70000 Per Year After Tax When examining a 70 000 a year after tax income the corresponding daily earnings can be determined Take home NET daily income 195 96 assuming a 5 day work week To find out 70 000 a year is how much a day divide the annual figure by 260 52 weeks 5 days resulting in a daily income of 195 96

An individual who receives 57 631 00 net salary after taxes is paid 70 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Answer is 36 14 assuming you work roughly 40 hours per week or you may want to know how much 70k a year is per month after taxes Answer is 4 802 58 in this example 70 000 00 After Tax This income tax calculation for an individual earning a 70 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance

70000 Per Year After Tax

70000 Per Year After Tax

https://www.aei.org/wp-content/uploads/2015/07/100-Map.png

70 000 After Tax Salary Calculators

https://salarycalculators.org/wp-content/uploads/2023/03/70000-After-Tax-1.png

I Make 70000 A Year How Much House Can I Afford Askcorran

https://askcorran.com/wp-content/uploads/2022/05/i-make-70000-a-year-how-much-house-can-i-afford.jpg

If you make 70 000 a year living in the region of Pennsylvania USA you will be taxed 15 714 That means that your net pay will be 54 286 per year or 4 524 per month Your average tax rate is 22 5 and your marginal tax rate is 32 8 This marginal tax rate means that your immediate additional income will be taxed at this rate When earning a salary of 70 000 a year you will have a net income of 56 985 a year after federal taxes This comes to a monthly net income of 4 749 Depending on the state you live or work in you may pay additional state income taxes which can reduce your monthly paycheck further to a minimum of 4 513

If you make 70 000 a year living in the region of New York USA you will be taxed 17 361 That means that your net pay will be 52 639 per year or 4 387 per month Your average tax rate is 24 8 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate 70 000 a year is approximately 33 65 per hour based on a standard 40 hour workweek This calculation assumes 2 080 working hours per year 52 weeks at 40 hours each The hourly rate may vary if overtime paid time off or non standard schedules are considered

More picture related to 70000 Per Year After Tax

70k A Year Is How Much An Hour Before After Tax Breakdown

https://www.moneyforthemamas.com/wp-content/uploads/2022/06/what-can-i-afford-on-70000-salary-683x1024.jpg

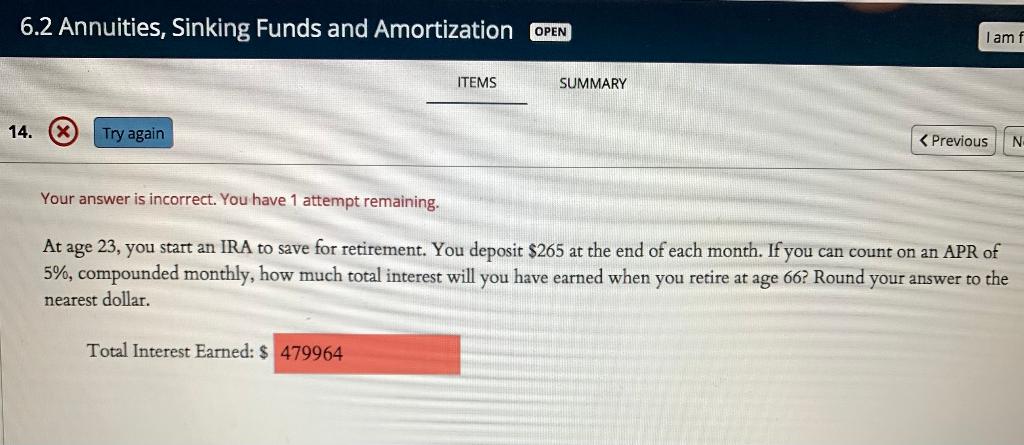

Solved At Age 23 You Start An IRA To Save For Retirement Chegg

https://media.cheggcdn.com/media/893/8935d662-4d84-472c-8fe3-df40f9f6e9ac/phpm9WZaB

70 000 A Year Is How Much An Hour And 6 Tips To Make Save Money

https://radicalfire.com/wp-content/uploads/2022/09/70000-A-Year-Is-How-Much-An-Hour-and-6-Tips-To-Make-Save-Money.jpg

Anyone making 70 000 a year will have an after tax income of 52 500 70 000 a year is 269 23 per day before taxes The standard workday is 8 hours So by multiplying 8 hours by 33 65 an hour you would earn 269 23 every day After taxes you would earn 201 92 a day Given that the first tax bracket is 10 you will pay 10 tax on 11 600 of your income This comes to 1 160 Given that the second tax bracket is 12 once we have taken the previously taxed 11 600 away from 25 400 we are left with a total taxable amount of 13 800 After taking 12 tax from that 13 800 we are left with 1 656 of tax

[desc-10] [desc-11]

70k A Year Is How Much An Hour Before After Tax Breakdown

https://www.moneyforthemamas.com/wp-content/uploads/2022/06/70000-a-year-is-how-much-an-hour.jpg

How Much Is 87 000 Per Year After Tax

https://salarycalculators.org/wp-content/uploads/2023/06/87000-After-Tax.png

70000 Per Year After Tax - When earning a salary of 70 000 a year you will have a net income of 56 985 a year after federal taxes This comes to a monthly net income of 4 749 Depending on the state you live or work in you may pay additional state income taxes which can reduce your monthly paycheck further to a minimum of 4 513