80 000 A Year Is How Much A Month After Taxes In Texas FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Summary If you make 80 000 a year living in the region of Texas USA you will be taxed 16 488 That means that your net pay will be 63 512 per year or 5 293 per month Your average tax rate is 20 6 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate 2014 53 875 2013 51 406 2012 51 926 Payroll taxes in Texas are relatively simple because there are no state or local income taxes Texas is a good place to be self employed or own a business because the tax withholding won t as much of a headache And if you live in a state with an income tax but you work in Texas you ll be sitting

80 000 A Year Is How Much A Month After Taxes In Texas

80 000 A Year Is How Much A Month After Taxes In Texas

https://images-cdn.9gag.com/photo/a6qoX3e_700b.jpg

Top 10 52000 A Year Is How Much A Month After Taxes That Will Change

https://images.squarespace-cdn.com/content/v1/55693d60e4b06d83cf793431/1658954291602-IT66OQ32WNXK3P7KU2OZ/AdobeStock_469754966.jpeg

40 000 A Year Is How Much An Hour Why A 40k Salary Is Good

https://www.themoneygalileo.com/wp-content/uploads/2021/08/40000-a-year-is-how-much-an-hour.jpg

Social Security 6 2 Medicare 1 45 to 2 35 Other non tax deductions health insurance 401k etc also reduce your take home pay The combined tax percentage usually ranges from 15 to 30 of your paycheck Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in Texas How much is 80 000 a Year After Tax in the United States In the year 2024 in the United States 80 000 a year gross salary after tax is 63 512 annual 4 783 monthly 1 100 weekly 219 99 daily and 27 5 hourly gross based on the information provided in the calculator above

After entering it into the calculator it will perform the following calculations Federal Tax Filing 80 000 00 of earnings will result in 9 441 00 of that amount being taxed as federal tax FICA Social Security and Medicare Filing 80 000 00 of earnings will result in 6 120 00 being taxed for FICA purposes Texas State Tax The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

More picture related to 80 000 A Year Is How Much A Month After Taxes In Texas

44 000 A Year Is How Much An Hour

https://savvybudgetboss.com/wp-content/uploads/2022/04/40000-a-year-after-taxes.png

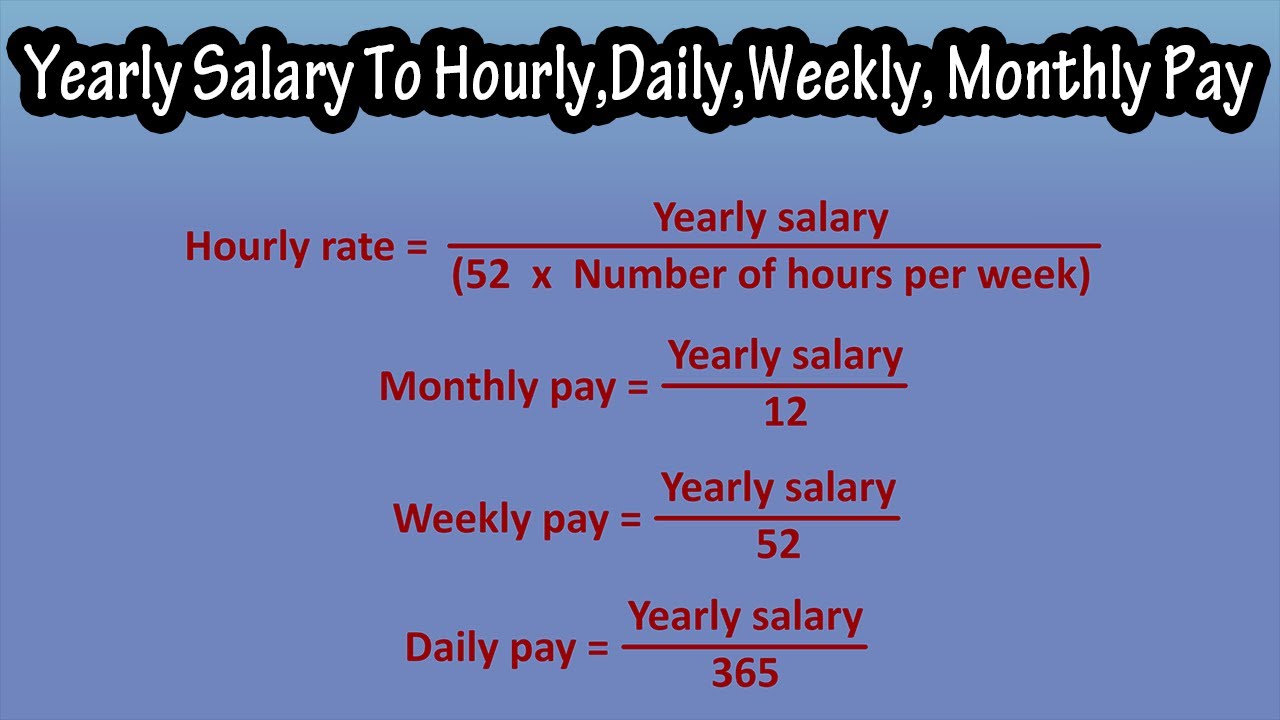

How To Convert Yearly Salary To Hourly Pay Rate Weekly Pay Monthly

https://i.ytimg.com/vi/dieGbkfnt1Q/maxresdefault.jpg

30 000 A Year Is HOW Much An Hour Find Out Here Wise Healthy n

https://images.squarespace-cdn.com/content/v1/5d91b73a83856c46984c2857/1665516885172-IUGAMUBD1AHAPY9IEF0Y/30%2C000+a+Year+Is+How+Much+an+Hour.jpg

Texas Income Tax Calculator 2023 2024 Learn More On TurboTax s Website If you make 70 000 a year living in Texas you will be taxed 7 660 Your average tax rate is 10 94 and your marginal tax The Monthly Salary Calculator is updated with the latest income tax rates in Texas for 2024 and is a great calculator for working out your income tax and salary after tax based on a Monthly income The calculator is designed to be used online with mobile desktop and tablet devices

The additional amount is 3 900 00 if the individual is both 65 or over and blind Retirement Plan Contributions 401 k 403 b SARSEP and 457 plans Calculated using the individual contributions limits for 2024 22 500 00 standard with additional 7 500 00 catch up for those 50 or older at the end of 2024 The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

80 000 A Year Is How Much An Hour Saving Budgeting Guidelines

https://www.moneyforthemamas.com/wp-content/uploads/2022/07/50-30-20-budget-for-80000-pay-512x1024.jpg

50 000 A Year Is How Much An Hour Good Salary Or Not Savvy Budget

https://savvybudgetboss.com/wp-content/uploads/2021/12/50000-a-year-is-how-much-an-hour-1.jpg

80 000 A Year Is How Much A Month After Taxes In Texas - 80 000 00 Salary Income Tax Calculation for Texas This tax calculation produced using the TXS Tax Calculator is for a single filer earning 80 000 00 per year The Texas income tax example and payroll calculations are provided to illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year when filing a tax return in Texas for 80 000 00 with no special