30000 Hourly Rate After Tax To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2023 tax brackets and the new W 4 which in 2020 has had its first major Take your annual salary and divide it by 2 080 hours Following this formula 30000 annual salary 2 080 working hours per year 14 42 per hour So an annual salary of 30000 breaks down to 14 42 per hour This is the most straightforward way to derive an hourly wage from a known annual salary amount

30000 Hourly Rate After Tax

30000 Hourly Rate After Tax

https://media.cheggcdn.com/media/151/1511f7ee-2ad0-49f1-a79f-4c09aacab27d/image.png

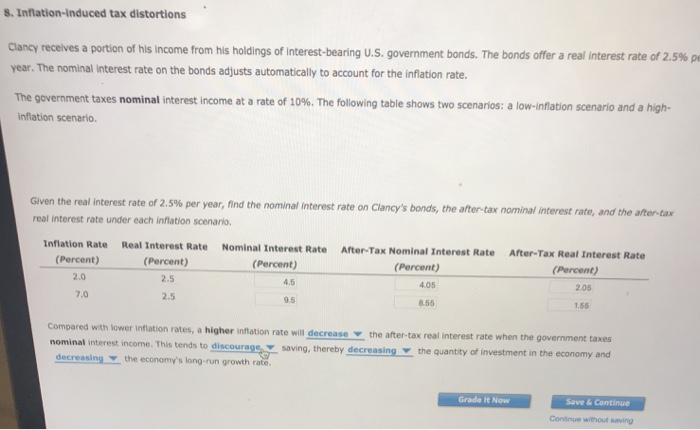

Antonio Receives A Portion Of His Income From His Holdings Of Interest

https://us-static.z-dn.net/files/dff/de0f82760ffa6f86ce0dc52d598e12ed.png

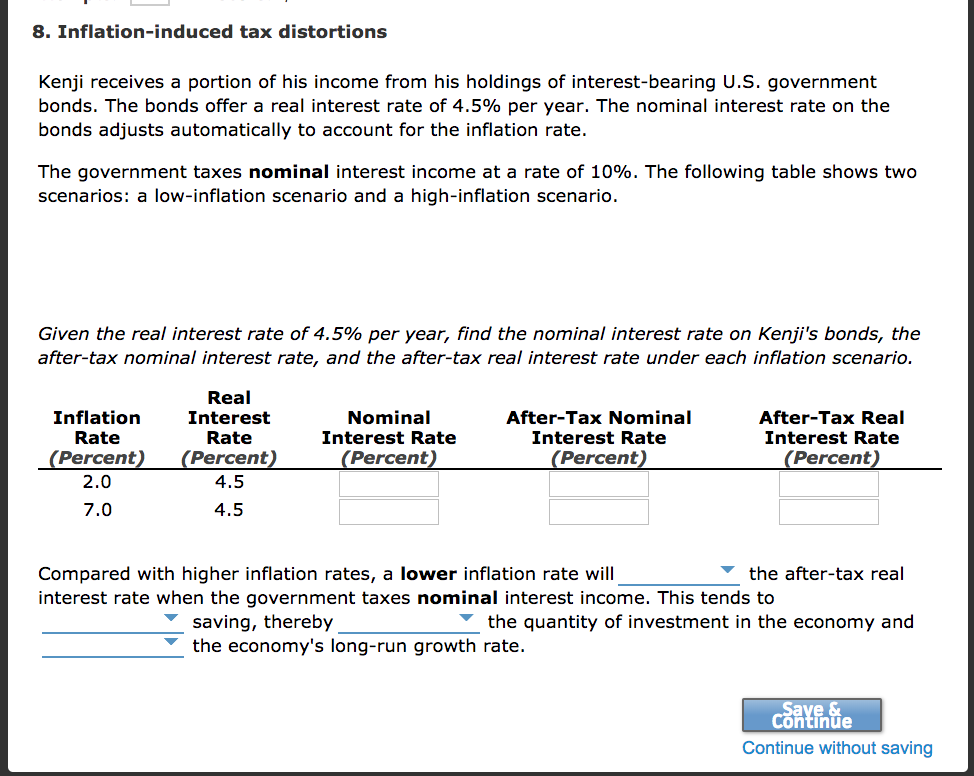

Solved 8 Inflation induced Tax Distortions Kenji Receives A Chegg

https://media.cheggcdn.com/media/655/65574248-fb9c-4912-99da-0a44ee5d1135/phpsDUMB9.png

An individual who receives 24 963 50 net salary after taxes is paid 30 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 30 000 00 salary When analyzing a 30 000 a year after tax salary the associated hourly earnings can be calculated Take home NET hourly income 11 29 assuming a 40 hour work week To answer 30 000 a year is how much an hour divide the annual amount by 2 080 52 weeks 40 hours resulting in an hourly income of 11 29 Is 30 000 a Year a Good Salary

In 2023 the maximum 401 k contribution is 22 500 per individual or 30 000 for those 50 or older These contributions may reduce your taxable income Marginal tax rate Summary If you make 55 000 a year living in the region of New York USA you will be taxed 11 959 That means that your net pay will be 43 041 per year or 3 587 per month Your average tax rate is 21 7 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate

More picture related to 30000 Hourly Rate After Tax

We Promote Case Study Written Assignment Unit 3 WePROMOTE Case

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/c94af724b4ab06b9e84c09bf6d10cafb/thumb_1200_1553.png

https://p3-bk.byteimg.com/tos-cn-i-mlhdmxsy5m/52da4610b8b3482fb0ccaf444bef7ab6~tplv-mlhdmxsy5m-q75:0:0.image

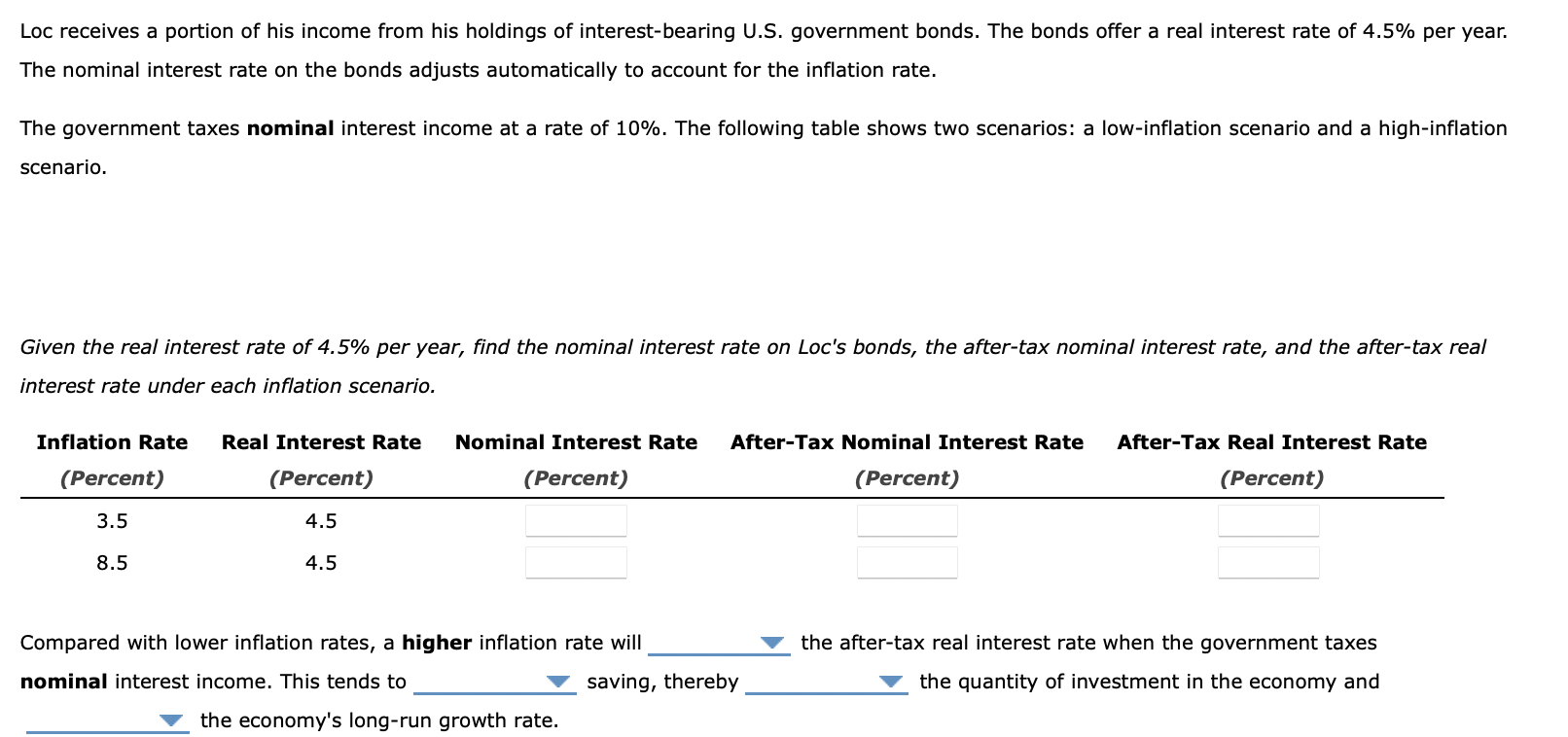

Solved Loc Receives A Portion Of His Income From His Chegg

https://media.cheggcdn.com/media/73f/73f141bc-c88e-40a0-b664-813fafb7e6b1/phpZAsfw7

Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 24 04 per hour Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 28 85 Weekly paycheck to hourly rate 1500 per week 40 hours per week 37 50 per hour Daily wage to hourly rate All features services support prices offers terms and conditions are subject to change without notice Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate

30 000 a year is how much an hour short answer Let s say you work the traditional 40 hr workweek 30 000 52 weeks a year 576 92 a week 40 hours 14 42 an hour If you work 50 hrs a week which would be more typical for a salaried worker 30 000 52 weeks a year 576 92 a week 50 hrs 11 54 an hour The seven federal income tax brackets for 2023 and 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status The seven federal income tax

BUS 5111 Financial Management Written Assignment Unit 3 6 Case

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0d85745aff348129d4f6edb3edcd6874/thumb_1200_1698.png

Hourly Rate For Retail Sales Associate Semashow

https://fm.cnbc.com/applications/cnbc.com/resources/img/editorial/2015/06/02/102726257-463871900.1910x1000.jpg

30000 Hourly Rate After Tax - When analyzing a 30 000 a year after tax salary the associated hourly earnings can be calculated Take home NET hourly income 11 29 assuming a 40 hour work week To answer 30 000 a year is how much an hour divide the annual amount by 2 080 52 weeks 40 hours resulting in an hourly income of 11 29 Is 30 000 a Year a Good Salary