14 Per Hour Annual Salary After Tax The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page Hourly Wage

1 Pretax deductions withheld These are the deductions to be withheld from the employee s salary by their employer before the salary can be paid out including 401k the employee s share of the health insurance premium health savings account HSA deductions child support payments union and uniform dues etc 2 Deductions not withheld 14 per hour is 2 240 per month Biweekly salary 14 per hour is 1 120 biweekly Weekly salary 14 per hour is 560 per week Daily salary 14 per hour is 112 per day Salary after taxes 14 hr is 21 840 a year after taxes You may be wondering if 14 an hour is enough money to pay the bills However a lot of it comes down to where you reside

14 Per Hour Annual Salary After Tax

14 Per Hour Annual Salary After Tax

http://budgetandbillz.com/wp-content/uploads/2022/03/10-an-Hour-is-How-Much-a-Year.jpg

How Much Do Zoologist Make An Hour MudFooted

https://img.mudfooted.com/how-much-do-zoologist-make-an-hour-.jpg

How Much Does A Zoologist Make An Hour MudFooted

https://img.mudfooted.com/how-much-does-a-zoologist-make-an-hour-.jpg

If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status How Much Is 14 per Hour Annual Salary Before Taxes Let s get the basics right assuming that you re working full time and the typical 40 hours per week Also not taking any days off Here s how you calculate your 52 weeks x 40 hours 2 080 hours 2 080 hours x 14 29 120 annual salary

How to Calculate Hourly Pay Estimate the after tax pay for hourly employees by entering the following information into a hourly paycheck calculator Hourly rate For example if an employee makes 25 per hour and works 40 hours per week the annual salary is 25 x 40 x 52 52 000 Important Note on the Hourly Paycheck Calculator With estimated taxes you need to pay taxes quarterly based on how much you expect to make over the course of the year The payment dates for Massachusetts estimated taxes are April 15 June 15 Sep 15 and Jan 15

More picture related to 14 Per Hour Annual Salary After Tax

25 An Hour Is How Much A Year Can I Live On It Money Bliss

https://moneybliss.org/wp-content/uploads/2021/09/25-per-hour-is-how-much-per-year.jpg

16 An Hour Is How Much A Year Frugal Mom Boss

https://frugalmomboss.com/wp-content/uploads/2023/02/16-an-hour-is-how-much-a-year-salary-720x720.jpg

Annual Salary To Hourly Income Conversion Calculator

https://calculator.me/img/salary-raise.png

14 An Hour Is How Much A Year After Taxes Factoring in Federal Income Tax Considering State Income Tax Factoring in Local Taxes Accounting for FICA Taxes Social Security Medicare Total Estimated Tax Payments Calculating Your Take Home Pay Convert 14 Per Hour to Yearly Monthly Biweekly and Weekly Salary After Taxes 14 hourly is how much per year If you make 14 per hour your Yearly salary would be 29 120 This result is obtained by multiplying your base salary by the amount of hours week and months you work in a year assuming you work 40 hours a week People also ask How much tax do I pay if I make 14 per hour

For someone with an income of 30 per hour the annual salary is 62 400 assuming 40 weekly working hours We can use the following formula for the total yearly pay to calculate it Annual salary Hours per week Weeks per year Hourly wage Annual salary 40 hrs week 52 weeks yr 30 hr Annual salary 62 400 yr Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week

30 An Hour Is How Much A Year Is It Enough Freedomeer

https://freedomeer.com/wp-content/uploads/2022/08/30-dollars-an-hour-featured.png

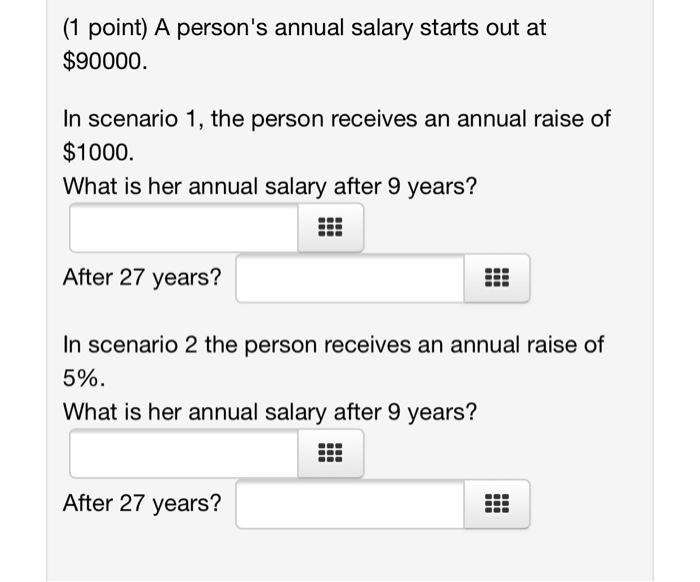

Solved 1 Point A Person s Annual Salary Starts Out At Chegg

https://media.cheggcdn.com/study/226/2268ad54-32a7-408a-a1b1-780864f9fcc6/image

14 Per Hour Annual Salary After Tax - A 14 an hour rate equals a gross annual income of approximately 29 120 if you work a 40 hour week for 52 weeks a year