12 Per Hour Monthly Salary Uk After Tax Hourly Wage Tax Calculator 2023 24 The Hourly Wage Tax Calculator uses tax information from the tax year 2023 2024 to show you take home pay See where that hard earned money goes with UK income tax National Insurance student loan and pension deductions More information about the calculations performed is available on the page

Update for UK tax year from 2024 April Calculate and visualize your Take Home Pay using the salary calculator considering income tax national insurance and more Updated for 2024 2025 tax year My Pay Calculator Menu If your adjusted net income exceeds 60 000 per year you may be subject to the High Income Child Benefit Charge After Tax If your salary is 40 000 then after tax and national insurance you will be left with 31 222 This means that after tax you will take home 2 602 every month or 600 per week 120 00 per day and your hourly rate will be 19 23 if you re working 40 hours week Scroll down to see more details about your 40 000 salary

12 Per Hour Monthly Salary Uk After Tax

12 Per Hour Monthly Salary Uk After Tax

https://i.ytimg.com/vi/yLfNO3atxa4/maxresdefault.jpg

12 Per Hour Annual Salary Before After Taxes Budget Billz

https://budgetandbillz.com/wp-content/uploads/2022/03/12-an-Hour-is-How-Much-a-Year-1536x864.jpg

Minimum Wage In US Nebraska Among States That Voted For Higher Rate

https://d.ibtimes.com/en/full/3198288/efforst-raise-us-minimum-wage-15-hour-have-not-advanced-congress-more-companies-are-still.jpg

The Salary Calculator has been updated with the latest tax rates which take effect from April 2024 Try out the take home calculator choose the 2024 25 tax year and see how it affects your take home pay If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by Calculate your salary after tax in the UK in just a few clicks salaryafter tax Salary After Tax Home Monthly payments per year 12 Biweekly payments per year 52 Working days per week 5 Working hours per week 37 5 Show Taxes Monthly Gross Income 2 934 35 204 1 354 677 135 40 18 05 Tax Due 528

UK Take Home Salary Calculator Take Home Salary Calculator provides accurate insights into your monthly take home pay or annual earnings factoring in UK Tax National Insurance and Student Loan deductions Utilizing the most up to date budget information from April 2023 the calculator offers a comprehensive overview of your financial details About SalaryBot Use SalaryBot s salary calculator to work out tax deductions and allowances on your wage The results are broken down into yearly monthly weekly daily and hourly wages To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which

More picture related to 12 Per Hour Monthly Salary Uk After Tax

60 000 After Tax 2023 2024 Income Tax UK

https://www.income-tax.co.uk/images/60000-after-tax-salary-uk-2020.png

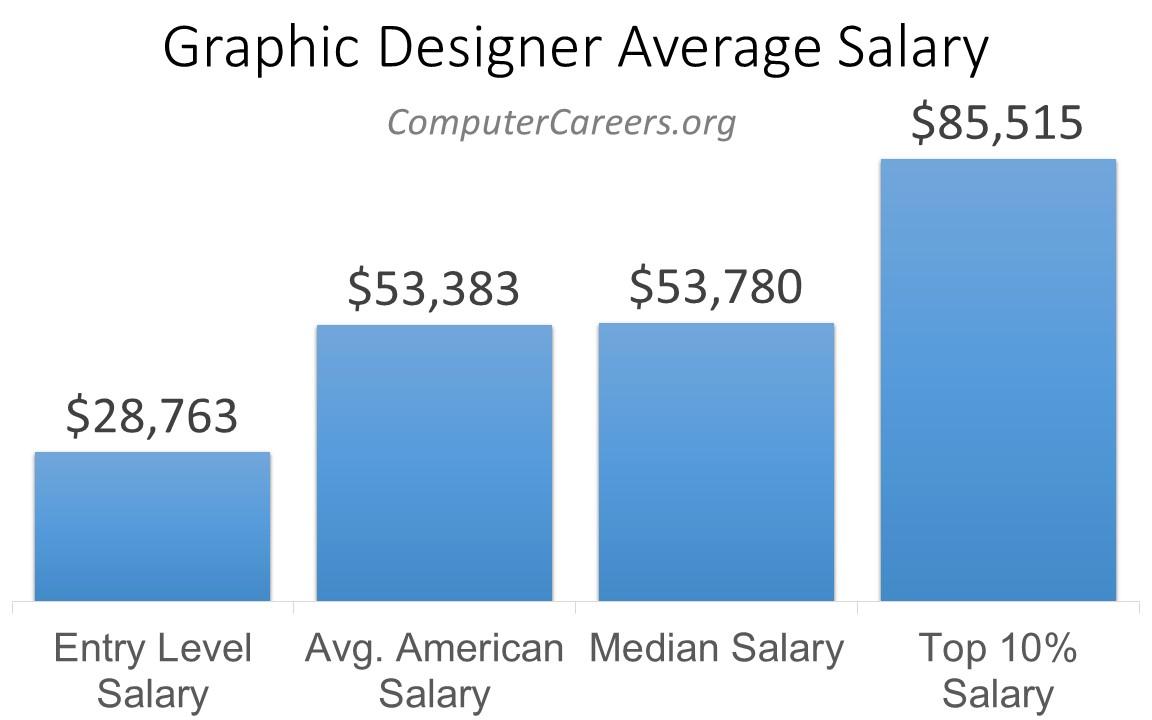

Graphic Designer Salary In 2023 ComputerCareers

https://cdn.computercareers.org/wp-content/uploads/Graphic-Designer-Average-Salary.jpg

Annual Salary To Hourly Income Conversion Calculator

https://calculator.me/img/salary-raise.png

The latest figures for April 2023 2024 are now accessible providing you with the most current data Utilize our Take Home Salary Calculator to determine your salary after taxes For example a salary of 30 000 a year is about 24 424 after tax in the UK for a resident full year You will have to pay about 19 of your salary in taxes and For salaries ranging from 242 to 967 per week 1 048 to 4 189 per month the Class 1 rate is 12 For salaries exceeding 967 per week more than 4 189 per month the Class 1 rate is 2 Self Employed If you are self employed you will pay Class 2 and Class 4 National Insurance contributions Class 2 A flat 3 45 per week

About SalaryBot salary after tax Contact Blog Calculates your gross and net salary income tax national insurance student loan pension contribution and allowances in 2024 2025 Now includes part time salary calculator The 2024 Hourly Rate Tax Calculator calculates your take home pay based on your Hourly Salary Calculate your Hourly take home pay based of your Hourly salary to see full calculations for Pay As You Earn PAYE National Insurance Contributions NICs Employer National Insurance Contributions ENICs Pension Dividend tax etc for 2023 24

2080 Calculate Salary GurmareMeggan

https://buddypunch.com/wp-content/uploads/2022/05/how_do_I_calculate_my_salary.png

After Tax Income Percentile Calculator UK 2024

https://www.projectfinanciallyfree.com/wp-content/uploads/2023/07/after-tax-income-percentile-calculator-uk.png

12 Per Hour Monthly Salary Uk After Tax - About SalaryBot Use SalaryBot s salary calculator to work out tax deductions and allowances on your wage The results are broken down into yearly monthly weekly daily and hourly wages To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which