33000 A Year Monthly After Tax How much is 33 000 a Year After Tax in the United States In the year 2024 in the United States 33 000 a year gross salary after tax is 28 275 annual 2 146 monthly 493 52 weekly 98 7 daily and 12 34 hourly gross based on the information provided in the calculator above

Updated on Jul 06 2024 Free paycheck calculator to calculate your hourly and salary income after taxes deductions and exemptions 33 000 annual income x 12 tax rate 3 960 So after taxes you would have approximately 29 040 left as your annual income To calculate your monthly income after taxes you can divide 29 040 by 12 since there are 12 months in a year 29 040 annual income after tax 12 months 2 420

33000 A Year Monthly After Tax

33000 A Year Monthly After Tax

https://savoteur.com/wp-content/uploads/2022/06/33000-a-year-1.jpg

Solved As Of December 31 Of The Current Year Armani Company s

https://www.coursehero.com/qa/attachment/34292297/

Tsp 20 2012 2023 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/100/80/100080475/large.png

What is a 33k after tax 33000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2024 tax return and tax refund calculations 26 308 59 net salary is 33 000 00 gross salary Tax Year 2024 2025 If you live in California and earn a gross annual salary of 69 368 or 5 781 per month your monthly take home pay will be 4 537 This results in an effective tax rate of 22 as estimated by our US salary calculator

Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes 33 000 00 After Tax This income tax calculation for an individual earning a 33 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance

More picture related to 33000 A Year Monthly After Tax

Subscribe To Which Your Consumer Champion

https://join.which.co.uk/assets/hero-car-guide-v3-74414c2ec5995f3fa01c9dce180dc021941948dc9e7be1add3b0dcd5327cdde1.png

How Much Is 33 000 Per Year After Tax

https://salarycalculators.org/wp-content/uploads/2023/06/33000-After-Tax-1.png

33 000 After Tax 2023 2024 Income Tax UK

https://www.income-tax.co.uk/images/33000-after-tax-salary-uk-2020.png

Discover Talent s income tax calculator tool and find out what your paycheck tax deductions will be in USA for the 2024 tax year Federal income tax rates and brackets You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is higher

For example if you get 36 000 a year 3 000 a month from Social Security and have no other income your combined income is 36 000 divided by 2 or 18 000 None of your benefits are taxable if your income is below 25 000 for a single filer or 32 000 for joint filers 33 000 After Tax Explained This is a break down of how your after tax take home pay is calculated on your 33 000 yearly income If you earn 33 000 in a year you will take home 26 462 leaving you with a net income of 2 205 every month

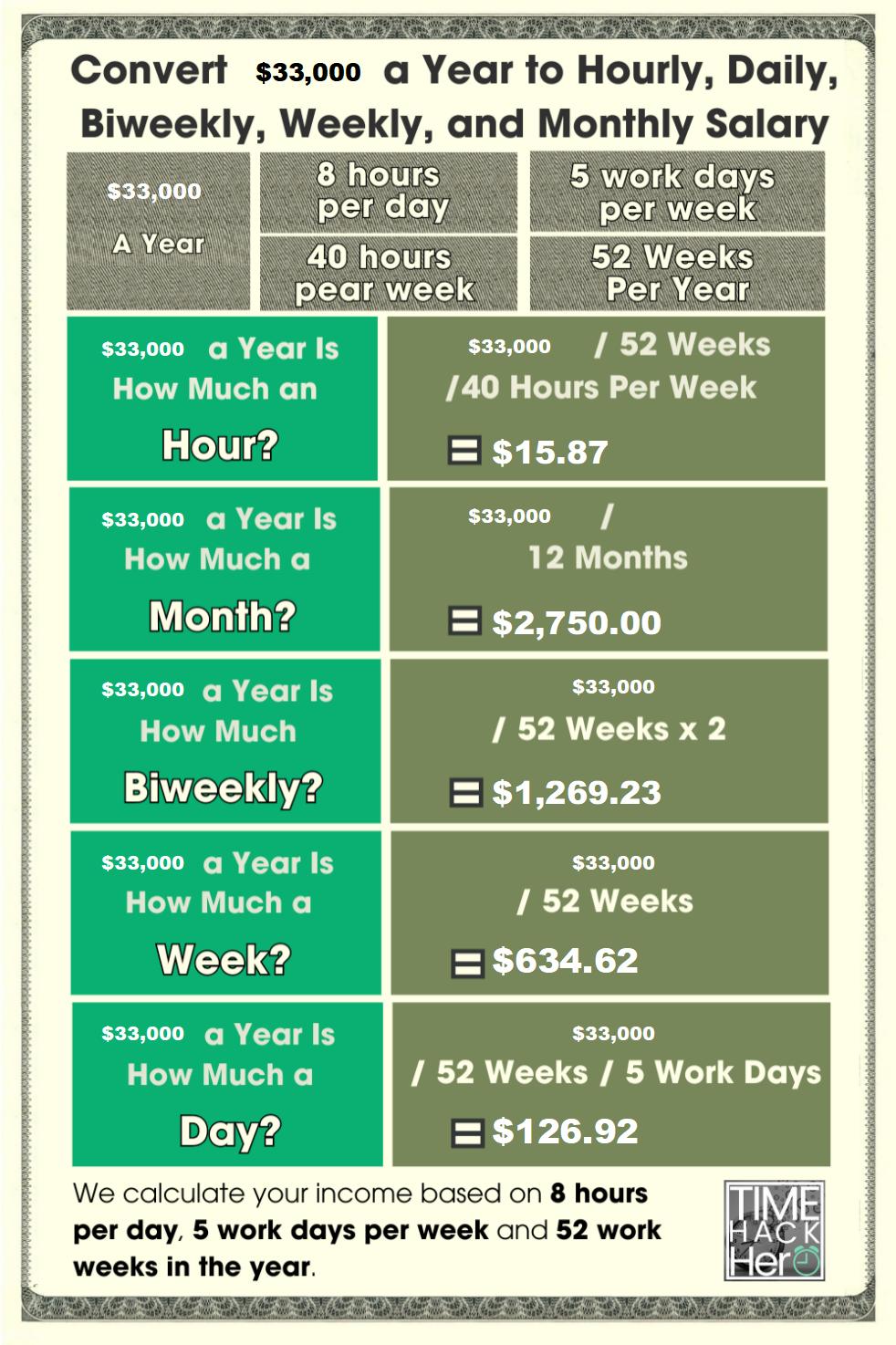

33000 A Year Is How Much An Hour Before And After Taxes

https://timehackhero.com/wp-content/uploads/2023/10/Convert-33000-a-Year-to-Hourly-Daily-Biweekly-Weekly-and-Monthly-Salary.jpg

Mandevilleartistsguild

https://img1.wsimg.com/isteam/stock/9694/:/

33000 A Year Monthly After Tax - Tax Year 2024 2025 If you live in California and earn a gross annual salary of 69 368 or 5 781 per month your monthly take home pay will be 4 537 This results in an effective tax rate of 22 as estimated by our US salary calculator