Business Acquisition Companies Improve the target company s performance Improving the performance of the target company is one of the most common value creating acquisition strategies Put simply you buy a company and radically reduce costs to improve margins and cash flows In some cases the acquirer may also take steps to accelerate revenue growth

6 Prioritize Cultural Compatibility In an M A deal leaders must prioritize due diligence on cultural compatibility This is crucial as cultural misalignment can lead to integration challenges The phrase mergers and acquisitions M A refers to the consolidation of multiple business entities and assets through a series of financial transactions The merger and acquisition process includes all the steps involved in merging or acquiring a company from start to finish This includes all planning research due diligence closing and implementation activities which we will discuss in

Business Acquisition Companies

Business Acquisition Companies

https://www.accountingfirms.co.uk/wp-content/uploads/2021/10/what-is-Acquisition-in-Business.png

Business Acquisition Or Merger What Is Beneficial Accounting

https://wilkinsonaccountingsolutions.co.uk/wp-content/uploads/2022/12/shutterstock_2187551027.png

6 Reasons Why Companies Pursue Mergers And Acquisitions Shawano Leader

http://www.shawanoleader.com/wp-content/uploads/2021/06/iStock_000075360805_Large_BusinessIllustration.jpg

Mergers and Acquisitions M A Mergers and acquisitions M A is a general term that refers to the consolidation of companies or assets M A can include a number of different transactions such Acquisition An acquisition is a corporate action in which a company buys most if not all of another firm s ownership stakes to assume control of it An acquisition occurs when a buying company

From Vodafone s point of view the acquisition cut the company value roughly in half to 100 billion The business acquisition also moved Vodafone from the second largest phone company in the world down to fourth behind China Mobile AT T and Verizon 8 Dow Chemical and DuPont merger 2015 130B 166B adjusted for inflation A Better Approach to Mergers and Acquisitions Far more mergers succeed today than in the past and when done well M A is a sure path to value creation This new Harvard Business Review article uncovers the best practices for successful mergers

More picture related to Business Acquisition Companies

IT In Merger And Acquisition CyberSRC

https://cybersrcc.com/wp-content/uploads/2021/05/image2-1-3.png

Oracle Consummates Acquisition Of NetSuite Eyes 1bn Cloud Revenue

https://cdn.ttgtmedia.com/visuals/German/article/merger-acquisition-fotolia.jpg

M A Meaning Mergers Acquisitions Definition Types Examples 2022

https://global-uploads.webflow.com/5a710020b54d350001949426/61cb6e4b4ee66637fbea901e_What is M%26A.jpeg

When companies are considering a business acquisition one of the first decisions to make is how the deal will be financed There are a variety of ways to do this such as company funds company equity earnout leveraged buyout and more Here are 10 different ways and explanations on how to finance a business acquisition in 2024 M A Strategy Your M A strategy should be a logical extension of your growth strategy and should be based on a disciplined and repeatable model that supports frequent ever larger deals Our industry leading work spans corporate strategy private equity investing and related disciplines With more than 9 000 projects completed across virtually

The essence of a business acquisition lies in the act of one company absorbing another Whether it s purchasing a controlling stake assets or the entire entity the objective remains consistent to gain ownership and influence over the target company also known as the acquiree The primary goal of a business acquisition is to In the acquisition marketplace private equity appears to be better suited to quickly engage the owner assess the business and complete the acquisition A reasonably well run mid market company

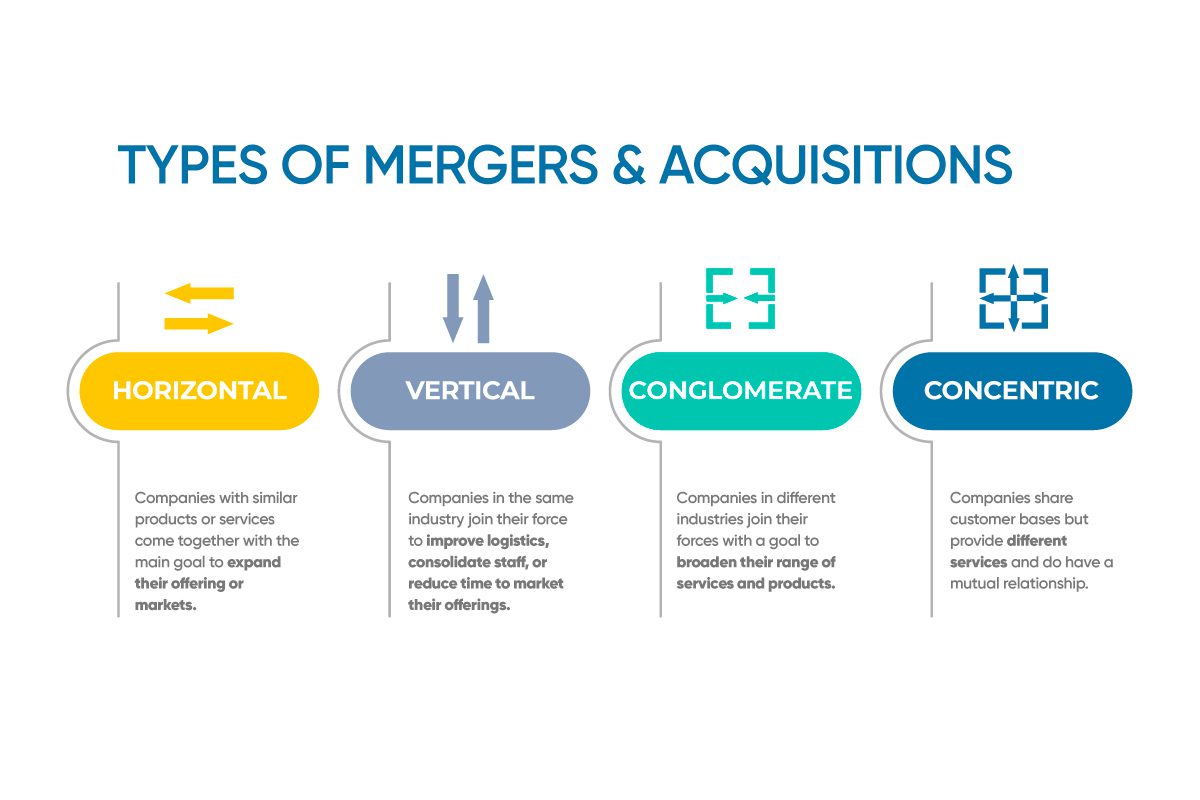

Types Of Mergers

https://www.nowcfo.com/wp-content/uploads/2021/05/4-MA-Types-blog-1.jpg

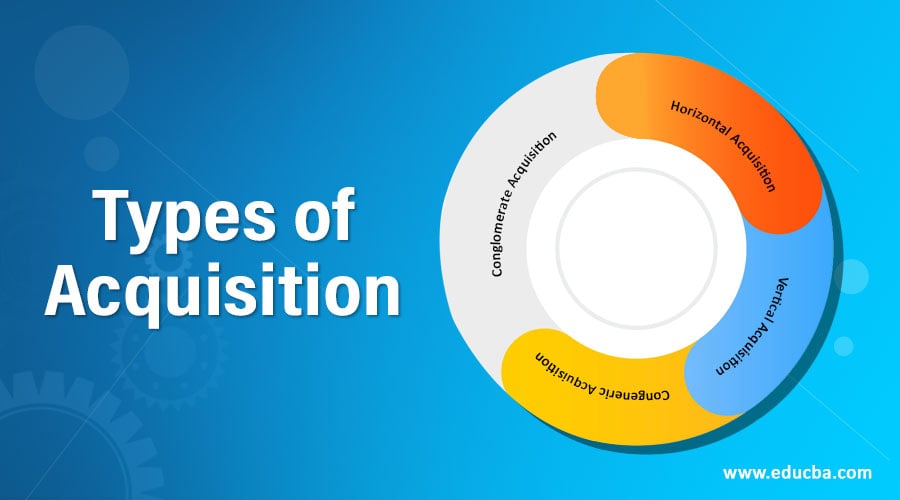

Types Of Acquisition Top 4 Types Of Acquisition With Purpose

https://cdn.educba.com/academy/wp-content/uploads/2020/04/Types-of-Acquisition.jpg

Business Acquisition Companies - From Vodafone s point of view the acquisition cut the company value roughly in half to 100 billion The business acquisition also moved Vodafone from the second largest phone company in the world down to fourth behind China Mobile AT T and Verizon 8 Dow Chemical and DuPont merger 2015 130B 166B adjusted for inflation