65000 Per Hour Uk If your salary is 65 000 then after tax and national insurance you will be left with 46 750 This means that after tax you will take home 3 896 every month or 899 per week 179 80 per day and your hourly rate will be 31 25 if you re working 40 hours week Scroll down to see more details about your 65 000 salary

Per hour With an annual salary of 65 000 your net wage per hour will be 24 54 You will pay 7 05 in tax per hour or 52 87 per day Your Class 1 NI contribution will be 2 53 per hour or 18 97 per day leaving you with a net hourly rate of 24 54 for each hour worked equating to 184 06 per day Income For salaries ranging from 242 to 967 per week 1 048 to 4 189 per month the Class 1 rate is 12 For salaries exceeding 967 per week more than 4 189 per month the Class 1 rate is 2 Self Employed If you are self employed you will pay Class 2 and Class 4 National Insurance contributions Class 2 A flat 3 45 per week

65000 Per Hour Uk

65000 Per Hour Uk

https://energyguide.org.uk/wp-content/uploads/2022/10/How-Much-Gas-Does-a-Boiler-Use-Per-Hour-UK.jpg

Mild Steel Lever Type Hydraulic Plate Making Machine Capacity 2500

https://5.imimg.com/data5/SELLER/Default/2021/10/GM/OC/ZN/66131214/lever-type-hydraulic-plate-making-machine-500x500.jpg

Vinpack System Plain L Sealer For Shrink Wrapping Capacity 500 1000

https://5.imimg.com/data5/SELLER/Default/2020/12/PB/HH/OX/3117036/plain-l-sealer--500x500.jpeg

Hourly Wage Tax Calculator 2023 24 The Hourly Wage Tax Calculator uses tax information from the tax year 2023 2024 to show you take home pay See where that hard earned money goes with UK income tax National Insurance student loan and pension deductions More information about the calculations performed is available on the page The Salary Calculator has been updated with the latest tax rates which take effect from April 2024 Try out the take home calculator choose the 2024 25 tax year and see how it affects your take home pay If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by

On a 65 000 salary your take home pay will be 45 738 after tax and National Insurance This equates to 3 811 per month and 880 per week If you work 5 days per week this is 176 per day or 22 per hour at 40 hours per week Disclaimer This figure is for guidance only and does not in any way constitute financial advice If your salary is 65 000 then after tax and national insurance your take home net will be 48 257 40 This means that after tax your monthly take home will be 4 021 45 or 928 03 per week 185 61 per day and your hourly rate will be 23 20 if you re working 40 hours week Advanced options

More picture related to 65000 Per Hour Uk

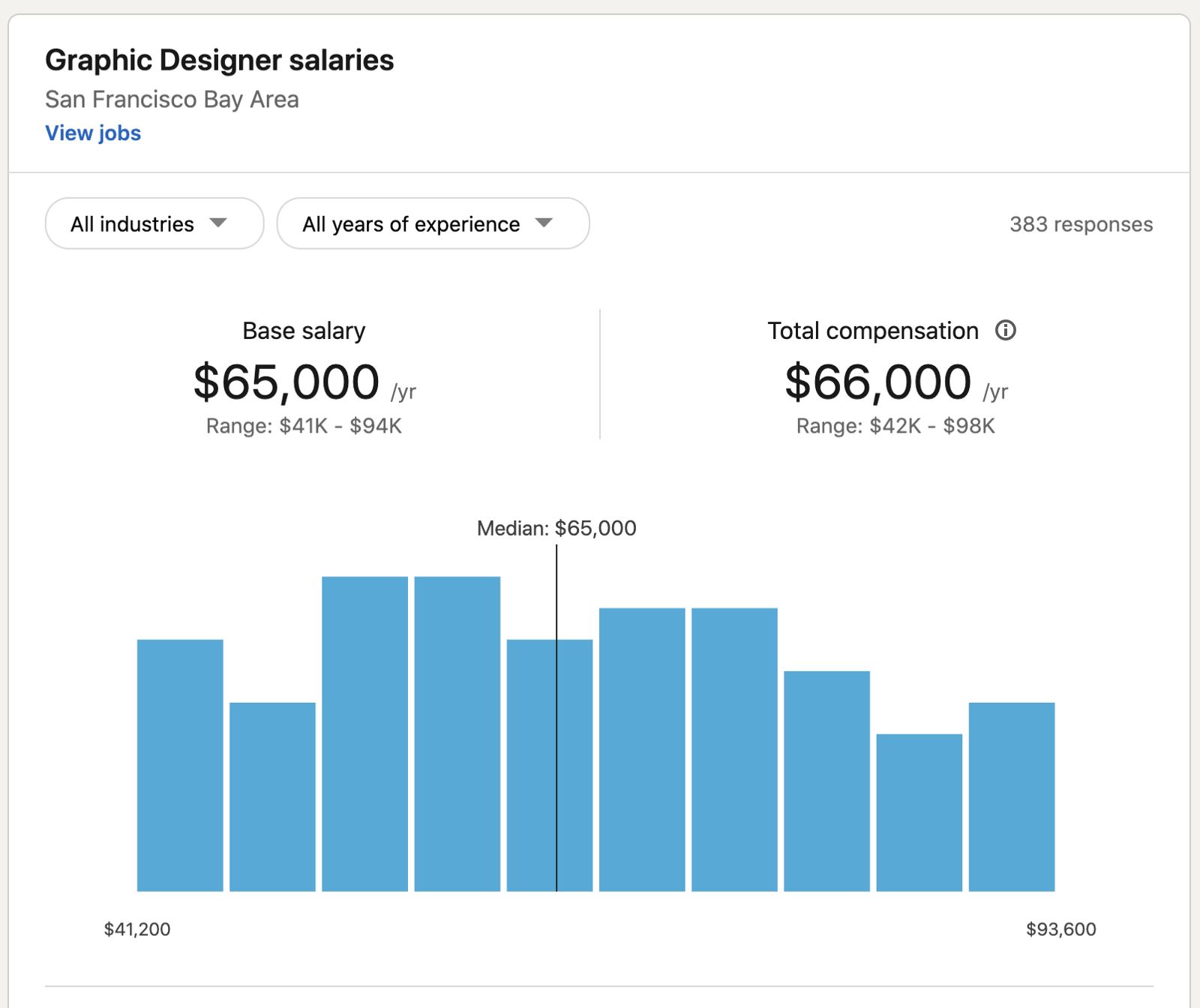

Graphic Designer Salary San Francisco Company Salaries 2023

https://assets-global.website-files.com/5f4bb8e34bc82700bda2f385/5ffcba84744f3e617f0027c6_59zw4xZBGRrSUbjayYm52yE_SzTW2L1pBwY3tLIWPfv2-NvIO4f0HKk0sNrY52laDt-sJLCUtJmn03cfXK10YMwBFnztU8LhBBbWr2jaaA7DbF-Ch-7ccEM6WEauIfBCuQsv3zLo.png

Hourly Rate For 65000 Salary SyedaGustavs

https://static.zippia.com/answer-images/65000-a-year-is-how-much-an-hour.png

40 Miles Per Hour Speed Limit Road Sign UK Stock Photo Alamy

https://c8.alamy.com/comp/EHC76M/40-miles-per-hour-speed-limit-road-sign-uk-EHC76M.jpg

In the year 2024 in the United Kingdom 65 000 a year gross salary after tax is 46 075 annual 3 840 monthly 883 05 weekly 176 61 daily and 22 08 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 65 000 a year after tax in the United Kingdom Yearly How much tax do I pay on 65 000 salary UK In the tax year 2024 25 if your annual salary is 65 000 and you re an employee you ll pay 16 742 60 in tax and National Insurance and earn 48 257 40 after tax

Summary If you make 65 000 a year living in United Kingdom you will be taxed 18 902 That means that your net pay will be 46 098 per year or 3 841 per month Your average tax rate is 29 1 and your marginal tax rate is 43 3 This marginal tax rate means that your immediate additional income will be taxed at this rate If you make 65 000 a Year your hourly salary would be 33 78 This calculation is based on the assumption that 52 working weeks per year and you work 37 hours a week If you were paid once a month your paycheck would be 5416 67 If you were paid once every two weeks your paycheck would be 2500 00 Assuming 50 working weeks per year

Electric Stainless Steel Single Head Liquid Filling Machine Capacity

https://5.imimg.com/data5/HS/GQ/OC/SELLER-8357685/single-head-liquid-filling-machine-500x500-500x500.jpg

30 Mile Per Hour Road Sign England UK Stock Photo Alamy

https://c8.alamy.com/comp/EKPJRP/30-mile-per-hour-road-sign-england-uk-EKPJRP.jpg

65000 Per Hour Uk - If your salary is 45 000 a year you ll take home 2 851 every month You ll pay 6 486 in tax 4 297 in National Insurance and your yearly take home will be 34 217 Your gross hourly rate will be 21 63 if you re working 40 hours per week Please see the table below for a more detailed break down Salary