Accounting Firm Partner Compensation For most firms the base is 60 90 of total partner compensation The bonus is reserved for what have you done for us lately What kind of a year did each partner have To what extent did they achieve their goals and otherwise meet expectations Did anyone hit any home runs For most firms bonus is 10 30 of total partner compensation

A part owner has to make a capital investment when buying into an accounting firm This is typically a pretty steep investment and can be taken out of their annual salary throughout the years The amount of the buy in varies due to location the partner s role the number of clients and how much business they will be taking on 9 15

Accounting Firm Partner Compensation

Accounting Firm Partner Compensation

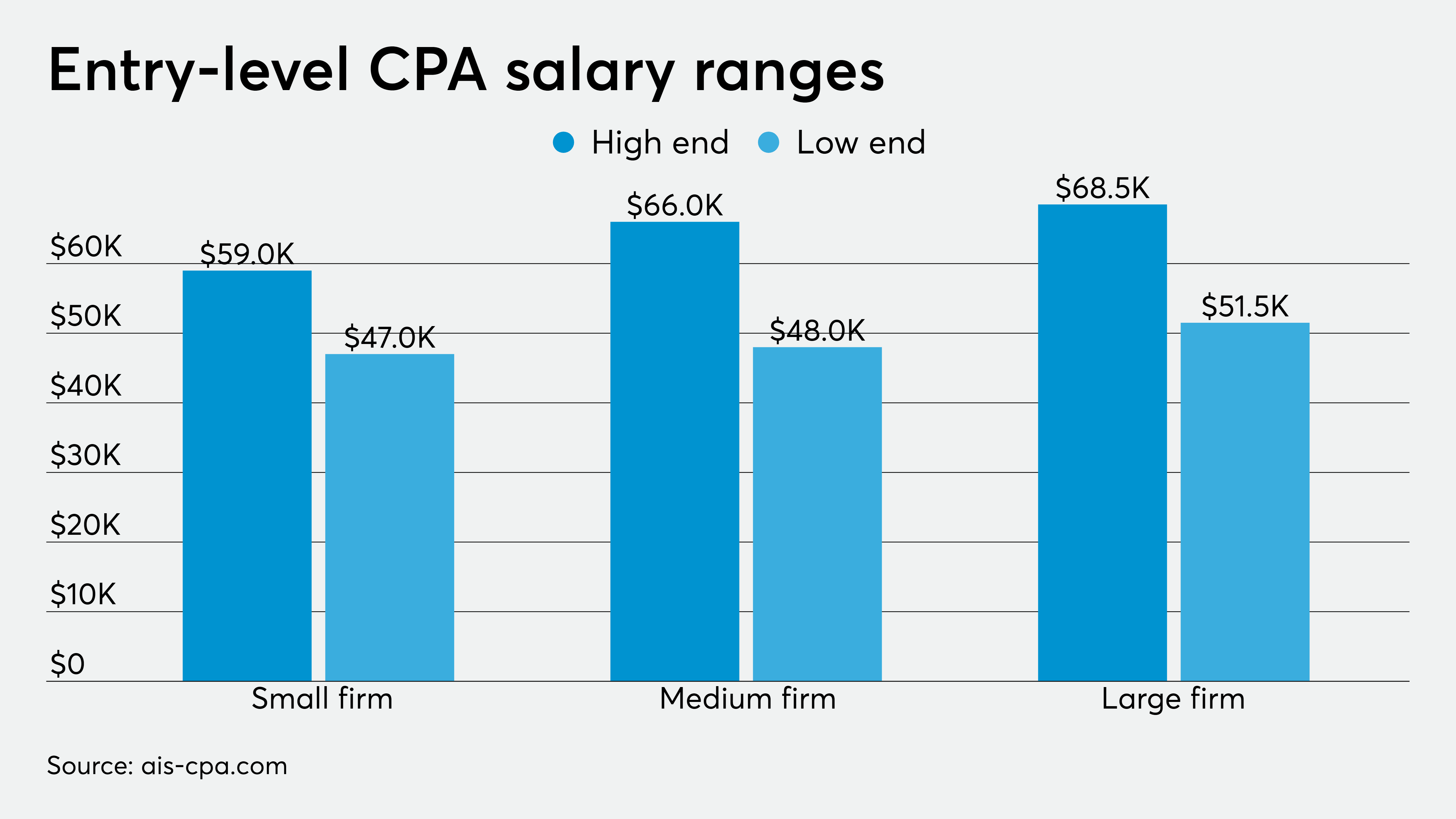

https://arizent.brightspotcdn.com/bd/d5/fce293dc4ea0a95832c8ed4ba7f7/at-082719-entrylevelcpasalarieschart.png

State of the Profession - The CPA Journal

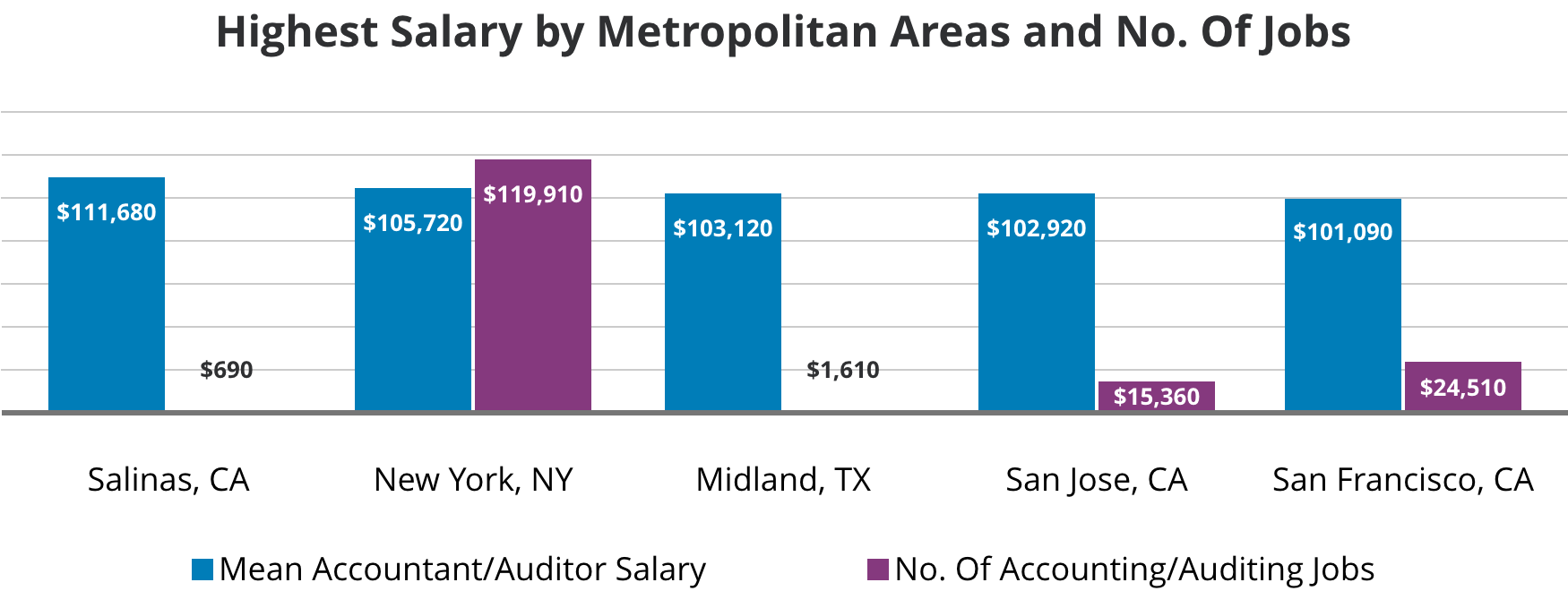

https://www.nysscpa.org/cpaj-images/CPA.2021.91.12.020_t001.jpg

Biglaw Firm Matches First-Year Salaries (In Some Markets), Senior Associates Not So Lucky - Above the LawAbove the Law

https://abovethelaw.com/uploads/2021/07/faegre-scaled-e1625165717868.jpeg

The average Accounting Firm Partner salary in the United States is 164 742 as of November 27 2023 but the salary range typically falls between 140 471 and 195 228 Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession Job Listings Employers 176 382 year Avg Base Salary USD 10 109k MEDIAN 176k 90 344k The average salary for a Partner Accounting Firm is 176 382 in 2023 Base Salary 109k

How partner compensation is determined e g eat what you kill or shared revenue model What the partner benefits are for senior partners and for new partners Step three Redefine your role in the firm and set developmental goals It is imperative that CPAs understand what their responsibilities will be as a partner Video transcript The three best practices I have seen in terms of how firms compensate partners are the following One compensation has to tie into the firm s strategic plan So going through the strategic planning process determining what s best for the firm and then looking at the individual partners strengths and figuring out how

More picture related to Accounting Firm Partner Compensation

Wiley CPA Career Guide - Average CPA Salary | Wiley

https://www.efficientlearning.com/wp-content/uploads/2022/03/highest-salary-2x.png

Private Equity Salary: Associate Compensation Report (2022)

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/17003826/Private-Equity-Salaries.jpg

How Accounting Firm Compensation Committees Assess Partner Performance

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/17042/salary_0_1_.5446acbc2a3fd.png

The average Accounting Firm Partner salary in California is 180 670 as of September 25 2023 but the range typically falls between 154 051 and 214 103 Salary ranges can vary widely depending on the city and many other important factors including education certifications additional skills the number of years you have spent in your The average Accounting Firm Partner salary in Los Angeles CA is 184 424 as of October 25 2023 but the salary range typically falls between 157 252 and 218 554 Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession

Art of Accounting Partner compensation By Edward Mendlowitz December 07 2020 10 10 a m EST 5 Min Read Enjoy complimentary access to top ideas and insights selected by our editors As this unusual year comes to an end many firms will be divvying up profits and assigning new partner salary or draw amounts for 2021 Why did you change your firm s partner comp model What pain points were you trying to address or what objectives were you trying to achieve And can you also compare and contrast the former partner comp model with the one you now have Cardello Sure

Making The System Work Well - Tri-Merit

https://tri-merit.com/wp-content/uploads/2021/06/Unique-CPA-Featured-Image-Ep-42-Kristen-Rampe.png

Wiley CPA Career Guide - Average CPA Salary | Wiley

https://www.efficientlearning.com/wp-content/uploads/2022/03/top-states-salaries-2x.png

Accounting Firm Partner Compensation - How partner compensation is determined e g eat what you kill or shared revenue model What the partner benefits are for senior partners and for new partners Step three Redefine your role in the firm and set developmental goals It is imperative that CPAs understand what their responsibilities will be as a partner