75k Biweekly Pay After Taxes This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major change since 1987 Income Tax Calculator Budget Calculator Before Tax vs After Tax Income

These tools are available for free and are perfect for getting a head start on your 2025 tax return We re rolling out these apps for all States by mid January 2024 but you can already check out the States that have been updated Find out how much your salary is after tax Enter your gross income Per Where do you work Calculate Salary rate Annual Month Weekly Day Hour Withholding Salary 75 000 Federal Income Tax 9 268 Social Security 4 650 Medicare 1 088 Total tax 15 006 Net pay 59 995 Marginal tax rate 29 6 Average tax rate 20 0 80 0 Net pay 20 0

75k Biweekly Pay After Taxes

75k Biweekly Pay After Taxes

https://i.insider.com/5c536ca374c58705765939ed?width=1000&format=jpeg&auto=webp

$75,000 a year is how much an hour? - Zippia

https://static.zippia.com/answer-images/75000-a-year-is-how-much-an-hour.png

$75000 a Year is How Much an Hour? Good Salary? - Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/75000-a-year.jpg

Free tool to calculate your hourly and salary income after taxes deductions and exemptions Bi weekly Your net pay 26 Your bi weekly paycheck Semi monthly How much is a 75k paycheck Paycheck after federal tax liability for a single filer Monthly 5 041 83 Bi weekly 2 327 00 If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status

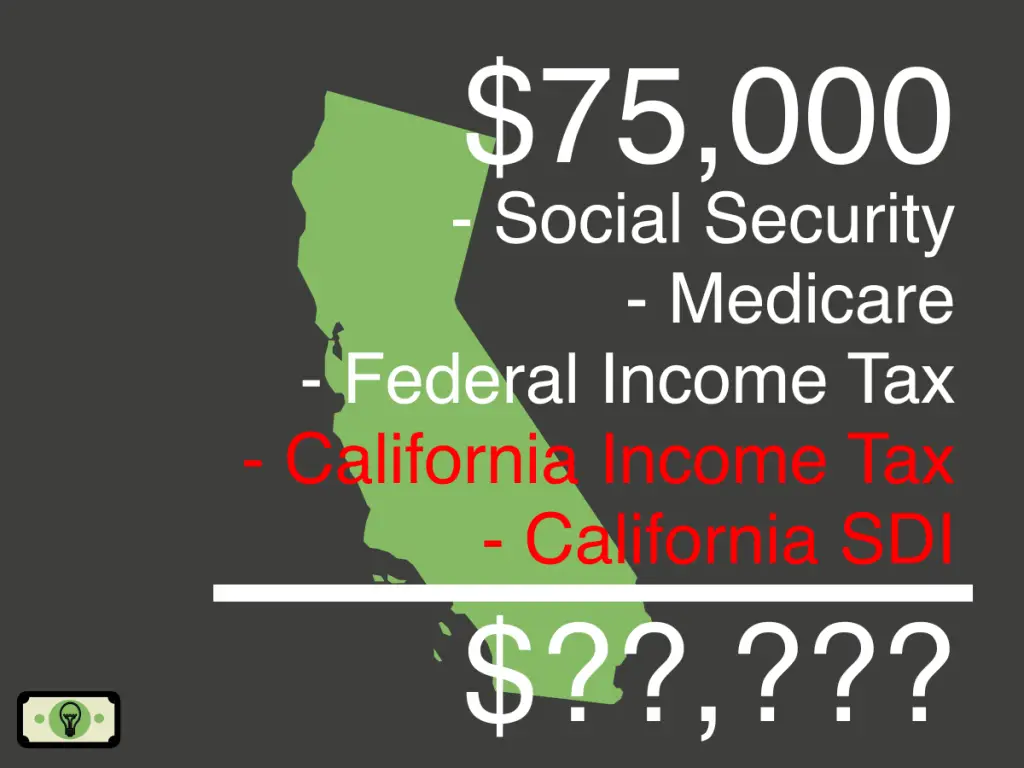

I just got my first paycheck today and looks like I m getting 1950 gross biweekly after taxes deductions If you multiply that by 2 that s 3900 a month Multiply 3900 12 46 800 Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 75 000 Federal Income Tax 9 268 State Income Tax 3 741 Social Security 4 650 Medicare 1 088 SDI State Disability Insurance 31 20 FLI Family Leave Insurance 383 Total tax

More picture related to 75k Biweekly Pay After Taxes

💷£75000 After tax 💶 (75k take home pay) (2021-2022)

https://www.what.tax/assets/generatedImages/75000-After-tax-75k-take-home-pay.png

Paycheck Calculator for $100,000 Salary: What Is My Take-Home Pay?

https://i.insider.com/5e613c58fee23d33111dd372?width=1000&format=jpeg&auto=webp

$75K Salary After Taxes in California (single)? - Smart Personal Finance

https://smartpersonalfinance.info/wp-content/uploads/2022/08/ca-75000-after-taxes-2-sm-1024x768.png

Biweekly wage 2 Weekly wage For a wage earner who gets paid hourly we can calculate the biweekly salary from the formula above Remembering that the weekly wage is the hourly wage times the hours worked per week Biweekly wage 2 Hourly wage Hours per week We can also express the first formula in terms of the daily wage Anyone making 75 000 a year will have an after tax income of 56 250 This number is calculated by assuming you will pay around 25 of your income towards taxes When you re earning 75 000 dollars annually it is always a good idea to know your after tax annual income and hourly wage

How do I convert my monthly income to weekly pay To calculate your weekly pay given the monthly income you need to Multiply your monthly income by 12 the number of months in a year and then Divide the result by 52 the number of weeks in a year This formula for weekly pay is implemented in most of online weekly wage calculators Paycheck calculator A yearly salary of 75 000 is 2 885 every 2 weeks This number is based on 40 hours of work per week and assuming it s a full time job 8 hours per day with vacation time paid If you get paid weekly your gross paycheck will be 1 442

$75K Salary After Taxes in California (single)? - Smart Personal Finance

https://smartpersonalfinance.info/wp-content/uploads/2022/08/ca-75000-after-taxes-2.svg

💷£75000 After tax 💶 (75k take home pay) (2021-2022)

https://www.what.tax/assets/generatedImages/75k-After-tax-75000-take-home-pay.png

75k Biweekly Pay After Taxes - Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 75 000 Federal Income Tax 9 268 State Income Tax 3 884 Social Security 4 650 Medicare 1 088 SDI State Disability Insurance 825 Total tax 19 714 Net pay 55 286