75000 Salary To Hourly After Taxes This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major change since 1987 Income Tax Calculator Budget Calculator Before Tax vs After Tax Income

Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 75 000 Federal Income Tax 9 268 Social Security 4 650 Medicare 1 088 Total tax 15 006 Net pay 59 995 Marginal tax rate 29 6 Average tax rate 20 0 80 0 Net pay 20 0 Total tax If you were looking for the 75k Salary After Tax Example for your 2024 Tax Return it s here Brace yourselves for a surprise Just when you thought navigating tax season couldn t be more exhilarating we re here with some spectacular news to elevate your excitement before you settle into the math for your salary after tax calculations

75000 Salary To Hourly After Taxes

75000 Salary To Hourly After Taxes

https://i.pinimg.com/originals/5c/62/2a/5c622a11ef8e29375d81a446c2ebfb98.jpg

75000 A Year Is How Much An Hour Good Salary Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/75000-a-year.jpg

Translate Annual Salary To Hourly KerrynBalqees

https://www.howtofire.com/wp-content/uploads/23-an-hour-salary-1024x800.png

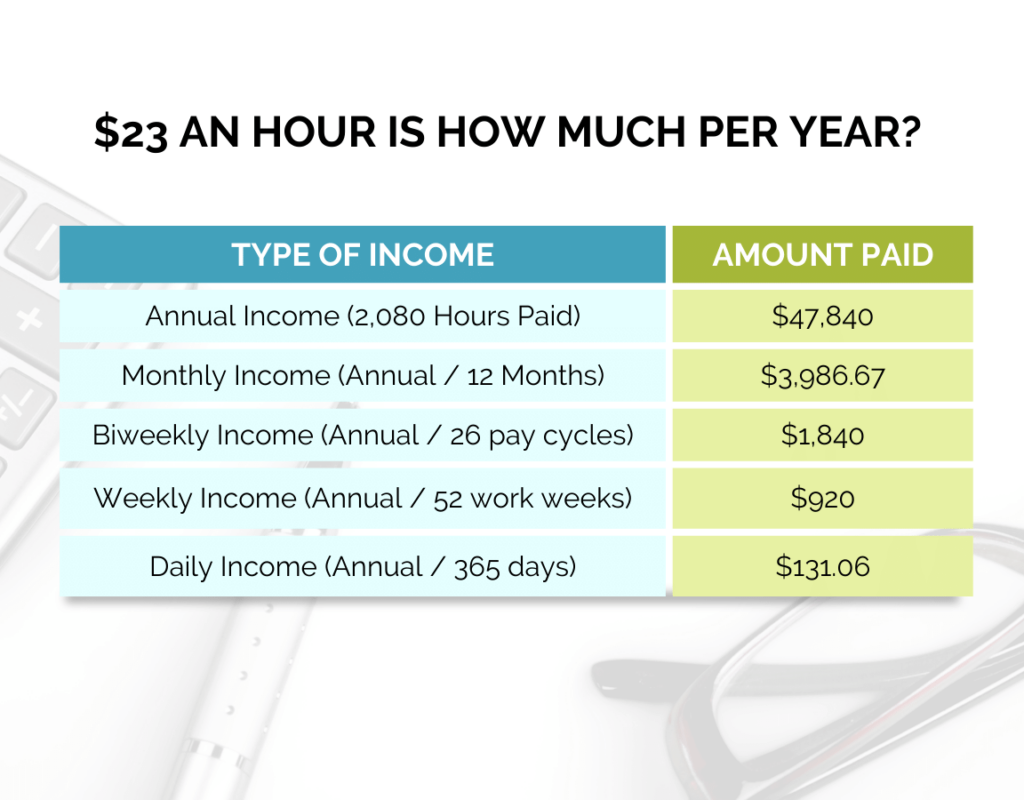

How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 There are nine tax brackets that vary based on income level and filing status Wealthier individuals pay higher tax rates than lower income individuals New York s income tax rates range from 4 to 10 9 The top tax rate is one of the highest in the country though only taxpayers whose taxable income exceeds 25 000 000 pay that rate

Just like federal income taxes your employer will withhold money to cover this state income tax Pennsylvania also levies local income taxes in more than 2 400 municipalities And of Pennsylvania s 500 school districts 469 of them levy a local income tax The table below lists the local income tax rates in some of the state s biggest cities To calculate your salary from your hourly pay Choose for which period you want to calculate your salary yearly monthly weekly etc Find the number of hours you worked If you work 8 hours a day 5 days a week you work 8 5 40 hours weekly 40 52 2 080 hours yearly and 2 080 12 173 34 hours monthly

More picture related to 75000 Salary To Hourly After Taxes

Going Hourly To Salary Calculate Pay Taxes Tips More

https://millennialmoney.com/wp-content/uploads/2021/04/hourly-to-salary-1.jpg

Free Annual Salary To Hourly Calculator Paycheck Calculations

https://michaelryanmoney.com/wp-content/uploads/2022/10/Annual-Salary-to-Hourly-Calculator-1920x1483.jpg

Here s How Much Money You Actually Take Home From A 75 000 Salary

https://i.pinimg.com/originals/c4/27/78/c427786af7639694e4187271a34d14ff.png

Estimate the after tax pay for hourly employees by entering the following information into a hourly paycheck calculator Hourly rate Gross pay and pay frequency Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 Use this calculator to convert an annual salary into an equivalent hourly rate an employee with an annual salary of 60 000 might receive 12 monthly payments of 5 000 before taxes Salary

What is Taxable Income Taxable income is a crucial concept in the realm of personal finance and taxation In essence it represents the income amount that the federal state or local government can tax But how do we arrive at this figure Taxable income is not solely your gross salary It encompasses To answer 75 000 a year is how much an hour divide the annual amount by 2 080 52 weeks 40 hours resulting in an hourly income of 26 Is 75 000 a Year a Good Salary To answer if 75 000 a year is a good salary We need to compare it to the national median

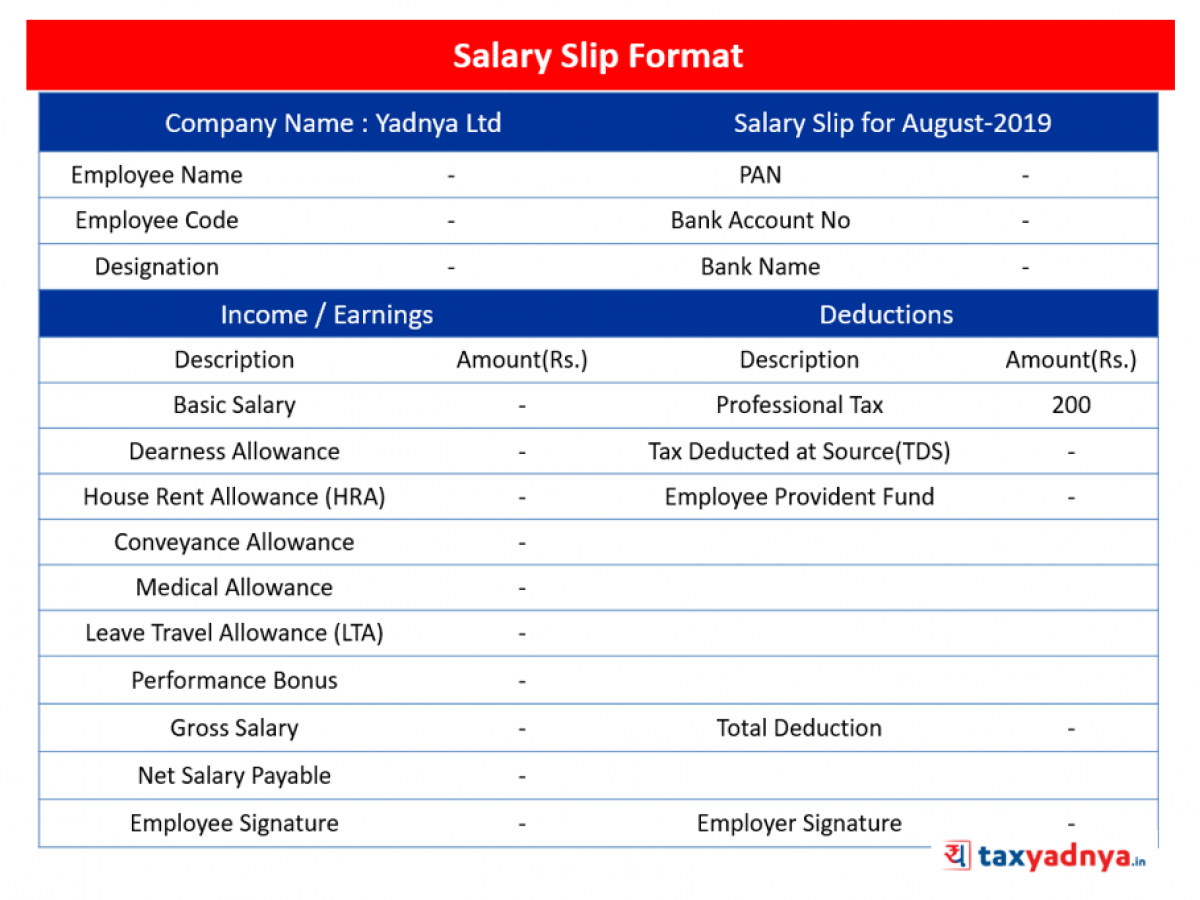

Format Of Salary Slip Communicationslasopa

https://blog.investyadnya.in/wp-content/uploads/2019/08/Salary-Slip-Format-1200x900.png

Comparing Pros And Cons Hourly Pay Vs Annual Salary Infographic

https://graphicspedia.net/wp-content/uploads/2019/05/Comparing-Pros-and-Cons-Hourly-Pay-Vs-Annual-Salary-Infographic.jpg

75000 Salary To Hourly After Taxes - There are nine tax brackets that vary based on income level and filing status Wealthier individuals pay higher tax rates than lower income individuals New York s income tax rates range from 4 to 10 9 The top tax rate is one of the highest in the country though only taxpayers whose taxable income exceeds 25 000 000 pay that rate