30 Per Hour Monthly Salary After Taxes The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the U S Updated on Jul 06 2024 Free paycheck calculator to calculate your hourly and salary income after taxes deductions and exemptions

30 Per Hour Monthly Salary After Taxes

30 Per Hour Monthly Salary After Taxes

https://financeoverfifty.com/wp-content/uploads/2022/01/18-an-hour-comparison-table-1.png

Salary calculator Germany: this is how much net income you will earn | SiB

https://www.settle-in-berlin.com/wp-content/uploads/2022/05/Gross-to-Net-salary-in-Germany.jpg

How To Calculate Gross Weekly, Yearly And Monthly Salary, Earnings Or Pay From Hourly Pay Rate - YouTube

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

The best free online tool paycheck tax calculator calculates the take home net pay after deducting taxes from your gross hourly wages and salary in all states For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 How do I calculate taxes from paycheck Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W 4

Use SmartAsset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes Calculate your take home pay per paycheck for both salary and hourly employees using Forbes Advisor s paycheck calculator

More picture related to 30 Per Hour Monthly Salary After Taxes

30 an Hour Is How Much a Year? » Savoteur

https://haveyourdollarsmakesense.com/wp-content/uploads/2022/06/30anhourishowmuchayear.jpg

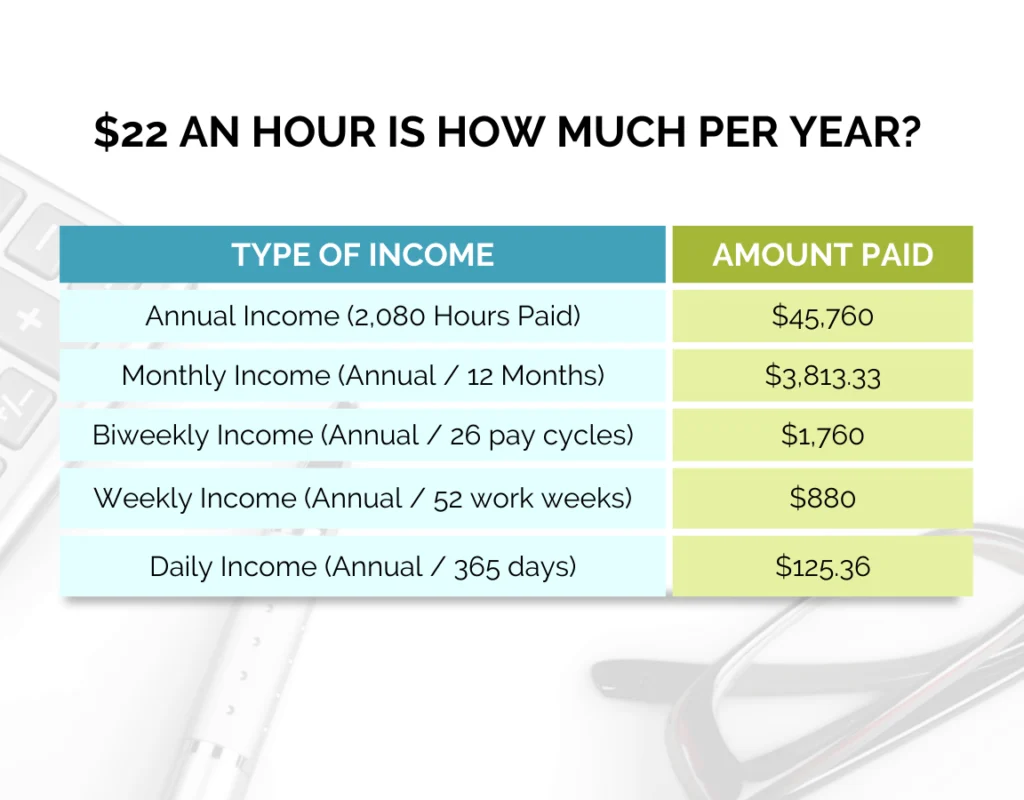

$22 an Hour is How Much a Year? | How To FIRE

https://www.howtofire.com/wp-content/uploads/22-an-hour-salary-1024x800.png.webp

How to Calculate Net Pay | Step-by-step Example

https://www.patriotsoftware.com/wp-content/uploads/2018/05/how-to-calculate-net-pay-1.png

An hourly calculator lets you enter the hours you worked and amount earned per hour and calculate your net pay paycheck amount after taxes You will see what federal and state taxes were deducted based on the information entered You can use this tool to see how changing your paycheck affects your tax results Tax Year 2024 2025 If you live in California and earn a gross annual salary of 69 368 or 5 781 per month your monthly take home pay will be 4 537 This results in an effective tax rate of 22 as estimated by our US salary calculator

Use SmartAsset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes Types of salaries in this hourly to salary calc Hourly pay is probably the most popular type of payroll worldwide however we d still love to know what our income will be during a more extended period of time Our payroll calculator allows you to calculate the amount of money you earn

$30 an Hour is How Much a Year? - SpendMeNot

https://spendmenot.com/wp-content/uploads/2022/05/30-an-Hour-is-How-Much-a-Year.jpg

Paycheck Calculator for $100,000 Salary: What Is My Take-Home Pay?

https://i.insider.com/5e613c58fee23d33111dd372?width=1000&format=jpeg&auto=webp

30 Per Hour Monthly Salary After Taxes - Hourly to Salary calculation In order to convert an hourly rate to salary you need to first enter your hourly pay and an average number of hours per week that you bill Then you need to enter things that will allow us to estimate an equivalent weekly monthly and yearly salary the number of working days per week the number of days that we should subtract due to official holidays as well