105k Salary After Taxes Florida 105k Salary After Tax in Florida 2024 This Florida salary after tax example is based on a 105 000 00 annual salary for the 2024 tax year in Florida using the State and Federal income tax rates published in the Florida tax tables The 105k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour

SmartAsset s Florida paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow right sm arrow right Loading Home Buying Calculators How Much House Can I Afford Mortgage Calculator 105k Salary After Tax in Florida 2021 This Florida salary after tax example is based on a 105 000 00 annual salary for the 2021 tax year in Florida using the State and Federal income tax rates published in the Florida tax tables The 105k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour

105k Salary After Taxes Florida

105k Salary After Taxes Florida

https://www.picserver.org/assets/library/2020-10-24/originals/salary.jpg

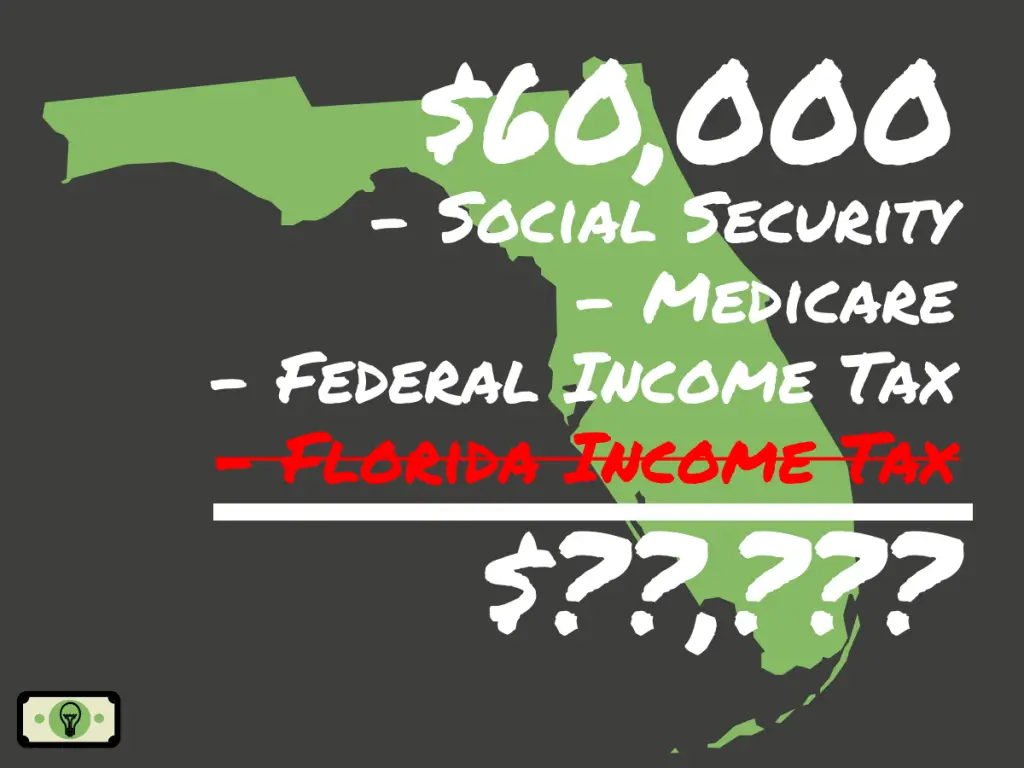

60 000 Dollars Salary After Taxes In Florida single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/09/fl-60000-after-taxes-sm-1024x768.png

Top 10 52000 A Year Is How Much A Month After Taxes That Will Change

https://images.squarespace-cdn.com/content/v1/55693d60e4b06d83cf793431/1658954291602-IT66OQ32WNXK3P7KU2OZ/AdobeStock_469754966.jpeg

No Votes This 105 000 00 Salary Example for Florida is based on a single filer with an annual salary of 105 000 00 filing their 2024 tax return in Florida in 2024 You can alter the salary example to illustrate a different filing status or show an alternate tax year The taxes that are taken into account in the calculation consist of your Federal Tax Florida State Tax No individual income tax in Florida Social Security and Medicare costs that you will be paying when earning 105 000 00

Provided you file taxes with the status single 105 000 annually will net you 81 607 a year This means you pay 23 392 66 in taxes on an annual income of 105 000 dollars In this article we will explore What is the marginal tax rate on 105 000 and What other taxes do you pay in Florida There is no state level income tax so all you need to pay is the federal income tax How much do you make after taxes in Florida The take home pay is 44 467 50 for a single filer with an annual wage of 53 000

More picture related to 105k Salary After Taxes Florida

Salary Of 105k Needed For Comfortable Lifestyle In UK R FIREUK

https://external-preview.redd.it/OCNeDvSvs6xsGsQcvfQ6r0zzDoejyrAzTOytZkjknMI.jpg?auto=webp&s=fc2e9f63d9820377da627400d2da62723e24966b

Should I Ask About Salary At My Interview Much As Salary

https://i.ytimg.com/vi/MVnoMcQnmtc/maxresdefault.jpg

How Much To Counter Offer Salary Maximize Pay With 2 Examples

https://paydestiny.com/media/2022/03/How-Much-to-Counter-Offer-Salary-Feature.001.jpeg

Use ADP s Florida Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Important note on the salary paycheck calculator The calculator on this page is provided through the ADP What is the income tax rate in Florida The state income tax rate in Florida is 0 while federal income tax rates range from 10 to 37 depending on your income This paycheck calculator can help estimate your take home pay and your average income tax rate

2024 US Tax Calculation for 2025 Tax Return 105k Salary Example If you were looking for the 105k Salary After Tax Example for your 2024 Tax Return it s here Brace yourselves for a surprise The tax calculation below shows exactly how much Florida State Tax Federal Tax and Medicare you will pay when earning 100 000 00 per annum when living and paying your taxes in Florida The 100 000 00 Florida tax example uses standard assumptions for the tax calculation

High Court Group D Salary In Rajasthan HelpStudentPoint

https://helpstudentpoint.in/wp-content/uploads/2021/07/Copy-of-HSP-Salary-100.png

10 Psychological Tricks To Negotiate A Higher Salary JobCluster Blog

http://www.jobcluster.com/blog/wp-content/uploads/2014/11/How-to-win-salary-negotiation.png

105k Salary After Taxes Florida - There is no state level income tax so all you need to pay is the federal income tax How much do you make after taxes in Florida The take home pay is 44 467 50 for a single filer with an annual wage of 53 000