50000 Per Hour Uk With an annual salary of 50 000 your net wage per hour will be 19 96 You will pay 3 93 in tax per hour or 29 47 per day Your Class 1 NI contribution will be 2 36 per hour or 17 68 per day leaving you with a net hourly rate of 19 96 for each hour worked equating to 149 71 per day Income

If you were paid once a month your paycheck would be 1603 33 If you were paid once every two weeks your paycheck would be 740 00 Assuming 50 working weeks per year if your hourly salary is 10 your yearly salary would be 19 240 The formula for the salary calculator Yearly salary 52 weeks 37 hours a week 50 000 a year is how much per hour If you earn 50 000 per year your hourly wage works out as being 24 04 per hour In addition your monthly pre tax wage would be 4 166 67 and your weekly pay would be 961 54 Salary comparisons for the US and UK Our salary to hourly rate calculator includes median pay figures for US and UK workers

50000 Per Hour Uk

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/7FOI7NS2QJEB3OEECQMTJGQ5HA.jpg)

50000 Per Hour Uk

https://thenational-the-national-prod.cdn.arcpublishing.com/resizer/m3Ifa_JI19DxUByPkQQQXEsqi08=/1440x810/filters:format(jpg):quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/7FOI7NS2QJEB3OEECQMTJGQ5HA.jpg

How tax cuts will affect your monthly salary revealed | The Sun

https://www.thesun.co.uk/wp-content/uploads/2022/09/DD-OFF-PLATFORM-TAX-CUT-SAVINGS.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

David Cameron 'to earn £1.5m from memoirs and £50,000 per hour giving after dinner talks' | The Independent | The Independent

https://static.independent.co.uk/s3fs-public/thumbnails/image/2016/07/13/13/david-cameron.jpg?width=1200

For salaries ranging from 242 to 967 per week 1 048 to 4 189 per month the Class 1 rate is 12 For salaries exceeding 967 per week more than 4 189 per month the Class 1 rate is 2 Self Employed If you are self employed you will pay Class 2 and Class 4 National Insurance contributions Class 2 A flat 3 45 per week Trying to compare jobs where everyone quotes different salaries or wages Convert any salary wage amount to hourly daily weekly monthly or annual amounts plus overtime rates

Enter your pay per hour in the calculator and the number of hours you work per week The hourly wage calculator UK will work out your annual salary take home pay Tax Free Allowance Taxable Income National Insurance and Income Tax Calculate your hourly wage here This calculator is intended only as a guide and uses normal UK tax and NI If your income is 50 000 per year then your hourly wage stands at 24 05 per hour This computation is derived from multiplying your foundational salary by the total number of hours weeks and months you dedicate to work in a year presuming a standard 40 hour workweek

More picture related to 50000 Per Hour Uk

Top 10 highest paying jobs in UK 2021| Which jobs pay well in UK? Jobs that pay well in the UK 2021 - YouTube

https://i.ytimg.com/vi/bk6RMyluQWE/maxresdefault.jpg

The jobs paying £60,000 a year that you DON'T need a degree for | The Sun

https://www.thesun.co.uk/wp-content/uploads/2022/01/RW-COMP-MONEY-HIGHEST-PAYING-JOBSv2.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

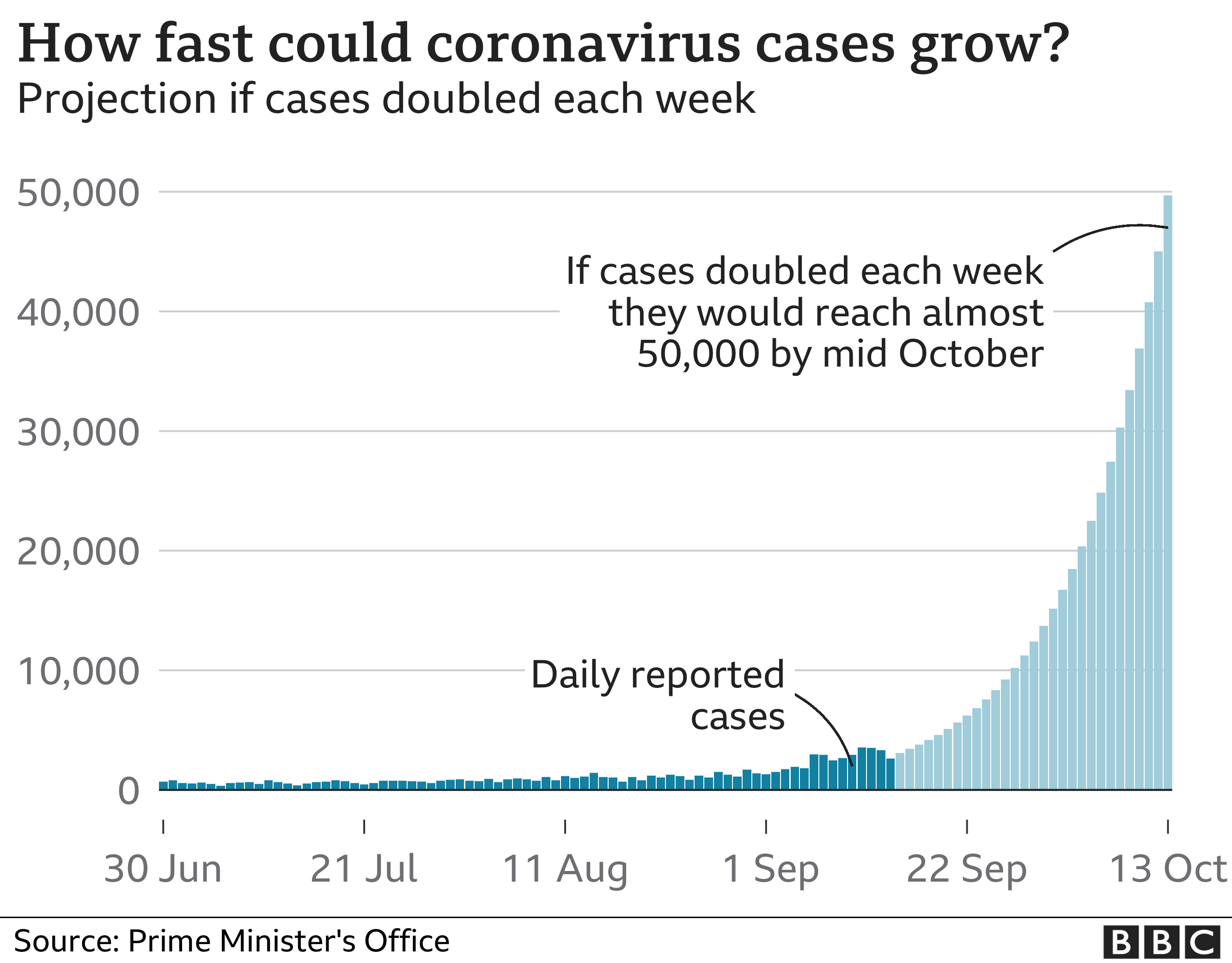

Covid-19: UK could face 50,000 cases a day by October without action - Vallance - BBC News

https://ichef.bbci.co.uk/news/640/cpsprodpb/A0EA/production/_114549114_optimised-exponential_cases_chart_21sep-nc.png

John earns 50 000 per year working 40 hours per week and works 48 weeks per year after holidays We can calculate his hourly wage by filling in the formula Hourly Pay 50 000 40 x 48 Hourly Pay 50 000 1920 Hourly Pay 26 04 Hour You now know how to calculate your hourly wage from your yearly salary If you make 50 000 a Year your hourly salary would be 25 99 This calculation is based on the assumption that 52 working weeks per year and you work 37 hours a week If you were paid once a month your paycheck would be 4166 67 If you were paid once every two weeks your paycheck would be 1923 08

Enter your current Hourly salary or the first Hourly salary you want to compare Enter the tax year you want to use the default is 2024 on this salary calculator Choose the number of comparisons you want to make upto a maximum of 5 so you can compare upto 6 Hourly salary after tax calculations in one simple salary calculation If your salary is 50 000 then after tax and national insurance you will be left with 38 022 This means that after tax you will take home 3 169 every month or 731 per week 146 20 per day and your hourly rate will be 24 05 if you re working 40 hours week Scroll down to see more details about your 50 000 salary

🇬🇧 UK Free Work Visa 2022-2023 | UK Visa | UK Tier 2 Visa | Skilled Worker Visa | UK Immigration 🇬🇧 - YouTube

https://i.ytimg.com/vi/nOa_2dPrewA/maxresdefault.jpg

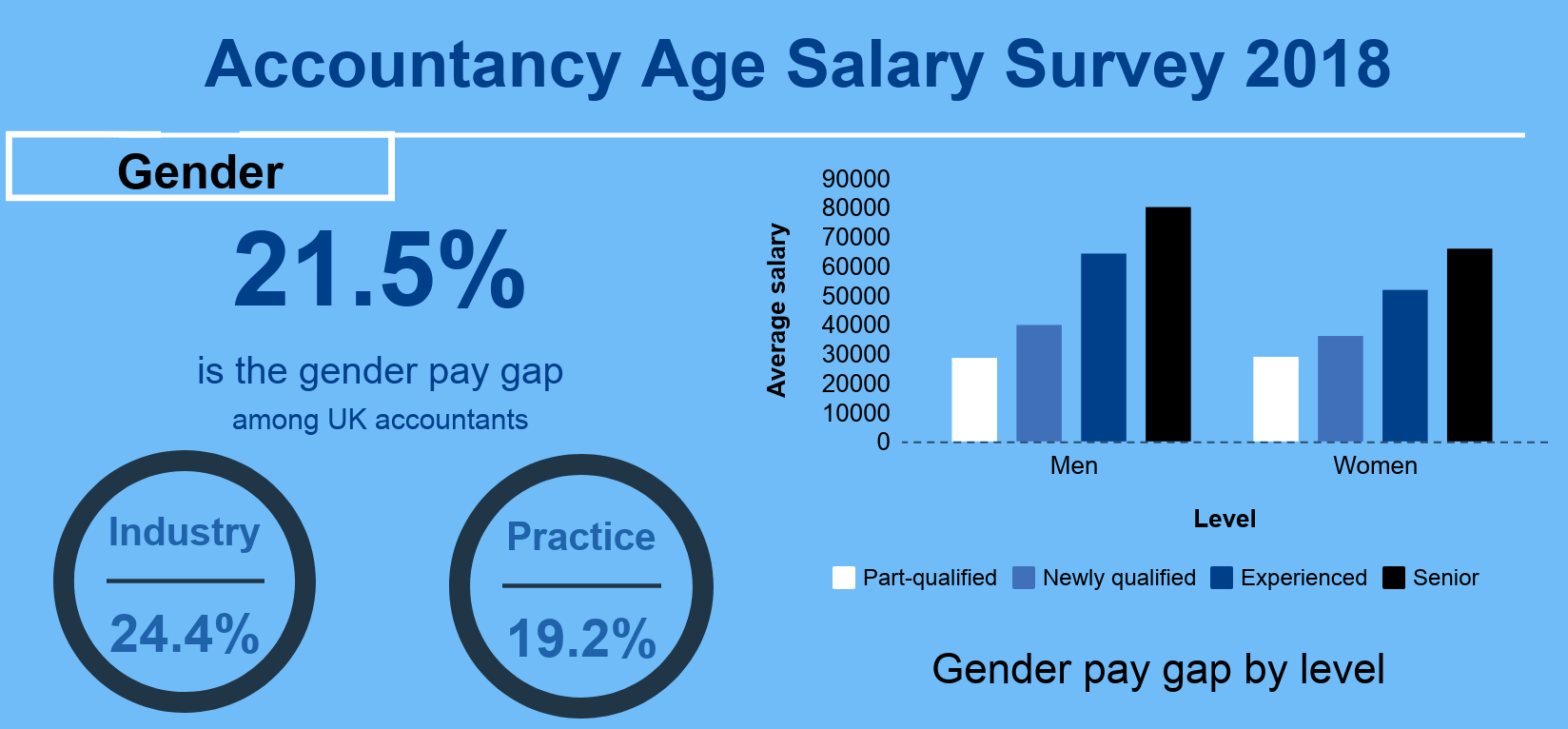

Salary Survey 2018: what are UK accountants earning right now? - Accountancy Age

https://www.accountancyage.com/wp-content/uploads/2018/04/Accountancy-Age-Salary-Survey-infographic-Copy-2.png

50000 Per Hour Uk - For salaries ranging from 242 to 967 per week 1 048 to 4 189 per month the Class 1 rate is 12 For salaries exceeding 967 per week more than 4 189 per month the Class 1 rate is 2 Self Employed If you are self employed you will pay Class 2 and Class 4 National Insurance contributions Class 2 A flat 3 45 per week