatically pay yourself for a job well done Getting paid when you own an S Corp Small side hustlers or newer self employed people who use a sole proprietorship or a traditional LLC can withdraw money from their business bank account to pay themselves whenever they want At the end of the

Blank Payroll Check Stub Template Payroll Template Payroll Checks

https://i.pinimg.com/736x/db/f4/86/dbf48699a44abc44d621ca137364956a.jpg

Payroll Processing Administration Sam Bond Benefit Group PEO

http://sbrecommend.com/wp-content/uploads/2018/07/payroll-peo-1024x683.jpg

Can I Do My Own Payroll For S Corp - S corporations S corporations are corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes Shareholders of S corporations report the flow through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates