50000 Per Hour After Tax Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Hourly wage Hourly wage Hours worked per day Days worked per week Weeks worked per year Your weekly paycheck Step 2 Federal income tax liability There are four substeps to take to work out your total federal taxes Step 2 1 Gross income adjusted The formula is Gross income Pre tax deductions Gross income adjusted To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get

50000 Per Hour After Tax

50000 Per Hour After Tax

https://radicalfire.com/wp-content/uploads/2021/08/50000-Per-Year-Is-How-Much-An-Hour-Your-Guide-To-Hourly-Salary.jpg

25 Dollars An Hour Is How Much A Year How To Discuss

https://moneybliss.org/wp-content/uploads/2021/09/25-per-hour-is-how-much-per-year.jpg

Cognition Reflecting On Things Behind The Light

https://martinborchjensen.files.wordpress.com/2014/07/modified-caacofsci-2-from-wikipedia.jpg

Estimate the after tax pay for hourly employees by entering the following information into a hourly paycheck calculator Hourly rate Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

In the year 2024 in the United States 50 000 a year gross salary after tax is 41 935 annual 3 176 monthly 730 38 weekly 146 08 daily and 18 26 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 50 000 a year after tax in the United States Yearly Monthly payments per year 12 Biweekly payments per year 26 Working weeks per year 52 Working days per week 5 Working hours per week 40 0 Show Taxes Monthly Gross Income 5 781 69 368 2 668 1 334 266 80 33 35 Tax Due 1 244 which is around 4 537 a month after taxes and contributions depending on where you live However

More picture related to 50000 Per Hour After Tax

How Much Hourly Is 50000 A Year HOW MUCH VGR

https://i2.wp.com/mrsdaakustudio.com/wp-content/uploads/2021/05/50000-a-year-is-how-much-an-hour.png

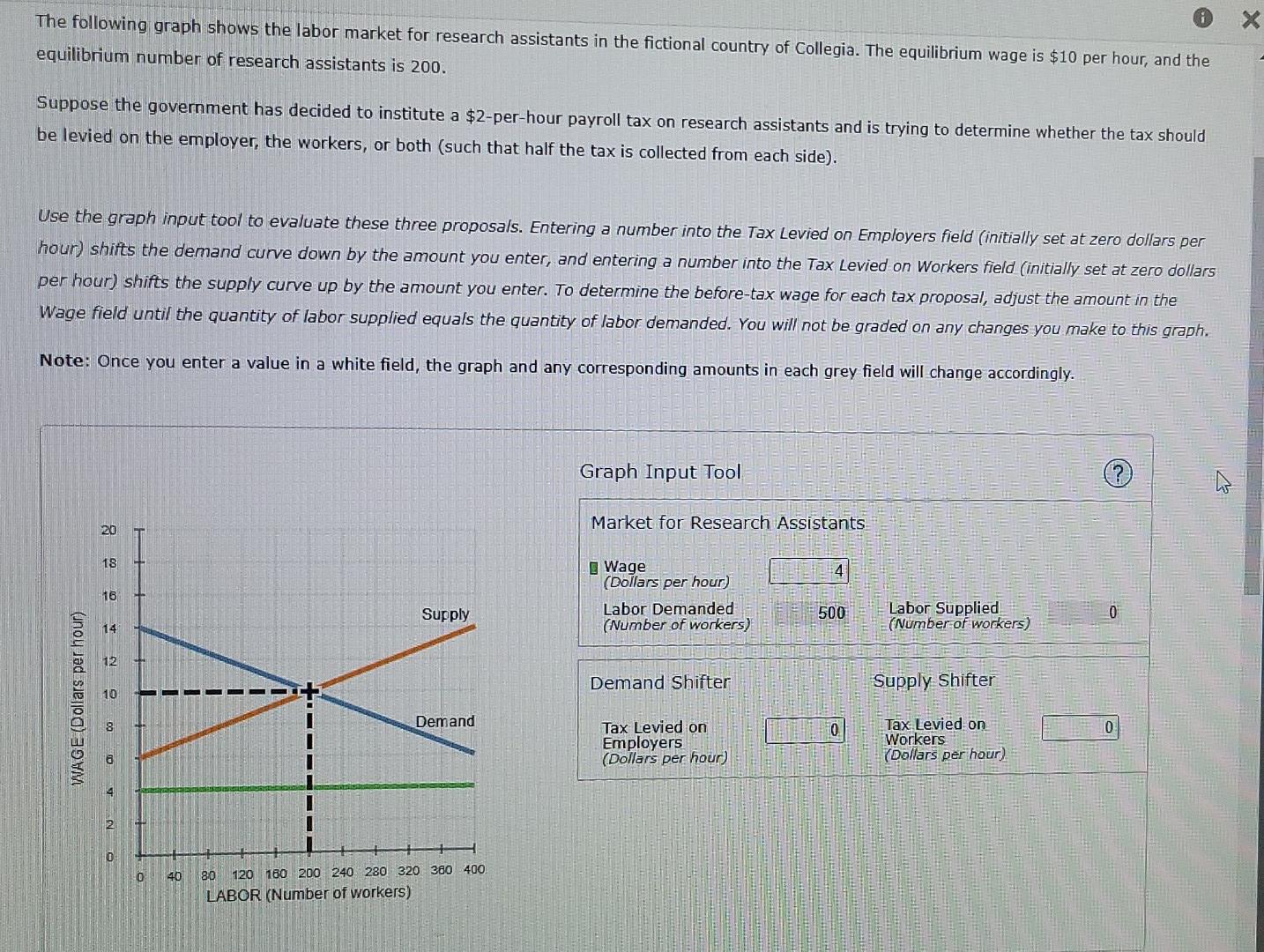

Solved The Following Graph Shows The Labor Market For Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/51a/51a5b0b1-3659-40c0-86aa-1a47a4c0f9df/phpC6jZ7J.png

Teach English In Hoi An Impact Teaching

https://www.impact-teaching.com/wp-content/uploads/2022/04/Hoi-An-3-800x533.jpg

An individual who receives 39 715 25 net salary after taxes is paid 50 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security We then provide a periodic breakdown of this calculated figures so you can see how much each deduction is per year per month per week per day and per hour etc Total Estimated Taxes 8 065 Subtracting the 8 065 in taxes from the 50 000 gross salary gives you a 41 935 Net Income for the year 41 935 Net Income 2 080 hours 20 16 per hour after taxes So for a typical single filer a 50 000 salary equates to approximately 24 per hour before taxes and 20 per hour after taxes are deducted

After Tax If your salary is 50 000 then after tax and national insurance you will be left with 38 022 This means that after tax you will take home 3 169 every month or 731 per week 146 20 per day and your hourly rate will be 24 05 if you re working 40 hours week Scroll down to see more details about your 50 000 salary Use SmartAsset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes Overview of Maryland Taxes Maryland has a progressive income tax system with rates that range from 2 00 to 5 75

Solved The Following Graph Shows The Labor Market For Chegg

https://media.cheggcdn.com/study/16b/16b200ce-4736-486b-8f98-1b3dafc34ff5/image

50000 A Year Is How Much An Hour Is 50K A Year Good Money Bliss

https://moneybliss.org/wp-content/uploads/2021/09/50000-a-year-683x1024.jpg

50000 Per Hour After Tax - In the year 2024 in the United States 50 000 a year gross salary after tax is 41 935 annual 3 176 monthly 730 38 weekly 146 08 daily and 18 26 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 50 000 a year after tax in the United States Yearly