401k Employer Match Rules 2023 Total employee and employer contributions including forfeitures the lesser of 100 of an employee s compensation or 66 000 for 2023 61 000 for 2022 58 000 for 2021 not including catch up elective deferrals of 7 500 in 2023 6 500 in 2021 and 2022 for employees age 50 or older IRC section 415 c

For tax year 2023 filed by April 2024 the contribution limit is 22 500 Savers who are 50 or older can make up to 7 500 in catch up contributions for a total contribution of 30 000 Employer Match Does Not Count Toward the 401 k Limit The good news is that these limits do not include employer matches What companies offer the best employer match According to Ocho when looking at the companies with the best employer matches in 2023 some companies offer up to 25 of compensation

401k Employer Match Rules 2023

401k Employer Match Rules 2023

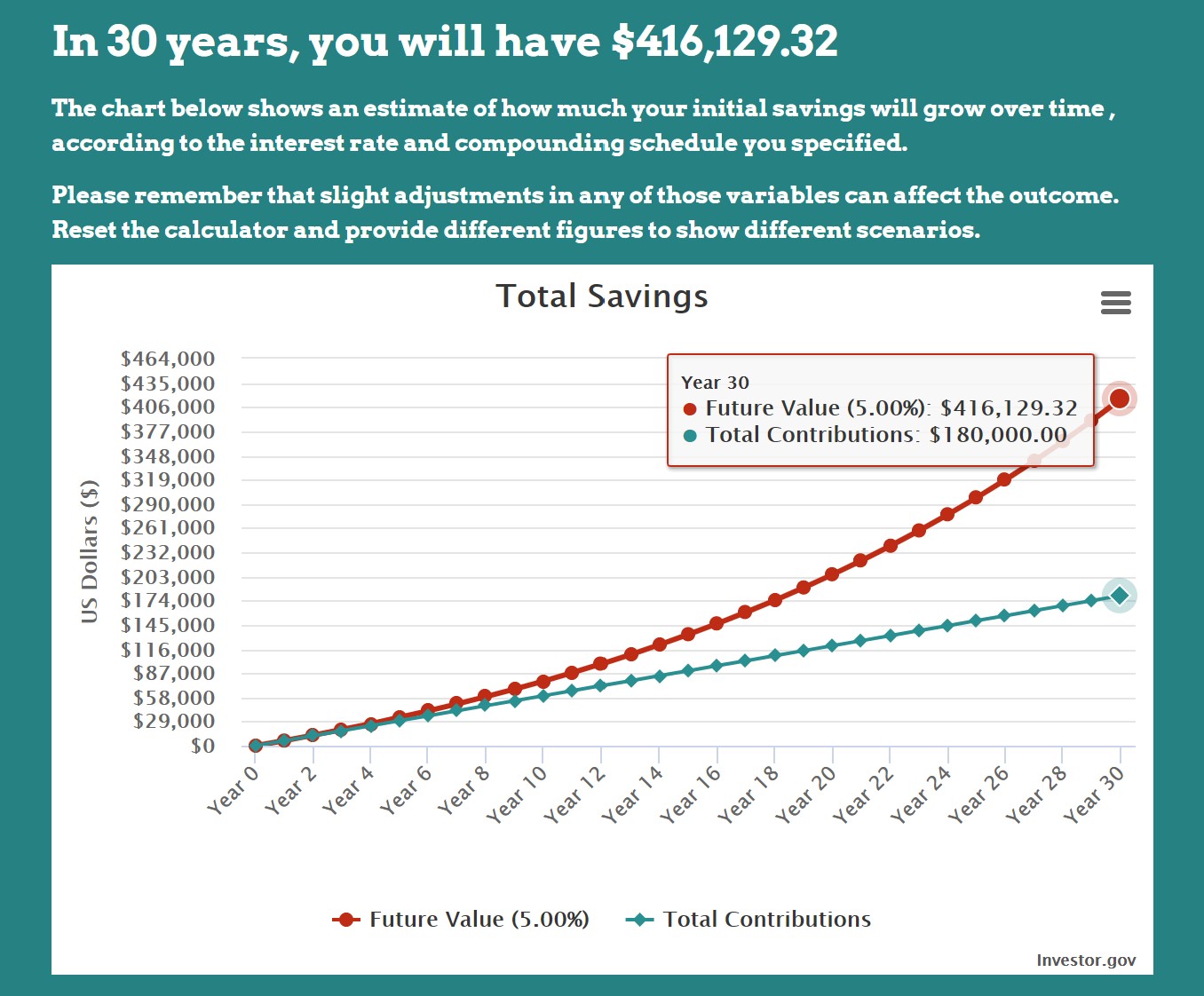

http://static1.squarespace.com/static/5c101a4e7c9327fdf174b93b/t/5d41a5796761e800017015e3/1564583294853/30years_3%25.jpg?format=1500w

Best Guide To 401k For Business Owners 401k Small Business Owner Tips

https://moderawealth.com/wp-content/uploads/2022/02/401k-and-Profit-sharing-illustration-02-1-scaled-1.jpeg

2023 Dcfsa Limits 2023 Calendar

https://www.wexinc.com/wp-content/uploads/2022/05/ContributionLimitsChart_Blog_SupplementalGraphic_2023-1-1024x768.jpg

Generally employees with compensation of 150 000 or more from the employer in the prior year are considered highly compensated for 2023 135 000 for 2022 130 000 for 2021 and for 2020 125 000 for 2019 120 000 for 2015 2016 2017 and 2018 subject to cost of living adjustments The SECURE 2 0 Act passed at the end of 2022 made significant changes to retirement accounts Employers will now have the option to make Roth contributions to their workers Roth 401 k s You

The 401 k contribution limit for 2024 is 23 000 for employee contributions and 69 000 for the combined employee and employer contributions If you re age 50 or older you re eligible for an additional 7 500 in catch up contributions raising your employee contribution limit to 30 500 Highlights of changes for 2023 The contribution limit for employees who participate in 401 k 403 b most 457 plans and the federal government s Thrift Savings Plan is increased to 22 500 up from 20 500 The limit on annual contributions to an IRA increased to 6 500 up from 6 000

More picture related to 401k Employer Match Rules 2023

Does Employer Match Count Towards 401k Limit

https://www.annuityexpertadvice.com/wp-content/uploads/does-employer-match-count-towards-401k-limit.png

What 401 k Employer Match Is And How It Works In 2023

https://www.betterup.com/hs-fs/hubfs/Google Drive Integration/Delivery URL - BetterUp - 401 employer match [ARTICLE].png?width=4000&name=Delivery URL - BetterUp - 401 employer match [ARTICLE].png

What Is The Maximum Employer 401k Contribution For 2020 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/401k-contribution-limits-2020-what-employers-need-to-know.png

401 k Contribution Limits for Highly Compensated Employees Before we explore how restrictions may apply to you here s what you need to know about maximum 401 k contribution rules that apply to all For 2024 a 401 k participant filing single can contribute up to 23 000 up from 22 500 in 2023 Employees age 50 and older can also Employers who start new retirement plans after 2025 would be required under the new bill to automatically enroll workers into 401 k or 403 b plans by 2025 at a rate between 3 and 10 of

The IRS issued guidance on twelve 12 provisions of the SECURE 2 0 Act on December 20 2023 Included in the guidance were details surrounding the ability of an employer to make Roth matching or non elective contributions to their 401 k 403 b or 457 b plan While recordkeepers for qualified retirement plans are still updating their 06 Jun 2023 What is a Safe Harbor 401 k plan What do you have to do to offer one And what do all those acronyms mean Don t worry We ve helped many companies set up compliant 401 k plans and we can walk you through all the basics

401 K Limits 2024 Stefa Emmalynn

https://insights.wjohnsonassociates.com/hubfs/Contribution Limits_BP_Blog_2023_11_1600x900_Over 50.png#keepProtocol

:max_bytes(150000):strip_icc()/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png)

What Is A Safe Harbor 401 k

https://www.thebalancemoney.com/thmb/5U94M-tu0r7GNJapxKsopeJ4hww=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png

401k Employer Match Rules 2023 - The contributions allocated to a 401 k participant account each limitation year are considered annual additions under Internal Revenue Code IRC section 415 For most 401 k plans the limitation year is the same as the plan year Each limitation year annual additions are capped by the 415 limit 69 000 for 2024 7 500